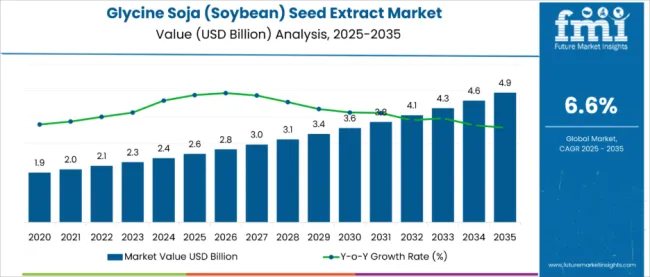

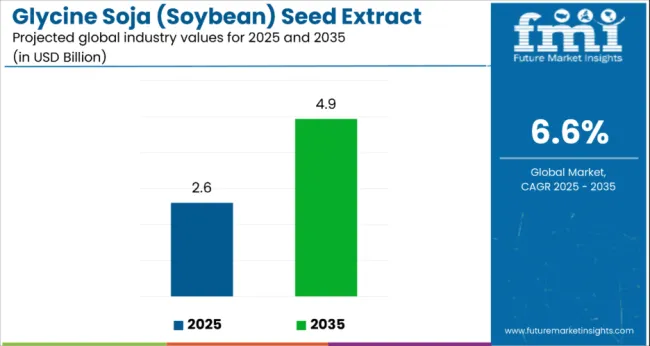

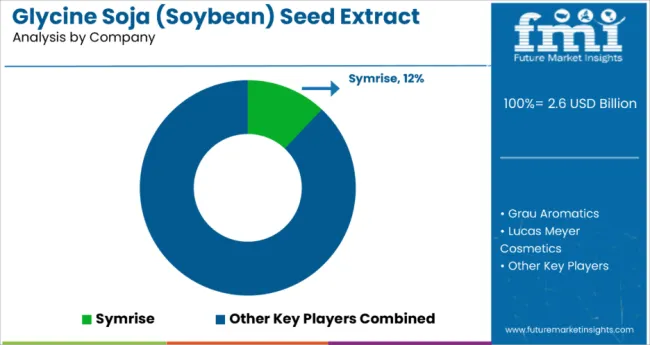

The glycine soja (soybean) seed extract market is estimated at USD 2.6 billion in 2025, an dis projected to reach USD 5.9 billion by 2035, reflecting a CAGR of approximately 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 2.6 Billion |

| Market Size (2035) | USD 5.9 Billion |

| Overall CAGR (2025-2035) | 6.6% |

This growth reflects expanding consumer awareness of natural ingredients and increased per capita spending on premium skincare formulations across developed economies. The rise in demand is linked to growing preference for plant-based cosmetic ingredients, heightened consciousness about anti-aging benefits, and evolving beauty and wellness trends.

By 2025, per capita consumption in leading global regions such as North America, Europe, and East Asia averages between 0.8 to 1.2 kilograms, with projections reaching 1.4 to 1.8 kilograms by 2035. The United States leads among individual countries, expected to generate USD 1.21 billion in glycine soja seed extract sales by 2035, followed by China (USD 1.06 billion), Germany (USD 487 million), India (USD 394 million), and Japan (USD 312 million).

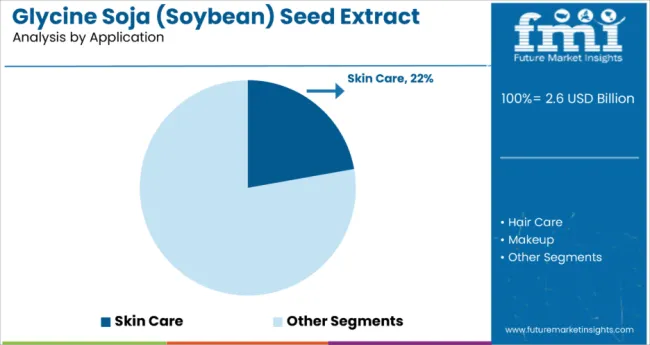

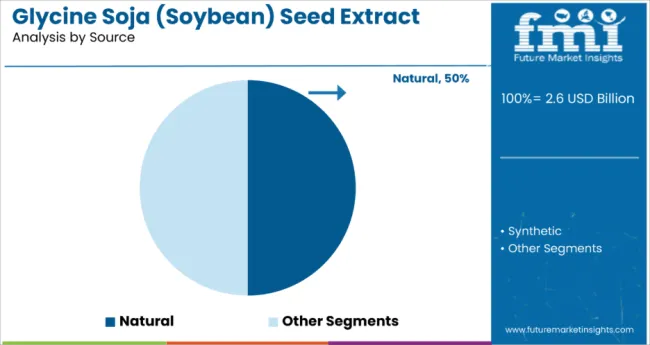

The largest contribution to demand continues to come from skincare applications, which are expected to account for 22% of total sales in 2025, owing to proven anti-aging properties, antioxidant benefits, and widespread adoption in premium cosmetic formulations. By source classification, organic variants represent the dominant category, responsible for 50% of all sales, while natural and synthetic alternatives are expanding steadily across price-sensitive segments.

Consumer adoption is particularly concentrated among health-conscious millennials and Gen-Z demographics, with income levels and urban lifestyle patterns emerging as significant drivers of demand. While premium pricing remains a consideration, the average price differential between organic and conventional variants has stabilized around 15-20% in 2025.

Continued improvements in extraction technologies and scale manufacturing are expected to accelerate affordability and access across mid-income consumer segments. Regional disparities persist, but per capita demand in emerging economies is narrowing the gap with traditionally strong developed regions.

The glycine soja (soybean) seed extract segment globally is classified across several categories. By application, the key segments include skincare, haircare, makeup, bath and body care, food and medicines. By form, the segment spans liquid extracts, semi-liquid. By source, classifications include natural and synthetic. By end-use industry, the segment covers cosmetic and personal care industry, pharmaceutical industry, food and beverage industry, and other specialized applications. By region, coverage includes North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

Skincare applications are projected to dominate sales in 2025, supported by proven anti-aging benefits, antioxidant properties, and increasing consumer awareness of natural beauty ingredients. Other applications such as haircare, makeup, and pharmaceutical uses are growing steadily, each serving distinct consumer needs.

Glycine soja (soybean) seed extract globally is sourced through organic, natural, and synthetic production methods. Organic variants are expected to remain the primary category in 2025, followed by natural extracts and synthetic alternatives. Sourcing strategies are evolving to match consumer preferences for clean-label ingredients, with growth coming from certified organic and sustainably sourced materials.

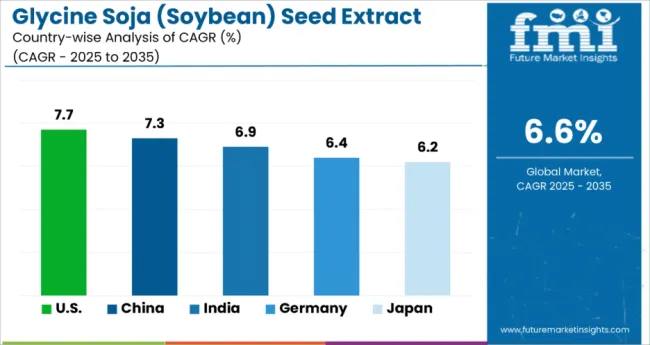

| Countries | CAGR (2025 to 2035) |

| United States | 7.7% |

| China | 7.3% |

| India | 6.9% |

| Germany | 6.4% |

| Japan | 6.2% |

The USA leads with the highest CAGR at 7.7%, driven by its strong R&D ecosystem, premium skincare demand, and a robust clean beauty movement. China follows closely at 7.3%, propelled by a rapidly expanding middle class, e-commerce dominance, and high adoption of plant-based cosmetics. India posts a healthy 6.9% CAGR, supported by urbanization, digital retail growth, and rising botanical skincare awareness.

Germany, with a 6.4% CAGR, benefits from eco-conscious consumer habits and stringent quality regulations, though growth is steadier due to its mature market status. Japan registers the slowest among the top five at 6.2%, yet remains competitive through innovation in multifunctional beauty products and strong premium positioning.

Glycine soja seed extract sales will not grow uniformly across every region. Rising disposable incomes and faster adoption of natural beauty ingredients in emerging economies give India and China a measurable edge, while mature developed regions such as North America and Europe expand more steadily from higher baseline consumption. The table below shows the compound annual growth rate (CAGR) each of the five largest countries is expected to record between 2025 and 2035.

The United States glycine soja (soybean) seed extract market is expected to grow at a CAGR of 7.7%, driven by advanced cosmetic R&D capabilities and strong emphasis on clean beauty trends. Demand is fueled by consumers seeking plant-based, antioxidant-rich formulations, particularly in premium skincare. The presence of leading global players ensures consistent innovation and product quality.

With widespread availability across both retail and online platforms, the USA benefits from high consumer spending power and brand loyalty. Strict regulations safeguard ingredient quality, building trust in natural formulations. Marketing strategies focus heavily on sustainability and transparency, resonating with eco-conscious buyers. Rising interest in anti-aging products further enhances the market outlook.

Revenue of glycine soja (soybean) seed extract in China is projected to expand at a CAGR of 7.3%, driven by a rapidly growing middle class and the rising preference for natural, plant-based cosmetics. Urban consumers are increasingly willing to invest in premium beauty products offering visible skin health benefits. E-commerce leaders like Alibaba and JD.com are boosting product accessibility, enabling both domestic and international brands to thrive.

Younger buyers are especially drawn to products marketed with sustainability and natural-origin claims. Government support for the cosmetics industry and improved ingredient safety regulations are boosting market credibility. Social media influencers amplify product awareness and trend adoption, making China a powerhouse in beauty consumption.

Sales of glycine soja (soybean) seed extract in Germany is growing at a CAGR of 6.4%, supported by its strong eco-conscious culture and high trust in certified organic products. The nation’s beauty industry is mature, with both domestic and international brands competing in the natural cosmetics space. Stringent safety regulations ensure consistently high product quality, appealing to environmentally aware consumers.

Premium retailers, pharmacies, and specialty beauty stores dominate distribution, reinforcing the preference for transparency and ethical sourcing. Innovation in natural anti-aging skincare continues to be a major growth driver. Collaboration between local suppliers and global beauty houses strengthens competitiveness and market depth.

Sales of glycine soja seed extractmarket in India is projected to grow at a CAGR of 6.9%, fueled by rapid urbanization, rising disposable incomes, and increased beauty consciousness. The expanding middle class is increasingly exposed to premium beauty and wellness products through digital and modern retail channels. E-commerce growth, supported by high smartphone penetration, has opened access to international brands.

Social media influencers and celebrity endorsements are powerful drivers of demand for botanical skincare. Domestic manufacturing capacity is improving with investments in advanced extraction technologies, keeping production cost-competitive. Partnerships with global players are enriching the product mix and enhancing market innovation.

Demand for glycine soja seed extractin Japan is projected to grow at a CAGR of 6.2%, driven by a refined beauty culture valuing multifunctional, high-efficacy formulations. Consumers favor products that combine anti-aging, hydration, and skin barrier protection, underpinned by advanced R&D in cosmetic science. Brands focus on ingredient transparency and safety, earning strong consumer trust.

Premium department stores and specialty beauty outlets ensure high-end positioning. Collaborations between domestic producers and global suppliers broaden ingredient diversity and innovation potential. The Japanese market’s commitment to combining tradition with modern science sustains its reputation for premium natural cosmetics.

The competitive environment is characterized by a mix of established ingredient suppliers and specialized natural extract manufacturers. Supply chain reliability rather than sheer product portfolio breadth remains the decisive success factor: the five largest suppliers collectively serve more than 15,000 cosmetic manufacturers globally and account for a majority of organic and premium extract sourcing in the category.

Symrise is the most established participant. As a global specialty chemicals company, the organization offers comprehensive natural ingredient solutions, all meeting international quality standards. Its core range of plant extracts and botanical ingredients gives it deep penetration in premium cosmetic channels while maintaining full global coverage through major beauty manufacturers and contract formulators.

Grau Aromatics, specialized in natural aromatic ingredients, leverages deep extraction expertise to place high-quality soybean seed extracts in luxury skincare formulations and niche beauty brands. Post-expansion investments in organic certification have allowed Grau Aromatics to introduce premium-grade extracts positioned for clean beauty applications, reinforcing its role as a key supplier for emerging natural cosmetic brands.

Lucas Meyer Cosmetics, owned by International Flavors & Fragrances, benefits from scale synergies inside a comprehensive cosmetic ingredients portfolio and from co-development partnerships with major beauty brands. Recent innovations under specialized active ingredient platforms extend Lucas Meyer beyond basic extracts into enhanced bioactive formulations targeting specific skin concerns and age-related beauty needs.

The next tier comprises specialized extract manufacturers and regional ingredient suppliers. Bellatorra Skin Care LLC focuses on premium botanical ingredients for luxury skincare applications which showed steady growth in specialty extract sales, signaling established but focused positioning. Natural Solution, expanding through sustainable sourcing partnerships, adds certified organic soybean extracts to growing clean beauty supply chains and is expected to benefit from increased demand for traceable ingredient sourcing.

Private-label ingredient programmes at major chemical distributors and contract manufacturers are widening availability at price points 8-12% below branded equivalents, putting margin pressure on smaller suppliers while supporting formulation accessibility for emerging beauty brands. Consolidation is therefore likely to continue as extraction scale and global distribution capabilities become critical for maintaining supplier partnerships and quality consistency in this expanding category.

Key Developments

| Item | Value |

| Market Size (2025) | USD 2.6 Billion |

| By Source | Natural and Synthetic |

| By Application | Skin Care, Hair Care, Makeup, Bath and Body Care, Food, and Medicines |

| By Form | Liquid and Semi-Liquid |

| By End Use Industry | Cosmetic and Personal Care Industry, Pharmaceutical Industry, Food and Beverage Industry, and Others (nutraceuticals and biotechnology) |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Oceania, and Middle East & Africa |

| Country Covered | United States, China, Germany, India, Japan, and 40+ countries |

| Top Companies Profiled | Grau Aromatics, Symrise, Bellatorra Skin Care LLC, Natural Solution, The Organic Pharmacy Ltd, Lucas Meyer Cosmetics, JF Natural, Durae Corporation, and Carrubba |

| Additional Attributes | Rising consumer preference for natural and plant-based skincare ingredients, increasing demand for anti-aging and antioxidant-rich formulations, expansion of clean beauty and sustainable sourcing trends, growth in e-commerce and premium beauty retail chann els, continuous innovation in botanical extraction technologies |

The global glycine soja (soybean) seed extract market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the glycine soja (soybean) seed extract market is projected to reach USD 4.8 billion by 2035.

The glycine soja (soybean) seed extract market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in glycine soja (soybean) seed extract market are skin care, hair care, makeup, bath and body care, food and medicines.

In terms of form, liquid segment to command 41.7% share in the glycine soja (soybean) seed extract market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Savory Yogurt in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Patient-Controlled Analgesia Pumps in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Salon Chairs in USA Size and Share Forecast Outlook 2025 to 2035

Demand for OTC Glucose Monitors in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Online Clothing Rental in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Optical Spectrum Analyzer in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Peripherally Inserted Central Catheter in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Nutritive Sweetener in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Preoperative Bathing Solution in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Packaging Tubes in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for High-Density Racks (100Kw) in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Heavy Duty Bag and Sack in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Heat Stabilizers in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Hanger in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Functional Flavour in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Gluten Free Prepared Food in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Fruit Snacks in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Fruit Pectin in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Food Grade Dipotassium Phosphate in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Carrier Infrastructure in Telecom Applications in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA