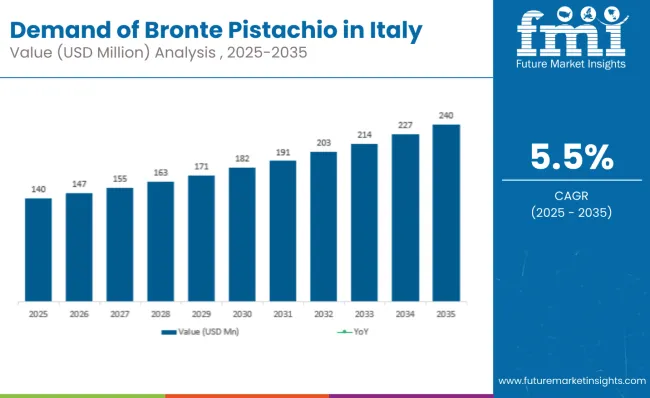

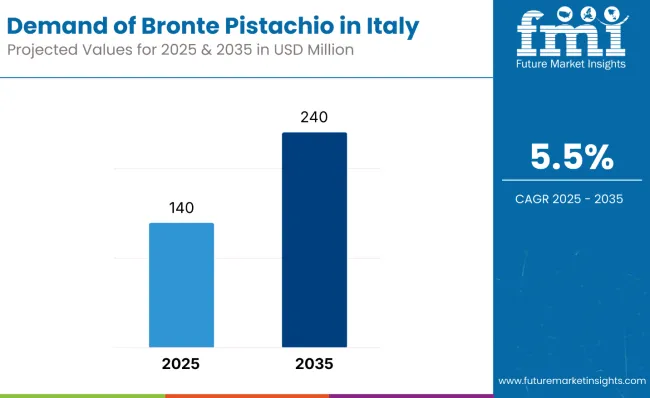

Demand for Bronte pistachio in Italy is estimated at USD 140 million in 2025, with projections indicating a rise to USD 240 million by 2035, reflecting a CAGR of approximately 5.5% over the forecast period. This growth reflects both expanding culinary applications and increased consumer appreciation for premium Italian ingredients.

The rise in demand is linked to growing artisanal food culture, premiumization trends in Italian gastronomy, and expanding recognition of Bronte pistachio's unique flavor profile and protected designation of origin status.

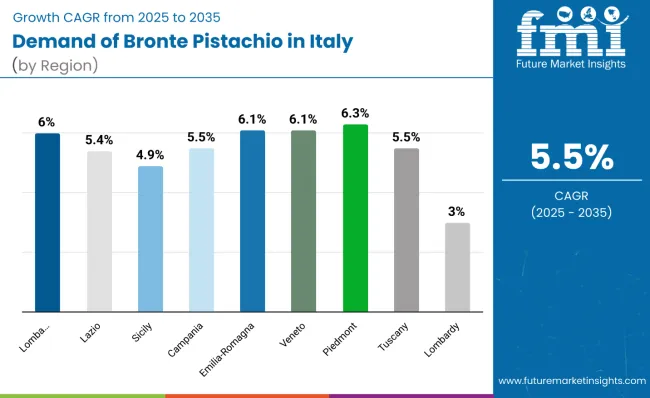

Lombardy leads regional demand, expected to generate USD 55.2 million in Bronte pistachio sales by 2035, followed by Sicily (USD 40.8 million), and Lazio (USD 33.6 million). Northern regions including Lombardy, Emilia-Romagna, Veneto, and Piedmont demonstrate the strongest growth rates, ranging from 6.01% to 6.39% CAGR, driven by concentration of high-end pâtisseries, gelaterias, and premium food manufacturing.

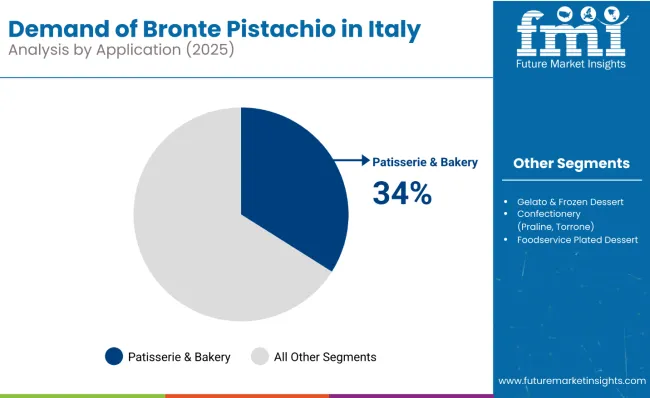

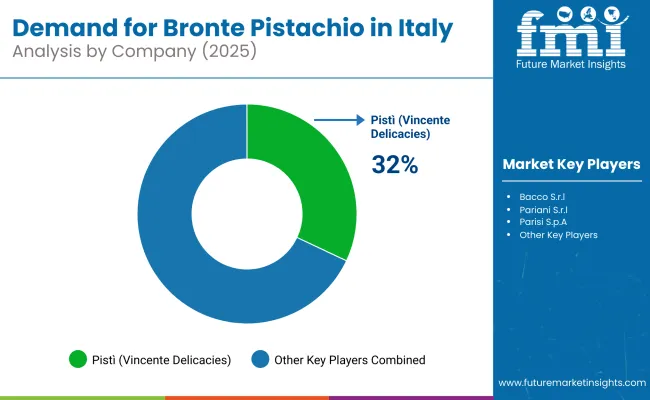

The largest contribution to demand continues to come from pâtisserie and bakery applications, which are expected to account for 32% of total consumption by 2035, though declining slightly from 34% in 2025 as gelato applications expand rapidly. By distribution channel, hypermarkets and supermarkets represent the dominant retail format, responsible for 39% of all sales, while gourmet and specialty retail channels expand from 18% to 21% share.

Consumer adoption spans professional pastry chefs seeking authentic ingredients, gelato artisans emphasizing quality and origin, and affluent home cooks exploring premium Italian culinary traditions. Regional preferences reflect local culinary specialties, with northern regions favoring paste and purée forms for industrial applications, while southern regions maintain stronger demand for whole kernel presentations.

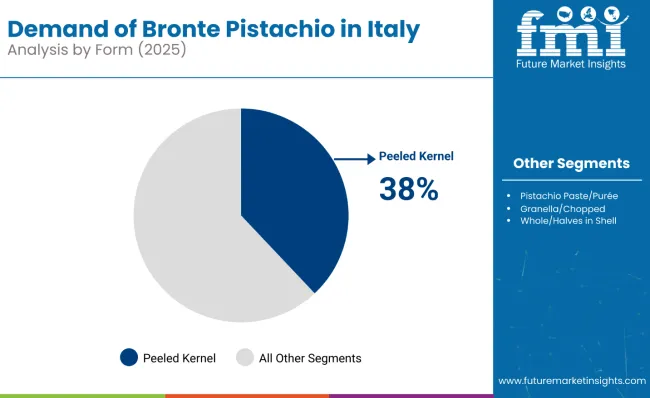

The Bronte pistachio segment in Italy is classified across several categories. By application, key uses include pâtisserie and bakery preparations, gelato and frozen desserts, confectionery production, foodservice plated desserts, and retail kernels and spreads. By form and ingredient type, the segment spans peeled kernels, pistachio paste and purée, granella and chopped varieties, and whole or halved in-shell presentations.

By distribution channel, sales occur through hypermarkets and supermarkets, gourmet and specialty retail, professional pâtisserie and gelateria supply, and online direct channels. By region, coverage includes Lombardy, Sicily, Lazio, Campania, Emilia-Romagna, Veneto, Piedmont, Tuscany, and all other Italian regions.

Pâtisserie and bakery applications are projected to maintain category leadership through 2035, though facing slight share erosion as gelato applications expand rapidly. This segment benefits from Italy's renowned pastry tradition, growing artisanal bakery culture, and increasing consumer demand for premium desserts.

Bronte pistachio in Italy is available across multiple form factors, with pistachio paste and purée gaining leadership as professional applications expand. Form preferences reflect both industrial processing needs and artisanal preparation methods across different culinary applications.

Bronte pistachio in Italy is distributed through specialized channels reflecting both premium positioning and professional usage requirements. Hypermarkets and supermarkets maintain channel leadership while gourmet and specialty retail expand to serve growing consumer sophistication.

Regional demand for Bronte pistachio reflects Italy's culinary geography, with northern regions leading both growth rates and absolute consumption despite Sicily's proximity to production. Economic development, concentration of premium food businesses, and sophisticated consumer preferences drive regional performance differences.

Lombardy represents the largest regional segment, growing from USD 30.8 million (22% share) in 2025 to USD 55.2 million (23% share) by 2035, achieving a CAGR of 6.01%. This performance is supported by Milan's concentration of high-end pâtisseries, gelaterias, and food manufacturing companies, strong consumer purchasing power, and role as Italy's economic capital driving premium food consumption.

Sicily maintains significant demand despite declining share, expanding from USD 25.2 million (18% share) to USD 40.8 million (17% share) by 2035, with a CAGR of 4.94%. The region benefits from cultural connection to pistachio consumption, traditional recipes featuring local ingredients, and growing agritourism supporting direct sales, though facing competitive pressure from higher-growth northern regions.

Lazio demonstrates steady growth from USD 19.6 million to USD 33.6 million (maintaining 14% share) with a 5.54% CAGR, supported by Rome's restaurant scene, tourism-driven dessert consumption, and growing number of artisanal food establishments serving both locals and international visitors.

Northern regions including Emilia-Romagna and Veneto (both 6.11% CAGR) and Piedmont (6.39% CAGR) show the strongest growth rates, driven by concentration of premium food manufacturing, sophisticated consumer base, and established networks of high-end restaurants and pâtisseries emphasizing authentic ingredients.

Regional concentration remains significant, with the top five regions (Lombardy, Sicily, Lazio, Campania, Emilia-Romagna) accounting for 73% of demand in 2025, maintaining 73.5% share by 2035. This concentration reflects economic development patterns, culinary sophistication, and concentration of premium food businesses across these key regions.

The regional data reveals clear performance tiers, with northern regions led by Lombardy demonstrating the strongest growth potential, while Sicily maintains substantial demand despite slower growth reflecting its role as production center and traditional consumption base.

Application preferences demonstrate gradual diversification, with traditional pâtisserie uses maintaining leadership while gelato applications capture growing consumer interest. The expansion of gelato applications from 26% to 29% represents significant opportunity for premium positioning, reflecting both domestic consumption and international tourism demand.

Confectionery applications maintain steady positioning, supported by traditional Italian confectionery houses and seasonal demand patterns, while foodservice applications face pressure from cost considerations despite maintaining importance in luxury dining segments.

Form preferences reflect increasing sophistication in professional applications, with paste and purée gaining leadership as industrial and semi-industrial users seek consistent quality and efficient incorporation methods. The growth of processed forms from 34% to 38% indicates successful adaptation to professional user requirements while maintaining authentic flavor characteristics.

Whole kernel demand maintains substantial share, reflecting artisanal applications where visible pistachio presence adds perceived value and authentic Italian character to finished products.

Channel evolution reflects premiumization trends and growing consumer sophistication, with specialty retail expanding share as consumers seek authentic protected designation products. The growth of gourmet channels from 18% to 21% indicates successful positioning of Bronte pistachio as premium ingredient worthy of specialized retail attention.

Professional channels maintain stable share, reflecting established relationships and consistent demand from artisanal food producers, while mainstream retail adapts to serve growing consumer interest in authentic Italian ingredients.

Bronte pistachio consumption serves multiple cultural and commercial functions across Italy, from traditional family recipes to professional culinary applications. Artisanal food producers drive significant professional demand through specialized supply channels, while affluent consumers seek authentic ingredients for home cooking and gift-giving occasions.

Regional taste preferences and culinary traditions influence application success, with northern regions emphasizing industrial efficiency and consistent quality, while southern regions maintain stronger connection to traditional preparations and whole kernel presentations.

Cultural associations with Sicilian authenticity and protected designation status support premium positioning and willingness to pay higher prices compared to generic pistachio products, particularly important for professional users seeking competitive differentiation.

Bronte’s pistachio producers know they’re not competing on volume only around 3,400 tonnes are harvested every other year from the rugged lava terraces of Mount Etna. Instead, their strategy is value-first: protect the DOP status, lean into provenance-driven storytelling, and expand into premium derivatives like pistachio creams, pestos, panettoni, and gelato bases.

Many players invest in in-house processing, co-brand with artisanal pastry and gelato makers, and focus on gourmet exports while leaving the bulk kernel market to Iran and California. The emphasis is on luxury cues vivid green color, manual harvest, volcanic terroir backed by cooperative funding for selective mechanization and agronomic innovation to combat labor and climate pressures.

| Attribute | Details |

|---|---|

| Study Coverage | Italy demand and consumption of Bronte pistachio from 2025 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2025 to 2035 |

| Units of Measurement | USD (sales), Percentage shares, CAGR |

| Geography Covered | All Italian regions with detailed analysis of top 8 regions |

| Top Regions Analyzed | Lombardy, Sicily, Lazio, Campania, Emilia-Romagna, Veneto, Piedmont, Tuscany |

| By Application | Pâtisserie /bakery, Gelato/frozen desserts, Confectionery, Foodservice, Retail |

| By Form | Peeled kernels, Paste/purée, Granella /chopped, Whole/halved in shell |

| By Distribution Channel | Hypermarkets/supermarkets, Gourmet/specialty, Professional supply, Online |

| Metrics Provided | Sales (USD), Share by segment, CAGR (2025-2035), YoY growth |

| Competitive Landscape | Protected designation positioning, artisanal applications, premium channels |

| Forecast Drivers | Culinary sophistication, tourism, premiumization , authentic ingredient trends |

By 2035, total Italian demand for Bronte pistachio is projected to reach USD 240 million, up from USD 140 million in 2025, reflecting a CAGR of 5.5%.

Pâtisserie and bakery applications hold the leading share, accounting for 32% of total demand by 2035, followed by gelato and frozen desserts (29%) and confectionery (19%).

Piedmont leads in projected growth with a CAGR of 6.39%, followed by Emilia-Romagna and Veneto both at 6.11%, significantly outpacing Sicily's 4.94% growth.

Hypermarkets and supermarkets dominate with 39% share by 2035, while gourmet and specialty retail shows expansion from 18% to 21% share over the forecast period.

Pistachio paste and purée lead with 38% share by 2035, overtaking peeled kernels (36%), driven by growing professional applications requiring consistent texture and efficient incorporation methods.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Pepper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Evaporative Condensers in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Control Network Modules in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Zinc-Tin Alloy Sputtering Target in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Miniature Duplex Connectors in USA Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in UK Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in the USA Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Marine-grade Polyurethane in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in UK Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in UK Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA