The Global Bubble Tea Market is a relatively fragmented market structure in which specialty tea brands and multinational beverage players vie for market share. In contrast to the traditional beverage markets controlled by multinational players, the bubble tea market is influenced by local brands and specialty chains that specialize in highly customized drinks and regional flavors.

Domestic leading multinational and popular bubble tea chains hold 50% market share, with Gong Cha, Coco Fresh Tea & Juice, and Bubbleology at the forefront due to their international reach, extensive menu customization, and strong franchise systems. Regional top players and upcoming bubble tea chains hold 30% market share, including Boba Guys, 7 Leaves Café, and Happy Lemon Bubble Tea.

These brands have benefited from high regional customer loyalty, premium positioning, and imaginative product options. Niche and start-up brands with names such as DaBoba and Boba Loca occupy 15% and feature innovative ingredient sourcing, natural sweeteners, and artisanal blends. Private label and independent shops hold 5% in market share, with local bubble tea stands and small-sized stores providing homemade-style, boutique bubble teas.

| Market Structure | Top Multinational Chains |

|---|---|

| Industry Share % | 50% |

| Key Companies | Gong Cha, CoCo Fresh Tea & Juice, Bubbleology |

| Market Structure | Regional Leaders |

|---|---|

| Industry Share % | 30% |

| Key Companies | Boba Guys, 7 Leaves Café, Happy Lemon Bubble Tea |

| Market Structure | Niche & Emerging Brands |

|---|---|

| Industry Share % | 15% |

| Key Companies | DaBoba, Boba Loca, Processing Company (MPC) |

| Market Structure | Private Labels & Independents |

|---|---|

| Industry Share % | 5% |

| Key Companies | Local and boutique bubble tea shops |

The market for bubble tea is still moderately fragmented, with multinational companies growing internationally, yet smaller regional and niche players spearheading innovation and specialty products.

Ready-To-Drink (60%) leads the market, fueled by convenience and store growth. Top brands such as Del Monte Foods Inc. and CoCo Fresh Tea & Juice drive this segment with bottled and canned bubble tea products. Ready-To-Mix (40%) is picking up momentum, especially among cafés and specialty tea stores, where buyers want freshly brewed beverages with a choice of ingredients. Players such as Bubbleology and Gong Cha are betting on DIY bubble tea kits and powdered mix at home. Subscription-based mixology kits and online shopping are boosting the ready-to-mix market, particularly among millennial and Gen Z generations.

Flavored bubble tea (75%) is the leading segment, with fruit flavors such as mango, lychee, passion fruit, and taro being the most popular among consumers. Boba Guys and Happy Lemon Bubble Tea are popular brands that offer seasonal fruit flavors and high-end tea blends. Unflavored tea (25%) is popular among traditional tea consumers and health enthusiasts, who opt for pure green tea, black tea, and oolong varieties without sweeteners. The increasing need for sugar-free and functional bubble teas is giving rise to herbal-infused and unsweetened beverages, especially in regions such as North America and Europe.

The bubble tea industry saw significant advancements in 2024, centering on sustainability, sugar-free, and functional ingredient infusions. The following are the industry's top trends:

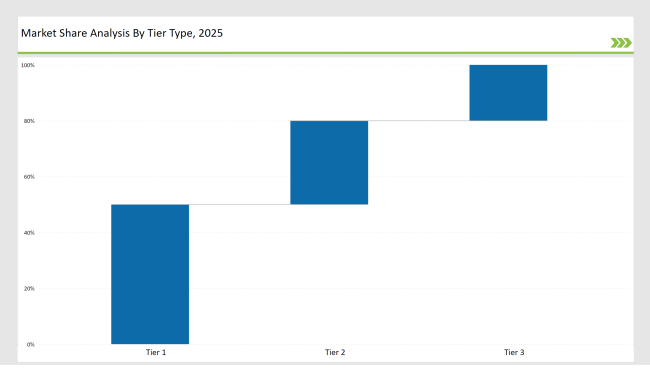

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Gong Cha, CoCo Fresh Tea & Juice, Bubbleology |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Boba Guys, 7 Leaves Café, Happy Lemon Bubble Tea |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | DaBoba, Boba Loca, Processing Company (MPC) |

| Brand | Key Focus |

|---|---|

| Gong Cha | Opened sustainability-focused stores, using solar-powered operations and biodegradable packaging. |

| CoCo Fresh Tea & Juice | Partnered with fitness influencers to launch low-calorie, electrolyte-infused bubble teas. |

| Bubbleology | Expanded into alcohol-infused bubble tea cocktails, targeting premium nightlife markets. |

| Boba Guys | Launched AI-driven personalized drink recommendations through smartphone ordering apps. |

| 7 Leaves Café | Developed probiotic-enhanced bubble teas, catering to gut-health-conscious consumers. |

| Happy Lemon Bubble Tea | Expanded franchise model into the Middle East, tapping into new emerging markets. |

| DaBoba | Launched collagen-infused bubble teas, capitalizing on beauty-focused functional beverages. |

| Del Monte Foods Inc. | Entered ready-to-drink bubble tea retail, introducing canned bubble tea products in North America. |

| Boba Loca | Strengthened food service partnerships, adding bubble tea kiosks to fast-casual restaurant chains. |

| Processing Company (MPC) | Developed bulk wholesale ingredients, supplying bubble tea cafés with premium syrups and toppings. |

Worldwide demand for bubble tea is growing outside of Asia, and Middle Eastern, Latin American, and European markets are becoming high-growth opportunities. Although brands such as Gong Cha and Happy Lemon Bubble Tea have already made their way into North America, the next step will be regional-specific adaptations. For example, spiced bubble teas in India, coconut-based blends in Brazil, and date-sweetened tea in the UAE will enable brands to connect with local taste buds. Growth will also target franchising and joint ventures, allowing bubble tea chains to open outlets in high-traffic sites like airports, shopping malls, and food courts. Brands that invest in regional menu diversification and localized promotion will be the winners.

With the world moving towards healthy eating, bubble tea brands will launch low-sugar, probiotic, and functional beverage innovations. CoCo Fresh Tea & Juice and Boba Guys have already launched stevia- and monk fruit-sweetened bubble teas, but the next step will be collagen-infused, protein-fortified, and adaptogen-fueled versions. Superfood-infused bubble teas like turmeric, spirulina, matcha, and ashwagandha-based flavors will find takers among wellness-conscious consumers. Herbal and caffeine-free bubble teas will also become popular, particularly among pregnant women, teenagers, and caffeine-sensitive consumers. Brands that combine functional ingredients with the classic chewy texture of bubble tea will win over various consumer groups.

The market is moderately fragmented, with 50% controlled by multinational brands like Gong Cha, CoCo Fresh Tea & Juice, and Bubbleology, while regional players and niche brands drive innovation and customization.

Ready-to-drink (60%) dominates due to convenience and supermarket distribution, while ready-to-mix (40%) is gaining traction with DIY home kits and online subscription services.

Consumers are demanding low-sugar, functional, and plant-based bubble teas. Superfood-infused options and sustainable packaging are also key trends.

Companies like Boba Guys and CoCo Fresh Tea are offering stevia-based, collagen-infused, and probiotic-enhanced bubble teas, reducing sugar content without sacrificing flavor.

Online sales, delivery services, and subscription-based DIY tea kits are driving revenue growth, especially through platforms like Amazon, Uber Eats, and brand-owned websites.

Brands are investing in biodegradable cups, reusable straws, and compostable packaging, with leaders like Bubbleology and Gong Cha leading eco-friendly initiatives.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bubble Tea Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bubble Tea Industry Analysis in USA - Size, Share, and Forecast 2025 to 2035

UK Bubble Tea Market Report – Trends, Demand & Industry Forecast 2025–2035

Competitive Breakdown of Tear Tape Providers

Competitive Breakdown of Bubble Tubes Suppliers

Europe Bubble Tea Market Trends – Growth, Demand & Forecast 2025–2035

Competitive Breakdown of Tea Packaging Providers

Market Share Breakdown of Leading Tear-Tab Lids Manufacturers

Market Share Breakdown of Leading Tea Polyphenols Suppliers

Competitive Breakdown of Vegan Steak Manufacturers

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Understanding Market Share Trends in the Air Bubble Bags Industry

Market Share Insights of Tear Tape Dispenser Manufacturers

Demand for Bubble Tea in EU Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Bubble Wrap Packaging Manufacturers

Market Share Distribution Among Tea Packaging Machine Manufacturers

Analyzing Pyramid Tea Bags Market Share & Industry Leaders

Evaluating Garment Steamer Market Share & Provider Insights

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Market Share Breakdown of Leading Corrugated Bubble Wrap Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA