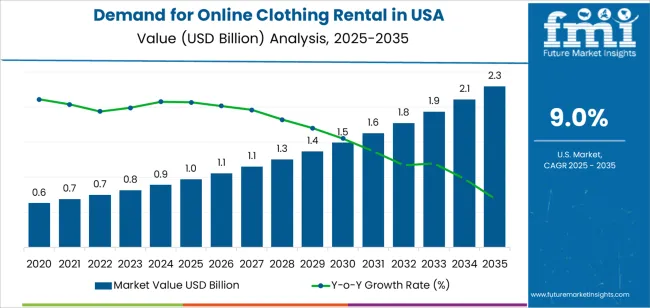

The demand for online clothing rental in the USA is projected to grow from USD 1.0 billion in 2025 to USD 2.3 billion by 2035, reflecting a CAGR of 9%. The growth in the online clothing rental market is driven by several factors, including the increasing popularity of sustainable fashion, the rising demand for cost-effective clothing solutions, and the growing trend of experience-based consumption over traditional ownership. With consumers becoming more eco-conscious, online clothing rental services provide an attractive alternative to buying new clothing, allowing customers to wear high-quality, fashionable items without the long-term commitment.

The growth is also driven by advancements in e-commerce, increased consumer comfort with rental models, and the broadening of rental offerings, from formal wear to everyday attire. Additionally, the rising acceptance of subscription services and the expansion of luxury fashion rental will further support the market growth. The increasing focus on sharing economy models and cost-efficient fashion among younger generations also adds to the demand for clothing rentals, which offer both accessibility and variety without the environmental impact of fast fashion.

The market share erosion or gain analysis for online clothing rental in the USA reveals that the market is expected to experience significant market share gains over the forecast period from 2025 to 2035. The market will grow from USD 1.0 billion in 2025 to USD 2.3 billion in 2035, reflecting an increase of USD 1.3 billion over the next decade. This growth indicates a strong expansion of the online clothing rental market, with more consumers opting for rental services rather than traditional clothing purchases.

From 2025 to 2030, the market will grow from USD 1.0 billion to USD 1.5 billion, contributing USD 0.5 billion in growth. This phase will see an initial gain in market share as more consumers adopt the rental model, driven by an increasing interest in sustainable fashion and cost-effective alternatives to buying clothes. The demand for formal wear rentals, particularly for events like weddings and parties, will contribute significantly to this growth.

From 2030 to 2035, the market will expand further from USD 1.5 billion to USD 2.3 billion, contributing USD 0.8 billion in growth. This phase will see stronger market share gains as the model becomes more mainstream, with more consumers choosing to rent everyday clothing, luxury items, and seasonal wardrobes. Additionally, with more brands and retailers embracing the rental model, the market is expected to capture a larger share of the overall fashion industry, particularly among younger and environmentally conscious consumers. The strong growth momentum in the latter half of the forecast period reflects the maturation of the market, where rental services become an integrated part of mainstream fashion consumption in the USA.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1 billion |

| Industry Forecast Value (2035) | USD 2.3 billion |

| Industry Forecast CAGR (2025-2035) | 9% |

Demand for online clothing rental in the USA is rising as consumers increasingly embrace access over ownership, driven by sustainability concerns and the desire for wardrobe variety at lower cost. Many consumers, especially younger demographics, prefer renting designer or premium apparel for special occasions or rotating wardrobes instead of buying items that may be worn only once or rarely. Online platforms offering subscription models, peer to peer rentals and curated collections support this shift by providing convenience, fast delivery, and flexibility. Additionally, brands and retailers are collaborating with rental services to extend the lifecycle of garments and enhance customer engagement, which further fuels adoption. Market data show that the USA online clothing rental market is valued at approximately USD 220 million and is expected to grow steadily.

Another key factor is the convergence of fashion trends, social media influence and the circular economy mindset. Consumers increasingly seek to experiment with style, follow influencer-driven fashion changes and minimise waste, which make rental models attractive. Advances in logistics, inventory management and digital platforms reduce friction in rental processes and improve service reliability, which encourages broader acceptance. Nonetheless, challenges remain: managing garment condition across multiple uses, ensuring hygiene and fit in an online model, and maintaining operational profitability amid logistics and cleaning costs. Despite these headwinds, as consumer behavior shifts toward sustainability and experience, the demand for online clothing rental in the USA is projected to continue its upward trajectory.

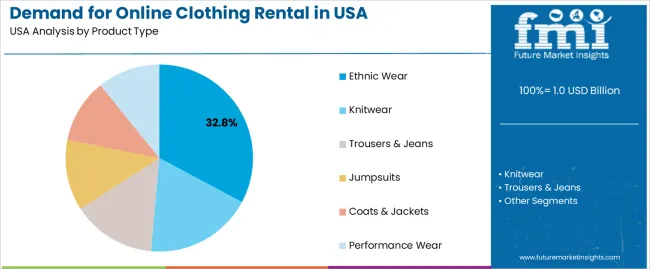

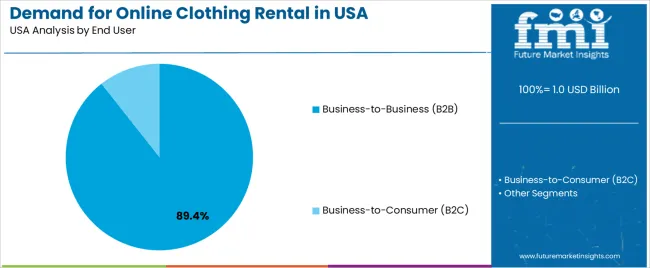

The demand for online clothing rental services in the USA is primarily driven by product type and end user. The leading product type is ethnic wear, which holds 33% of the market share, while business-to-business (B2B) is the dominant end-user segment, accounting for 89.4% of the demand. Online clothing rental has gained significant traction in both the retail and corporate sectors due to its convenience, cost-effectiveness, and the growing trend of sustainable fashion. The rental model allows consumers and businesses to access high-quality, fashionable clothing without the need for long-term ownership, which appeals to various customer bases.

Ethnic wear is the leading product type in the online clothing rental market, capturing 33% of the market share. The increasing popularity of ethnic and cultural attire for events such as weddings, festivals, and cultural celebrations has driven demand for these garments in the rental space. Renting ethnic wear allows consumers to access high-quality, traditional, and designer outfits for special occasions without the significant cost of purchasing these items outright.

In the USA, where cultural diversity is prominent, online rental services for ethnic wear have become an attractive alternative for people seeking stylish, occasion-specific clothing. Renting ethnic wear for weddings, parties, or cultural events also supports the growing trend of sustainable fashion, as these garments are often worn only a few times. As consumers continue to prioritize sustainability and cost-efficiency in fashion choices, the demand for ethnic wear rentals is expected to remain strong, positioning it as a dominant category in the online clothing rental market.

Business-to-business (B2B) is the leading end-user segment for online clothing rental in the USA, capturing 89.4% of the market share. In the B2B space, companies, particularly those in the corporate sector, are increasingly turning to clothing rental services for uniforms, workwear, and promotional apparel. B2B clients benefit from rental services by ensuring a steady supply of high-quality clothing for their employees, without the need for large upfront investments or concerns about maintenance.

Online clothing rental services also offer businesses the flexibility to update or refresh their employee wardrobes seasonally or for specific events, which can enhance the professional image of their staff without the financial burden of purchasing and maintaining large inventories. Additionally, the growing emphasis on sustainability and reducing corporate waste has driven many companies to seek rental solutions, which align with their environmental goals. As the B2B sector continues to embrace flexible, sustainable, and cost-effective business practices, the demand for online clothing rental services is expected to grow, further solidifying its position as the dominant segment in the market.

Demand for online clothing rental in the USA is rising as consumers increasingly prioritise access over ownership, driven by sustainability concerns, rapid fashion cycles and technology enabled rental platforms. Growth stems from subscription models, on demand wardrobe access and social media driven fashion trends. However, operational challenges like logistics, garment turnover and consumer reluctance to rent are restraining expansion. Key trends include interactive virtual try on tools, peer to peer rental models and the shift of rental services into mainstream apparel rather than just occasion or luxury wear.

Several factors support growth in the USA market. First, younger generations (Gen Z and Millennials) demonstrate strong interest in variety, circular fashion and budget efficient access to designer garments, driving rental demand. Second, the proliferation of mobile apps, e commerce infrastructure and subscription services simplifies clothing rental logistics and enhances consumer convenience. Third, sustainability imperatives such as reducing textile waste and extending the lifecycle of garments boost rental adoption among eco aware shoppers. Fourth, occasions and social events (weddings, corporate events, nights out) continue to fuel demand for higher end garments on a rental basis rather than purchase based.

Despite momentum, several restraints inhibit growth. Customer concerns about hygiene, fit and condition of rented garments may limit adoption among more cautious buyers. The cost structure of rental models garment acquisition, cleaning, logistics and returns can reduce margin and raise rental fees, making the offering less compelling versus purchase for some segments. Additionally, the rental category remains niche compared to total apparel spend, and many consumers continue to prefer ownership. Operational complexity, including inventory management and reverse logistics, adds risk for service providers.

Major trends include the move from event wear rental to broader wardrobe subscription services covering everyday apparel, workwear and casual outfits. There is increasing integration of technology such as virtual try on, AI driven styling and personalised rental selections, improving user experience and reducing fit related returns. Peer to peer rental platforms are emerging, enabling individuals to rent garments from other consumers and expanding the market beyond business to consumer only. Retailers and rental platforms are also consolidating with traditional fashion brands, offering hybrid purchase and rent models, and promoting circular fashion credentials to appeal to sustainability conscious consumers.

The demand for online clothing rental in the USA is growing as consumers increasingly seek affordable, sustainable, and convenient options for fashion. Online clothing rental services allow individuals to rent high-quality, trendy clothing for a fraction of the purchase price, reducing the need for frequent purchases and promoting more sustainable consumption. This model is particularly attractive to consumers who want access to a wide variety of styles without the commitment of long-term ownership. Factors driving this demand include the rise in eco-consciousness, the popularity of experience-driven consumerism, and the growing trend of shared economy platforms.

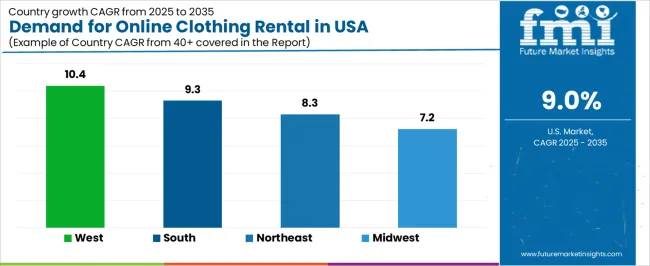

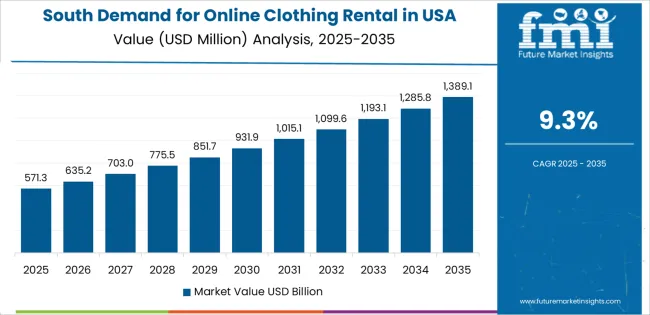

Additionally, the increasing focus on fast fashion's environmental impact is encouraging consumers to seek more sustainable alternatives, like clothing rental. Regional demand varies depending on factors such as consumer income, fashion trends, and access to technology. The West leads in demand, supported by higher disposable income and tech-savvy populations, while the South, Northeast, and Midwest show steady adoption driven by shifting consumer behavior towards more sustainable and cost-effective fashion choices. This analysis explores the factors shaping the demand for online clothing rental across the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 10.4% |

| South | 9.3% |

| Northeast | 8.3% |

| Midwest | 7.2% |

The West region leads the USA in the demand for online clothing rental with a CAGR of 10.4%. The region’s large population, particularly in cities like Los Angeles, San Francisco, and Seattle, is highly attuned to fashion trends and sustainability, both of which drive the demand for online clothing rental services. California, known for its eco-conscious consumers, is a key market where the demand for sustainable and cost-effective fashion is growing.

The West also has a higher concentration of tech-savvy individuals who are comfortable with online platforms and sharing economy models. With the region's focus on environmental sustainability, online clothing rental offers a viable alternative to fast fashion, enabling consumers to access high-quality garments for various occasions without the environmental cost of mass production. As the demand for versatile and sustainable fashion options continues to rise in the West, the region remains the leading market for clothing rental services.

The South shows strong demand for online clothing rental with a CAGR of 9.3%. The region’s increasing focus on sustainability, combined with a growing interest in fashion, contributes to the rising adoption of clothing rental services. States like Texas, Florida, and Georgia have large urban populations and emerging fashion markets, making them key drivers of demand for affordable and sustainable clothing solutions.

The growing middle-class population in the South, with its higher disposable income and increasing awareness of the environmental impact of fast fashion, further supports the demand for online clothing rental. The convenience factor, coupled with the trend toward renting instead of buying, is appealing to many consumers in the South. With the rise of e-commerce and shifting consumer preferences, the South is expected to continue to see strong demand for clothing rental services.

The Northeast demonstrates steady demand for online clothing rental with a CAGR of 8.3%. The region, home to major fashion hubs like New York and Boston, has a high concentration of fashion-conscious consumers who are increasingly turning to rental services for high-quality, trendy clothing. The Northeast's emphasis on style, combined with growing environmental awareness, is driving the adoption of sustainable fashion solutions.

In addition, the high cost of living in major cities like New York makes clothing rental an attractive option for individuals seeking variety in their wardrobes without the hefty price tag of purchasing expensive clothing. While growth is steady compared to the West and South, the Northeast's fashion-forward population and strong retail infrastructure ensure that the demand for online clothing rental remains a key part of the fashion landscape.

The Midwest shows moderate growth in the demand for online clothing rental with a CAGR of 7.2%. While the region may not be as fashion-focused as the West or Northeast, there is a growing interest in more affordable and sustainable fashion choices. Cities like Chicago, Detroit, and Minneapolis are seeing an increasing number of consumers turning to online clothing rental services as they seek alternatives to fast fashion and want to reduce their clothing consumption.

The Midwest's steady adoption of clothing rental services is driven by the growing desire for convenience and the availability of more rental platforms that cater to diverse consumer needs. As the awareness of the environmental benefits of clothing rental increases and consumers seek more affordable, sustainable fashion solutions, demand for these services will continue to grow in the Midwest, albeit at a slower pace compared to other regions.

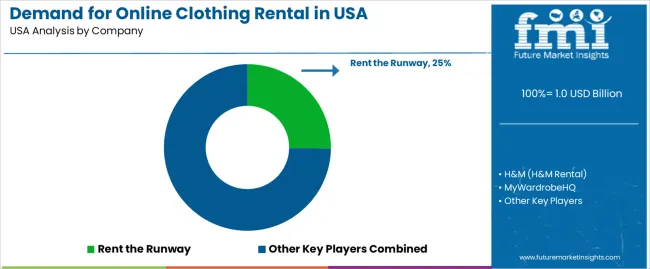

The online clothing rental industry in the United States is growing as consumers increasingly seek more sustainable and affordable fashion options. Companies such as Rent the Runway (holding approximately 25.2% market share), H&M (H&M Rental), MyWardrobeHQ, Le Tote, and GlamCorner are key players in this industry, providing customers with access to high-quality, trendy clothing and accessories for short-term use. The rise of fast fashion, growing environmental awareness, and the desire for variety without the commitment of ownership are all driving factors behind the market's expansion.

Competition in the online clothing rental industry is centered around product variety, customer experience, and pricing flexibility. Companies focus on offering a wide selection of clothing styles, from casual wear to formal attire, and expanding their size ranges to cater to a broader customer base. Another competitive advantage is convenience, with many companies offering subscription-based models, free shipping, and easy returns.

Some players are also emphasizing eco-friendly practices, such as the use of sustainable fabrics and the promotion of circular fashion. Marketing materials typically highlight product quality, convenience of rental process, and the affordability of access to high-end fashion. By aligning their offerings with the growing demand for sustainability, convenience, and style, these companies are positioning themselves to lead the USA online clothing rental industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Ethnic Wear, Knitwear, Trousers & Jeans, Jumpsuits, Coats & Jackets, Performance Wear |

| End User | Business-to-Consumer (B2C), Business-to-Business (B2B) |

| Key Companies Profiled | Rent the Runway, H&M (H&M Rental), MyWardrobeHQ, Le Tote, GlamCorner |

| Additional Attributes | The market analysis includes dollar sales by product type and end-user categories. It also covers regional demand trends in the United States, particularly driven by the growing popularity of online clothing rental services in both B2C and B2B segments. The competitive landscape highlights major players in the online rental clothing market, focusing on their product offerings and service models. Trends in the increasing demand for sustainable fashion, convenience, and variety in clothing options are explored, along with advancements in rental platforms and logistics technologies. |

The global demand for online clothing rental in USA is estimated to be valued at USD 1.0 billion in 2025.

The market size for the demand for online clothing rental in USA is projected to reach USD 2.3 billion by 2035.

The demand for online clothing rental in USA is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in demand for online clothing rental in USA are ethnic wear, knitwear, trousers & jeans, jumpsuits, coats & jackets and performance wear.

In terms of end user, business-to-business (b2b) segment to command 89.4% share in the demand for online clothing rental in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA