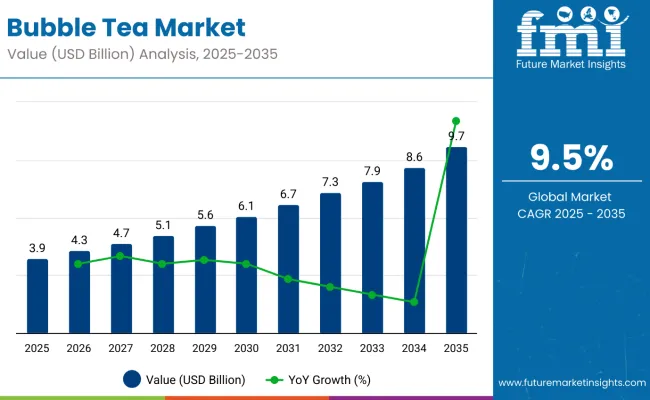

The global bubble tea market, valued at USD 3.96 billion in 2025, is set to reach USD 9.72 billion by 2035, registering a 9.5% CAGR. Growth is projected to be driven by rising consumer demand for customizable beverages and continuous flavor innovation that broadens appeal beyond its East Asian origin. Key trends are expected to include premiumization of ingredients, the launch of healthier low-sugar variants, and wider adoption of RTD packaging to tap on-the-go consumption.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.96 billion |

| Industry Value (2035F) | USD 9.72 billion |

| CAGR (2025 to 2035) | 9.5% |

Per capita consumption of bubble tea is growing steadily across global markets, driven by its unique appeal, wide range of flavors, and increasing popularity among younger consumers. Once considered a niche product, bubble tea has become a mainstream beverage in both developed and emerging regions. Social trends, café culture, and innovative marketing have further accelerated its adoption as a lifestyle drink.

The international trade of bubble tea and its core ingredients has expanded significantly due to growing global demand. Key components such as tapioca pearls, flavored syrups, tea bases, and specialized equipment are increasingly being exported to support the proliferation of bubble tea outlets in both developed and emerging markets. The trade ecosystem is shaped by production capabilities in Asia and rising consumer interest in Western and developing regions.

The table shows the projected compound annual growth rate (CAGR) for the global bubble tea market from 2025 to 2035. The annual growth rate for the first half of this period (H1 2025 to 2035) is expected to rise to 9.1%. This growth is expected due to the rising popularity among young adults, the customizable flavors and topping options, and versatility to go with any other drink format, such as alcoholic beverages. Growth is expected to be higher in the second half (H2 2024 to 2034).

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 8.5% |

| H2 (2024 to 2034) | 8.8% |

| H1 (2025 to 2035) | 9.1% |

| H2 (2025 to 2035) | 9.6% |

Previously, in the first half of the 2024 to 2034 period, the sector growth was lower than the current CAGR, owing to people just catching up on the trend of boba tea and limited awareness. However, the market gained momentum in the second half of 2024 to 2034, achieving a growth rate of 9.5%.

This indicates the demand for bubble tea is increasing in countries such as the UK, as there are multiple new bubble tea shops opening up, and the ready-to-drink format of the bubble tea is now being seen on the shelves of hypermarkets and supermarkets.

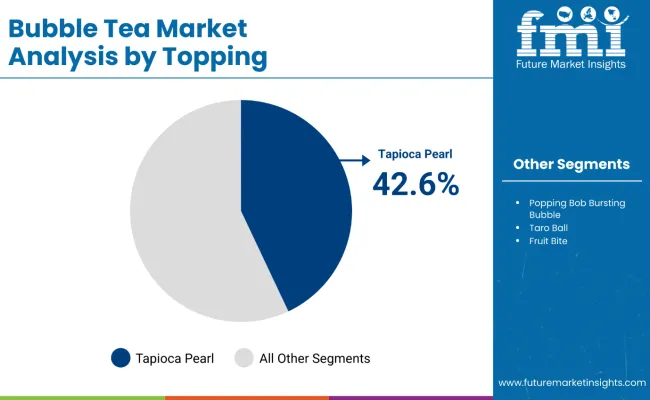

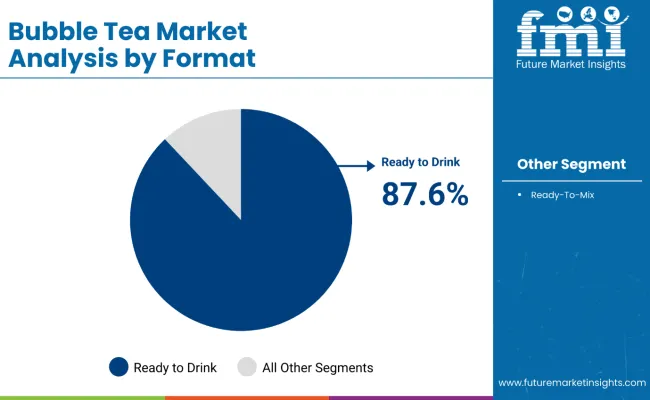

The bubble tea market is segmented based on toppings, format, flavor, distribution channel, and region. By toppings, the market includes tapioca pearls, popping boba bursting bubbles, taro balls, coconut jelly, red bean, grass jelly, fruit bits, and mochi. In terms of format, the market is categorized into ready to drink and instant mixes.

When classified by flavor, the segments are residential, unflavored, and flavored. The distribution channel segmentation covers the food service industry, indirect, and online retailing. Geographically, the market is divided into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

| Topping | Share (2025) |

|---|---|

| Tapioca Pearls | 42.6% |

Among the various toppings available in the bubble tea market, tapioca pearls dominate with a substantial market share of approximately 42.6% in 2025. Tapioca pearls, also known as "boba," are considered the signature ingredient that defines traditional bubble tea.

These chewy, gelatinous balls made from tapioca starch are loved by consumers for their unique texture and mouthfeel, which perfectly complement milk-based or fruit-flavored teas. Their popularity remains high across both Asia-Pacific and Western markets, primarily due to the authenticity and familiarity they offer to bubble tea enthusiasts.

The widespread preference for tapioca pearls is also supported by their availability across almost all bubble tea outlets, ranging from specialized tea shops to ready-to-drink bottled bubble tea formats available in retail stores. These pearls are often customized in terms of sweetness and size to meet regional taste preferences, further increasing their demand globally.

Additionally, innovative variations such as colored or flavored tapioca pearls are being introduced by manufacturers to cater to experimental consumers looking for novelty while maintaining the traditional essence of bubble tea. This versatility and ability to blend seamlessly with a variety of tea bases have solidified tapioca pearls as the most sought-after topping in the global bubble tea market.

| Format | Share (2025) |

|---|---|

| Ready to Drink | 87.6% |

Within the bubble tea market by format, the ready-to-drink (RTD) segment holds a market share of approximately 87.6% in 2025. This segment’s dominance is attributed to the convenience it offers consumers who seek quick and easy access to bubble tea without the need for preparation. RTD bubble tea products are widely available across various distribution channels, including supermarkets, convenience stores, and online platforms, making them an accessible choice for on-the-go consumption.

The popularity of ready-to-drink bubble tea is also driven by the diversity of flavors and packaging options that appeal to a broad range of consumer tastes. Manufacturers have introduced innovative flavors such as matcha, taro, and fruit teas in attractive, portable packaging to cater to younger demographics, particularly in urban areas.

Furthermore, the busy lifestyles of modern consumers, especially in developed regions such as North America, Europe, and parts of Asia-Pacific, have accelerated the demand for ready-to-drink options over traditional or instant mixes. This format’s success is also enhanced by collaborations with retail chains and promotional in-store displays that boost visibility and encourage impulse purchases, securing its position as the leading format in the global bubble tea market.

| Flavor | CAGR (2025 to 2035) |

|---|---|

| Flavored | 10.3% |

The flavored segment is projected to witness the fastest growth, expanding at a CAGR of 10.3% during the forecast period from 2025 to 2035. This growth is primarily driven by evolving consumer preferences for diverse and exotic tastes such as matcha, taro, mango, lychee, and seasonal offerings like pumpkin spice or cherry blossom. The availability of these innovative flavors in both foodservice and ready-to-drink formats has captured the attention of younger consumers, making flavored bubble tea a preferred choice across global markets.

On the other hand, the unflavored segment continues to cater to a niche but stable customer base that prefers the original, authentic tea taste without added flavoring agents. This segment is favored by consumers who seek a more traditional tea experience or who wish to control sweetness and flavor levels when customizing their drinks. Meanwhile, the residential segment, which typically includes homemade or instant bubble tea preparations, remains modest in market share.

However, its popularity is gradually increasing as more consumers experiment with do-it-yourself bubble tea kits at home, encouraged by online tutorials and recipe sharing across social media platforms. Despite this, the growth rate of the residential and unflavored segments is expected to remain slower compared to the dynamic flavored category.

| Distribution Channel | CAGR (2025 to 2035) |

|---|---|

| Online Retail | 11.2% |

The online retailing segment is anticipated to register the fastest growth with a projected CAGR of 11.2% during the forecast period from 2025 to 2035. The surge in this segment is largely driven by the widespread adoption of e-commerce platforms and the rising preference for home delivery services.

Consumers are increasingly purchasing ready-to-drink bubble tea, instant mixes, and DIY kits through online channels due to convenience, a wider variety of options, and attractive promotional offers. The rise of dedicated bubble tea brand websites and partnerships with major e-commerce players like Amazon and Alibaba has further propelled this segment’s growth.

Meanwhile, the food service industry segment maintains its dominance in terms of market share, as specialty bubble tea shops and café chains remain the primary points of consumption for many customers seeking freshly prepared, customized bubble tea experiences. Brands such as Chatime, Gong Cha, and CoCo Fresh Tea & Juice have continued expanding their physical presence globally to meet growing demand.

The indirect channel, which includes supermarkets, hypermarkets, and convenience stores, also plays a critical role in market expansion by offering ready-to-drink bottled bubble tea and instant preparation kits. This channel appeals to consumers who prefer purchasing bubble tea products during routine grocery shopping, allowing for impulse buys and broad accessibility. Despite this, its growth pace is slower compared to the dynamic and rapidly expanding online retailing space.

Fizzy creations are shaking up the bubble tea market by mixing Boba pearls into carbonated beverages and energy drinks. Even coffee, shakes, and smoothies are coming with the boba. Bubble shakes and smoothies provide extra texture with familiar fruity flavors, while Boba slushies turn traditional bubble tea recipes into trendy iced teas.

As bubble drinks gain popularity, DIY kits and ready-to-drink (RTD) options are getting sold more. These kits come with pre-made Boba pearls and bases, giving consumers freedom to mix and match flavors as per their preference. Some bubble tea shops are even exploring alcoholic bubble drinks, like Bobba’s alcoholic bubble teas in Canad.

The bubble drink category has grown significantly because it fits with current trends in the beverage industry. They are fun, customizable, and offer a unique sensory experience. Plus, their vibrant colors and toppings make them perfect for sharing on social media

Bubble tea, once primarily enjoyed by East Asian communities, has rapidly gained popularity among young women in Europe and North America. Early adopters of bubble tea are often those who have grown up with it, particularly within Asian cultures. However, as they introduce the drink to their friends, the consumer base has become increasingly varied, attracting a wider range of customers.

Market research shows that bubble tea is particularly popular among young female consumers aged 10 to 20. This demographic's desire to drink has been heavily affected by social media and pop culture.

Celebrities, particularly K-pop singers and social media influencers, routinely promote bubble tea on social media platforms. Their popularity has encouraged interest among young people, who are generally more willing to sample novel flavors and beverages inspired by diverse cultures.

Bubble tea, which was first popular among East Asian diaspora communities in the United States and the United Kingdom, is now developing as a trendy beverage for young people who have no direct connection to Asian culture. This trend reflects a rising openness and interest in varied gastronomic experiences among younger generations.

Interestingly, many young people in these locations may not recognize conventional bubble tea preparations since they have been exposed to a variety of novel flavors and toppings that have adapted to local tastes.

The bubble tea market is experiencing rapid growth globally, with a significant rise in the number of shops and brands emerging in major cities. In the UK alone, there are +1,400 bubble tea shops, making it a central hub for bubble tea manufacturers in UK This quick expansion reflects a strong acceptance of bubble tea among consumers, who are increasingly drawn to its unique flavors and customizable options.

The popularity of bubble tea in the UK is marked from consumer engagement, with an average of 119,000 searches for bubble tea each month. This high search volume indicates a growing interest and curiosity about the drink, as more people look to explore the various offerings available. As bubble tea shops continue to pop up, they are not only catering to traditional tastes but also adapting their menus to attract a wider range of customers.

This trend is further supported by the lively culture supporting bubble tea, fuelled by social media and word-of-mouth channel. As more brands enter the market and consumers search for new flavors and experiences, the bubble tea industry is expected to grow.

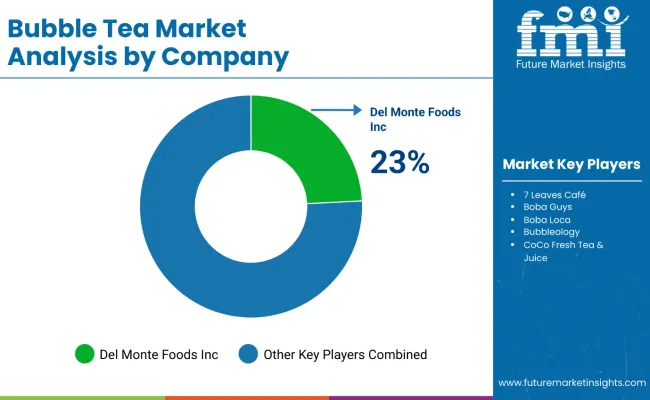

In the bubble tea industry, well-established players such as CoCo Fresh Tea & Juice, Gong Cha, and Quickly hold a significant market share, ranging from 10-15%. These Tier 1 players dominate the market in the developed countries as there are more organized chains of the bubble tea shops. These players benefit from standardized practices, extensive marketing strategies, and a strong consumer base that supports consistent quality and branding.

In contrast, the situation is quite different in South Asian countries, where bubble tea has been present for several years but the industry remains less organized. Local shops and small-scale vendors often dominate this market, reflecting a more fragmented approach. These regional players cater to the unique preferences of their communities but may lack the resources and infrastructure that larger chains in developed markets possess.

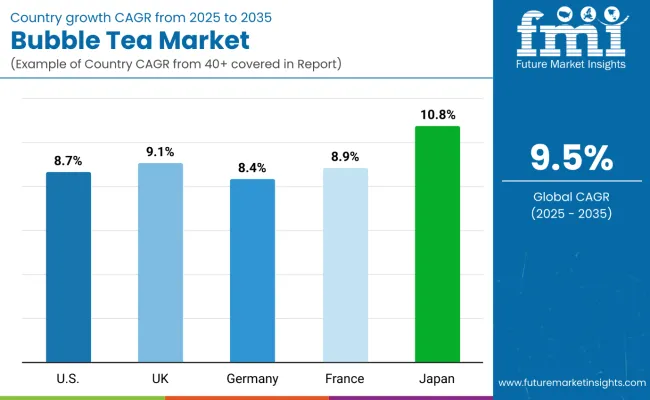

The bubble tea market in the United States is expected to expand at an 8.7% CAGR from 2025 to 2035. Growth is being stimulated by strong social-media visibility, especially on TikTok and Instagram, where playful flavor launches and colorful “boba” videos are going viral.

Urban millennials and Gen Z consumers are being drawn to sugar-free syrup options, plant-based milk bases, and functional add-ins such as collagen or probiotics. RTD cans are appearing in convenience stores, while national café chains are rolling out seasonal menus that keep foot traffic steady. Regional festivals and food-truck circuits are also being leveraged to introduce bubble tea to suburban audiences.

The United Kingdom market is forecast to register a 9.1% CAGR over 2025 to 2035. Acceptance has been heightened by a multicultural food scene that embraces Asian trends, while more than 1,400 dedicated bubble-tea outlets are operating nationwide. London, Manchester, and Birmingham form the core cluster, yet pop-up stalls at music festivals are exposing provincial consumers to the drink.

Vegan oat and pea milks are being incorporated to align with local dietary expectations, and halal certification is being sought by leading chains. Search interest, averaging 119,000 queries per month, is reinforcing digital awareness and guiding store-location analytics.

Germany is projected to advance at an 8.4% CAGR between 2025 and 2035. The market’s resurgence has been anchored in low-sugar and organic formulations that satisfy the country’s wellness ethos. Major cities like Berlin, Hamburg, and Munich are hosting concept cafés that emphasize transparent sourcing of tapioca starch and natural colorants.

Supermarkets, notably Edeka and Rewe, have begun stocking chilled RTD cans near functional beverages, extending access beyond foodservice. Local roasteries are experimenting with coffee-bubble blends, reflecting cross-category innovation that keeps the product line fresh for returning patrons.

France is anticipated to grow at an 8.9% CAGR from 2025 to 2035, propelled by the rise of premium beverage boutiques in Paris, Lyon, and Marseille. Aesthetic presentation is prized, so cafés are focusing on pastel colors and glass-bottle offerings that photograph well for social sharing.

Collaborations with pâtisserie chefs are producing macaron-inspired boba infusions that bridge local taste preferences and Asian novelty. Low-lactose and organic options are being positioned as guilt-free indulgences, and “tea sommelier” workshops are introducing consumers to nuanced flavor pairings, thereby elevating perceived value.

Japan, the fastest-growing of the five, is predicted to climb at a 10.8% CAGR through 2035. Bubble tea has been woven into a mature tea culture, with matcha, yuzu, and sakura flavors resonating strongly. Dense café networks in Tokyo, Osaka, and Fukuoka provide easy access, while vending machines dispensing chilled boba cans are being installed near train stations.

Cross-branding with anime franchises is common, turning limited-run cup designs into collectible items. High repeat visitation is secured by points programs that reward experimentation with new textures like mochi-filled pearls.

Competition has been characterized by two distinct cohorts. Internationally franchised operators such as CoCo Fresh Tea & Juice, Gong cha, and Quickly have prioritized master-franchise agreements, centralized ingredient procurement, and digital ordering integrations to accelerate outlet roll-outs.

Region-focused specialists and boutique cafés, in contrast, have concentrated on hyper-local flavors, seasonal toppings, and limited-time collaborations to sustain neighborhood loyalty. Supply partnerships with plant-based milk processors are being secured to manage cost volatility, while recyclable straw-free lids and spill-proof cups are being piloted to meet tightening packaging rules. Cloud kitchens, pop-up counters, and self-serve kiosks are being adopted as low-capex entry points before full storefront commitments.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.96 billion |

| Projected Market Size (2035) | USD 9.72 billion |

| CAGR (2025 to 2035) | 9.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2024 to 2034 |

| Projections Period | 2025 to 2035 |

| By Format | Ready-To-Drink and Ready-To-Mix |

| By Toppings | Tapioca Pearls, Popping Bob Bursting Bubbles, Taro Balls, Coconut Jelly, Red Bean, Grass Jelly, and Fruit Bites |

| By Flavor | Unflavored, Flavored, Nut Flavored, Honey, Mocha, Caramel, Vanilla, and Taro |

| By Distribution Channel | Food Service Industry, Indirect, and Online Retailing |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa. |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | 7 Leaves Café, Boba Guys, Boba Loca, Bubbleology, CoCo Fresh Tea & Juice, DaBoba, Del Monte Foods Inc., Gong Cha, Happy Lemon Bubble Tea, J Way Foods, Jazen Tea, Kung Fu Tea, La Kaffa International Co., Quickly, Sharetea, Tapioca Express, Ten Ren Tea Co., Ltd., Tiger Sugar,and Yifang USA Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis. |

| Customization and Pricing | Available upon request |

As per Format type, the industry has been categorized into Ready-To-Drink, and Ready-To-Mix.

As per the Toppings, the industry is sub-segmented into Tapioca Pearls, Popping Bob Bursting Bubbles, Taro Balls, Coconut Jelly, Red Bean, Grass Jelly, and Fruit Bites.

Unflavored, Flavored, Nut Flavored, Honey, Mocha, Caramel, Vanilla, Taro, and others are key Flavors covered in report.

The distribution channel segment includes Food Service Industry, and Direct Sales the direct sales is further categorized into Hypermarket Supermarket, Convenience store, Grocery Retailers, Specialty Retailers, Wholesale Stores.

Industry analysis has been carried out in key countries of the regions such as North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The bubble tea market stands at roughly USD 3.96 billion in 2025.

The bubble tea market is projected to expand at a 9.5 % CAGR during 2025 to 2035.

Tapioca pearls dominate the bubble tea market toppings segment with about 42.6% share in 2025.

Ready-to-drink options control the bubble tea market with roughly 87.6% share in 2025.

Japan is set to record the quickest bubble tea market growth, rising at an estimated 10.8% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bubble Tea Industry Analysis in USA - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Bubble Tea Providers

UK Bubble Tea Market Report – Trends, Demand & Industry Forecast 2025–2035

Europe Bubble Tea Market Trends – Growth, Demand & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Demand for Bubble Tea in EU Size and Share Forecast Outlook 2025 to 2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Bubble Wrap Machine Market Size and Share Forecast Outlook 2025 to 2035

Bubble Wrap Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bubble Lined Courier Bags Market Size and Share Forecast Outlook 2025 to 2035

Bubble Blower Market Size and Share Forecast Outlook 2025 to 2035

Bubble Wrap Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Bubble Tubes Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Bubble Wrap Packaging Manufacturers

Competitive Breakdown of Bubble Tubes Suppliers

Korea Bubble Wrap Packaging Market Growth – Trends & Forecast 2023-2033

Western Europe Bubble Wrap Packaging Market Analysis – Growth & Forecast 2023-2033

Air Bubble Bags Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in the Air Bubble Bags Industry

Fine Bubble Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA