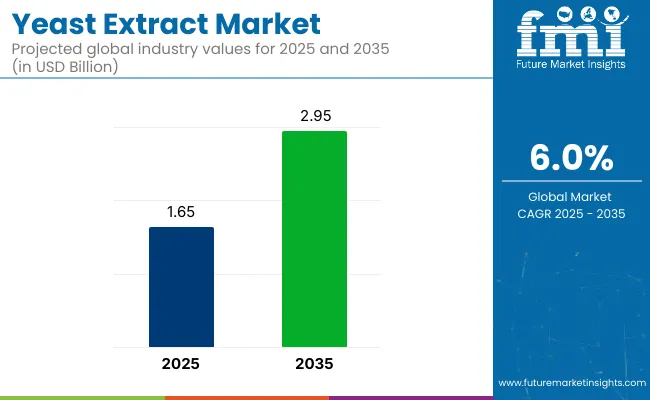

In 2025, the global yeast extract market is expected at USD 1.65 billion and projected at USD 2.95 billion by 2035, growing at a CAGR of 6.0%. Demand is rising across food, animal feed, cosmetics, and pharmaceuticals, driven by interest in clean-label, natural ingredients.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 1.65 billion |

| Projected Industry Value (2035F) | USD 2.95 billion |

| CAGR (2025 to 2035) | 6.0% |

The food and beverage segment leads usage, while changing dietary habits in Asia-Pacific and Latin America support further expansion. Advances in fermentation technology continue improving extraction efficiency, making yeast extract a preferred ingredient across various sectors seeking reliable, multi functional, and label-friendly solutions.

The industry draws demand from various industrial segments, with the food and beverage sector accounting for approximately 45-50%. Its natural origin and flavor-enhancing abilities make it a preferred choice in processed foods, snacks, soups, and sauces. The animal feed industry follows with a share of around 20-25%, using yeast extract to promote gut health and improve nutrient intake in livestock.

The pharmaceutical sector contributes close to 10-12%, where yeast extract supports microbial cultures used in drug manufacturing. The nutraceuticals market holds about 8-10%, driven by the ingredient’s nutritional profile. The cosmetics and personal care sector accounts for the remaining 5-7%, incorporating yeast extract into skincare and hair care for its conditioning and revitalizing properties.

In March 2025, Antoine Bau, Vice President of Lallemand Bio-Ingredients, stated that yeast extracts containing beta-glucans and mannan-oligosaccharides (MOS) are more than just feed additives-they act as probiotic activators that support animal microbiome health.

Speaking at the Lallemand R&D Symposium, he noted that these bio-ingredients are contributing to a 9.47% growth in the animal nutrition sector, helping improve livestock health while reducing the need for antibiotics in feed formulations.

The yeast extract market reflects distinct regional per-capita use. France and Belgium lead, with widespread application across soups, meat blends, and plant-based sauces. In South Korea and Japan, individual usage aligns with seasoning powder formats in instant meal kits. Urban India and Indonesia record lower per-capita intake, centered in bakery and bouillon segments.

Cold-chain use in the yeast extract market is rare. The material is largely shelf-stable, though packaging integrity and humidity controls remain critical. Warehouses in Vietnam and Chile operate under ambient conditions. European institutional sales rely on pre-sealed drums distributed via regional logistic networks.

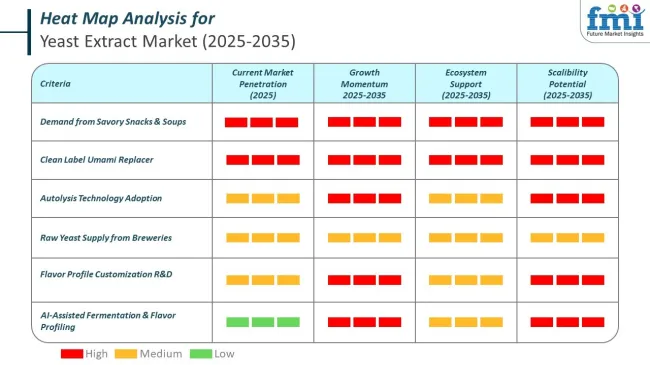

The market is witnessing a marked shift toward naturally derived, clean-label, and formulation-ready solutions. The most active investment opportunities lie in the autolyzed type, food-grade applications, powder form, and food & beverage use. These four segments collectively account for over 72% of the global demand.

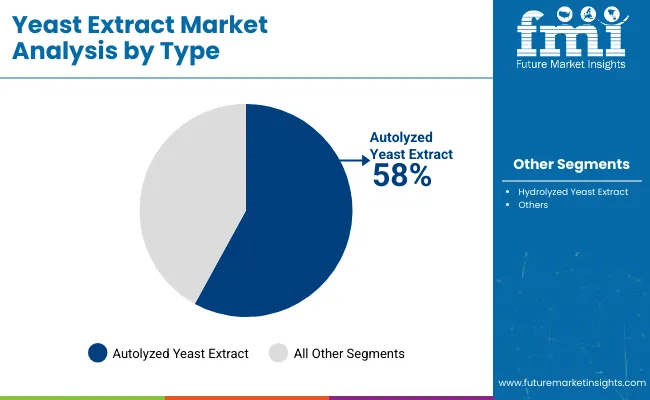

Autolyzed yeast based extract remains the top product type, holding 58% of global market share in 2025. The method of autolysis ensures nutrient retention and flavor quality without chemical additives, positioning it as a preferred flavor solution in soups, seasonings, sauces, and instant meals.

Food processors favor its stability and consistent performance, while regulatory ease adds to its commercial viability. Major producers like Angel Yeast, DSM, and Biospringer are scaling up production to meet expanding needs in processed and plant-based foods.

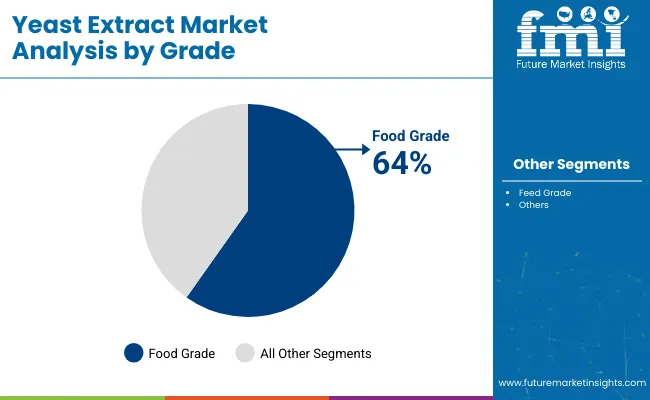

Food grade yeast extract accounts for the highest demand by grade, capturing 64% of the global share in 2025. It is widely used in the formulation of clean-label processed foods, including soups, snacks, frozen meals, and dairy analogs

. The nutritional content-rich in amino acids and B vitamins-supports broader health-positioning across both premium and mainstream product lines. Companies like Kerry Group, Lallemand, and Ohly are expanding their food-grade portfolios and local supply chains to serve Europe, North America, and Southeast Asia.

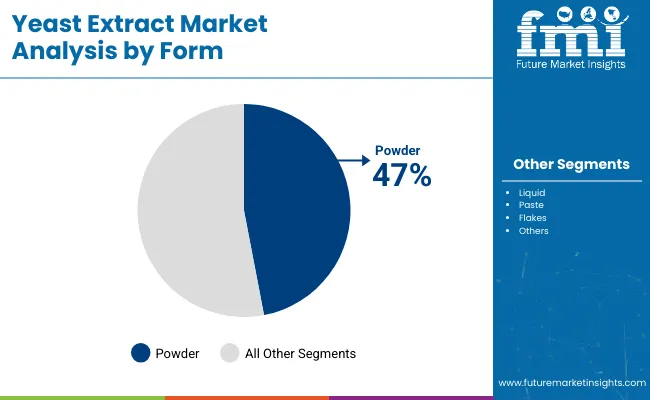

The powdered form segment is set to maintain a 47% share of the market in 2025. It is preferred for its long shelf life, simple blending capacity, and cost-effective storage solutions. Powder format is extensively used in dry food processing such as stock powders, bouillon cubes, seasoning blends, and dehydrated meals.

Its low water activity makes it especially suitable for warm and humid markets. Suppliers such as Sensient, TitanBiotech, and Lesaffre continue to optimize flowability and solubility characteristics to boost product appeal.

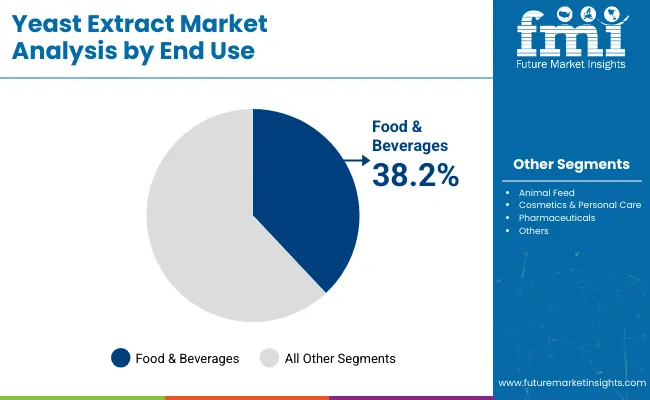

The food & beverages segment leads in end use, contributing 38.2% of global demand in 2025. It is widely used to enhance taste and nutritional profile in soups, broths, sauces, snacks, processed meats, and vegan offerings.

Its use allows manufacturers to reduce monosodium glutamate (MSG) and synthetic additives, while maintaining flavor performance. Companies like Nestlé, Ajinomoto, and Unilever integrate yeast based extract in a broad array of consumer packaged foods, aligning with evolving product labeling norms and consumer preference for natural inputs.

The market is growing as clean-label trends drive reformulations and increased demand for natural flavor enhancers. Suppliers are experiencing margin compression due to rising costs of raw materials, energy, and regulatory compliance. While some are adopting cost-efficient production methods, sensory limitations are slowing adoption in premium product lines.

Formulation Shifts Driven by Natural Flavoring Demand

The pivot toward natural flavor enhancement has gained momentum, with yeast extract emerging as a strategic substitute for synthetic additives. In 2024 to 2025, over 3,800 global food and beverage SKUs were reformulated to include yeast extract in place of MSG, particularly in ready meals, broths, and vegan proteins. China and Southeast Asia led growth with a combined 14% increase in yeast-based ingredient approvals.

Production capacities expanded-Angel Yeast alone scaled hydrolyzed yeast lines by 9% to match tailored flavor system orders. Advanced digital tools cut development timelines by over 20%, enabling faster reformulation cycles. Clean-label SKUs featuring yeast-based flavoring agents reported an average 19% increase in 3-month repurchase rates, signaling strong consumer validation.

Volatile Inputs and Tightened Regulations Erode Supplier Margins

Rising input costs and compliance burdens have placed downward pressure on extract supplier profitability. Molasses, a key raw input, climbed 13% year-on-year amid climatic disruptions in Brazil and India, while fermentation hubs in the EU faced energy cost hikes up to 21%. Global shipping lanes also saw reefer container rates surge by 12%, especially for Asia-EU corridors.

At the same time, evolving food-label regulations in the EU drove up certification and testing expenses by 16%. As a result, average gross margins contracted by 4.8 percentage points across mid-size exporters. To manage costs, some manufacturers transitioned to spray-dried formats, but sensory trade-offs have slowed market penetration in premium applications.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.3% |

| China | 6.7% |

| India | 6.5% |

| Germany | 5.8% |

| Brazil | 5.9% |

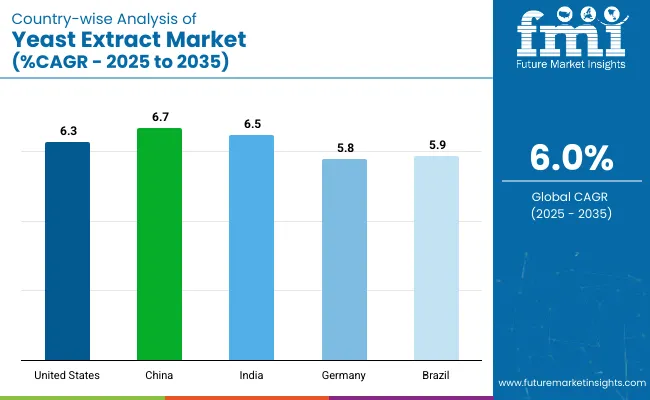

Global demand is projected to grow at a 6.0% CAGR between 2025 and 2035. Among the five key markets, China leads at 6.7%, followed by India at 6.5% and the United States at 6.3%. Brazil stands at 5.9%, while Germany posts 5.8%. This translates to a +12% premium for China, +8% for India, and +5% for the USA, compared to the global average.

Brazil and Germany fall slightly below, each showing a -2% differential. Growth patterns reflect differences in food manufacturing scale, demand for clean-label ingredients, and innovation pace. BRICS markets show stronger expansion, while OECD countries continue on a stable trajectory shaped by consumer preferences and mature food industry infrastructure.

The market in the United States is forecasted to grow steadily at a CAGR of 6.3% through 2035. Demand has been shaped by increased adoption in savory snacks and meat-alternative formulations. Around 67% of food processors have switched to yeast-based flavoring to support cleaner ingredient declarations.

Domestic producers are meeting over 74% of demand, reducing dependency on imports. Functional flavor enhancement remains central to its market performance, with high application in low-sodium categories and wellness-driven product lines.

China’s yeast based extract consumption is expanding at 6.7% CAGR, driven by processed food sectors targeting cleaner formulations. About 41% of instant noodles and condiments now incorporate yeast extract to replace MSG.

Angel Yeast commands over 35% of the national capacity, supported by rapid infrastructure growth. The product is also gaining popularity in ready-to-cook meal kits and export-grade condiments, where umami enhancement without synthetic additives is favored by both producers and regulators.

India’s yeast extract market is advancing at 6.5% CAGR, with demand rising in vegetarian instant meals, gravies, and savory snacks. Nearly 54% of new packaged entrees introduced use yeast extract as a flavor-enhancing agent.

Regional manufacturers are adopting yeast extract in traditional spice blends and protein-enriched formulations. Companies such as Symega and Synthite have expanded yeast derivative portfolios by 33% to meet this trend. Domestic production is scaling up to reduce foreign dependency.

Germany’s yeast extract market is growing at a 5.8% CAGR, powered by natural additive preferences across organic-certified products. Over 69% of plant-based meat analogues now use yeast extract for sodium reduction and flavor balance.

Only and Biospringer have scaled up fermentation infrastructure to meet higher bakery and seasoning demands. Yeast extract is increasingly used in clean-label bouillons, meal bases, and snack dustings aligned with regional retail standards.

Brazil is experiencing 5.9% CAGR growth in yeast extract applications, led by packaged seasonings, frozen foods, and protein-based meals. Marfrig and JBS have boosted yeast extract procurement by 44% to support clean-label product rollouts.

About 62% of new seasoning cubes released now include yeast extract to replace MSG. Domestic production capacity has expanded significantly to meet export demand and support retail brands entering plant-forward food segments.

The market is highly competitive, with a concentrated structure led by established players like Lesaffre Group, Kerry Group, and Angel Yeast. These companies are channeling resources into R&D to develop clean-label and naturally derived solutions tailored to evolving consumer preferences.

Their focus includes enhancing product quality and diversifying applications across food, beverage, and pharmaceutical sectors. Chr. Hansen, Lallemand Inc., and Biospringer are also expanding their offerings and strengthening regional footprints through product innovation.

The emerging players are introducing novel fermentation methods and targeting niche markets to gain visibility. Strategic alliances and acquisitions continue to shape the industry, indicating a market where a few dominant players maintain strong influence amid ongoing shifts in consumer demand and production technology.

Recent Yeast Extract Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.65 billion |

| Projected Market Size (2035) | USD 2.95 billion |

| CAGR (2025 to 2035) | 6.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Types Analyzed (Segment 1) | Autolyzed Yeast Extract, Hydrolyzed Yeast Extract |

| Grades Analyzed (Segment 2) | Food Grade, Feed Grade |

| Forms Analyzed (Segment 3) | Powder, Liquid, Paste, Flakes |

| End Uses Analyzed (Segment 4) | Food & Beverages, Animal Feed, Cosmetics & Personal Care, Pharmaceuticals, Others |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, Brazil, South Africa |

| Key Players | Lesaffre Group, Kerry Group, Angel Yeast, Lallemand Inc., Biospringer, Synergy Flavors, Thai Foods International Co., Associated British Foods, Chr. Hansen, Leiber, Novozymes |

| Additional Attributes | Dollar sales, share by protein level and end-use, increasing demand from poultry and aquaculture segments, adoption in microbial growth media and flavor enhancement, regional production patterns and export opportunities |

The global market is projected to reach USD 2.95 billion by 2035.

The industry is forecasted to grow at a CAGR of 6.0% during the period 2025 to 2035.

Autolyzed yeast extract is anticipated to hold the leading position with a 58% market share in 2025.

The food-grade segment is projected to account for 64% of the global market in 2025.

China is forecasted to record the highest growth, with a CAGR of 6.7% between 2025 and 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

UK Yeast Extract Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Extract Market Growth – Trends, Demand & Innovations 2025–2035

Europe Yeast Extract Market Trends – Growth, Demand & Forecast 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Latin America Yeast Extract Market Growth – Trends, Demand & Innovations 2025–2035

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Yeast Infection Diagnostics Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Yeast Nucleotides Market Analysis by Product Type, Nature, Form and Application Through 2035

Yeast Infection Treatment Market by Drug Type, Distribution Channel, End User, and Region, 2025 to 2035

Yeast Autolysates Market Outlook - Growth, Demand & Forecast 2024 to 2034

Yeast Flakes Market

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

GCC Yeast Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA