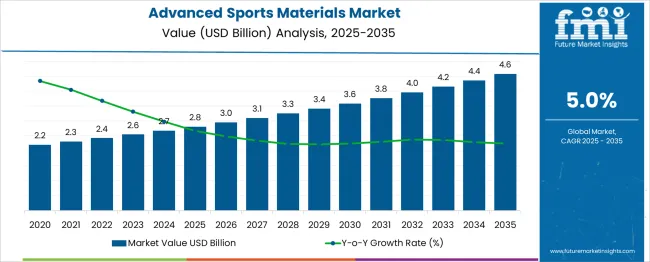

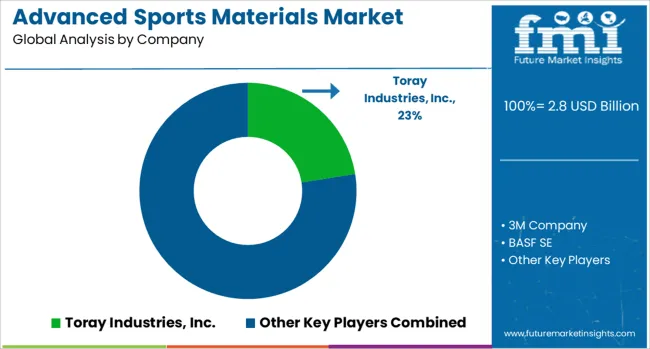

The Advanced Sports Materials Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Advanced Sports Materials Market Estimated Value in (2025 E) | USD 2.8 billion |

| Advanced Sports Materials Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The advanced sports materials market is expanding due to growing demand for high-performance and durable materials in athletic products. Innovations in polymer technologies have enabled manufacturers to produce lightweight, flexible, and resilient components that enhance athlete performance and safety.

Increased participation in sports activities and rising health awareness have driven demand for improved sports equipment that incorporates advanced materials. Additionally, professional athletes’ requirements for specialized gear that optimizes performance under diverse conditions have fueled market development.

Industry focus on sustainability and eco-friendly materials is also influencing product design and material choices. Growth opportunities are expected from emerging markets where sports infrastructure is rapidly developing. The market is set to benefit from continuous material innovations and expanding application in sports equipment and protective gear. Key segment growth is projected in Polymers as the preferred material, Sports Equipment as the dominant application, and Professional Athletes representing the largest end-user group.

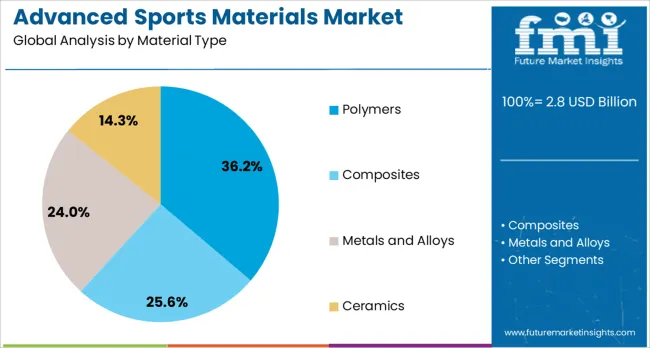

The advanced sports materials market is segmented by material type, application, and end-user and geographic regions. By material type of the advanced sports materials market is divided into Polymers, Composites, Metals and Alloys, Ceramics, Foams, and Others.

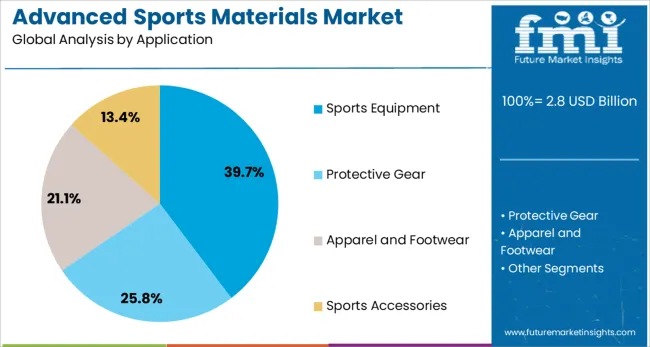

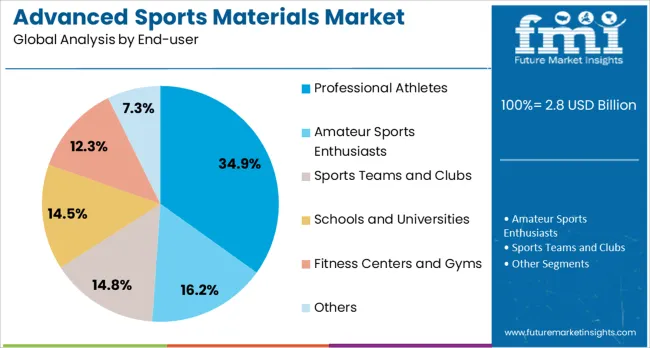

In terms of application of the advanced sports materials market is classified into Sports Equipment, Protective Gear, Apparel and Footwear, Sports Accessories, and Others. Based on end-user of the advanced sports materials market is segmented into Professional Athletes, Amateur Sports Enthusiasts, Sports Teams and Clubs, Schools and Universities, Fitness Centers and Gyms, and Others.

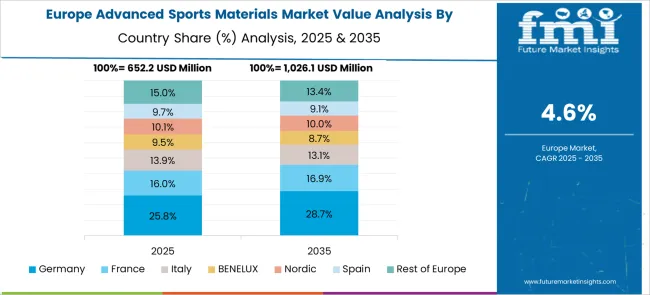

Regionally, the advanced sports materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polymers segment is projected to hold 36.2% of the advanced sports materials market revenue in 2025, maintaining its position as the leading material type. Growth has been driven by polymers’ versatility in delivering lightweight and durable properties essential for sports applications. Their ability to be engineered for specific performance attributes such as flexibility, impact resistance, and breathability has made polymers highly desirable.

Manufacturers have increasingly incorporated high-performance polymers into equipment like protective pads, footwear, and apparel. Polymers also support sustainability efforts by enabling recyclable and biodegradable options.

As material science advances continue to improve polymer properties and processing techniques, this segment is expected to retain its dominance in the market.

The Sports Equipment segment is expected to contribute 39.7% of the market revenue in 2025, securing its lead as the top application. Growth has been fueled by the rising demand for advanced materials in items such as helmets, bats, racquets, and protective gear that require enhanced strength and durability.

Sports equipment manufacturers have prioritized integrating innovative materials that improve performance while maintaining safety standards. The expansion of both professional and amateur sports leagues worldwide has increased consumption of high-quality equipment.

Continuous product development focused on optimizing ergonomics and impact absorption is anticipated to sustain this segment’s growth. The segment’s leadership is strengthened by ongoing investments in sports technology and athlete-focused gear.

The Professional Athletes segment is projected to represent 34.9% of the advanced sports materials market revenue in 2025, making it the leading end-user category. Growth is attributed to the specific and demanding performance requirements of professional athletes, who rely on cutting-edge materials to enhance competitive advantage.

This group often drives innovation through collaboration with manufacturers seeking to develop specialized equipment tailored to their sport and individual needs. The emphasis on injury prevention, comfort, and performance optimization in professional sports has propelled the adoption of advanced materials in footwear, protective gear, and apparel.

Sponsorship and endorsement programs have also elevated market visibility and consumer interest. As professional sports continue to evolve with a focus on science-backed performance, the demand from this segment is expected to sustain market expansion.

Demand for advanced sports materials is climbing as athletes and equipment manufacturers prioritize weight reduction, enhanced strength, and sustainable formulations. Sales of carbon-fiber composites, nanomaterials, and smart textiles are growing sharply in high-end gear such as bicycles, rackets, and protective wear. Asia Pacific leads adoption, supported by expanding sports infrastructure.

Demand for lightweight materials such as carbon-fiber composites in sports equipment increased significantly in 2024 and 2025, particularly in cycling, tennis, and winter sports. Carbon fiber held over 50 to 60% share of the materials used in premium segments, enabling 30 to 40% improvement in strength-to-weight ratios. Athletes and brands are replacing aluminum gear including bike frames and ski poles with composite versions that offer enhanced stiffness and aerodynamics. Nanotechnology-enhanced materials, including graphene-infused laminates and carbon nanotube additives, added to precision gear such as tennis rackets and hockey sticks, also improved fatigue resistance and durability by around 20%.

Sales of sustainable and sensor-embedded sports materials grew rapidly in 2025, particularly in wearables and protective apparel. Adoption of bio-based composites and recycled fibers including flax or ocean plastic blends increased as brands pushed eco-focused lines. Smart textiles with embedded motion or biometric sensors expanded into fitness apparel and helmets, reducing injury detection latency by 30%. Markets in North America and Europe led uptake, while Asia Pacific experienced the fastest equipment volume growth due to investment in amateur and professional sporting infrastructure.

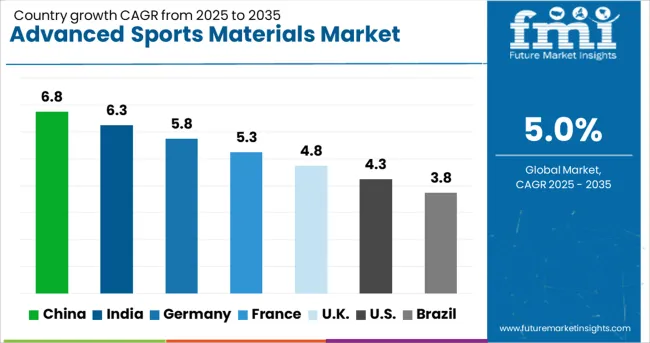

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global market is projected to expand at a CAGR of 5.0% from 2025 to 2035, propelled by rising demand for lightweight, high-performance gear in competitive sports and active lifestyles. China leads the trajectory with a 6.8% CAGR, backed by state investment in professional athletics, growth of domestic sports brands, and innovation in graphene-infused fabrics and polymer composites. India is expected to grow at 6.3%, driven by increased spending on fitness, rapid urbanization, and government-backed sports development programs that encourage the adoption of smart, durable materials.

Germany, with a 5.8% CAGR, benefits from advances in carbon fiber and elastomeric technology for elite footwear and protective gear. The United Kingdom is poised for 4.8% CAGR, supported by eco-conscious innovations in recycled performance textiles and sustained investments in Olympic training infrastructure.

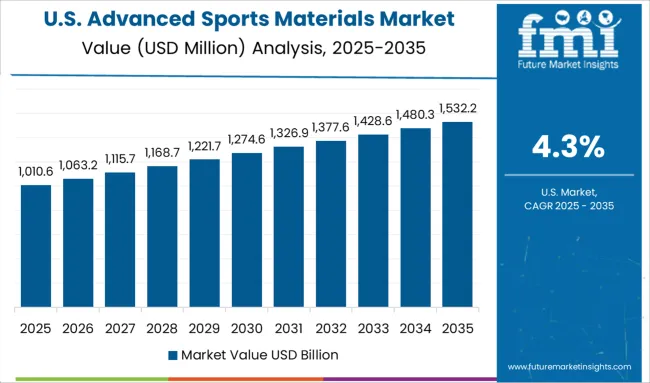

The United States market, growing at 4.3%, is emphasizing hybrid material R&D and wearable integration for outdoor and performance applications. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 6.8% CAGR, driven by major government programs to strengthen sports infrastructure and rising consumer interest in premium athletic gear. Domestic brands are focusing on graphene-infused fabrics and polymer composites for enhanced durability and performance. Winter sports, fueled by national programs, and fitness-oriented apparel are contributing to demand growth. OEM partnerships with global textile innovators support the development of breathable, lightweight fabrics for elite and recreational segments. Expanding e-commerce platforms make smart athletic gear more accessible, while local players emphasize cost-effective solutions with high tensile strength and moisture management properties.

India is expected to grow at a 6.3% CAGR, supported by growing interest in fitness activities and increased sports infrastructure under programs like Khelo India. Domestic manufacturers are introducing elastomeric fabrics and moisture-wicking materials for cricket, running, and outdoor sportswear. Global brands are forming alliances with local firms to develop lightweight, abrasion-resistant textiles. Digital-first distribution models and rising influence of premium sports apparel in Tier II and Tier III cities are driving volume growth. The introduction of advanced shock-absorbing pads and breathable fibers in protective gear further strengthens adoption across contact sports.

Germany is forecast to grow at a 5.8% CAGR, fueled by innovation in carbon fiber composites and elastomer-based performance materials. Automotive-grade material expertise is being adapted for high-end protective sports gear and professional footwear. Manufacturers emphasize advanced engineering for shock absorption and tensile strength to cater to elite athletes. Precision-driven R&D ensures durability without adding excess weight, aligning with professional training needs. Integration of smart textiles capable of biometric tracking is emerging in competitive sports apparel. Exports of advanced material-based products to other European countries continue to bolster domestic market influence.

The United Kingdom is projected to grow at a 4.8% CAGR, supported by advancements in high-performance textiles for competitive sports and gym wear. Local manufacturers prioritize recycled fibers and biodegradable options in product lines for brands targeting environmentally responsible consumers. Demand for antimicrobial coatings and moisture-control technology is increasing in response to hygiene-conscious buying behavior. Adoption of 3D knitting technologies is enhancing customization and fit for athletic wear. Integration of digital design platforms in material prototyping accelerates product development cycles, offering performance optimization for Olympic and professional sports programs.

The United States is projected to grow at a 4.3% CAGR, supported by material innovation for outdoor gear and performance apparel. Investment in hybrid composites and nano-engineered coatings is enhancing footwear cushioning and breathability. Wearable technology integration is becoming standard in premium apparel, delivering real-time fitness insights. Leading brands collaborate with material science firms to launch adaptive textiles optimized for energy return and long-duration comfort. Expanding athleisure and outdoor sports trends continue to strengthen domestic demand, while OEM partnerships accelerate commercialization of new material blends.

Toray Industries holds a significant market share, driven by its high-performance carbon fiber and composite solutions used in professional sports gear and athletic apparel. The company's strong partnerships with leading sports brands and innovation in lightweight materials give it a competitive edge. 3M focuses on impact-resistant materials and adhesives for protective equipment. BASF supplies advanced polyurethane systems for footwear and cushioning. DuPont leverages proprietary fibers such as Kevlar and Tyvek in sports apparel and gear. Hexcel plays a key role in supplying carbon fiber prepregs for bicycles, skis, and racket frames. Mitsubishi Chemical and Teijin continue to grow through composite technology innovations, particularly in global winter and water sports segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Material Type | Polymers, Composites, Metals and Alloys, Ceramics, Foams, and Others |

| Application | Sports Equipment, Protective Gear, Apparel and Footwear, Sports Accessories, and Others |

| End-user | Professional Athletes, Amateur Sports Enthusiasts, Sports Teams and Clubs, Schools and Universities, Fitness Centers and Gyms, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toray Industries, Inc., 3M Company, BASF SE, DuPont de Nemours, Inc., Hexcel Corporation, Mitsubishi Chemical Holdings Corporation, and Teijin Limited |

| Additional Attributes | Dollar sales by material category (polymers, composites, foams, ceramics) and application (apparel, protective gear, equipment), demand dynamics across performance wear and elite sports segments, regional leadership in North America and Asia‑Pacific, innovation in carbon‑fiber composites, smart textiles and self‑healing materials, and environmental impact via recyclability and bio‑based sourcing. |

The global advanced sports materials market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the advanced sports materials market is projected to reach USD 4.6 billion by 2035.

The advanced sports materials market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in advanced sports materials market are polymers, _thermoplastics, _elastomers, _thermosets, composites, _carbon fiber composites, _glass fiber composites, _aramid fiber composites, metals and alloys, _aluminum alloys, _titanium alloys, _magnesium alloys, ceramics, _advanced ceramics, _bioceramics, foams, _polyurethane foams, _polyethylene foams and others.

In terms of application, sports equipment segment to command 39.7% share in the advanced sports materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Process Control Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA