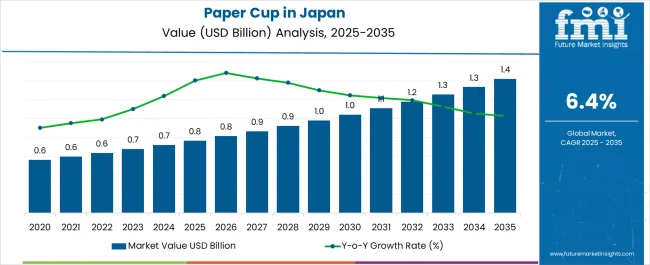

The Demand and Sales Analysis of Paper Cup in Japan is estimated to be valued at USD 0.8 billion in 2025 and is projected to reach USD 1.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Demand and Sales Analysis of Paper Cup in Japan Estimated Value in (2025 E) | USD 0.8 billion |

| Demand and Sales Analysis of Paper Cup in Japan Forecast Value in (2035 F) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The paper cup market in Japan is experiencing consistent growth. Increasing consumption of on-the-go beverages, rising awareness of environmental sustainability, and government regulations promoting recyclable and biodegradable packaging are driving market expansion.

Current market dynamics are influenced by evolving consumer preferences for convenient and hygienic packaging solutions, advancements in manufacturing technologies, and the adoption of lightweight and durable materials. Supply chain optimization and strategic collaborations among manufacturers have enhanced product availability and reduced production costs.

The future outlook is shaped by rising demand from cafes, fast-food outlets, and retail chains, along with innovations in coating technologies and material enhancements that improve product performance and environmental compliance Growth rationale is underpinned by the combination of robust consumer demand, technological improvements in paper cup production, and ongoing initiatives to reduce plastic usage, which collectively are expected to sustain market expansion and increase adoption of paper cups across Japan.

The 8 Oz segment, holding 28.60% of the capacity / wall type category, has been leading due to its versatility in serving standard beverage portions and compatibility with various hot and cold drinks. Its market share has been supported by widespread adoption in cafes, fast-food outlets, and convenience stores.

Manufacturing efficiencies and standardized sizing have facilitated large-scale production and distribution, while consistency in cup strength and insulation has reinforced consumer trust. Demand has been stabilized by ongoing consumption trends and the convenience offered to end-users.

Product innovation, such as improved wall thickness and structural design, is expected to sustain segment leadership and maintain competitive advantage within the paper cup market.

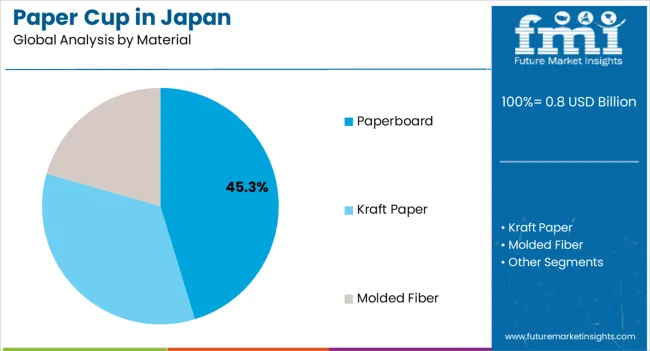

The paperboard segment, accounting for 45.30% of the material category, has maintained a dominant position due to its strength, durability, and recyclability. Its adoption has been driven by compliance with environmental regulations and increasing consumer preference for sustainable packaging.

Manufacturing processes have been optimized to ensure uniform quality and cost-effectiveness, while structural integrity and resistance to leakage have enhanced end-user satisfaction. Growth is being supported by innovation in lightweight and reinforced paperboard varieties, which allow for broader application across hot and cold beverages.

Continued focus on environmentally friendly sourcing and improved performance is expected to sustain the segment’s market share.

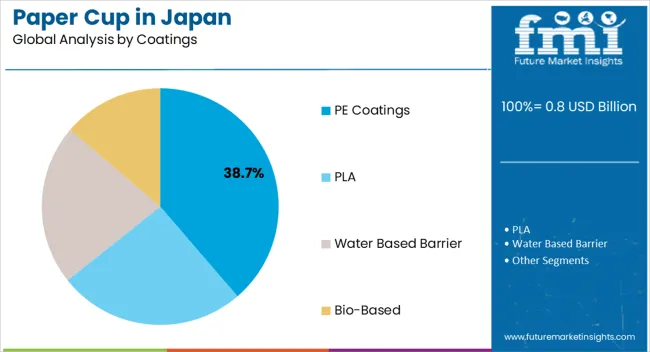

The PE coatings segment, representing 38.70% of the coatings category, has emerged as the leading coating due to its effectiveness in providing moisture resistance and maintaining structural integrity. Adoption has been reinforced by compatibility with paperboard materials and the ability to extend product shelf life.

Manufacturing standardization and regulatory compliance have contributed to consistent quality and reliability. Demand stability has been supported by widespread use in foodservice and beverage sectors, while ongoing innovations in coating formulations are improving environmental compliance and recyclability.

These factors are expected to maintain the segment’s leadership and support continued market growth in Japan.

The Kanto region, which includes Tokyo and its surrounding prefectures, has a significant awareness of environmental issues and a growing trend towards sustainability. The government has taken steps to reduce plastic waste, increasing demand for eco-friendly alternatives like paper cup. Many cafes, restaurants, and businesses in Kanto have embraced the shift from single-use plastics to paper cup. The proactive approach has resulted in a substantial uptick in paper cup consumption, making it a prominent industry in the region.

The Chubu region, known for its industrial centers, has also witnessed a notable shift towards sustainability. Implementing regulations prohibiting single-use plastics, including plastic cup, has accelerated the adoption of paper cup. Businesses in sectors such as manufacturing and services have increasingly adopted eco-friendly packaging solutions, contributing to the growing demand for paper cup in Chubu. The trend is thus expected to continue as the region emphasizes reducing plastic waste.

Kinki, home to prominent cities like Osaka and Kyoto, has proactively curbed plastic pollution. Several towns in this region have enforced bans on single-use plastics, fostering a strong demand for sustainable alternatives such as paper cup. Cafes, eateries, and event organizers in Kinki seek eco-friendly packaging options, driving the industry for paper cup. The trend of embracing environmentally conscious choices is firmly established in this region.

The table highlights that the paperboard material segment leads the industry, holding a share of 54.4% in 2025. The table further details applications and shows how beverage segment is taking the industry by storm acquiring a value share of 70.3% in 2025.

| Category | Value Share in 2025 |

|---|---|

| Paperboard | 54.4% |

| Beverage | 70.3% |

Disposable cup for hot beverages is increasingly favored by various establishments, including restaurants, cafés, and hotels, owing to their double-walled construction that effectively preserves temperature and thermal characteristics. Tea and coffee consumption is supplementary but increasingly prevalent compared to cold beverages.

The emergence of trendy drinks in Japan, such as kombucha, Chhai, Ramune Soda, and Aojiru, further contributes to the demand for paperboard cups. Many of these beverages are served in paperboard cups, especially in takeaway formats, aligning with the fast-paced lifestyle of many consumers in Japan.

Efficient features and superior heat insulation are requisite for cup-serving hot drinks to ensure convenient consumption. As the production of cup designed for hotter beverages surges, it is anticipated to substantially influence the production rate more than cup for cold beverages. The burgeoning preference for hot drinks presents a promising growth opportunity for the global paper cup industry.

The popularity of beverages like green tea, royal milk tea, bubble tea, flavored soy milk, and yakult, highlights the strong culture of enjoying drinks on the go. These beverages are often served in disposable paper cups, which are convenient for both the consumers and the businesses. Therefore, as these drinks continue to be favored by consumers, the demand for paper cups remains robust.

The growing appetite for specialty foods and beverages like gourmet coffee, artisanal tea, and exotic-flavored salts suggests that there could be a surge in the number of cafes and specialty stores. These establishments typically use paper cups for serving their beverages, underlining the importance of paper cup demand in the food and beverage sector.

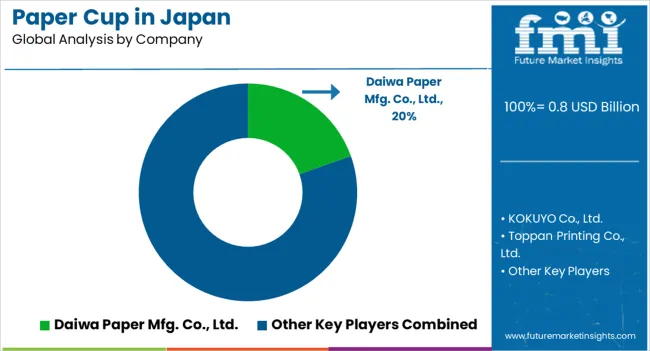

In Japan's competitive paper cup industry, key strategies revolve around sustainability, quality, and innovation. Companies focus on eco-friendly materials and responsible production practices to meet evolving environmental standards. They are focusing on diversification and customization of product offerings cater to diverse consumer needs, while stringent quality control ensures compliance with industry regulations.

They are also embracing technological advancements improves efficiency and product performance. Additionally, they are streamlining the supply chain and targeted industry segmentation to enhance operational agility.

Recent Developments Observed in Paper Cup Services in Japan

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 0.8 billion |

| Projected Industry Size in 2035 | USD 1.4 billion |

| Anticipated CAGR between 2025 to 2035 | 6.4% CAGR |

| Demand Forecast for Paper Cup Industry in Japan | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Paper Cup in Japan, Insights on Global Players and their Industry Strategy in Japan, Ecosystem Analysis of Local and Regional Japan Providers |

| Key Countries Analyzed | Kanto, Chubu, Kinki (Kansai), Kyushu and Okinawa, Tohoku |

| Key Companies Profiled | Daiwa Paper Mfg. Co., Ltd.; KOKUYO Co., Ltd.; Toppan Printing Co., Ltd.; Nichimo Co., Ltd.; Eco One Co., Ltd.; Sakano Co., Ltd.; Nihon Dixie Co., Ltd.; HARIO Co., Ltd.; Tomizawa Printing Co., Ltd.; Dixie Japan Co., Ltd. |

The global demand and sales analysis of paper cup in Japan is estimated to be valued at USD 0.8 billion in 2025.

The market size for the demand and sales analysis of paper cup in Japan is projected to reach USD 1.4 billion by 2035.

The demand and sales analysis of paper cup in Japan is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in demand and sales analysis of paper cup in Japan are 8 oz, _single wall, _double wall, _ripple wall, 4 oz, _single wall, _double wall, _ripple wall, 12 oz, _single wall, _double wall, _ripple wall, 16 oz, _single wall, _double wall, _ripple wall, 20 oz, _single wall, _double wall, _ripple wall, other capacities, _single wall, _double wall and _ripple wall.

In terms of material, paperboard segment to command 45.3% share in the demand and sales analysis of paper cup in Japan in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

Demand for DMPA in EU Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Vanillin in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Gypsum in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Barite in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mezcal in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA