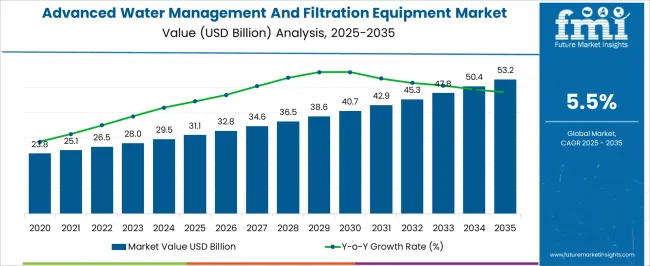

The Advanced Water Management And Filtration Equipment Market is estimated to be valued at USD 31.1 billion in 2025 and is projected to reach USD 53.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. The advanced water management and filtration equipment market is projected to experience steady growth, expanding from USD 23.8 billion in 2020 to approximately USD 53.2 billion by 2035. Between 2020 and 2030, the market value rises from USD 23.8 billion to around USD 36.5 billion, reflecting an average annual growth rate close to 5.3%. This initial growth phase is driven by increasing demand for efficient water treatment solutions across industrial, municipal, and residential sectors. Factors such as rising water scarcity, stringent regulatory requirements on water quality, and growing awareness of sustainable water use contribute to market expansion. Technological advancements in filtration media, membrane technologies, and smart water management systems enhance efficiency and drive adoption.

From 2030 to 2035, the market accelerates from USD 38.6 billion to USD 53.2 billion, supported by investments in infrastructure modernization, expansion of wastewater treatment facilities, and rising adoption of advanced technologies such as IoT-enabled monitoring and AI-driven water quality analysis. Emerging economies demonstrate rapid market uptake due to industrial growth and urbanization, while established markets benefit from upgrades to aging infrastructure and increasing focus on water reuse and recycling. The advanced water management and filtration equipment market is positioned for sustained growth through 2035, fueled by regulatory compliance, technological innovation, and the growing global emphasis on water sustainability and conservation.

| Metric | Value |

|---|---|

| Advanced Water Management And Filtration Equipment Market Estimated Value in (2025 E) | USD 31.1 billion |

| Advanced Water Management And Filtration Equipment Market Forecast Value in (2035 F) | USD 53.2 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The advanced water management and filtration equipment market is undergoing significant evolution, driven by heightened regulatory pressure, resource scarcity, and industrial expansion across emerging economies. Increasing global awareness of water pollution, water stress, and sustainability goals is compelling industries and municipalities to adopt modern, high-efficiency treatment solutions.

Investments in decentralized treatment systems, real-time water quality monitoring, and energy-efficient filtration are gaining traction, especially in response to tightening discharge norms and ESG compliance mandates. Additionally, the proliferation of industrial water reuse and zero-liquid discharge (ZLD) strategies is creating demand for advanced physical, chemical, and biological technologies.

Strategic collaborations between utility providers, equipment manufacturers, and digital solution vendors are enabling integration of automation, AI, and IoT across water infrastructure. Looking forward, long-term market growth is expected to be supported by green infrastructure deployment, circular water systems, and government-backed infrastructure modernization programs.

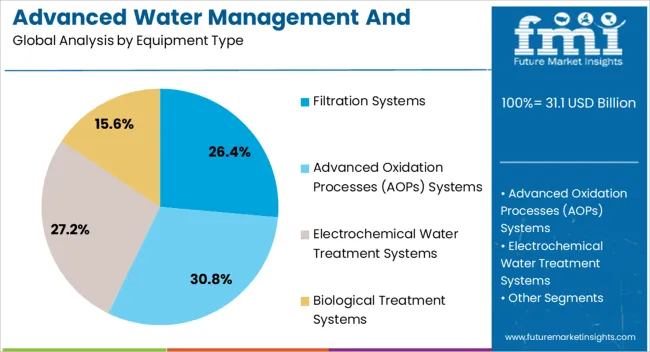

The advanced water management and filtration equipment market is segmented by equipment type, technology, application, distribution channel, and geographic regions. By equipment type, the advanced water management and filtration equipment market is divided into Filtration Systems, Advanced Oxidation Processes (AOPs) Systems, Electrochemical Water Treatment Systems, and Biological Treatment Systems.

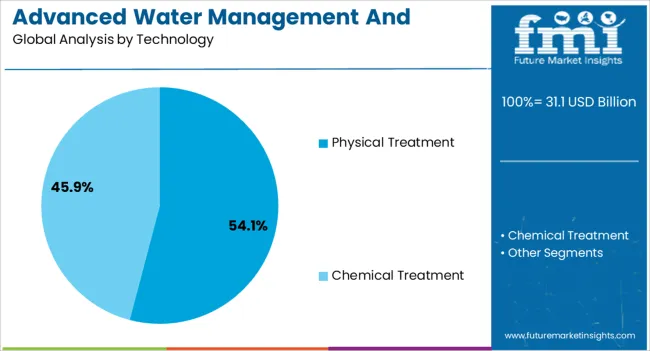

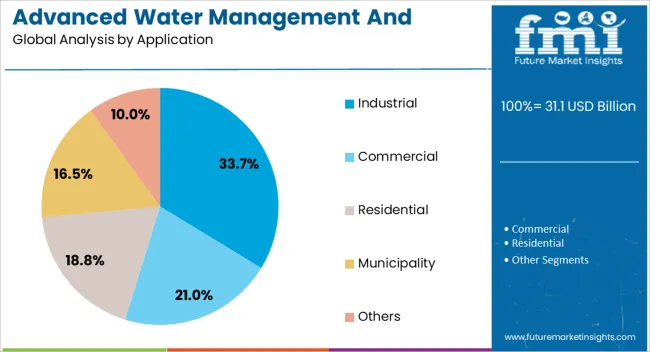

In terms of technology, the advanced water management and filtration equipment market is classified into Physical Treatment and Chemical Treatment. Based on application, the advanced water management and filtration equipment market is segmented into Industrial, Commercial, Residential, Municipality, and Others. By distribution channel, the advanced water management and filtration equipment market is segmented into Direct and Indirect. Regionally, the advanced water management and filtration equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Filtration systems are projected to account for 26.40% of the total market share in 2025, making them the leading equipment type. Their dominance is being driven by their modularity, scalability, and effectiveness in removing suspended solids, particulates, and pathogens across diverse water streams.

Industries and utilities have favored filtration systems due to their lower footprint, reduced energy requirements, and compatibility with both pre-treatment and tertiary treatment processes. The adoption of membrane-based filtration, pressure sand filters, and media filtration has further enhanced reliability and performance across municipal, industrial, and commercial applications.

As sustainability benchmarks become increasingly stringent, filtration systems are being prioritized for their operational efficiency, easy retrofitting potential, and suitability for closed-loop water management solutions.

Physical treatment technologies are expected to command 54.10% of the market revenue in 2025, ranking them as the dominant technology segment. Their leadership is attributed to the robustness, simplicity, and low chemical dependency associated with processes like sedimentation, screening, flotation, and filtration.

These methods offer predictable performance, require less intensive monitoring, and pose fewer ecological risks, making them ideal for both temporary and permanent installations. Industrial sectors, in particular, have preferred physical systems due to their lower lifecycle costs and minimal secondary waste generation.

As decentralized and mobile water treatment units gain market relevance, physical treatment technologies are being rapidly adopted for on-site remediation, groundwater purification, and influent pre-processing. Their integration into hybrid systems alongside biological or chemical treatments is also enhancing end-use versatility.

The industrial segment is anticipated to hold 33.70% of the total revenue share in 2025, establishing it as the largest application category in the market. This dominance is being supported by intensified water use in manufacturing, energy production, food processing, and chemical industries, all of which are facing stricter water discharge and reuse mandates.

Growing reliance on water-intensive processes and the rising cost of freshwater procurement have accelerated the shift toward industrial wastewater treatment and recycling systems. Customized solutions for effluent treatment, process water purification, and closed-loop systems are gaining adoption across high-volume facilities.

Additionally, ESG reporting standards and regulatory audits are driving industries to invest in traceable, automated, and energy-efficient water management equipment. With industrial zones emerging in water-stressed geographies, demand for reliable, cost-effective treatment infrastructure continues to rise.

The advanced water management and filtration equipment market is driven by the need for clean water, regulatory pressures, and increasing industrial and consumer demand. These dynamics are contributing to sustained market growth, with innovation in filtration technologies continuing to expand adoption.

The growing need for clean and safe drinking water is one of the key dynamics driving the advanced water management and filtration equipment market. Water contamination concerns are leading both industries and municipalities to invest in more efficient filtration systems. Filtration equipment is increasingly being used to remove harmful pollutants like heavy metals, bacteria, and chemical contaminants from water supplies. As water safety standards become more stringent, especially in industrial sectors, the demand for high-performance filtration solutions is intensifying. Moreover, consumers’ rising awareness about health and wellness further boosts demand for residential water filtration systems. This has led to increased innovation in filtration technologies to meet various water quality needs.

Regulatory requirements and policies are critical factors shaping the growth of the water filtration market. Governments worldwide are imposing stricter regulations on water quality, leading to a higher demand for advanced filtration equipment across multiple sectors, including municipal, industrial, and residential. Water treatment plants must comply with growing environmental standards, especially in urbanized areas with limited water resources. In addition, industries such as pharmaceuticals, food processing, and chemicals are required to adhere to stringent discharge standards, which drives the adoption of advanced water filtration solutions. Increasingly stringent regulations ensure that filtration systems must be both efficient and capable of removing a wider range of contaminants.

The demand for advanced water filtration systems in industrial and commercial sectors is experiencing rapid growth, driven by the need for efficient, reliable water treatment solutions. Manufacturing, chemical, and power generation industries require high-quality water for operational processes, and filtration equipment plays a vital role in ensuring water meets the necessary standards. Filtration systems are also being integrated into waste treatment facilities to handle industrial effluents. In addition, commercial applications such as hotels, restaurants, and healthcare facilities are adopting advanced filtration systems to provide high-quality water to customers and meet hygiene standards. This has driven a steady expansion of the market, with businesses focusing on improving water efficiency and minimizing environmental impact.

Consumer interest in home water filtration solutions is increasing as people become more conscious of the quality of water they consume. Many consumers are now seeking ways to improve the quality of their tap water due to concerns over pollutants and the potential long-term health effects. This growing interest is driving the residential filtration equipment market, with consumers opting for both point-of-use and whole-house filtration systems. The demand is fueled by the availability of compact, easy-to-install solutions, as well as a broader variety of water filtration products tailored for different household needs. As a result, manufacturers are focusing on producing affordable, high-efficiency water filtration equipment for residential use.

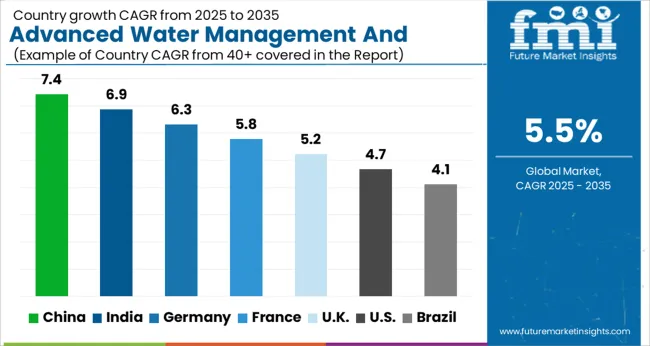

The advanced water management and filtration equipment market is projected to grow globally at a CAGR of 5.5% from 2025 to 2035, driven by increasing demand for clean water, environmental regulations, and advancements in water purification technologies. China leads with a CAGR of 7.4%, supported by the country’s rapid industrialization, urbanization, and growing demand for sustainable water treatment solutions. India follows at 6.9%, driven by a rising population, industrial expansion, and increasing demand for water filtration systems due to water scarcity issues. France grows at 5.8%, benefiting from strong government regulations and a push towards sustainable water management practices. The United Kingdom achieves a CAGR of 5.2%, fueled by demand for advanced filtration systems in both residential and industrial sectors. The United States records a CAGR of 4.7%, supported by investments in infrastructure upgrades and the rising need for efficient water management solutions. This growth trajectory highlights the increasing importance of water management technologies, driven by global environmental concerns, industrialization, and regulatory pressures for water conservation and purification.

The UK’s advanced water management and filtration equipment market grew at a CAGR of 4.3% from 2020 to 2024 and is projected to rise to 5.2% during 2025–2035. The initial growth was moderate, driven by increasing demand for clean water, tightening environmental regulations, and infrastructure upgrades. However, the market is expected to see accelerated growth in the next decade due to rising concerns over water scarcity, water quality management, and the UK's focus on improving its water infrastructure. Additionally, the push for more sustainable water management solutions in both urban and industrial sectors will further drive the demand for advanced filtration and water treatment technologies. Technological advancements in filtration systems, including smart water management solutions, are expected to support the growth of the market.

China’s advanced water management and filtration equipment market is projected to grow at a CAGR of 7.4% during 2025–2035, surpassing the global CAGR of 5.5%. The market grew at a CAGR of 6.0% during 2020–2024, supported by rapid industrialization, urbanization, and growing demand for water purification technologies. The acceleration in growth in the coming decade will be fueled by China’s ongoing efforts to address water pollution, improve water quality, and enhance water use efficiency. The government’s commitment to providing clean and safe water will drive investments in advanced water management and filtration technologies. As industrial and residential demands for clean water grow, the market for advanced filtration equipment in China will continue to expand.

India’s advanced water management and filtration equipment market is expected to grow at a CAGR of 6.9% from 2025 to 2035, above the global average of 5.5%. The market grew at a CAGR of 5.5% during 2020–2024, supported by increasing population, rapid industrialization, and a growing focus on water quality and conservation. The anticipated rise in the market is linked to India’s efforts to improve water infrastructure, combat water pollution, and address water scarcity issues in both urban and rural areas. Increased awareness about the importance of clean water and government initiatives to promote water filtration systems will further drive demand in the coming years. As India continues to expand its water treatment capabilities, the market for advanced filtration equipment will see significant growth.

France’s advanced water management and filtration equipment market is expected to grow at a CAGR of 5.8% during 2025–2035. The market grew at a CAGR of 4.9% from 2020 to 2024, driven by stringent environmental regulations, the need for high-quality water in both residential and industrial sectors, and the push towards sustainability. The upcoming growth is attributed to France’s continuous investments in water purification infrastructure, rising concerns about water pollution, and the increasing adoption of advanced filtration systems in agriculture and municipal water management. France’s strong regulatory framework for water quality and its commitment to sustainable practices will further boost the demand for advanced water filtration equipment in the coming years.

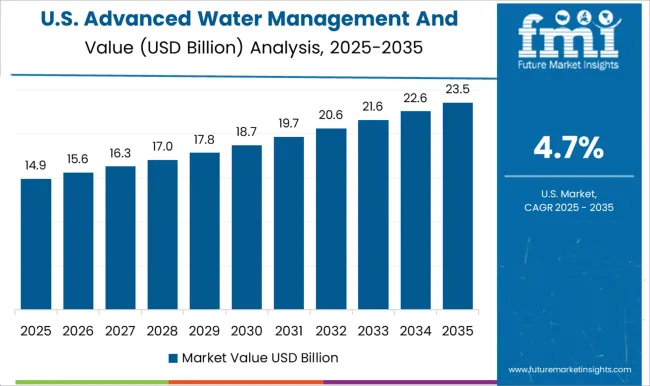

The USA advanced water management and filtration equipment market is projected to grow at a CAGR of 5.5% from 2025 to 2035. The market grew at a CAGR of 4.3% from 2020 to 2024, driven by the demand for water purification systems in both municipal and industrial applications. The expected rise in the next decade is linked to increased environmental concerns, stricter water quality standards, and the growing need for energy-efficient and sustainable water treatment solutions. The USA government’s initiatives to promote water conservation and reduce contamination will further fuel demand for advanced filtration technologies. The market’s growth will also be supported by the rising adoption of smart water management solutions and innovations in filtration technology.

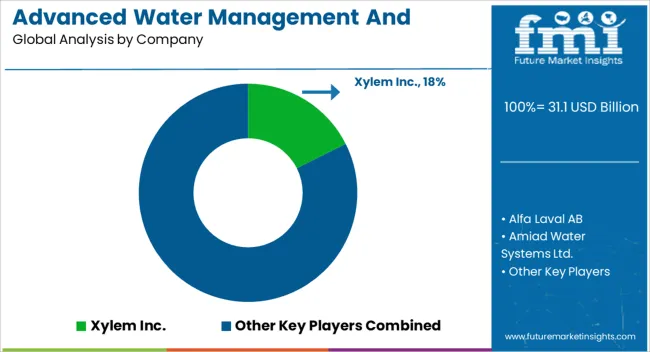

The advanced water management and filtration equipment market is shaped by key players like Xylem Inc., Alfa Laval AB, Amiad Water Systems Ltd., Bluewater Group, and Calgon Carbon Corporation, each competing on system efficiency, cost-effectiveness, and innovation. Xylem Inc. leads with its extensive portfolio of water filtration solutions, offering tailored products for municipal, industrial, and residential applications. Alfa Laval AB is renowned for its sustainable water treatment technologies, focusing on energy-efficient filtration systems for the industrial sector. Amiad Water Systems Ltd. specializes in filtration solutions for irrigation, industrial, and municipal sectors, providing automated systems that optimize water usage. Bluewater Group is recognized for its advanced home and commercial water filtration systems, emphasizing water purification technologies like reverse osmosis and UV treatment.

Calgon Carbon Corporation focuses on the production of activated carbon systems for water treatment, addressing emerging needs in chemical, pharmaceutical, and manufacturing industries. Other players such as CDE Group, Doosan Enpure, GEA Group AG, and Hydranautics focus on industrial-scale filtration solutions, offering specialized systems that cater to the needs of power plants, mining operations, and food processing industries. Kurita Water Industries Ltd. and Lenntech B.V. emphasize the development of high-performance water treatment systems, addressing complex water challenges in energy, chemicals, and pharmaceuticals. MANN+HUMMEL Water & Fluid Solutions provides advanced filtration products for various industrial applications, including the automotive and food industries. Pall Corporation and Pentair PLC lead with innovative filtration solutions that offer high filtration precision for various water management sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.1 Billion |

| Equipment Type | Filtration Systems, Advanced Oxidation Processes (AOPs) Systems, Electrochemical Water Treatment Systems, and Biological Treatment Systems |

| Technology | Physical Treatment and Chemical Treatment |

| Application | Industrial, Commercial, Residential, Municipality, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Xylem Inc., Alfa Laval AB, Amiad Water Systems Ltd., Bluewater Group, Calgon Carbon Corporation, CDE Group, Doosan Enpure, GEA Group AG, Hydranautics, Kurita Water Industries Ltd., Lenntech B.V., MANN+HUMMEL Water & Fluid Solutions, Pall Corporation, Pentair plc, and Toray Industries, Inc. |

| Additional Attributes | Dollar sales by region, market share of key players, growth trends in industrial and residential sectors, demand for specific filtration technologies (e.g., reverse osmosis, UV), and competitive strategies. They would also focus on regulatory impacts, emerging markets, and consumer preferences for sustainable and energy-efficient solutions. |

The global advanced water management and filtration equipment market is estimated to be valued at USD 31.1 billion in 2025.

The market size for the advanced water management and filtration equipment market is projected to reach USD 53.2 billion by 2035.

The advanced water management and filtration equipment market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in advanced water management and filtration equipment market are filtration systems, _membrane filters, _mechanical filters, _activated carbon filters, _ion exchange systems, _uv disinfection, _ozone filtration, advanced oxidation processes (aops) systems, electrochemical water treatment systems, biological treatment systems, _membrane bioreactors (mbr) and _moving bed biofilm reactor (mbbr).

In terms of technology, physical treatment segment to command 54.1% share in the advanced water management and filtration equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Filtration and Separation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Desalination and Purification Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Filtration Equipment Market Growth – Trends & Forecast 2019-2027

Demand for Advanced Driver Assistance System (ADAS) Testing Equipment in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Driver Assistance System (ADAS) Testing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Demand for Water Soluble Fertilizers in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Water Testing Kit in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Water Soluble Fertilizers in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Mobile UX Design Services in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Water Ionizer in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Water Ionizer in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Mobile UX Design Services in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Water Treatment System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Water Treatment System in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Water Flavouring Drops in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Waterproofing Chemicals in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA