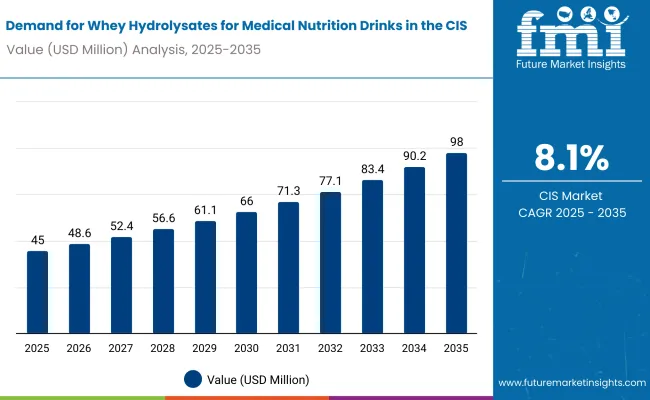

Demand for whey hydrolysates for medical nutrition drinks in the Commonwealth of Independent States (CIS) is estimated at USD 45 million in 2025, with projections indicating a rise to USD 98 million by 2035, reflecting a CAGR of approximately 8.1% over the forecast period. This growth reflects both modernizing healthcare infrastructure and increased per capita consumption in urban medical centers. The rise in demand is linked to improving clinical nutrition protocols, growing awareness of protein therapy benefits, and evolving geriatric care standards.

By 2025, per capita consumption in leading CIS countries such as Russia, Kazakhstan, and Ukraine averages between 0.12 to 0.18 kilograms, with projections reaching 0.25 kilograms by 2035. Moscow leads among metropolitan areas, expected to generate USD 28 million in whey hydrolysate sales for medical nutrition by 2035, followed by Almaty (USD 12 million), Kiev (USD 9 million), Minsk (USD 7 million), and Tashkent (USD 5 million).

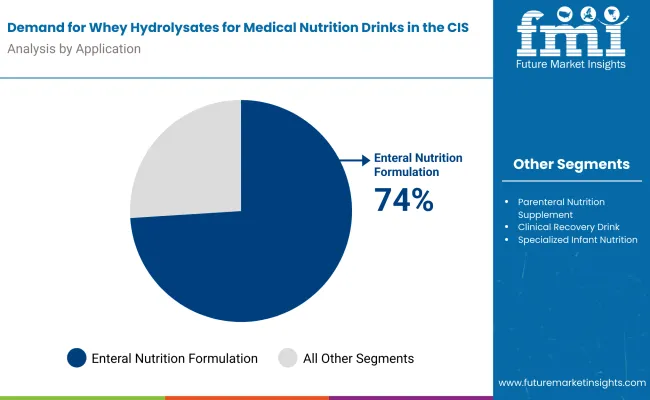

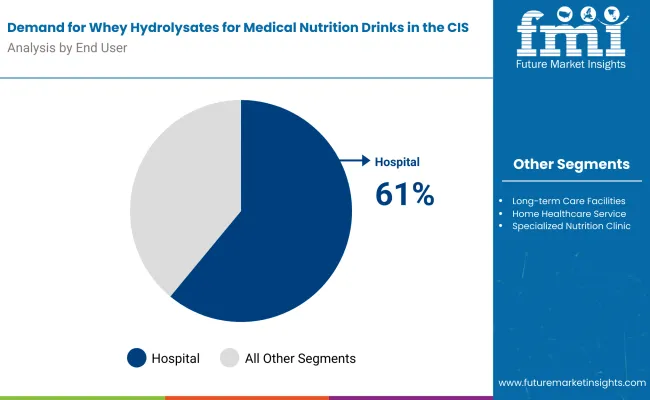

The largest contribution to demand continues to come from enteral nutrition formulations, which are expected to account for 74% of total sales in 2025, owing to established clinical protocols, proven efficacy in malnutrition management, and institutional procurement preferences. By end-user segment, hospitals represent the dominant consumption pattern, responsible for 61% of all sales, while specialized rehabilitation centers and geriatric care facilities are expanding rapidly.

Adoption is particularly concentrated among state-funded medical institutions and private healthcare networks, with government healthcare spending and protein deficiency prevalence emerging as significant drivers of demand. While import costs remain a limiting factor, the average price differential compared to standard protein supplements has stabilized at 28% in 2025. Continued improvements in regional manufacturing capabilities and bulk procurement agreements are expected to accelerate affordability and access across mid-tier healthcare facilities. Regional disparities persist, but per capita demand in emerging CIS capitals is narrowing the gap with traditionally strong healthcare hubs in Moscow and St. Petersburg.

The whey hydrolysates for medical nutrition drinks segment in the CIS is classified across several segments. By application, the key categories include enteral nutrition formulations, parenteral nutrition supplements, clinical recovery drinks, and specialized infant nutrition. By end-user, the segment spans hospitals, rehabilitation centers, long-term care facilities, and home healthcare services. By hydrolysis degree, formulations include extensive hydrolysates, partial hydrolysates, and elemental amino acid blends.

By patient profile, the segment covers post-surgical recovery, geriatric malnutrition, pediatric feeding disorders, and chronic disease management. By country, regions such as Russia, Kazakhstan, Ukraine, Belarus, and Uzbekistan are included, along with coverage across all CIS member states. By city, key metro areas analyzed include Moscow, Almaty, Kiev, Minsk, and Tashkent.

Enteral nutrition formulations are projected to dominate sales in 2025, supported by established clinical guidelines, institutional procurement protocols, and proven therapeutic outcomes. Other applications such as parenteral supplements, recovery drinks, and infant nutrition are growing steadily, each serving distinct medical needs.

Whey hydrolysates for medical nutrition drinks in the CIS are distributed through a mix of institutional healthcare providers and specialized medical channels. Hospitals are expected to remain the primary consumption point in 2025, followed by rehabilitation centers and long-term care facilities. Distribution strategies are evolving to match clinical protocols, with growth coming from both acute care and extended care formats.

Whey hydrolysates for medical nutrition drinks in the CIS utilize varying degrees of protein breakdown, selected for digestibility, absorption rate, allergenicity profile, and clinical indication. Extensive hydrolysates remain the most widely used formulation, though partial hydrolysates and elemental preparations are gaining adoption for specific therapeutic applications.

The whey hydrolysates for medical nutrition category serves diverse patient populations across age groups, medical conditions, and nutritional requirements. While therapeutic goals vary from protein supplementation to specialized clinical nutrition, demand is concentrated among four key patient clusters. Each group brings distinct clinical needs, consumption patterns, and therapeutic expectations.

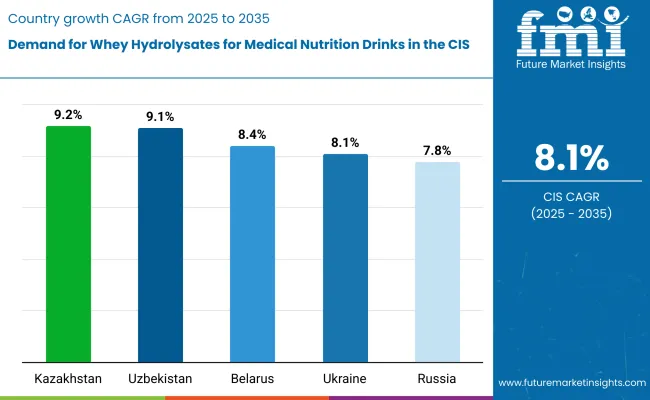

Whey hydrolysate sales will not grow uniformly across every CIS nation. Rising healthcare investments and faster clinical adoption in resource-rich countries give Russia and Kazakhstan a measurable edge, while smaller economies expand more gradually from lower baseline consumption. The table below shows the compound annual growth rate (CAGR) each of the five largest countries is expected to record between 2025 and 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Kazakhstan | 9.2% |

| Uzbekistan | 9.1% |

| Belarus | 8.4% |

| Ukraine | 8.1% |

| Russia | 7.8% |

Between 2025 and 2035, demand for whey hydrolysates for medical nutrition drinks is projected to expand across all major CIS countries, but the pace of growth will vary based on healthcare infrastructure development, clinical protocol adoption, and baseline consumption levels. Among the top five countries analyzed, Kazakhstan and Uzbekistan are expected to register the fastest compound annual growth rate (CAGR) of 9.2% and 9.1% respectively, outpacing more established healthcare systems.

This acceleration is underpinned by a combination of factors: healthcare sector modernization, growing clinical nutrition awareness, and increasing availability of specialized medical products across regional hospitals and private clinics. In both countries, per capita consumption is projected to rise from 0.14 kg in 2025 to 0.28 kg by 2035, closing the gap with higher-consumption countries such as Russia and Belarus. Clinical adoption is also expanding faster in these regions, with new therapeutic protocols and specialized nutrition units gaining traction in major medical centers.

Belarus and Ukraine are each forecast to grow at a CAGR of 8.4% and 8.1% respectively over the same period. Both countries already maintain established healthcare systems, with widespread access to clinical nutrition products in major hospitals, specialty care centers, and rehabilitation facilities. In Belarus, growth is supported by state healthcare investments, clinical protocol standardization, and increasing utilization of specialized nutrition in geriatric care. Ukraine reflects similar dynamics, particularly among post-acute care facilities and patients requiring extended nutritional support. In both countries, per capita consumption is projected to increase from 0.16 kg in 2025 to 0.31 kg by 2035, reflecting mainstreaming of therapeutic nutrition options.

Russia, while maintaining the highest overall sales in absolute terms, is expected to grow at a CAGR of 7.8%, slightly below its CIS counterparts. The country already exhibits higher-than-average per capita consumption (0.18 kg in 2025), extensive clinical adoption, and a comprehensive healthcare distribution network. Growth will likely come from protocol expansion, new therapeutic applications, and specialized nutrition integration rather than first-time clinical adoption.

Collectively, these five countries represent the core of clinical demand for whey hydrolysates for medical nutrition drinks in the CIS, but their individual growth paths highlight the importance of country-specific approaches in clinical education, regulatory compliance, and healthcare partnership strategies.

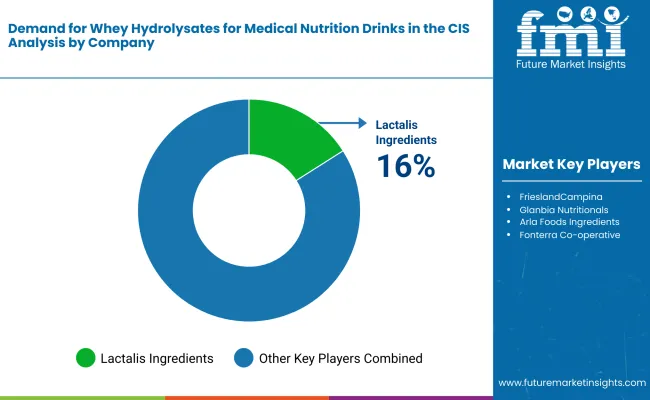

The competitive environment is characterized by a mix of established global nutrition ingredients suppliers and regional healthcare distributors. Clinical validation rather than product variety remains the decisive success factor: the five largest suppliers collectively serve more than 500 medical institutions across the CIS and account for a majority of hospital and clinic procurement contracts in the category.

Lactalis Ingredients is the most established participant in the CIS region. The French multinational offers comprehensive hydrolyzed whey protein solutions specifically formulated for medical applications, all meeting European pharmacopoeia standards. Its core range of extensively hydrolyzed proteins provides deep penetration in state hospitals while maintaining full coverage through regional distributors and medical wholesalers.

Friesland Campina, through its ingredients division, leverages established dairy supply chains to deliver pharmaceutical-grade whey hydrolysates across CIS healthcare systems. Post-expansion initiatives in Kazakhstan and Russia have allowed Friesland Campina to introduce cost-effective bulk formulations priced competitively with locally-sourced alternatives, reinforcing its role as a primary supplier for large hospital networks.

Glanbia Nutritionals benefits from scale advantages within its global medical nutrition portfolio and specialized manufacturing capabilities for therapeutic applications. Recent partnerships with regional medical distributors extend Glanbia beyond standard protein ingredients into ready-to-use clinical formulations expressly targeting the medical nutrition consumer.

The next tier comprises specialized nutrition companies and regional players. Arla Foods Ingredients focuses on high-bioavailability whey peptides for critical care applications; recent clinical studies conducted in Moscow medical centers demonstrated significant outcomes in post-surgical recovery, signaling growing clinical validation but still specialized scale. Fonterra Co-operative, expanding through its medical nutrition division, adds specialized hydrolysate formulations to complement its broader CIS dairy presence and benefits from established regulatory approvals and clinical partnerships.

Private-label programs at major CIS pharmaceutical distributors and hospital procurement networks are widening product access at price points 15-20% below international branded equivalents, putting margin pressure on smaller suppliers while supporting clinical adoption. Consolidation is therefore likely to continue as regulatory compliance and clinical validation become critical for maintaining hospital contracts and therapeutic endorsements in this specialized healthcare category.

| Attribute | Details |

|---|---|

| Study Coverage | CIS demand and consumption of whey hydrolysates for medical nutrition from 2020 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 |

| Forecast Period | 2025 to 2035 |

| Units of Measurement | USD (sales), Metric Tonnes (volume), Kilograms per capita (consumption) |

| Geography Covered | All CIS member states; country-level and city-level granularity |

| Top Countries Analyzed | Russia, Kazakhstan, Ukraine, Belarus, Uzbekistan, 12+ |

| Top Cities Analyzed | Moscow, Almaty, Kiev, Minsk, Tashkent and 15+ |

| By Application | Enteral nutrition, Parenteral supplements, Clinical recovery drinks, Infant nutrition |

| By End-User | Hospitals, Rehabilitation centers, Long-term care, Home healthcare |

| By Hydrolysis Degree | Extensive hydrolysates, Partial hydrolysates, Elemental preparations, BCAA-enriched |

| By Patient Profile | Post-surgical recovery, Geriatric malnutrition, Pediatric disorders, Chronic disease management |

| Metrics Provided | Sales (USD), Volume (MT), Per capita consumption (kg), CAGR (2025 to 2035), Share by segment |

| Price Analysis | Average unit prices by application and country |

| Competitive Landscape | Company profiles, distribution strategies, clinical validation, hospital partnerships |

| Forecast Drivers | Per capita demand trends, clinical adoption, healthcare investments, demographic changes |

By 2035, total CIS sales of whey hydrolysates for medical nutrition drinks are projected to reach USD 98 million, up from USD 45 million in 2025, reflecting a CAGR of approximately 8.1%.

Enteral nutrition formulations hold the leading share, accounting for approximately 74% of total sales in 2025, followed by parenteral supplements and clinical recovery drinks.

Kazakhstan and Uzbekistan lead in projected growth, registering CAGRs of 9.2% and 9.1% respectively between 2025 and 2035, due to healthcare modernization and expanding clinical adoption.

Hospitals are the dominant consumption segment (61% share in 2025), with rehabilitation centers and long-term care facilities showing rapid growth in specialized therapeutic applications.

Major players include Lactalis Ingredients, FrieslandCampina, Glanbia Nutritionals, Arla Foods Ingredients, and Fonterra Co-operative, with growing presence from regional medical distributors and pharmaceutical wholesalers.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA