The Latin America Yeast Extract sector is hypothesized to make progress from around USD 177.7 million in 2025 to USD 333.6 million by 2035, demonstrating a CAGR (Compound Annual Growth Rate) of 6.5% over the projected period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 177.7 million |

| Projected Latin America Value (2035F) | USD 333.6 million |

| Value-based CAGR (2025 to 2035) | 6.5% |

The yeast extract market in Latin America is predicted to have a steady growth rate during the course of 2025 to 2035, primarily in the food and beverage industry, especially in the savory area, and the rising nutritional supplement sector. The use of yeast extract in a variety of products including soups, sauces, snacks, and ready-to-eat meals, due to its high protein and nutritional levels as an Umami additive and thickener, is expected to witness an increasing trend in this region.

Due to the popularity of plant-based and clean-label products in the area, yeast extract can be used as a natural and clean alternative to artificial compounds like monosodium glutamate (MSG).

The booming trend of people seeking healthier, functional foods, accompanied by the increase in the consumption of plant-based diets, is anticipated to drive the yeast extract market in Latin America.

The fact that the population is focused on health is manifested in the growth of products like protein-enriched and probiotic supplements in which yeast extract is used as an important component, thus making it a significant condiment in the developing health and wellness sector.

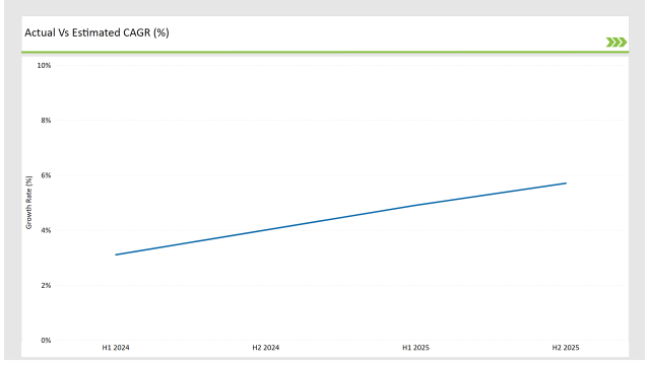

A breakdown of changes in the compound annual growth rate (CAGR) between six months from the base and current year (2024 and 2025 respectively) reveal an increase of 10% for the Latin America yeast extract market in total.

This biannual assessment reports important transformations in the market conditions and reports revenue realization patterns, thus providing stakeholders with the proper insight about the growth tendencies within the year. The first half of the year (H1) ranges from January to June while the second half of the year (H2) embraces July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.1% |

| H2 (2024 to 2034) | 4.0% |

| H1 (2025 to 2035) | 4.9% |

| H2 (2025 to 2035) | 5.7% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin Americaan Yeast Extract market, the sector is predicted to grow at a CAGR of 3.1% during the first half of 2024, with an increase to 4.0% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 4.9% in H1 but is expected to rise to 5.7% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

Rising Interest in Food and Beverage Use

The market for yeast extract in Latin America is turning towards the use of ingredients with a more sustainable and clean nature. The fame of products made from plants has increased, thus the demand for yeast extracts skyrockets, especially for savory type foods, snacks, and dry meals. On top of that, yeast extract's function, which is to enhance flavors without artificial additives, should be taken into account in other food categories while its adoption in different industries is rising continuously..

Increasing Adoption in Nutritional Supplements

Yeast extract is being increasingly incorporated into nutritional supplements, driven by its rich amino acid and B-vitamin content. As consumers in Latin America seek functional foods and dietary supplements that offer health benefits, yeast extract is emerging as a key ingredient in protein supplements, probiotics, and other fortified products. This trend is expected to fuel the market growth for yeast extract in the coming years.

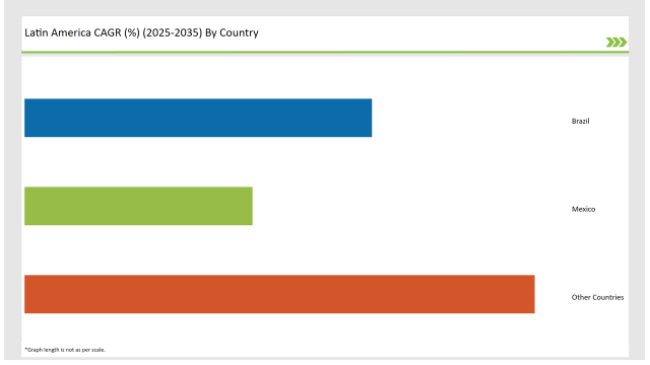

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Brazil | 32% |

| Mexico | 21% |

| Other Countries | 47% |

Brazil, which has the largest market share of 32% in the Latin American yeast extract market, is the main player in this sector. As a major economic power in the region, Brazil is not only one of the largest consumers but also one of the largest producers of yeast extract, mainly from its food and beverage sector.

With the growing demand for sauces, soups, snacks, and ready-to-eat meals, the consumers' needs have increased which are focusing on more natural and clean label ingredients. Furthermore, yeast extract is boosting the demand for clean-living and vegetable-based products as it is perceived as a vegetable-derived flavor enhancer that is better for health.

As the country continues to build up its middle class and as consumer health entrenches itself as a core value, the yeast extract product in Brazil would be sustained for a long period in both local and international markets

Mexican yeast extract market is the second player holding a corresponding 21% market share. This is due primarily to the demand for yeast extract that is incorporated in the food and beverage sector, specifically in the case of savory foods, processed snacks, and instant meals.

With the growth of naturally derived and clean-label products, yeast extract is winning the race due to its characteristic of using no chemical compounds to enhance flavor. Furthermore, the trend toward plant-based products and the availability of functional foods in Mexico also contributed to the growth of the yeast extract market locally.

Added to that, the country's blossoming food processing business and the size of the consumer base present several opportunities in which the growth of yeast extract as a product would be a part of food and beverage applications.

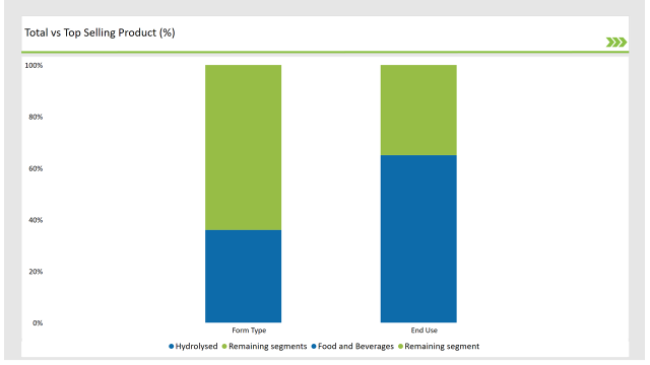

% share of Individual Categories Type and End-Use in 2025

| Main Segment | Market Share (%) |

|---|---|

| Type (Hydrolysed) | 36% |

| Remaining segments | 64% |

In the Latin American yeast extract sector, Hydrolyzed yeast extract is in a pole position, occupying a solid market share of 36%. With its rich umami flavor, this type of yeast extract is preferred by food processors for the addition of flavor to a wide range of food products. Hydrolyzed yeast extract is often used in foods such as soups, sauces, seasonings, snacks, and ready-to-eat meals where it's valued for its ability to add a deep but natural flavor to these products.

Its acceptance comes from its flexibility and its being clean-label as increasingly consumers expect products that contain natural and understandable ingredients. Hydrolyzed yeast extract is also a good source of B vitamins, amino acids, and antioxidants, which are in line with the trend towards functional foods that consumers are increasingly interested in.

In accordance with the growth of the plant-based and natural products market in the region, hydrolyzed yeast extract will maintain its lead, primarily where it is used for both adding flavor and fortifying nutrition.

| Main Segment | Market Share (%) |

|---|---|

| End Use (Food and Beverages) | 65% |

| Remaining segments | 35% |

The end-user application for yeast extract in the food and beverage industry in Latin America ranks first with a market share of 65%. The yeast extract product is widely used in this sector for its ability to improve the taste of food, especially for savory products such as soups, sauces, snacks, ready-to-eat meals, and seasonings. New product formulations are introducing yeast extract as a flavor that is not added with artificial preservatives which is a great solution to the problem.

Moreover, aside from their role in flavor improvement, yeast extract is also gaining importance in functional foods and beverages. The presence of amino acids, B-vitamins, and antioxidants makes this product a desirable ingredient for health-oriented foods and beverages.

The new age of the health-conscious consumer, along with the increased popularity of plant-based diets, is projected to be the main drivers for the yeast extract demand in food and beverages in Latin America. With the growth in the market of the clean-label and natural ingredients the food and beverage sector would continue being a significant growth factor for the yeast extract industry in the region.

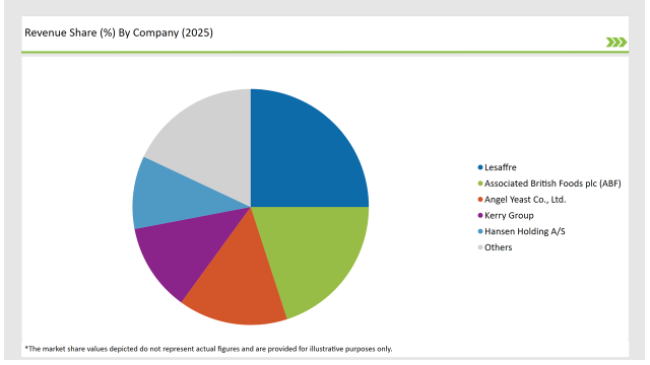

2025 Market share of Latin America Yeast Extract manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Lesaffre | 25% |

| Associated British Foods plc (ABF) | 20% |

| Angel Yeast Co., Ltd. | 15% |

| Kerry Group | 12% |

| Hansen Holding A/S | 10% |

| Others | 18% |

The yeast extract market in Latin America is moderately concentrated, with a few major players dominating the landscape. Leading major international firms control a considerable share of the market on account of their quality relations with suppliers, state-of-the-art technical resources, and broad product assortments. These key players generally manage to cater to the broadest market areas such as the food and beverage sector, pharmaceutical, and cosmetics industries, and other niche markets as well.

In the meantime, regional companies also move forward, focusing on the local production model and adapting their products to the preferences of Latin American consumers. Firms also utilize their understanding of local market characteristics and customer preferences, including the growing trend of clean-label, natural, and plant-based ingredients.

The presence of dominant players has not avoided the competition, as different companies strive to distinguish themselves through product innovations, sustainability, and product development. The overall demand for yeast extract is rising particularly in the food and beverage sector, therefore both multinational and regional companies are anticipated to battle for market share through capacity expansions and enhanced product offerings.

As per Type, the industry has been categorized into Autolyzed Yeast Extract, and Hydrolysed Yeast Extract.

As per Grade, the industry has been categorized into Food Grade, and Feed Grade.

As per form, the industry has been categorized into Powder, Liquid, Paste, and Flakes.

As per End-Use, the industry has been categorized into Food & Beverages, Animal Feed, Cosmetics & Personal Care, Pharmaceuticals, and Others.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The growth is fueled by demand for clean-label, plant-based ingredients and natural flavor enhancers in the food and beverage industry.

Yeast extract is mainly used in savory foods, snacks, seasonings, and ready-to-eat meals, as well as in functional foods for its nutritional benefits.

Brazil (35%) and Mexico (20%) are the top countries in the Latin American yeast extract market.

Hydrolyzed yeast extract is the most popular, followed by liquid and powder forms for food applications.

The market is expected to grow due to rising demand in food and beverages, plant-based diets, and functional foods with natural ingredients.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA