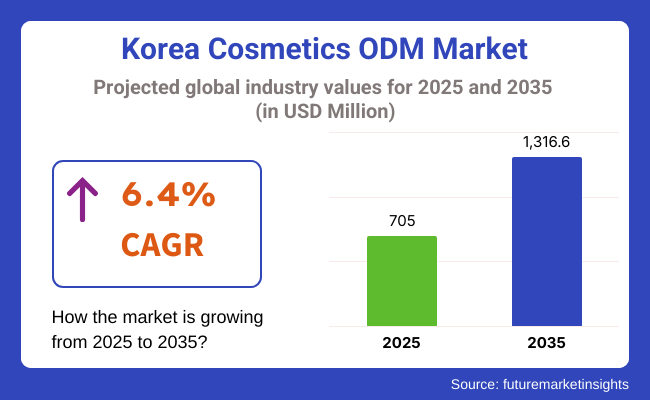

The Korea cosmetics ODM market is poised to register a valuation of USD 705 million in 2025. The industry is slated to grow at 6.4% CAGR from 2025 to 2035, witnessing USD 1,316.6 million by 2035. The expansion of the industry is being fueled by a number of interrelated global and regional trends. One of the main drivers is the rising global demand for K-beauty products, which are renowned for their innovation, quality, and good looks.

South Korea has positioned itself as the trendsetter of the world beauty industry, with customers throughout Asia, North America, and Europe adopting Korean skincare habits and cosmetics. This has prompted numerous global brands to collaborate with Korean ODM companies to leverage their sophisticated R&D abilities, innovative formula technologies, and speed-to-market benefits.

Another key driver is the increasing need for functional and customized skincare. Korean ODM producers are recognized for their ability to keep up with shifting consumer demands, providing tailored solutions that include ingredients such as hyaluronic acid, niacinamide, peptides, and even fermented extracts. As skincare becomes increasingly scientific and consumers become more ingredient-literate, brands are turning more and more to Korean ODMs to create products that are effective and clean beauty trend-friendly.

Support for the cosmetics industry by the Korean government-through innovation grants, export incentives, and deregulation-has raised the global competitiveness of Korean ODMs. Moreover, higher adoption of e-commerce and online marketing has helped smaller beauty companies to come up and grow rapidly, typically leveraging ODM companies to design and produce their product lines economically.

The trend toward sustainability is restructuring the industry as ODMs are making investments in green packaging, cruelty-free operations, and vegan formulations. These innovations not only reflect response to worldwide consumer values but are also enabling Korean companies to distinguish themselves in an overcrowded international industry.

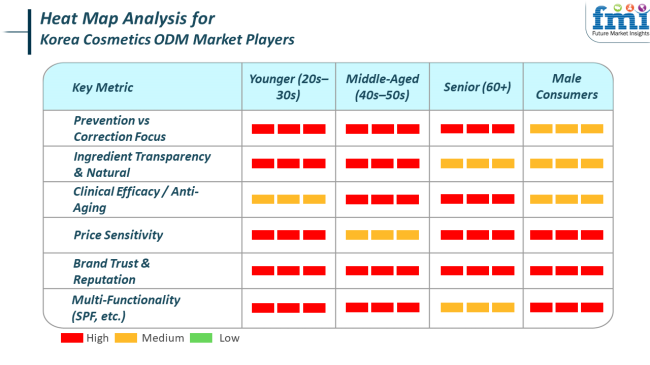

Various end-use segments in the Korea cosmetics ODM industry have unique trends and buying behaviors according to their positioning in the industry and the expectations of consumers. Mass brands and mid-range brands focus on price, trend sensitivity, and fast production capacity. These firms seek ODM suppliers that offer high-volume output with competitive pricing and quick lead times.

Trending features in this category are multifunctional skin care, viral textures such as jelly or cloud creams, and fun packaging-factors that resonate well with younger, fashion-conscious consumers. Pre-developed product ideas or white-label offerings from ODMs are most appealing to this category as they facilitate quicker product launches with little R&D outlay.

Premium, indie, and clinical skin care brands, on the other hand, are all about innovation, ingredient purity, and differentiation of brand. These segments favor ODMs with sophisticated R&D capabilities, clinical testing facilities, and small batch production for niche or customized formulations. Premium brands look for proprietary ingredients, green packaging, and skin science-supported formulations, as they align with increasing consumer demand for clean, effective, and ethical beauty.

linical skincare brands, on the other hand, focus on efficacy, dermatological endorsement, and regulatory approval. Across these premium segments, the buying criteria also encompass long-term cooperation potential, transparent sourcing, and co-development flexibility, as brand owners increasingly require ODMs to be strategic innovation partners and not merely manufacturers.

Between 2020 and 2024, Korea's cosmetics ODM sector underwent significant changes influenced by global disruptions, changing consumer behavior, and technological innovation. The COVID-19 pandemic in 2020 first dampened demand due to reduced discretionary spending and lower international travel, impacting exports and domestic sales.

The crisis also hastened the digitalization of the beauty industry. While consumers began to gravitate towards online shopping and virtual product discovery, ODMs soon followed suit by helping brands introduce e-commerce-ready, content-centric beauty lines.

The coming decade will see more integration of technology, sustainability, and personalization into the Korea cosmetics ODM industry. With artificial intelligence, big data, and biotechnology coming of age, ODMs will make greater use of predictive analytics to develop hyper-targeted products that are designed on the basis of consumer behavior, skin type, and even environmental factors.

Sustainability will shift from a point of differentiation to a minimum standard requirement. ODMs will have to invest in biodegradable packaging, carbon-neutral manufacturing, and circular economy models.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024: Industry Shifts | 2025 to 2035: Future Trends |

|---|---|

| The COVID-19 crisis drove consumers to online beauty purchasing, with DTC (Direct-to-Consumer) brands growing faster as a result. ODMs responded by providing flexible, scalable manufacturing options, facilitating influencer-led launches and fast rollout of products. | Artificial intelligence and big data will take center stage in ODM business, allowing brands to develop customized products according to skin diagnostics, behavioral patterns, and geographic-specific requirements-enhancing product efficacy and targeting. |

| With increased time at home, consumer interest turned from makeup to skincare. ODMs reacted by creating barrier-repair products, simple routines, and calming formulations with ingredients such as CICA, probiotics, and ceramides. | Future demand will be fueled by biotech breakthroughs like lab-grown collagen, plant stem cells, and microbiome-based actives. ODMs will focus on scientific performance and clinical proof for product authenticity. |

| Consumers were increasingly looking for ingredient clarity, cruelty-free formulations, and clean-label ingredients. ODMs needed to reformulate heritage products and make clean chemistry investments in order to remain competitive. | ESG-compliant ODMs with the ability to achieve stringent ESG targets and trackable supply chain standards will be expected by brands. Sustainable packaging, carbon-free operations, and waterless beauty forms will be anticipated. |

| Decreased barriers to entry and digital marketing capabilities precipitated a tidal wave of small, niche brands. ODMs needed to provide smaller MOQs, agile product development, and white- labeling to accommodate this burgeoning segment. | ODMs will transform into strategic partners providing not only manufacturing, but also branding, compliance guidance, digital marketing intelligence, and product lifecycle assistance. |

The Korea cosmetics ODM industry, although growing substantially worldwide, is not without challenges. One of the major risks is industry saturation and fierce competition, both local and global. With numerous ODMs providing comparable services and capabilities, differentiation becomes more challenging.

This can result in price competition and margin squeezes, particularly for smaller ODMs without proprietary technologies or established customer bases. Furthermore, increased in-house R&D and production by key beauty companies pose a long-term risk to legacy ODM business models because certain companies can internalize product development in order to preserve their IP and lower their costs.

A further significant risk comes from regulatory complexity and cross-border compliance obligations. With increasing Korean ODMs entering multi-diverse markets like the EU, USA, China, and Southeast Asia, they need to comply with different regulations on ingredients, labeling, testing, and claims.

Failure to comply or late certification can result in product recall, rejection of shipments, or brand reputation loss for both the ODMs and their client brands. In addition, growing attention on environmental and ethical conduct implies that ODMs have to invest in ESG standards constantly, which can be operationally and financially costly, particularly for mid-sized companies.

Bottles continue to be one of the most preferred packaging forms for skincare products, particularly for liquids such as toners, serums, and moisturizers. Their popularity stems from their versatility as well as from being able to offer accurate, controlled dispensing.

Glass bottles are especially preferred in the high-end skincare industry because of their visual appeal and luxury image, while plastic bottles fill mass-market products because of their light weight and low cost. Moreover, the rise in the trend of going green has compelled brands to incorporate recyclable packaging and sustainable designs, and thus bottles have emerged as a good option for brands seeking to be eco-friendly.

Compact cases are very trendy in the makeup category, particularly for products such as foundations, powders, blushes, and cushion compacts, which are cornerstone products of Korean beauty regimens. These cases are particularly popular due to their convenience, portability, and stylish high-end appearance they provide.

Given the new boom in travel beauty and travel-product-friendly makeup, compact cases fit perfectly for people looking for fashionable, smaller-scale packaging that goes easily into one's bags.

Prestige brands such as high-end makeup and luxury skincare lines are important customers for Korean ODMs looking for high-performance, sophisticated products. Such brands require the exclusive, science-advanced, clinically validated formulas with established efficacy and are frequently supported by dermatological studies or patented technologies.

Korean ODMs court such players on the basis of R&D, premium ingredient purchasing, and the capability to provide sophisticated packaging design. In exchange, prestige brands elevate the status of ODMs by linking them with luxury and international popularity, particularly as K-beauty continues to gain aspirational value in global markets.

Private labels, including those created by mass retailers, beauty chains, or online retailers, also comprise a significant end-user category. These customers tend to require quick, low-cost production focusing on trend matching and brand differentiation.

Korean ODMs offer turnkey solutions for such labels and manage everything from formulation to packaging and regulatory affairs. The possibility of launching premium collections in short order and being able to adjust to seasonal patterns makes private label alliances particularly desirable in the high-stakes retail environment.

The Korean industry is very competitive, with both local and foreign companies competing to dominate the industry. The competition is mostly fueled by technology, innovation, and capability to respond to changing consumer needs for high-quality, functional, and fashion-based products. Korean cosmetic ODMs are central to serving a wide variety of brands, from international luxury brands to domestic indie startups, in terms of performance, sustainability, and packaging. Some of the major players in the Korea cosmetics ODM market are listed below:

Kolmar is one of the top ODM players in Korea, recognized for its end-to-end service portfolio from R&D to packaging. The company has established a reputation for its state-of-the-art technology in skincare and cosmetic development, catering to domestic and global brands. Kolmar's success comes from its capability to innovate and deliver high-quality formulations, which makes it a major player in the luxury and high-performance categories.

Cosmax is another industry leader among the Korean cosmetics ODM players. It is known for its strength in delivering innovative and tailor-made beauty products to large multinational brands and new-gen indie labels alike. The company boasts a strong worldwide presence, with major operations in China, the USA, and Europe, and is reputed for its potential in combining advanced technology with consumer-focused design.

Cosmecca is one of the largest ODM firms with its core business areas in skincare, color cosmetics, and hair care. With strong R&D efforts and sophisticated manufacturing procedures, the company has become a trusted partner for both international beauty giants and mid-sized brands. Its concentration on developing safe, efficient, and fashionable products makes it a desired partner for businesses that seek to enter the Korean beauty industry.

Nowcos Co. Ltd deals in a wide variety of beauty and skincare products, both mass market and premium. With its effective manufacturing and strong formulation capabilities, the company is well known among local and global beauty companies. Its wide product portfolio and quick response to industry trends help Nowcos become a dominant player in the Korean cosmetics ODM industry.

Intercos Group is a global pioneer in the industry of cosmetics ODM, leading strongly in Korea. The company offers turnkey solutions, from R&D through packaging, to luxury and mass-market brands. The company is recognized for its commitment to high-end skincare formulations and state-of-the-art technologies, such as green packaging, following current global sustainability trends.

Oracle OEM is a strong incumbent in the Korean cosmetics ODM industry, with expertise in offering private-label solutions for color cosmetics, haircare, and skincare. Its robust R&D capabilities enable it to create highly customized products, which are attractive to local brands as well as international players interested in entering the Korean industry.

Viaderm Limited is a leading contract manufacturer in Korea, dealing in premium skincare products. The company provides a complete value chain of services, ranging from product development to quality control and packaging design. The company's focus on good quality ingredients and efficient formulations has established it as a go-to contract manufacturer for high-end beauty companies.

Herrco Ltd has a reputation for its established position in the international beauty and skincare industry, focusing on quality formulation and cost-effective manufacturing techniques. The firm serves high-end and mass market segments, offering tailor-made solutions that address the varied requirements of beauty companies seeking innovative, result-oriented products.

BioTruly Group has made a niche for itself in the Korean cosmetics ODM industry through its emphasis on natural and eco-friendly ingredients. The company has established a reputation for itself as an eco-friendly, organic, and ethical manufacturer. Both high-end and mid-range skincare labels are catered to by BioTruly Group, enabling them to keep pace with the increasing demand for clean beauty among consumers.

Milliona is a growing star of the cosmetics ODM industry, providing customized services for luxury and indie beauty companies. Emphasizing creating original and tailored products, The companyis rapidly emerging as an attractive partner for original, trend-forward beauty companies with an emphasis on quality and customization.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Kolmar | 12-15% |

| Cosmax | 14-18% |

| Cosmecca | 8-10% |

| Nowcos Co. Ltd | 5-7% |

| Intercos Group | 7-9% |

| Oracle OEM | 4-6% |

| Viaderm Limited | 3-5% |

| Herrco Ltd | 2-4% |

| BioTruly Group | 3-5% |

| Milliona | 1-2% |

| Other Key Players | 10-12% |

Key Company Insights

Cosmax has the biggest industry share in the Korean cosmetics ODM industry, with a market share of 14-18%. With its strong R&D and global network, the company is a favorite among multinational and domestic brands seeking innovative and efficient manufacturing solutions.

Kolmar comes in second with a market share of 12-15%, serving high-end and mass-market brands alike with its strong formulation capabilities. Cosmecca, with 8-10% share, continues to be a reliable ally for a large number of beauty items, particularly those in the business of creating customized skincare offerings.

Intercos Group, with a 7-9% share in the industry, has a good presence across the luxury as well as the mass segment and has end-to-end services encompassing sustainability-based packaging. Oracle OEM and Viaderm Limited play more niche roles, serving niche markets like high-performance skin care and private-label options, with shares of 4-6% and 3-5%, respectively.

Upcoming players like BioTruly Group and Milliona, with shares of 3-5% and 1-2%, respectively, are increasingly making inroads in the expanding clean beauty and indie brand markets.

In terms of product type, the industry is classified into skin care, hair care, makeup, body care, and others.

With respect to nature type, the industry is bifurcated into natural/organic and synthetic.

By packaging format, the industry is divided into bottles, compact cases, droppers, folding cartons, jars, pouches, pumps and dispensers, roll-ons, roll-on sticks, sachets, sticks, and tubes.

Based on end use, the industry is divided into prestige brands, private labels, mass brands, and indie brands.

Regionally, the industry is divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 705 million in 2025.

The industry is projected to witness USD 1,316.6 million by 2035.

The industry is slated to grow at 6.4% CAGR during the study period.

Prestige brands are major end users.

Leading companies include Kolmar, Cosmax, Cosmecca, Nowcos Co. Ltd, Intercos Group, Oracle OEM, Viaderm Limited, Herrco Ltd, BioTruly Group, and Milliona.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 21: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 22: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 24: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 26: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 27: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 30: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 31: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 32: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 34: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 35: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 37: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 38: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 39: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 40: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 41: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: Jeju Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 43: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 45: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 46: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 47: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 48: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 49: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 50: Rest of Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 43: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 44: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 45: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 46: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 47: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 48: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 49: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 50: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 51: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 52: South Gyeongsang Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 53: South Gyeongsang Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 54: South Gyeongsang Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 61: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 62: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 63: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 64: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 65: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 66: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 68: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 69: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 70: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 72: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 73: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 74: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 75: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 76: North Jeolla Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 77: North Jeolla Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 78: North Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 79: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 80: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 81: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 82: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 83: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 84: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 85: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 86: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 87: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 88: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 89: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 90: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 91: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 92: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 93: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 94: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 95: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 96: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 97: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 98: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 99: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 100: South Jeolla Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 101: South Jeolla Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 102: South Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 103: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 104: Jeju Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 105: Jeju Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 106: Jeju Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 107: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 108: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 109: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 110: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 111: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 112: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 113: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 114: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 115: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 116: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 117: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 118: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 119: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 120: Jeju Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 121: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 122: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 123: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 124: Jeju Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 125: Jeju Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 126: Jeju Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 127: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 129: Rest of Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 130: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 131: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 132: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 133: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 134: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 135: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 136: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 137: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 138: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 139: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 140: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 141: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 142: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 143: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 144: Rest of Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 145: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 146: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 147: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 148: Rest of Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 149: Rest of Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 150: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

Demand for DMPA in EU Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Vanillin in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Gypsum in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Barite in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mezcal in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA