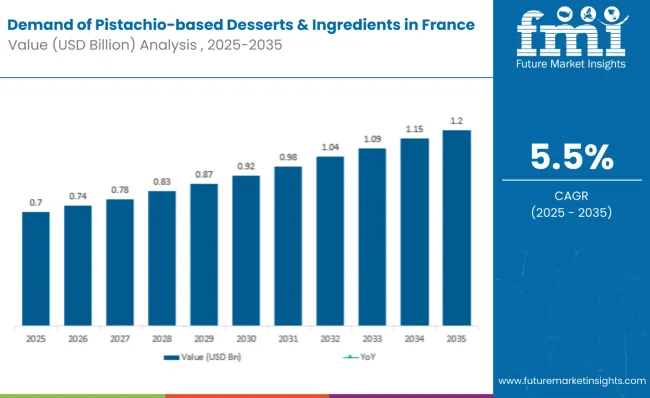

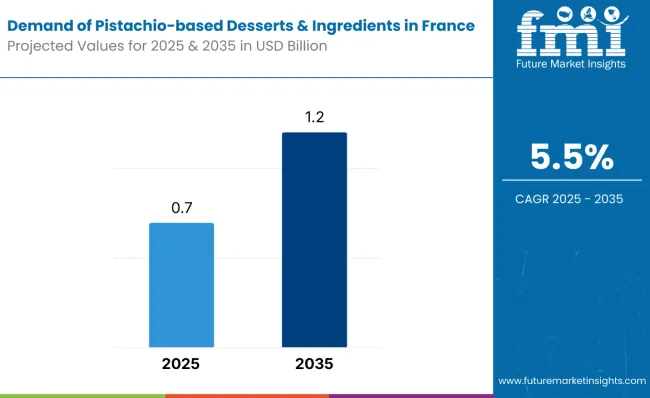

Demand for pistachio-based desserts and ingredients in France is estimated at USD 0.70 billion in 2025, with projections indicating a rise to USD 1.20 billion by 2035, reflecting a CAGR of approximately 5.5% over the forecast period. This growth reflects both expanding culinary applications and increased per capita consumption of premium nut-based ingredients.

The rise in demand is linked to evolving French pastry traditions, growing appreciation for Mediterranean flavors, and the premiumization of artisanal dessert offerings. By 2025, per capita consumption in leading French regions such as Île-de-France, Provence-Alpes-Côte d'Azur, and Auvergne-Rhône-Alpes averages between 1.8 to 2.4 kilograms annually, with projections reaching 3.2 kilograms by 2035. Île-de-France leads among regions, expected to generate USD 0.324 billion in pistachio-based dessert and ingredient demand by 2035, followed by Provence-Alpes-Côte d'Azur (USD 0.228 billion), Auvergne-Rhône-Alpes (USD 0.180 billion), Nouvelle-Aquitaine (USD 0.144 billion), and Occitanie (USD 0.132 billion).

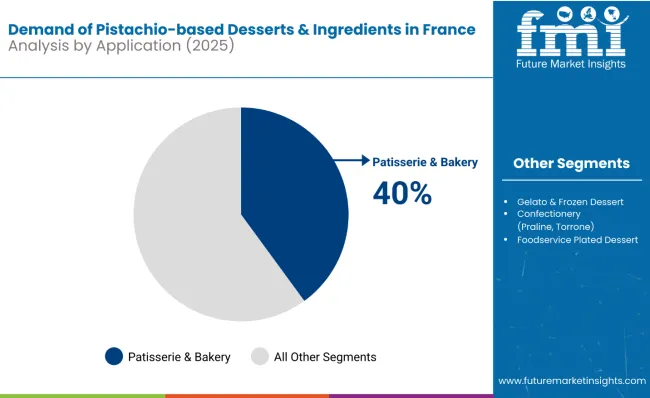

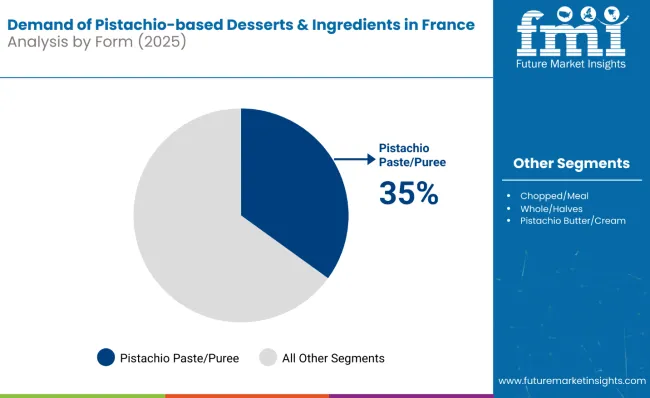

The largest contribution to demand continues to come from pastry and bakery applications, which are expected to account for 40% of total consumption in 2025, owing to traditional pâtisserie culture, seasonal dessert offerings, and professional culinary adoption. By form, pistachio paste and purée represent the dominant ingredient format, responsible for 38% of all usage, while whole and chopped varieties serve specific textural applications.

Consumer adoption is particularly concentrated among affluent urban households and professional pastry chefs, with culinary sophistication and disposable income emerging as significant drivers of demand. While premium pricing persists compared to traditional nuts, the average cost differential has stabilized as Mediterranean supply chains mature. Continued improvements in processing techniques and artisanal positioning are expected to accelerate adoption across high-end culinary establishments. Regional disparities persist, but per capita demand in southern regions is approaching levels seen in traditionally strong Parisian culinary centers.

The pistachio-based desserts and ingredients segment in France is classified across several segments. By application, the key categories include pastry and bakery products featuring traditional pâtisserie applications, confectionery items including pralines and nougat, ice cream and gelato formulations, foodservice plated desserts, and dairy/non-dairy spreads and yogurts. By form, the segment spans pistachio paste and purée for smooth applications, chopped and meal varieties for texture, whole and halved nuts for garnish, pistachio butter and cream for spreads, and flavorings and extracts for essence applications.

By distribution channel, the segment covers hypermarkets and supermarkets, gourmet and specialty retail, e-commerce platforms, and foodservice/industrial applications. By consumer profile, the segment covers professional pastry chefs, affluent home bakers, Mediterranean cuisine enthusiasts, premium dessert consumers, and health-conscious nut consumers. By region, areas such as Île-de-France, Provence-Alpes-Côte d'Azur, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, and Occitanie are included, along with coverage across all French regions.

Pastry and bakery applications are projected to maintain dominance through 2035, supported by French pâtisserie traditions, seasonal dessert innovations, and professional culinary adoption. Other applications including confectionery and ice cream continue growing steadily, serving different consumption occasions.

Pistachio-based products in France are processed into various forms to match culinary applications and processing requirements. Pistachio paste and purée are expected to strengthen their primary position through 2035, while whole nuts decline slightly in favor of processed formats.

Pistachio-based desserts and ingredients in France are distributed through diverse channels reflecting professional and consumer purchasing patterns. Hypermarkets and supermarkets are expected to maintain the primary position through 2035, while specialty retail and e-commerce expand.

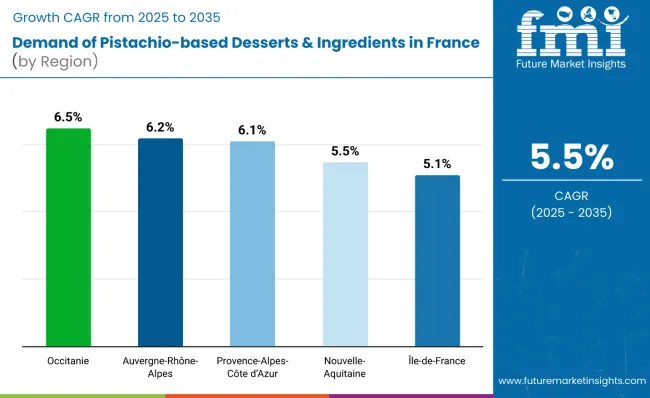

Pistachio-based product demand will grow at varying rates across French regions, with southern and eastern areas showing stronger expansion due to Mediterranean culinary influences and tourism patterns. The table below shows the compound annual growth rate (CAGR) each of the five largest regions is expected to record between 2025 and 2035.

Between 2025 and 2035, demand for pistachio-based desserts and ingredients is projected to expand across all major French regions, but the pace of growth will vary based on culinary culture, tourism influence, and Mediterranean cuisine adoption. Among the top five regions analyzed, Occitanie is expected to register the fastest compound annual growth rate (CAGR) of 6.56%, followed by Auvergne-Rhône-Alpes at 6.29%. This acceleration in southern and eastern regions is underpinned by Mediterranean cultural connections, growing tourism from pistachio-appreciating international visitors, and expanding artisanal food culture in cities like Toulouse and Lyon.

Provence-Alpes-Côte d'Azur maintains strong performance at 6.11% CAGR, supported by established Mediterranean cuisine traditions, luxury tourism influence, and proximity to Italian pistachio culture through cross-border culinary exchange. The region's sophisticated food culture provides natural alignment with premium pistachio applications.

Nouvelle-Aquitaine is forecast to grow at 5.54% CAGR, reflecting steady urbanization around Bordeaux and expanding culinary sophistication in regional centers. The region benefits from growing restaurant culture and premium food retail expansion targeting affluent populations.

Île-de-France, while maintaining the largest absolute demand volumes, is expected to grow at a CAGR of 5.16%, reflecting a more mature consumer base and established pistachio usage patterns. Growth primarily comes from premiumization trends and new application development rather than first-time adoption, as the region already exhibits sophisticated pistachio consumption across professional and consumer segments.

The regional variation in growth rates highlights the geographic expansion of Mediterranean flavor appreciation across France, with southern regions leading adoption while northern areas focus on premium positioning and professional applications.

Pistachio has evolved into a strategic growth lever within France’s premium dessert and ingredient sectors. The category is shaped by two distinct but interlinked segments: high-end patisserie brands driving consumer demand, and upstream ingredient players enabling consistency, scale, and clean-label compliance.

On the demand side, luxury patisserie houses are leading innovation by positioning pistachio as a flavour of distinction. Brands such as Ladurée and Pierre Hermé Paris have made pistachio a core SKU within their macaron and entremet portfolios, using its visual appeal and rich flavour profile to anchor seasonal launches and gifting occasions. Artisanal dessert makers and gelato chains are also leveraging pistachio to create limited-edition offerings that differentiate against traditional flavours like chocolate and vanilla, especially within urban and tourist-heavy retail zones.

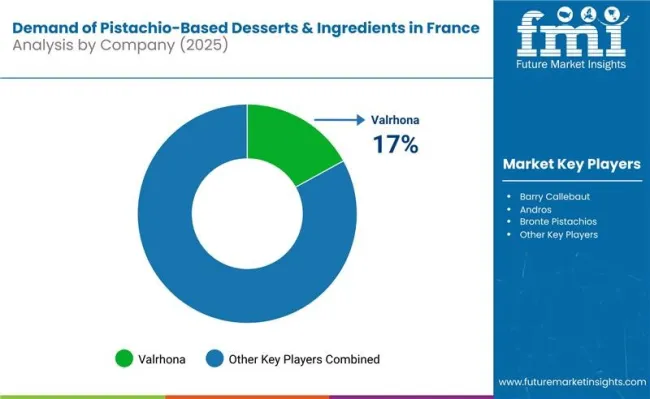

Upstream, the competitive dynamic centres on sourcing origin-certified pistachios and converting them into high-performance compounds. Ingredient majors such as Valrhona and Barry Callebaut focus on producing stable pastes, pralines, and fillings that meet industrial consistency requirements. Meanwhile, niche suppliers including Pariani and Esprit Gourmand emphasize origin traceability, artisanal processing, and the absence of artificial colouring to cater to pastry chefs with strict ingredient standards. As pistachio penetrates frozen desserts, ready-to-eat bakery, and foodservice menus, the winners will be those that can integrate quality control, brand equity, and channel reach into a seamless execution strategy.

| Attribute | Details |

|---|---|

| Study Coverage | France demand and consumption of pistachio-based desserts and ingredients from 2025 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2025 to 2035 |

| Units of Measurement | USD (demand), Metric Tonnes (volume), Kilograms per capita (consumption) |

| Geography Covered | All French regions; regional-level granularity |

| Top Regions Analyzed | Île-de-France, Provence- Alpes -Côte d'Azur, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Occitanie |

| By Application | Pastry & bakery, Confectionery, Ice cream & gelato, Foodservice plated desserts, Dairy/non-dairy products |

| By Form | Pistachio paste/purée, Chopped/meal, Whole/halves, Pistachio butter/cream, Flavorings/extracts |

| By Distribution Channel | Hypermarkets/Supermarkets, Gourmet/Specialty retail, E-commerce/direct, Foodservice/Industrial |

| By Consumer Profile | Professional pastry chefs, Affluent home bakers, Mediterranean cuisine enthusiasts, Premium dessert consumers, Health-conscious nut consumers |

| Metrics Provided | Demand (USD), Volume (MT), Per capita consumption (kg), CAGR (2025 to 2035), Share by segment |

| Price Analysis | Average unit prices by form and application |

| Competitive Landscape | Supplier profiles, distribution strategies, premium positioning, origin authentication |

| Forecast Drivers | Per capita demand trends, culinary sophistication, Mediterranean cuisine adoption, professional chef influence |

By 2035, total France demand for pistachio-based desserts and ingredients is projected to reach USD 1.20 billion, up from USD 0.70 billion in 2025, reflecting a CAGR of approximately 5.5%.

Pastry and bakery applications hold the leading share, accounting for approximately 38% of total demand by 2035, followed by confectionery at 23% and ice cream & gelato at 21%.

Occitanie and Auvergne-Rhône-Alpes lead in projected growth, registering CAGRs of 6.56% and 6.29% respectively between 2025 and 2035, driven by Mediterranean culinary influences and expanding food culture.

Pistachio paste and purée are the dominant form (38% share by 2035), driven by smooth dessert applications and professional bakery usage, followed by chopped/meal at 22% and whole/halves at 18%.

Major players include Bronte Pistachios, Andros, Valrhona, Materne, and Cacao Barry, with increasing focus on premium sourcing, professional chef partnerships, and artisanal positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Pepper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Evaporative Condensers in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Control Network Modules in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Zinc-Tin Alloy Sputtering Target in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Miniature Duplex Connectors in USA Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in UK Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in the USA Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Marine-grade Polyurethane in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in UK Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA