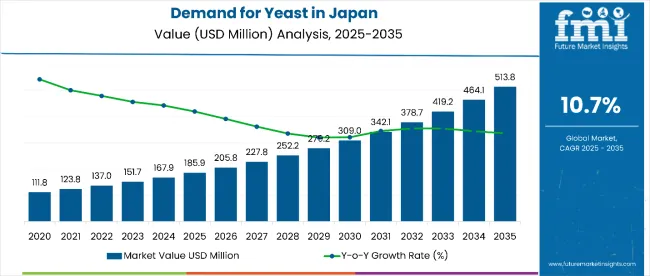

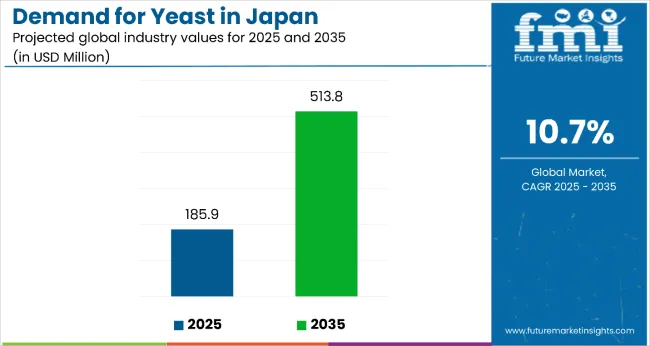

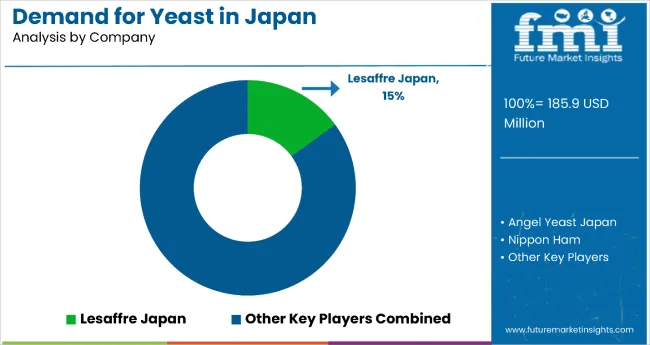

Sales of yeast in Japan are estimated at USD 185.9 million in 2025, with projections indicating a rise to USD 513.8 million by 2035, reflecting a CAGR of approximately 10.7% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 185.9 million |

| Forecast Value in (2035F) | USD 513.8 million |

| Forecast CAGR (2025 to 2035) | 10.7% |

This growth reflects both expanding applications across multiple sectors and increased per capita consumption driven by health awareness trends. The rise in demand is linked to booming food and beverage production, traditional fermented food culture, and emerging biofuel applications.

By 2025, per capita consumption in leading Japanese regions such as Kanto, Chubu, and Kinki averages between 0.8 to 1.2 kilograms, with projections reaching 2.1 to 2.8 kilograms by 2035. Kanto leads among regions, expected to generate USD 181.0 million in yeast sales by 2035, followed by Chubu (USD 129.0 million), Kinki (USD 108.2 million), Kyushu & Okinawa (USD 62.1 million), and Tohoku (USD 36.9 million).

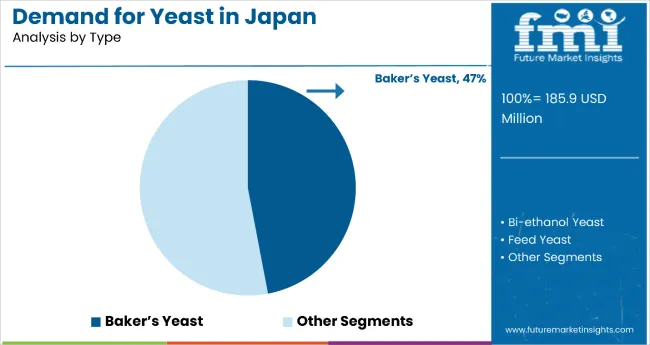

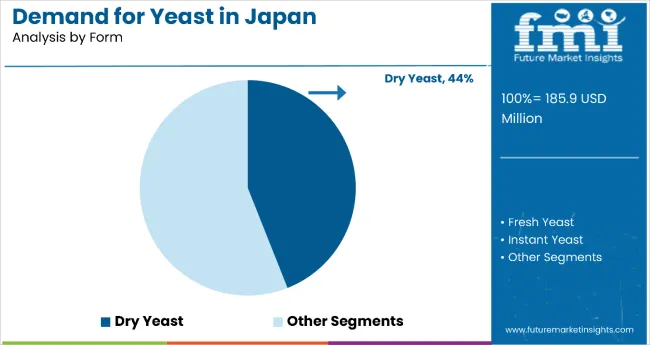

The largest contribution to demand continues to come from baker's yeast applications, which are expected to account for 47% of total sales in 2025, owing to widespread bread production, bakery expansion, and convenience food growth. By form, dry yeast represents the dominant format, responsible for 44% of all sales, while fresh and instant yeast segments serve specialized applications.

Consumer adoption is particularly concentrated among commercial bakeries and food manufacturers, with health benefits and convenience emerging as significant drivers of demand. While price sensitivity remains a consideration, technological improvements in yeast production have enhanced cost effectiveness and quality consistency.

Continued innovation in fermentation technology and expanding applications in pharmaceuticals and biofuels are expected to accelerate adoption across diverse usage segments. Regional disparities persist, but per capita demand in emerging regions is narrowing the gap with traditionally strong metropolitan areas.

The yeast segment in Japan is classified into multiple categories. By type, the key classifications include baker's yeast, bi-ethanol yeast, feed yeast, wine yeast, and brewer's yeast. By form, the segment spans dry yeast, fresh yeast, and instant yeast formulations. By region, areas such as Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and Rest of Japan are analyzed comprehensively.

Baker's yeast applications are projected to dominate sales in 2025, supported by widespread bread production, expanding bakery sector, and growing convenience food consumption. Other yeast types serve specialized applications with distinct growth trajectories.

Yeast form preferences in Japan reflect storage requirements, application convenience, and shelf life considerations. Dry yeast dominates due to practical advantages, while fresh and instant forms serve specific usage requirements.

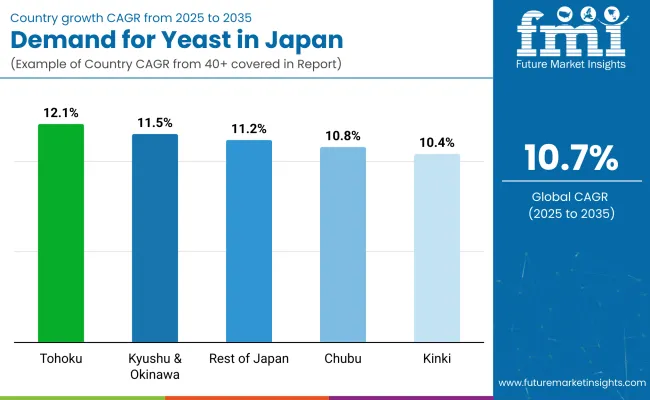

| Region | CAGR (2025 to 2035) |

|---|---|

| Tohoku | 12.1% |

| Kyushu & Okinawa | 11.5% |

| Rest of Japan | 11.2% |

| Chubu | 10.8% |

| Kinki | 10.4% |

In the demand and trend analysis of yeast in Japan, Tohoku leads with the highest CAGR of 12.1%, reflecting its rapid modernization of food processing and strong alignment with traditional fermentation practices. Kyushu & Okinawa follows at 11.5%, capitalizing on tourism-driven demand and unique flavor innovation. The Rest of Japan shows a steady 11.2%, driven by artisanal and small-scale production expansion. Chubu’s 10.8% growth highlights its blend of industrial-scale production and cultural brewing traditions, while Kinki records 10.4%, supported by its premium culinary culture and urban demand.

Revenue from yeast in Tohoku is expanding rapidly at a CAGR of 12.1%, driven by modernization of food processing facilities, innovation in fermentation techniques, and rising demand for premium bakery and brewing products. The agricultural foundation of the region supports feed yeast growth, while traditional fermented foods are gaining renewed popularity.

Strategic government initiatives encourage rural industrialization, attracting yeast producers. This strong combination of cultural heritage and industrial innovation positions Tohoku as a strategic hub for yeast supply, catering to both domestic consumption and inter-regional trade.

Sales for yeast in Kyushu & Okinawa is projected to grow at a CAGR of 11.5%, emerging as a high-potential hub that leverages tourism-driven demand for authentic and innovative food products. Local breweries and specialty beverage makers are integrating diverse yeast strains to create distinctive flavors, attracting both domestic and international visitors.

The agricultural base supports feed yeast applications in livestock and aquaculture, enhancing local production ecosystems. Government-backed regional branding strategies are elevating visibility. Collaborations between small producers and yeast suppliers are enabling niche, high-value product lines.

Sales of yeast in Rest of Japan are growing at a CAGR of 11.2%, driven by artisanal production, bakery expansion, and microbrewing innovations. Demand for specialty yeast strains is climbing as consumers seek unique taste experiences and health-oriented products. Home baking trends continue to push dry yeast sales higher. Investments in small-scale processing facilities are improving efficiency. Better distribution networks are making yeast products more available in rural and semi-urban areas, enabling smaller producers to compete nationally.

Demand for yeast in Chubu is projected to grow at a CAGR of 10.8%, driven by the region’s manufacturing strengths, blending traditional fermentation industries with modern high-capacity bakery and processed food production. Sake brewing remains a cultural pillar, sustaining consistent yeast demand, while new applications in bioethanol and specialty products are adding industrial depth.

The region’s central location boosts nationwide distribution. Partnerships between yeast producers and Chubu’s established food brands are fostering innovative, high-performance strains, keeping the region highly competitive in Japan’s yeast supply chain.

Sales of yeast on Kinki are expected to grow at a CAGR of 10.4%, due to its rich culinary heritage and strong urban food culture, especially in Osaka and Kyoto. Premium bakeries, artisanal brewers, and fusion cuisine innovators are increasingly using high-quality yeast strains to meet rising consumer expectations. Advanced logistics networks ensure fast delivery across urban and suburban areas. Growing interest in premium bread, craft beer, and experimental cuisine is boosting demand for both traditional and instant yeast formats, blending cultural legacy with modern culinary creativity.

The competitive environment is characterized by a mix of global yeast specialists and established Japanese food companies. Technical expertise and distribution capabilities remain decisive success factors, with leading suppliers maintaining advanced fermentation facilities and comprehensive technical support services.

Lesaffre Japan serves as a prominent participant in the Japanese yeast segment, leveraging global expertise in fermentation technology while providing localized technical support and Asahi Group Holdings leverages beverage production expertise and established distribution networks to serve both internal brewing requirements and external commercial customers seeking reliable yeast supplies and technical support.Ohly Japan focuses on specialty yeast extract applications and functional ingredient development, targeting health food manufacturers, pharmaceutical applications, and premium food products requiring specialized nutritional and flavor characteristics.

Key Developments

| Item s | Value s |

|---|---|

| Market Size (2025) | USD 185.9 Million |

| By Type | Baker’s Yeast, Bi-ethanol Yeast, Feed Yeast, Wine Yeast, and Brewer’s Yeast |

| By Form | Dry Yeast, Fresh Yeast, and Instant Yeast |

| Regions Covered | Tohoku, Kyushu & Okinawa, Rest of Japan, Chubu, and Kinki |

| Top Companies Profiled | Lesaffre Japan, Angel Yeast Japan, Nippon Ham, Asahi Group Holdings, and Ohly Japan |

| Additional Attributes | Rising demand for premium bakery and brewing products, expansion of fermentation-based foods, growth in bioethanol and industrial yeast applications, increasing adoption in livestock and aquaculture feed, regional diversification in yeast production and consumption |

By 2035, total Japanese sales of yeast are projected to reach USD 513.8 million, up from USD 185.9 million in 2025.

By 2035, the sales of yeast in Japan are forecasted to reach USD 513.8 million.

The yeast market in Japan is expected to grow at a CAGR of 10.7% between 2025 and 2035.

Baker’s yeast is projected to lead the type segment with a 47% share in 2025.

Dry yeast is expected to dominate the form segment with a 44% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Pepper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Evaporative Condensers in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Control Network Modules in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mineral Enrichment Ingredients in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Zinc-Tin Alloy Sputtering Target in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Miniature Duplex Connectors in USA Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in UK Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in the USA Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Online Clothing Rental in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Marine-grade Polyurethane in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in UK Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA