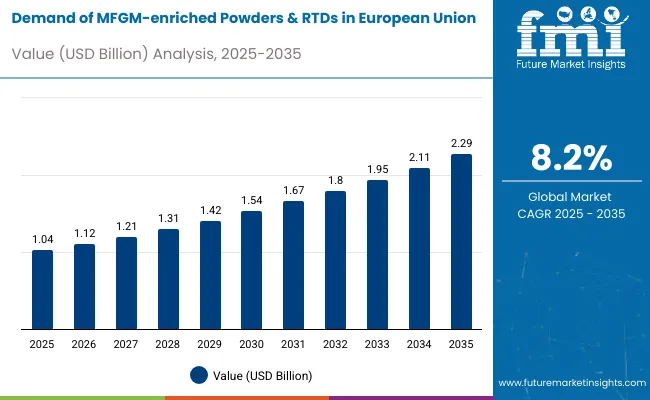

Sales of MFGM-enriched powders and ready-to-drink products across the European Union are estimated at USD 1.04 billion in 2025, with projections indicating a rise to USD 2.29 billion by 2035, reflecting a CAGR of approximately 8.2% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.04 billion |

| Industry Value (2035F) | USD 2.29 billion |

| CAGR (2025 to 2035) | 8.2% |

This growth reflects both strengthening regulatory frameworks and increased pediatric nutrition investment across member states. The rise in demand is linked to growing awareness of early childhood brain development, evolving healthcare recommendations, and premium nutrition positioning trends. By 2025, per capita consumption in leading EU countries such as Germany, France, and Netherlands averages between 0.7 to 0.9 kilograms, with projections reaching 1.4 kilograms by 2035. London leads among metropolitan areas, expected to generate USD 196 million in MFGM-enriched product sales by 2035, followed by Paris (USD 180 million), Berlin (USD 155 million), Amsterdam (USD 97 million), and Madrid (USD 83 million).

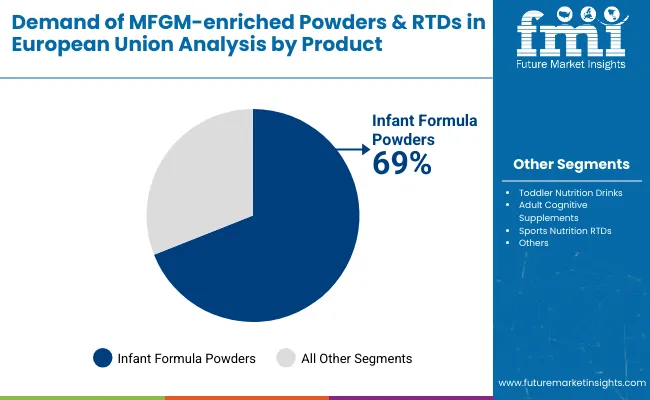

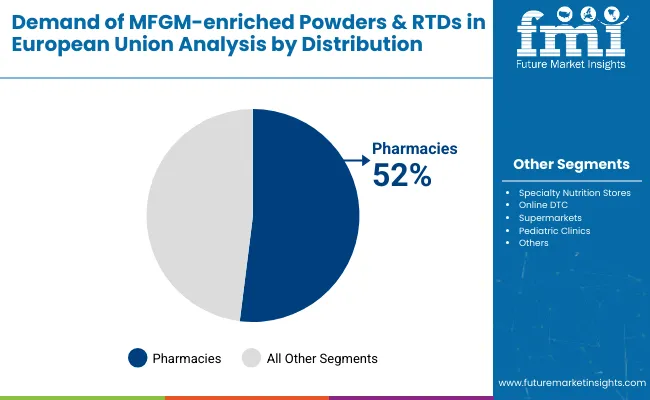

The largest contribution to demand continues to come from infant formula powders, which are expected to account for 69% of total sales in 2025, owing to strong pediatric healthcare integration, extended shelf life benefits, and regulatory compliance advantages. By distribution channel, pharmacies represent the dominant retail format, responsible for 52% of all sales, while specialty nutrition stores and online direct-to-consumer platforms are expanding rapidly.

Consumer adoption is particularly concentrated among health-conscious millennial parents and premium nutrition seekers, with household income and urban density emerging as significant drivers of demand. While price remains a consideration, the average price premium over conventional infant nutrition has stabilized at 18% in 2025, down from 24% in 2020. Continued improvements in MFGM extraction technology and increasing production scale are expected to accelerate affordability and access across middle-income households. Regional disparities persist, but per capita demand in Eastern European countries is narrowing the gap with traditionally strong Western European hubs.

The MFGM-enriched powders and RTDs segment across the EU is classified across several categories. By product, the key categories include infant formula powders, toddler nutrition drinks, adult cognitive supplements, and sports nutrition RTDs with MFGM. By distribution channel, the segment spans pharmacies, specialty nutrition stores, online direct-to-consumer platforms, supermarkets, and pediatric clinics.

By MFGM source, formulations include bovine milk fat globule membrane, organic certified MFGM, synthetic MFGM alternatives, and blended phospholipid complexes. By consumer profile, the segment covers new parents, health-conscious families, cognitive health seekers, elderly nutrition users, and fitness enthusiasts. By region, countries such as Germany, France, Netherlands, Italy, and Spain are included, along with coverage across all 27 EU member states. By city, key metro areas analyzed include London, Paris, Berlin, Amsterdam, and Madrid.

Infant formula powders are projected to dominate sales in 2025, supported by pediatric healthcare recommendations, regulatory approval frameworks, and category trust. Other formats such as toddler drinks, adult supplements, and sports nutrition are growing steadily, each serving distinct nutritional needs.

MFGM-enriched products in the EU are distributed through a mix of healthcare-focused retail and alternative sales channels. Pharmacies are expected to remain the primary point of sale in 2025, followed by specialty nutrition stores and online platforms. Distribution strategies are evolving to match consumer trust patterns, with growth coming from both traditional healthcare channels and digital formats.

MFGM-enriched products in the EU utilize various membrane sources, selected for bioavailability, regulatory approval status, and functional benefits. Bovine milk fat globule membrane remains the most widely used source, though alternative and synthetic options are gaining research attention. Product developers are increasingly exploring hybrid formulations to meet evolving regulatory and consumer demands.

The MFGM-enriched products category appeals to a diverse consumer base across age groups, income levels, and health priorities. While motivations vary from child development to cognitive health to performance enhancement, demand is concentrated among five key demographic clusters. Each group brings distinct purchase behaviors, channel preferences, and product expectations.

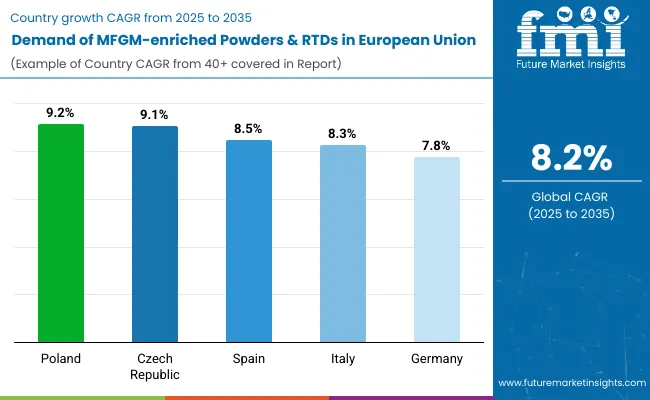

| Countries | CAGR (2025 to 2035) |

| Poland | 9.2% |

| Czech Republic | 9.1% |

| Spain | 8.5% |

| Italy | 8.3% |

| Germany | 7.8% |

MFGM-enriched product sales will not grow uniformly across every European country. Rising healthcare investment and faster regulatory adoption in Eastern Europe give Poland and Czech Republic a measurable edge, while mature Western European countries expand more steadily from a higher base. The table below shows the compound annual growth rate (CAGR) each of the five largest countries is expected to record between 2025 and 2035.

Between 2025 and 2035, demand for MFGM-enriched products is projected to expand across all major EU countries, but the pace of growth will vary based on healthcare infrastructure development, regulatory harmonization, and baseline consumption levels. Among the top five countries analyzed, Poland and Czech Republic are expected to register the fastest compound annual growth rates of 9.2% and 9.1% respectively, outpacing more mature Western European countries. This acceleration is underpinned by increasing healthcare spending, growing premium nutrition awareness, and expanding pharmacy networks. In both countries, per capita consumption is projected to rise from 0.6 kg in 2025 to 1.3 kg by 2035, closing the gap with higher-consumption countries such as Germany and Netherlands.

Spain and Italy are each forecast to grow at CAGRs of 8.5% and 8.3% over the same period. Both countries already maintain established pharmacy networks, with widespread access to MFGM-enriched infant formulas and adult supplements in healthcare channels and specialty retailers. Growth is supported by strong pediatric healthcare systems, brand experimentation, and increasing uptake of premium nutrition positioning.

Germany, while maintaining the highest overall sales in absolute terms, is expected to grow at a CAGR of 7.8%, reflecting its mature but stable consumption base. The country already exhibits higher-than-average per capita intake (0.9 kg in 2025), extensive product availability, and well-developed healthcare distribution networks.

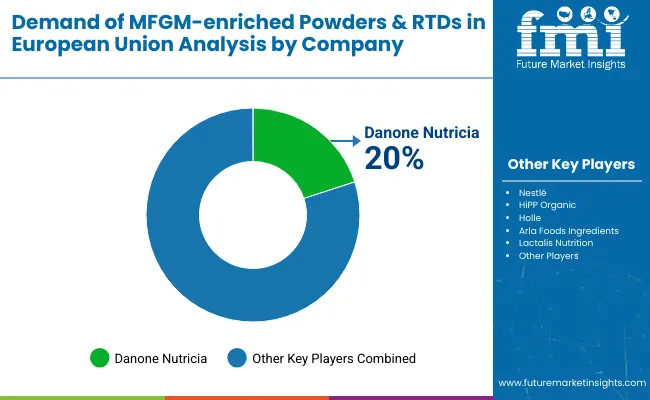

The competitive environment is characterized by a mix of established infant nutrition manufacturers and specialized ingredient companies. Regulatory compliance and healthcare channel access remain decisive success factors: the five largest suppliers collectively reach more than 40,000 pharmacy outlets across the EU and account for a majority of premium infant nutrition shelf presence.

Danone Nutricia is the most established participant in infant MFGM nutrition. The company leverages its Aptamil and Nutrilon brands to offer MFGM-enriched formulas across multiple EU countries, maintaining strong pediatric healthcare relationships and clinical research backing. Its European production facilities provide regulatory compliance advantages and supply chain efficiency.

Nestlé utilizes its extensive European distribution network to place MFGM-enriched products under the NAN and Gerber brands in mainstream pharmacies and specialty stores. Post-acquisition integration of Aimmune Therapeutics has allowed Nestlé to strengthen its clinical positioning and introduce therapeutic-grade MFGM formulations.

HiPP, the German organic specialist, benefits from strong brand trust in Central Europe and premium positioning advantages. Recent MFGM integration into its organic infant formula range reinforces its role as a clean-label leader while maintaining certified organic status across key European countries.

Holle focuses on anthroposophic and biodynamic MFGM formulations, targeting conscious parenting segments in Germany, Austria, and Switzerland. Its specialized distribution through natural health stores and online wellness platforms supports premium pricing and loyal customer retention.

Arla Foods leverages its Nordic dairy heritage and MFGM extraction capabilities to supply both branded products and white-label formulations to European nutrition companies, benefiting from vertical integration and strong B2B relationships.

Private-label programs at major pharmacy chains and health retailers are expanding MFGM offerings at price points 12-18% below branded equivalents, putting margin pressure on smaller suppliers while supporting household trial and category expansion.

| Attribute | Details |

| Study Coverage | EU sales and consumption of MFGM-enriched powders & RTDs from 2020 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 |

| Forecast Period | 2025-2035 |

| Units of Measurement | USD (sales), Metric Tonnes (volume), Kilograms per capita (consumption) |

| Geography Covered | All 27 EU member states; country-level and city-level granularity |

| Top Countries Analyzed | Germany, France, Netherlands, Italy, Spain, 25+ |

| Top Cities Analyzed | London, Paris, Berlin, Amsterdam, Madrid and 50+ |

| By Product Format | Infant formula powders, Toddler nutrition drinks, Adult cognitive supplements, Sports nutrition RTDs |

| By Distribution Channel | Pharmacies, Specialty nutrition stores, Online DTC, Supermarkets, Pediatric clinics |

| By MFGM Source | Bovine MFGM, Organic certified, Synthetic alternatives, Blended phospholipid complexes |

| By Consumer Profile | New parents, Health-conscious families, Cognitive health seekers, Elderly nutrition users, Fitness enthusiasts |

| Metrics Provided | Sales (USD), Volume (MT), Per capita consumption (kg), CAGR (2025-2035), Share by segment |

| Price Analysis | Average unit prices by product format and country |

| Competitive Landscape | Company profiles, private label strategies, healthcare channel presence |

| Forecast Drivers | Per capita demand trends, regulatory harmonization, clinical validation, aging demographics |

By 2035, total EU sales of MFGM-enriched powders and RTDs are projected to reach USD 2.29 billion, up from USD 1.04 billion in 2025, reflecting a CAGR of approximately 8.2%.

Infant formula powders hold the leading share, accounting for approximately 69% of total sales in 2025, followed by toddler nutrition drinks and adult cognitive supplements.

Poland and Czech Republic lead in projected growth, registering CAGRs of 9.2% and 9.1% respectively between 2025 and 2035, due to healthcare infrastructure development and growing premium nutrition awareness.

Pharmacies are the dominant sales channel (52% share in 2025), but specialty nutrition stores and online direct-to-consumer platforms are growing at double-digit CAGR, especially in urban regions.

Major players include Danone Nutricia, Nestlé, HiPP, Holle, and Arla Foods, with growing competition from private label pharmacy brands and specialized ingredient suppliers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Pepper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Evaporative Condensers in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Control Network Modules in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mineral Enrichment Ingredients in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Zinc-Tin Alloy Sputtering Target in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Miniature Duplex Connectors in USA Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in UK Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in the USA Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Online Clothing Rental in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Marine-grade Polyurethane in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Welding Consumables in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA