Demand for joint compound in EU is projected to expand from USD 1.2 million in 2025 to USD 2.1 million by 2035, advancing at a CAGR of 5.3%. Demand for joint compounds is strengthening as European construction increasingly shifts toward drywall finishing systems for both residential and commercial applications. Sales of joint compounds are being reinforced by renovation projects, energy-efficient retrofitting programs, and the adoption of modern interior design techniques that rely on smooth wall finishes.

One of the most prominent drivers is the growing demand for ready-mix compounds. Contractors prefer ready-mix over traditional powdered versions due to its ease of application, faster drying time, and consistent texture. Adoption of lightweight compounds is also expanding, supported by their ability to reduce worker fatigue and improve productivity. In parallel, the procurement of eco-friendly joint compounds with low volatile organic compound (VOC) emissions and dust-control features is gaining traction, aligning with stricter EU construction standards.

Sales of joint compounds are anticipated to grow significantly from 2025 and 2030, driven by housing renovations and steady demand from commercial real estate. Demand for drywall finishing materials in this phase will be shaped by the modernization of Europe’s aging housing stock and the adoption of modular construction practices. Renovation activity, especially in Western Europe, will require consistent procurement of multi-purpose joint compounds that can perform taping, topping, and finishing functions. The adoption of joint compounds in DIY retail channels is also forecast to expand as homeowners increasingly engage in small-scale interior remodeling.

Sales of joint compounds are forecast to accelerate further during 2030 to 2035, with commercial interiors, hospitality projects, and office refurbishments becoming the dominant growth drivers. Demand for high-performance compounds offering enhanced adhesion, superior crack resistance, and improved sanding properties will expand across these projects. Adoption of specialty formulations will rise, especially in high-traffic environments where durability and aesthetics converge. Procurement strategies during this phase are likely to focus on premium solutions, supported by digital platforms that simplify ordering and bulk distribution. Innovation remains central to the industry’s evolution. Manufacturers are expected to invest in joint compounds that offer regional adaptability, ensuring performance consistency across Europe’s diverse climates, from the humid Mediterranean south to the colder Nordic regions. The integration of intelligent packaging, recyclable containers, and improved mixing technologies will further enhance adoption.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.2 million |

| Forecast Value in (2035F) | USD 2.1 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

Industry expansion is being supported by the steady pace of residential construction across European countries and the corresponding demand for reliable, high-performance finishing materials with proven workability characteristics for drywall installation and repair applications. Modern construction professionals rely on joint compound as an essential material for seamless drywall finishing, texture application, minor wall repairs, and surface preparation, driving demand for products that deliver smooth application properties, reliable adhesion to gypsum board, and consistent drying behavior enabling efficient project completion. Even moderate construction activity, such as residential renovations, commercial tenant improvements, or institutional facility maintenance, drives comprehensive joint compound consumption to maintain optimal finishing quality and support professional installation standards.

The established infrastructure of professional contractor networks and increasing recognition of workplace safety requirements are driving demand for joint compound products from certified manufacturers with appropriate performance specifications and regulatory compliance. Regulatory authorities are increasingly establishing clear guidelines for low-VOC emissions in building materials, workplace dust exposure limits, and product labeling requirements to maintain jobsite safety and ensure product consistency. Construction industry standards and professional finishing specifications are providing requirements supporting joint compound performance characteristics, requiring specialized formulation expertise and standardized manufacturing protocols for consistent viscosity control, optimal sand-ability after drying, and appropriate shrinkage behavior preventing surface cracking.

Sales are segmented by product type (formulation), application (end use), distribution channel, nature (formulation attribute), and country. By product type, demand is divided into ready-mix, setting-type, and drying-type. Based on the application, sales are categorized into residential, commercial, institutional, and industrial. In terms of distribution channel, demand is segmented into pro/contractor channels, home centers/DIY, builder/wholesale, and e-commerce. By nature, sales are classified into low-dust/OSHA-friendly, low-VOC certified, mold/mildew-resistant, quick-dry/fast-set, and standard. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The ready-mix segment is projected to account for 70% of EU joint compound sales in 2025, establishing itself as the dominant product formulation across European markets. This commanding position is fundamentally supported by ready-mix compound's superior convenience eliminating mixing requirements, consistent quality through factory-controlled formulation, and improved workability characteristics enabling professional-grade finishing results. The ready-mix format delivers exceptional ease-of-use, providing contractors with ready-to-apply consistency that facilitates immediate application after opening, eliminates mixing errors affecting performance, and reduces jobsite preparation time supporting productivity improvements.

This segment benefits from mature manufacturing infrastructure, well-established distribution networks reaching professional contractor channels, and extensive availability from multiple European producers who maintain rigorous quality standards and consistent formulation specifications. Additionally, ready-mix joint compound offers versatility across multiple finishing coats, including taping, topping, and all-purpose applications, supported by proven performance characteristics addressing professional contractor requirements for smooth application, minimal shrinkage, and excellent sand-ability.

The ready-mix segment is expected to increase share to 72.0% through 2035, demonstrating continued market share gains as convenience advantages and professional contractor preferences continue driving adoption over traditional setting-type compounds throughout the forecast period.

.webp)

Residential application is positioned to represent 49% of total joint compound demand across European markets in 2025, maintaining substantial share around 48.0% through 2035, reflecting the segment's position as the primary consumption driver within the overall industry ecosystem. This considerable share directly demonstrates that residential construction and renovation represents the largest single application, with contractors and DIY users consuming joint compound for new home construction finishing, renovation projects, repair work, and basement finishing applications.

Modern residential construction increasingly relies on drywall systems requiring joint compound for seamless finishing, driving demand for ready-mix products optimized for taping joints between gypsum boards, applying finish coats achieving smooth surfaces, and repairing wall damage in existing homes. The segment benefits from steady new housing construction across European markets, substantial renovation activity in existing housing stock particularly in urban areas, and increasing DIY homeowner participation in smaller repair and improvement projects driving retail channel sales.

The segment's stable share reflects proportional growth across all application categories, with residential maintaining its leading position as the primary consumption driver throughout the forecast period.

EU joint compound sales are advancing steadily due to consistent residential construction activity, ongoing commercial renovation requirements, and increasing adoption of premium formulations. However, the industry faces challenges, including housing market cyclicality affecting new construction volumes, price pressure from private-label products in retail channels, and raw material cost volatility affecting polymer additives and binders. Continued innovation in formulation technology and distribution efficiency remains central to industry development.

The rapidly accelerating emphasis on indoor air quality and environmental sustainability is fundamentally transforming joint compound formulation from traditional solvent-containing systems to low-VOC certified products, enabling healthier indoor environments and supporting green building certification programs. Advanced low-VOC formulations featuring water-based binder systems, natural additives replacing synthetic chemicals, and reformulated compositions meeting stringent emission standards allow contractors to specify environmentally responsible products without sacrificing finishing quality or workability performance. These environmental innovations prove particularly transformative for commercial and institutional applications, including schools, healthcare facilities, and office buildings, where indoor air quality directly impacts occupant health and green building certifications provide market differentiation.

Modern joint compound producers systematically incorporate advanced formulation technologies, including optimized binder systems, specialized additives, and controlled particle size distributions that deliver accelerated drying performance, enabling faster coat-to-coat application and reduced project completion time. Strategic integration of quick-drying capabilities enables manufacturers to position premium products addressing contractor productivity requirements where shortened drying intervals directly determine project schedules and labor efficiency. These performance improvements prove essential for commercial construction, as project timelines demand rapid finishing sequences, multiple coat applications within compressed schedules, and reliable performance supporting aggressive construction calendars.

European contractors and construction professionals increasingly prioritize reliable distribution relationships featuring consistent product availability, technical support services, and partnership approaches supporting ongoing project requirements. This professional channel emphasis enables manufacturers and distributors to differentiate through account management services, jobsite delivery capabilities, and technical assistance resonating with contractors seeking suppliers understanding construction project dynamics beyond simple product transactions. Professional channel positioning proves particularly important for commercial and institutional applications where project specifications, performance requirements, and delivery reliability directly influence contractor purchasing decisions.

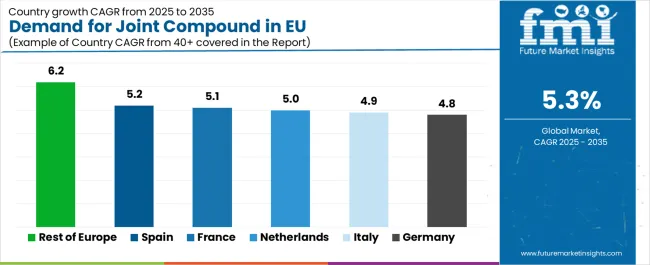

| Country | CAGR % |

|---|---|

| Rest of Europe | 6.2% |

| Spain | 5.2% |

| France | 5.1% |

| Netherlands | 5.0% |

| Italy | 4.9% |

| Germany | 4.8% |

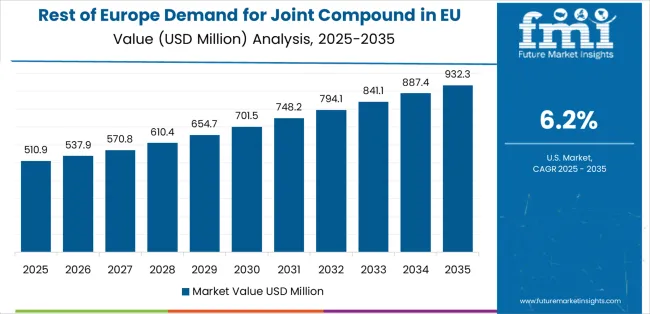

EU joint compound sales demonstrate steady growth across major European economies, with the Rest of Europe leading expansion at 6.2% CAGR through 2035, driven by emerging construction development and increasing drywall adoption. Germany maintains leadership through established construction infrastructure and mature professional contractor networks. France benefits from active renovation markets and steady commercial construction activity. Italy leverages ongoing renovation activity in historic building stock and residential improvement projects. Spain shows strong growth supported by residential construction recovery and tourism-related commercial development. The Netherlands emphasizes sustainable construction practices and professional contractor sophistication. Overall, sales show robust regional development reflecting steady construction activity and increasing adoption of premium finishing materials.

Revenue from joint compound in Germany is projected to exhibit steady growth with a CAGR of 4.8% through 2035, driven by exceptionally well-developed construction infrastructure, comprehensive professional contractor networks, and strong emphasis on quality finishing standards throughout the country. Germany's sophisticated construction industry and internationally recognized craftsmanship standards are creating substantial demand for diverse joint compound formulations across residential and commercial applications.

Major construction projects, including residential developments, commercial building renovations, and institutional facility improvements, systematically consume joint compound for drywall finishing, with professional contractors demonstrating strong preference for ready-mix formulations delivering consistent quality and reliable performance. German demand benefits from high construction quality standards, substantial renovation activity in existing building stock, and strong professional contractor culture emphasizing proper material selection and application techniques naturally supporting premium joint compound adoption.

Revenue from joint compound in France is expanding at a CAGR of 5.1%, substantially supported by active renovation markets particularly in urban areas, steady residential construction activity, and increasing commercial building modernization projects. France's substantial existing building stock and evolving construction practices are systematically driving demand for joint compound products across diverse application segments.

Major construction activities, including Parisian apartment renovations, provincial residential development, and commercial space modernization, are gradually establishing comprehensive joint compound consumption patterns serving continuously evolving requirements. French sales particularly benefit from historic building renovation requiring careful finishing work, urban residential improvement activity supporting renovation market growth, and commercial construction activity in major metropolitan areas driving professional contractor consumption.

Revenue from joint compound in Italy is growing at a CAGR of 4.9%, fundamentally driven by substantial renovation activity, ongoing residential improvement projects, and steady commercial construction supporting tourism and retail sectors. Italy's traditionally strong renovation market and growing adoption of modern drywall systems are gradually increasing joint compound requirements while maintaining quality standards for finishing work.

Major renovation projects, including historic building modernization, residential apartment improvements, and commercial space updates, strategically utilize joint compound for finishing applications supporting both traditional plastering systems and modern drywall installations. Italian sales particularly benefit from extensive renovation activity in historic building stock requiring careful restoration work, residential improvement projects supporting homeowner investment in property upgrades, and growing commercial construction serving tourism and retail sectors.

Demand for joint compound in Spain is projected to grow at a CAGR of 5.2%, substantially supported by residential construction market recovery following previous downturns, tourism-related commercial development, and increasing renovation activity in coastal and urban areas. Spanish construction industry's emphasis on residential development and commercial projects serving tourism infrastructure positions joint compound as essential finishing material supporting market growth.

Major construction activities, expanding residential developments serving both domestic and international buyers, and tourism-related commercial projects including hotels and retail facilities systematically expand joint compound consumption, with ready-mix formulations proving particularly successful in supporting professional contractor productivity requirements. Spain's residential construction recovery creates increasing finishing material demand, coastal development drives construction activity in tourism regions, and urban renovation projects support consistent consumption beyond new construction markets.

Demand for joint compound in the Netherlands is expanding at a CAGR of 5.0%, fundamentally driven by emphasis on sustainable construction practices, sophisticated professional contractor networks, and steady residential and commercial construction activity. Dutch construction industry's focus on environmental performance and quality standards positions joint compound selection as important consideration supporting green building objectives.

Netherlands sales significantly benefit from green building emphasis driving low-VOC product adoption, professional contractor sophistication supporting premium product specification, and compact urban development requiring efficient construction practices where ready-mix compounds support productivity objectives. The country's environmental leadership creates demand for certified low-VOC formulations, while professional contractor expertise supports proper material selection and application techniques ensuring optimal finishing quality.

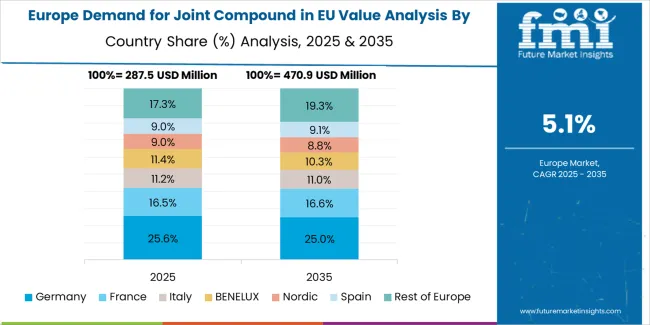

EU joint compound sales are projected to grow from USD 1.2 million in 2025 to USD 2.1 million by 2035, registering a CAGR of 5.3% over the forecast period. The Rest of Europe region is expected to demonstrate the strongest growth trajectory with a 6.2% CAGR, supported by emerging construction markets, increasing residential development, and growing adoption of modern drywall systems. Spain and France follow with 5.2% and 5.1% CAGR, respectively, attributed to active renovation markets and steady construction activity.

Germany, while maintaining the largest share at 21.4% in 2025, is expected to grow at a 4.8% CAGR, reflecting market maturity and established construction practices. Italy and the Netherlands demonstrate 4.9% and 5.0% CAGR, respectively, supported by renovation activity and steady commercial construction.

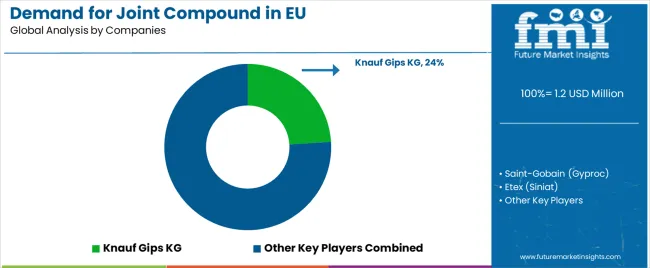

EU joint compound sales are defined by competition among integrated building materials manufacturers, gypsum board producers with downstream finishing products, and specialized finishing materials suppliers. Companies are investing in formulation technology, low-VOC product development, professional contractor relationships, and distribution network optimization to deliver high-quality, environmentally responsible, and application-appropriate joint compound solutions. Strategic partnerships with professional contractor channels, technical training programs, and marketing emphasizing productivity benefits are central to strengthening competitive position.

Major participants include Knauf Gips KG with an estimated 24% share, leveraging its extensive pan-European manufacturing infrastructure, integrated gypsum board and finishing materials production, and comprehensive professional contractor distribution relationships supporting consistent supply across multiple European markets. Knauf benefits from integrated operations combining gypsum board manufacturing with joint compound production, diverse product portfolio spanning multiple formulation types, and the ability to provide complete drywall system solutions supporting contractor efficiency.

Saint-Gobain (Gyproc brand) holds approximately 22.0% share, emphasizing comprehensive European distribution networks, strong brand recognition among professional contractors, and leadership in low-VOC certified formulations supporting green building requirements. Saint-Gobain's success in developing environmentally responsible products meeting stringent emission standards and maintaining extensive professional contractor relationships creates strong positioning across commercial and residential applications, supported by technical service capabilities and application support programs.

Etex (Siniat brand) accounts for roughly 18.0% share through its position as a European-focused building materials specialist, emphasizing comprehensive certification portfolio, technical expertise in formulation development, and strong relationships with professional distributors serving contractor markets. The company benefits from focused European market concentration, extensive product certifications supporting specification requirements, and technical capabilities enabling customized formulations addressing regional preferences and regulatory requirements.

Other companies and regional producers collectively hold 36.0% share, reflecting moderate fragmentation in European joint compound sales, where numerous regional manufacturers, private-label suppliers serving retail chains, specialized finishing materials producers, and national distributors serve local markets, specific application requirements, and niche customer segments. This moderate fragmentation provides opportunities for differentiation through specialized formulations (low-dust, quick-dry, mold-resistant), regional supply reliability, competitive pricing particularly for private-label products, and technical service excellence resonating with professional contractors seeking suppliers understanding construction project requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 2,086.6 million |

| Product Type (Formulation) | Ready-Mix, Setting-Type, Drying-Type |

| Application (End Use) | Residential, Commercial, Institutional, Industrial |

| Distribution Channel | Pro/Contractor Channels, Home Centers/DIY, Builder/Wholesale, E-commerce |

| Nature (Formulation Attribute) | Low-Dust/OSHA-Friendly, Low-VOC Certified, Mold/Mildew-Resistant, Quick-Dry/Fast-Set, Standard |

| Forecast Period | 2025 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 to 2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Knauf Gips KG, Saint-Gobain (Gyproc), Etex (Siniat), Regional manufacturers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (formulation), application (end use), distribution channel, and nature (formulation attribute); regional demand trends across major European markets; competitive landscape analysis with established building materials manufacturers and specialized finishing products suppliers; customer preferences for various formulation types and performance attributes; integration with drywall systems and finishing applications; innovations in low-VOC formulations, quick-drying technologies, and low-dust products; adoption across residential, commercial, and institutional construction sectors. |

The global demand for joint compound in eu is estimated to be valued at USD 1.2 million in 2025.

The market size for the demand for joint compound in eu is projected to reach USD 2.1 million by 2035.

The demand for joint compound in eu is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in demand for joint compound in eu are ready-mix, setting-type and drying-type.

In terms of application (end use), residential segment to command 49.0% share in the demand for joint compound in eu in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Joint Compound Market Size and Share Forecast Outlook 2025 to 2035

Ready Mix Joint Compound Market Size and Share Forecast Outlook 2025 to 2035

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Compound Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compound Semiconductor Hall Elements Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Joint Reconstruction Devices Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Compounds Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA