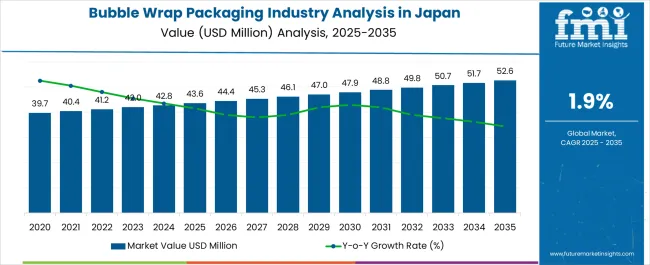

The Bubble Wrap Packaging Industry Analysis in Japan is estimated to be valued at USD 43.6 million in 2025 and is projected to reach USD 52.6 million by 2035, registering a compound annual growth rate (CAGR) of 1.9% over the forecast period.

| Metric | Value |

|---|---|

| Bubble Wrap Packaging Industry Analysis in Japan Estimated Value in (2025 E) | USD 43.6 million |

| Bubble Wrap Packaging Industry Analysis in Japan Forecast Value in (2035 F) | USD 52.6 million |

| Forecast CAGR (2025 to 2035) | 1.9% |

The bubble wrap packaging industry in Japan is experiencing steady growth. Increasing eCommerce penetration, rising consumer demand for safe and protective packaging, and the expansion of logistics and supply chain networks are driving market adoption.

Current dynamics are characterized by a preference for lightweight, cost-effective, and durable packaging solutions, while manufacturers are focusing on optimizing production processes, improving material efficiency, and ensuring compliance with environmental and recycling regulations. The future outlook is shaped by continued eCommerce expansion, urbanization, and technological innovation in packaging design and materials, which are expected to enhance protection, reduce waste, and improve handling efficiency.

Growth rationale is anchored on the rising need for damage-free delivery of goods, the ability of manufacturers to develop high-quality, eco-friendly bubble wrap variants, and strategic collaborations with logistics and retail players to expand distribution channels These factors are expected to sustain market expansion and strengthen the adoption of bubble wrap packaging across commercial and consumer segments.

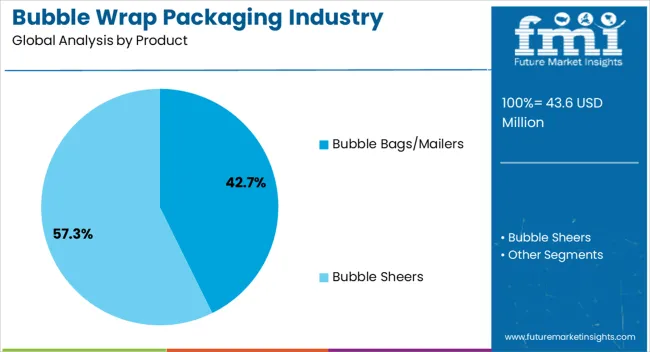

The bubble bags/mailers segment, representing 42.7% of the product category, has been leading the market due to their convenience, versatility, and protective performance for shipping and handling applications. Adoption has been driven by increasing demand from both small businesses and large-scale logistics operators.

The segment’s dominance has been supported by design innovations that enhance durability and reduce material usage. Production efficiencies and consistent quality standards have reinforced market confidence, while integration with customized sizes and branding options has strengthened commercial appeal.

Ongoing development in lightweight and recyclable variants is expected to expand applicability and maintain the segment’s competitive position Strategic partnerships with packaging distributors and eCommerce players are also enhancing reach and market penetration.

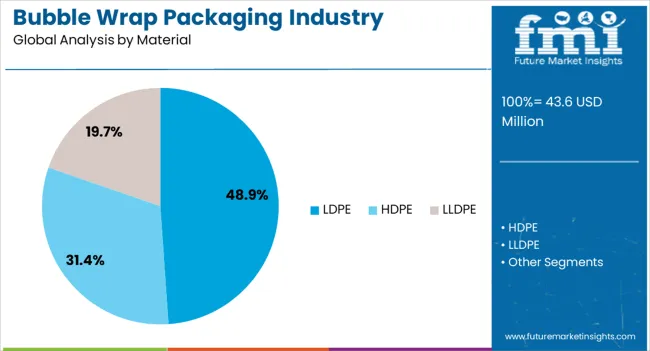

The LDPE segment, holding 48.9% of the material category, has emerged as the leading material due to its flexibility, strength, and cost-effectiveness. Adoption has been reinforced by its widespread availability and ease of processing in bubble wrap production.

The segment’s preference has been driven by consistent performance in cushioning and protective applications, along with compliance with industry safety standards. Innovations in LDPE formulations have improved durability, puncture resistance, and recyclability, further supporting market acceptance.

Supply chain reliability and integration with large-scale manufacturing operations have sustained its dominance Continued focus on developing environmentally friendly LDPE variants is expected to strengthen segment share and support long-term growth.

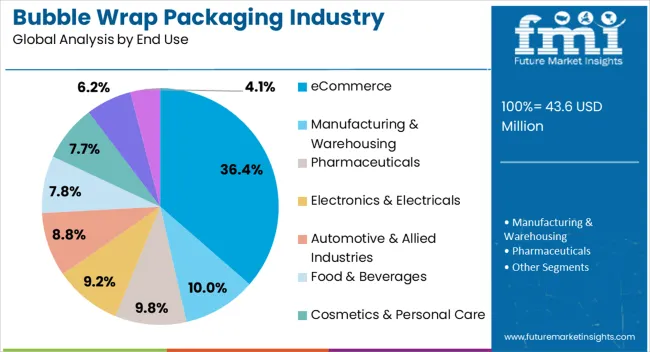

The eCommerce segment, accounting for 36.4% of the end-use category, has been leading due to rapid growth in online retail and direct-to-consumer shipping. Adoption has been driven by the need for reliable and damage-free delivery of diverse products.

Market share has been reinforced by increasing awareness among retailers and logistics providers regarding packaging performance and customer satisfaction. The segment benefits from the growing volume of small parcel shipments, seasonal demand fluctuations, and expansion of last-mile delivery networks.

Strategic partnerships between bubble wrap manufacturers and eCommerce companies have improved distribution efficiency and availability Ongoing growth in digital retail penetration and expansion of urban logistics infrastructure are expected to sustain segment share and reinforce the adoption of bubble wrap packaging solutions.

| Leading Material Type for Bubble Wrap Packaging in Japan | LDPE |

|---|---|

| Total Value Share (2025) | 72.20% |

Due to its diverse features and cost-effective benefits, LDPE (Low-Density Polyethylene) is the main material type in the bubble wrap packaging industry.

Its supremacy is partly due to its broad acceptance in a wide range of sectors and applications, making it a popular choice for organizations looking for dependable and cost-effective packaging solutions.

Japan-based manufacturers are responding to the ecological revolution by developing recyclable or recycled LDPE compositions. This is in tune with the global demand for more ecologically conscious packaging alternatives.

| Leading End Use for Bubble Wrap Packaging in Japan | Manufacturing & Warehousing |

|---|---|

| Total Value Share (2025) | 42.90% |

Japan's industrial environment contains a diverse variety of sectors, such as electronics, automotive, machinery, and pharmaceuticals, each with its own set of packaging needs. Bubble wrap's flexibility and versatility make it an excellent option for accomplishing these many goals, thus cementing its dominance in this particular sector.

Bubble wrap is adaptable to meet various criteria, whether catering to the fragility of electronic components or the sturdiness required for heavy machinery. The rise of Japan's manufacturing industries, including high-tech, automotive, and machinery, is increasing the demand for protective packaging, boosting the use of bubble wrap as a trusted packaging solution even further.

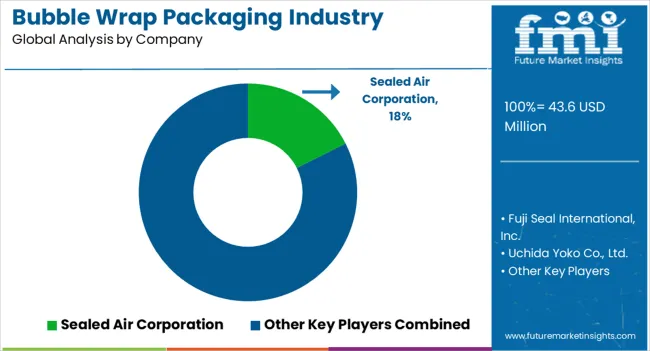

The bubble wrap packaging industry in Japan is characterized by a dynamic and competitive environment that includes both domestic and foreign players. Global packaging giants like Sealed Air Corporation, renowned for its Bubble Wrap brand, compete with Japan-based counterparts like Fuji Seal International and Uchida Yoko.

These Japanese corporations leverage their extensive distribution networks to offer customized solutions that cater to the specific needs of local sectors. Product innovation remains a significant driver of competition, with a focus on developing specialized bubble wrap variants tailored to industries such as electronics, automotive, and healthcare.

Recent Developments in Bubble Wrap Packaging in Japan

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 43.6 million |

| Projected Industry Size in 2035 | USD 52.6 million |

| Anticipated CAGR between 2025 to 2035 | 1.90% CAGR |

| Historical Analysis of Demand for Bubble Wrap Packaging in Japan | 2020 to 2025 |

| Demand Forecast for Bubble Wrap Packaging in Japan | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Bubble Wrap Packaging adoption in Japan, Insights on Global Players and their Industry Strategy in Japan, Ecosystem Analysis of Local and Regional Japan Manufacturers |

| Key Cities Analyzed While Studying Opportunities in Bubble Wrap Packaging in Japan | Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, Rest of Japan |

| Key Companies Profiled | Sealed Air Corporation; Fuji Seal International, Inc.; Uchida Yoko Co., Ltd.; Nitto Denko Corporation; Nippon Pillar Packing Co., Ltd.; Toyobo Co., Ltd.; Nihon Yamamura Glass Co., Ltd.; Shirohato Co., Ltd.; Japan Vilene Company, Ltd.; Air Sea Containers Japan Ltd. |

The global bubble wrap packaging industry analysis in japan is estimated to be valued at USD 43.6 million in 2025.

The market size for the bubble wrap packaging industry analysis in japan is projected to reach USD 52.6 million by 2035.

The bubble wrap packaging industry analysis in japan is expected to grow at a 1.9% CAGR between 2025 and 2035.

The key product types in bubble wrap packaging industry analysis in japan are bubble bags/mAIlers and bubble sheers.

In terms of material, ldpe segment to command 48.9% share in the bubble wrap packaging industry analysis in japan in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bubble Blower Market Size and Share Forecast Outlook 2025 to 2035

Bubble Tea Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bubble Tubes Market Size and Share Forecast Outlook 2025 to 2035

Bubble Lined Courier Bags Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Bubble Tea Providers

Competitive Breakdown of Bubble Tubes Suppliers

Bubble Tea Industry Analysis in USA - Size, Share, and Forecast 2025 to 2035

Bubble Wrap Machine Market Trends – Size, Growth & Forecast 2024-2034

Bubble Wrap Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Bubble Wrap Packaging Manufacturers

Korea Bubble Wrap Packaging Market Growth – Trends & Forecast 2023-2033

Western Europe Bubble Wrap Packaging Market Analysis – Growth & Forecast 2023-2033

UK Bubble Tea Market Report – Trends, Demand & Industry Forecast 2025–2035

Air Bubble Bags Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in the Air Bubble Bags Industry

Nano Bubble Generators Market Analysis – Size, Share & Forecast 2025-2035

Fine Bubble Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Kraft Bubble Mailer Market from 2024 to 2034

Paper Bubble Wrap Market Trends - Demand, Innovations & Growth 2025 to 2035

Europe Bubble Tea Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA