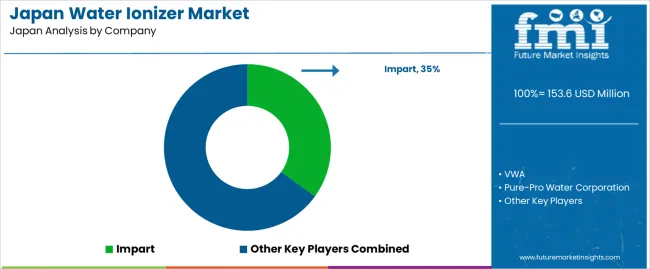

The demand for water ionizers in Japan is valued at USD 153.6 million in 2025 and is projected to reach USD 287.0 million by 2035, reflecting a compound annual growth rate of 6.5%. Growth is supported by rising interest in home-based water treatment systems and greater consumer focus on drinking water quality. Water ionizers offer pH adjustment and filtration features that appeal to households seeking improved taste and perceived health benefits.

As product designs become more compact and user friendly, adoption spreads across both urban and suburban markets. Increasing availability through online and retail channels strengthens overall demand, while manufacturers continue refining performance and device durability to meet changing consumer expectations across the domestic appliance sector.

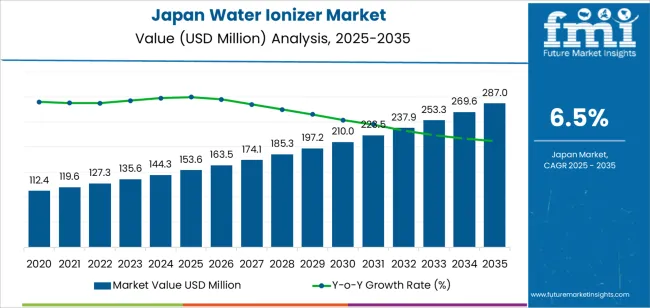

The market growth curve shows a smooth, upward trajectory with consistent year-on-year increases throughout the forecast period. Starting at USD 112.4 million in earlier years, the curve advances steadily to USD 153.6 million in 2025 before rising toward USD 287.0 million by 2035.

The shape of the curve reflects stable incremental gains rather than abrupt shifts, indicating a market that expands through continuous household adoption rather than short-term spikes. Annual values progress from USD 163.5 million in 2026 to USD 174.1 million in 2027, with similar spacing between later years. This pattern suggests a predictable growth path shaped by steady replacement cycles, rising consumer interest in water treatment devices and broadening product availability across Japan.

Demand in Japan for water ionizers is projected to grow from USD 153.6 million in 2025 to USD 287.0 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 6.5%. From USD 112.4 million in 2020 the value climbs through USD 144.3 million in 2024, reaching USD 153.6 million in 2025. Over the forecast period, it continues increasing toward USD 169.1 million in the late 2020s and ultimately hits USD 287.0 million in 2035. Growth is driven by rising health and wellness consciousness among consumers, increased penetration of home purification appliances, and the expansion of both residential and commercial segments adopting water ionising systems.

An inflection point for this segment likely emerges around 2027–2029 when demand accelerates markedly. From USD 153.6 million in 2025, the value rises to approximately USD 174.1 million in 2027 and USD 185.3 million in 2028, signalling a shift from early adopter growth to broader consumer adoption. Beyond that, post 2030 growth builds momentum toward USD 269.6 million in 2034 and USD 287.0 million in 2035, driven by enhanced functionality (smart connectivity, advanced filtration, higher pH ranges), greater affordability and broader distribution channels. This marks the transition to a more mature phase with stronger uptake across demographic segments.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 153.6 million |

| Forecast Value (2035) | USD 287.0 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The demand for water ionizers in Japan is fueled by growing interest in health-oriented home appliances, particularly those that offer benefits such as alkaline drinking water and enhanced hydration. With a well-established culture of wellness and appliance sophistication, Japanese households increasingly adopt water ionizers to support personal and family wellness routines. Urbanization and smaller living spaces elevate the appeal of countertop or compact models that integrate seamlessly into modern kitchens. The presence of local manufacturers and established distribution channels reinforces consumer confidence and adoption in Japan’s residential segment.

Commercial and institutional applications are further contributing to demand in Japan. Cafés, wellness centres and clinics are installing ionizer systems to provide value-added hydration options for visitors or patients. Healthcare facilities and senior living communities are also turning to certified ionizer units for patient hydration and recovery support. While higher initial cost and maintenance requirements remain obstacles for some buyers, the combination of consumer wellness awareness and commercial uptake supports a steady growth trend for water ionizers in Japan.

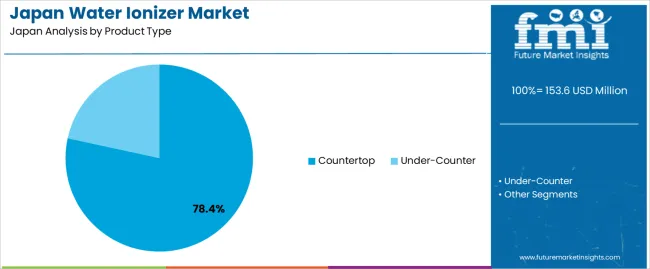

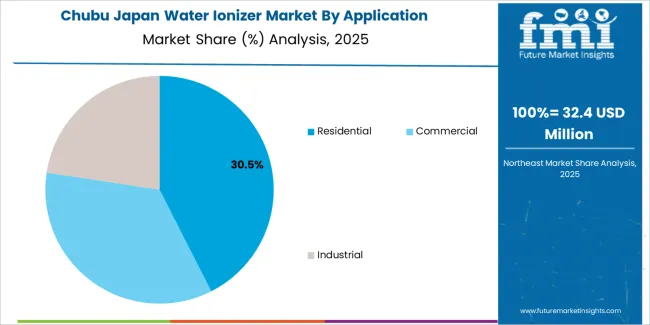

The demand for water ionizers in Japan is shaped by the range of product types available and the applications that rely on ionized water for daily use. Product types include countertop and under-counter systems, each offering different installation needs and convenience levels. Applications span residential, commercial and industrial settings, reflecting varied expectations for water quality, filtration performance and alkaline output. As households and businesses seek reliable solutions for improving drinking water characteristics, both product design and intended use shape adoption patterns. The balance between ease of installation, cost and long-term functionality guides how consumers and institutions choose among available systems.

Countertop water ionizers account for 78.4% of total demand in Japan. Their strong presence is tied to simple installation requirements that avoid plumbing modifications, making them suitable for apartments and smaller homes. Japanese households value compact appliances that fit limited counter spaces while offering consistent alkaline and filtered water. Countertop units provide accessible controls and straightforward maintenance routines, which enhances acceptance among different age groups. Their relatively lower upfront cost compared with built-in systems supports sustained household adoption, reinforcing their role as the most commonly selected type within the water ionizer category.

Demand for countertop systems is strengthened by growing interest in daily hydration practices that support general wellness. These units allow households to adjust pH output quickly, offering versatility for drinking, cooking and specialty uses. Their portability enables relocation within the kitchen or between residences, adding flexibility for long-term users. As interest in personal water quality rises, countertop ionizers remain the preferred choice for consumers who seek practical, space-efficient solutions that provide reliable ionized water without complicated installation requirements.

Residential use accounts for 26.9% of total demand for water ionizers in Japan, reflecting the emphasis households place on consistent access to treated drinking water. Many consumers seek systems that provide stable pH levels and additional filtration benefits within compact home environments. Residential settings prioritize daily usability, making ionizers appealing for families wanting convenient hydration options. The adoption is supported by preferences for appliances that integrate smoothly into kitchen routines while offering clear control over water characteristics. These needs encourage the steady incorporation of ionizers into household kitchens across urban and suburban areas.

Residential demand is also influenced by growing awareness of water quality differences across regions. Households increasingly adopt ionizers to manage taste, hardness and perceived benefits associated with alkaline water. The technology fits well with lifestyle habits focused on preparing beverages and meals with controlled water properties. As families look for reliable ways to improve home water consumption without major plumbing work, residential settings maintain a strong role in shaping overall demand for water ionizers within Japan.

In Japan, demand for water ionizers is increasing largely due to rising health and wellness awareness, especially interest in alkaline or ionised drinking water. Urban households and residential settings are adopting advanced kitchen appliances including water ionizers with filtration and ionisation features. At the same time, higher unit cost, consumer scepticism about claimed benefits, and competition from traditional water purification systems serve as constraints. These factors collectively influence how quickly and widely water ionisers gain traction across Japanese homes.

How Are Health-Conscious Consumer Behaviours Driving Uptake of Water Ionizers in Japan?

Japanese consumers are showing greater interest in home-based appliances that support wellness, including devices that claim to improve water quality or provide functional benefits such as alkaline or hydrogen-rich water. The concept of ionised water is well-established in Japan, creating a receptive audience for water ionisers. Manufacturers respond with premium models featuring multi-stage filtration, pH adjustment and compact designs for smaller homes. These behaviours contribute to stronger uptake in urban and affluent segments within Japan’s residential market.

Where Are Growth Opportunities Emerging for Water Ionizers in Japan’s Household Appliance Market?

A key opportunity lies in apartment-living environments in Japan, where space-efficient under-sink or counter-top ioniser units appeal to modern households. As smart home integration becomes more common, water ionisers with connected features and user-friendly interfaces may attract buyers. Moreover, as replacement cycles for kitchen appliances come around and health branding becomes more influential, water ionisers positioned as premium wellness appliances can command attention. This opens pathways for expansion beyond early adopters into broader segments.

What Challenges Are Limiting Wider Adoption of Water Ionizers in Japan?

Broader adoption faces obstacles such as the relatively high price point of quality water ionisers compared to standard filtration units, which limits accessibility for cost-sensitive consumers. Also, consumer perception and evidence of functional benefits remain mixed, which may dampen purchase intent. Moreover, competitive pressures from other water purification technologies and the need for maintenance such as filter replacements add to ownership cost and complexity. These challenges moderate how rapidly ioniser penetration extends beyond niche segments in Japan.

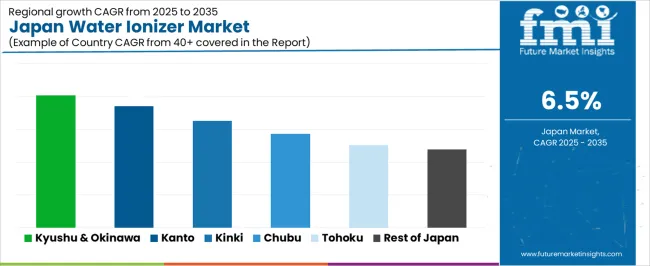

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 8.1% |

| Kanto | 7.4% |

| Kinki | 6.5% |

| Chubu | 5.7% |

| Tohoku | 5.0% |

| Rest of Japan | 4.8% |

Demand for water ionizers in Japan continues to rise, with Kyushu and Okinawa leading at 8.1%. Growth in this region reflects steady consumer interest in household water treatment units and an expanding retail presence across major cities. Kanto follows at 7.4%, supported by dense urban populations and strong distribution networks for home appliances. Kinki records 6.5%, shaped by consistent uptake among households seeking compact purification systems. Chubu grows at 5.7%, where regional retailers expand their product ranges. Tohoku reaches 5.0%, helped by gradual adoption across residential areas. The rest of Japan shows 4.8%, reflecting a stable but slower pattern of demand in smaller markets.

Kyushu & Okinawa is projected to grow at a CAGR of 8.1% through 2035 in demand for water ionizers. The region’s households and commercial establishments, particularly in Fukuoka, are adopting water ionizers for health, wellness, and drinking water quality improvement. Rising awareness of alkaline water benefits and consumer preference for clean, mineral-rich water drives adoption. Retailers and distributors in Kyushu & Okinawa are expanding access to ionizer devices. Increasing focus on health-conscious lifestyles, convenience, and modern home appliances further supports the growth of water ionizer demand across residential and commercial segments.

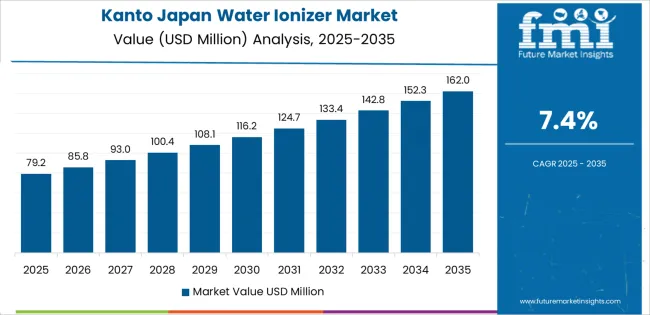

Kanto is projected to grow at a CAGR of 7.4% through 2035 in demand for water ionizers. As Japan’s economic and urban hub, including Tokyo, the region exhibits high adoption of water ionizers in households, gyms, and wellness centers. Rising interest in health, hydration, and functional water solutions drives consumer demand. Retail and e-commerce channels in Kanto are expanding product availability and variety. Manufacturers are introducing technologically advanced ionizer systems with improved filtration and alkaline control. Kanto’s population density, combined with growing health awareness, supports continued growth of water ionizer adoption across residential and commercial applications.

Kinki is projected to grow at a CAGR of 6.5% through 2035 in demand for water ionizers. The region’s cities, including Osaka and Kyoto, are increasingly adopting water ionizers in households, restaurants, and gyms to improve water quality and promote wellness. Rising awareness of alkaline and ionized water benefits drives consumer demand. Manufacturers and retailers in Kinki are expanding their offerings to include portable and multifunctional ionizer devices. The combination of health-focused lifestyles, convenience, and technological innovation supports consistent growth in the adoption of water ionizers across urban and semi-urban areas in the Kinki region.

Chubu is projected to grow at a CAGR of 5.7% through 2035 in demand for water ionizers. The region’s urban centers, particularly Nagoya, are integrating water ionizers in households, wellness centers, and commercial establishments. Rising consumer focus on clean water, health, and functional beverages supports adoption. Manufacturers in Chubu are producing devices with advanced filtration, user-friendly controls, and energy-efficient designs. Retail channels, including specialty stores and e-commerce platforms, increase accessibility. The combination of urban population growth, health consciousness, and demand for convenient water treatment solutions continues to drive the market for water ionizers in the Chubu region.

Tohoku is projected to grow at a CAGR of 5.0% through 2035 in demand for water ionizers. The region’s households and small commercial establishments are gradually adopting water ionizers to improve water quality and support health-conscious lifestyles. Rising awareness of alkaline water benefits and increasing interest in home wellness solutions drive adoption. Manufacturers are providing cost-effective, durable, and energy-efficient ionizer devices suitable for Tohoku’s market. Retailers and regional distributors expand product availability to meet growing demand. These trends ensure steady growth in water ionizer adoption across Tohoku, particularly in semi-urban and smaller urban areas.

The Rest of Japan is projected to grow at a CAGR of 4.8% through 2035 in demand for water ionizers. Smaller cities and rural areas are gradually adopting water ionizers for households, offices, and wellness-focused establishments. Rising interest in hydration, water quality, and health-conscious lifestyles supports adoption. Manufacturers are providing compact, portable, and affordable devices suitable for smaller markets. Regional retail and e-commerce channels increase accessibility. The growing awareness of functional water benefits, combined with an emphasis on convenience and health, ensures steady growth in water ionizer demand across less urbanized regions of Japan.

The demand for water ionizers in Japan is driven by growing consumer interest in health, wellness and premium kitchen appliances. Many Japanese households are increasingly adopting devices that provide better drinking water quality, including systems that offer alkaline or ionized profiles to support hydration and daily wellness. Urbanisation, smaller household sizes and rising disposable income strengthen interest in advanced water-treatment appliances. At the same time, technological innovation such as smart connectivity, compact designs suitable for Japanese homes and improved water filtration combine to make ionizers more relevant in the market. These factors create a favourable environment for water ionizer adoption in Japan.

Key companies active in Japan’s water ionizer segment include Kangen Water Ionizer (by Enagic) and other major brands offering similar devices and solutions tailored to the Japanese market. These firms deliver countertop and under-sink water ionizer systems with features such as adjustable pH levels, multi-stage filtration and smart monitoring. Their operations align with high standards of Japanese manufacturing and consumer expectations for reliability and performance. Through local distribution and after-sales service, these companies support market penetration and consumer confidence. By focusing on functionality, design and wellness branding, they influence how water ionizers are perceived and adopted within Japanese households.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Types | Countertop, Under-Counter |

| Applications | Residential, Commercial, Industrial |

| Distribution Channels | Hypermarkets/Supermarkets, Wholesalers/Distributors, Specialty Stores, Direct Sales, Online Retailers, Other Sales Channels |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Impart, VWA, Pure Pro Water Corporation, Ayana Water, Emco Tech Co. Ltd., Enagic |

| Additional Attributes | Dollar by sales by product type, application, and distribution channel; regional penetration and CAGR trends; residential vs commercial adoption; consumer preference for alkaline and ionized water; technological enhancements such as multi-stage filtration, smart connectivity, compact design, and pH adjustment; replacement and repeat purchase cycles; growth across urban, suburban, and rural areas; integration with home wellness and lifestyle trends. |

The demand for water ionizer in Japan is estimated to be valued at USD 153.6 million in 2025.

The market size for the water ionizer in Japan is projected to reach USD 287.0 million by 2035.

The demand for water ionizer in Japan is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in water ionizer in Japan are countertop and under-counter.

In terms of application, residential segment is expected to command 31.9% share in the water ionizer in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA