The yeast extract market is moderately consolidated and is dominated by multinational giants, besides strong regional players. Multinational giants like Lesaffre, DSM, and Angel Yeast command around 55% of market share.

Companies that are using widespread R&D capabilities and established distribution networks are leading both food-grade and pharmaceutical-grade yeast extracts segments. Regional players like India's Titan Biotech and Brazil's Biorigin represent about 30% of the market, serving local markets and niche applications.

The smaller, craft-oriented companies working with organic or specialty products are represented by about 10% market share, such as Belgium-based Specialty Yeast Products.

The remaining 5% is occupied by private labels - brands belonging to major retailers such as Walmart's Great Value-appealing to price-sensitive customers. While key players have a strong footing in the market, emerging brands and regional leaders also emerge as drivers for dynamics in the market through localized innovations and targeted applications.

Global Market Share by Key Players

| Global Market Share, 2025 | Industry Share% |

|---|---|

| Top Multinationals (Lesaffre, DSM, Angel Yeast) | 55% |

| Regional Leaders (Titan Biotech, Biorigin) | 30% |

| Startups & Niche Brands (Specialty Yeast Products, Synergy Flavors) | 10% |

| Private Labels (Walmart’s Great Value, Tesco’s Finest) | 5% |

The market is moderately consolidated with multinational giants at the forefront, along with regional and niche players.

Hydrolyzed Yeast Extract accounted for the largest market share of 77.8% through extensive applications in the flavor enhancement of food and beverage products. Hydrolyzed yeast extract imparts a strong umami flavor, so it's one of the most critical ingredients for savory snacks, soups, and sauces.

Lesaffre's BioSpringer line addresses the segment with umami-rich offers that cater to the growing demand for clean-label food. Hydrolyzed yeast extract is still the major adoption region, which is in North America and Europe, and these especially are influenced by consumer preference for natural flavoring agents.

Autolyzed Yeast Extract 22.2% is fully utilized in cost-sensitive applications, such as animal feed, where functional nutrition is the top priority. This is why product lines like Feed Solutions from Angel Yeast have gained ground by improving the health of livestock and enhancing digestibility.

The major usage of Powdered Yeast Extract 31.1% primarily because its addition, storage, and use are easy; it possesses a long shelf life, and it can be easily used in many applications. The main usage of the food and beverage industry of powdered yeast extract includes soups, seasonings, and snacks.

For the purposes of bulk or retailing, versatile powdered formulations are designed and offered by Lallemand among the major companies. Industrial scale is used by 20.2% Liquid Yeast Extract, including marinades, bakery products, and processed meat. Formulations that are liquid help with ease in blending.

Commercial food processing often utilizes liquid. Paste and flakes, though smaller in market share, are emerging as niche products targeting premium applications such as cosmetics and specialty gourmet foods.

The year 2024 is critical to the yeast extract market as firms approach this field with innovation, sustainability, and regional expansion. Multinational giants like Lesaffre and DSM set the tone with advanced product launches targeting clean-label markets, and plant-based markets. Regional leaders like Biorigin in Brazil and Titan Biotech in India capitalized on strong regional demand, giving low-cost access to the animal feed and niche food industries.

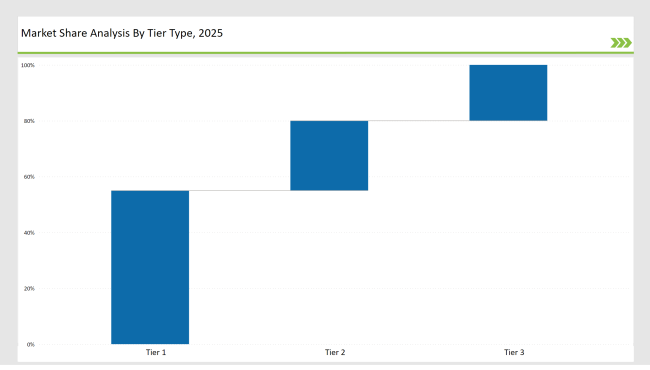

| By Tier Type | Tier 1 |

|---|---|

| Market Share% | 50% |

| Example of Key Players | Lesaffre, DSM, Angel Yeast |

| By Tier Type | Tier 2 |

|---|---|

| Market Share% | 30% |

| Example of Key Players | Titan Biotech, Biorigin, Biospringer |

| By Tier Type | Tier 3 |

|---|---|

| Market Share% | 20% |

| Example of Key Players | Specialty Yeast Products, Synergy Flavors |

| Brand | Key Focus |

|---|---|

| Lesaffre | Developed yeast extracts for sodium reduction in processed foods, catering to health-conscious consumers in North America. |

| DSM | Launched yeast extracts for fortified immune health beverages, targeting wellness-focused product lines in Europe. |

| Angel Yeast | Partnered with academic institutions to advance fermentation techniques for cost-effective production. |

| Kerry Group | Expanded organic yeast extract production facilities in Ireland to meet rising global demand. |

| Lallemand | Introduced functional yeast extracts for low-salt and clean-label applications in premium packaged foods. |

| Biorigin | Enhanced its organic product portfolio to cater to the growing South American market. |

| Ajinomoto | Increased focus on Asian food applications using yeast extracts, targeting traditional cuisines. |

| Titan Biotech | Invested in R&D for cost-effective feed-grade yeast extracts to support sustainable agriculture. |

| Synergy Flavors | Targeted premium culinary markets with customized yeast extract formulations for high-end chefs. |

As the demand for plant-based foods continues to rise, yeast extracts are becoming increasingly valuable as natural flavor enhancers. Lesaffre and DSM manufacturers are developing novel vegan meat and dairy alternatives using yeast extracts. These can then be utilized for enhancing taste, texture, and overall acceptability of the plant-based products.

Adding yeast extracts would allow such companies to formulate closer-to-traditional sensory-mimetic, plant-based foods that would help meet consumer demands for sustainable and responsible food options.

Increasingly, yeast extracts with specific functionalities are being applied in the livestock feed and pharmaceutical industries, especially in North America and Europe. In the feed sector, yeast extracts have been used to support animal health and well-being, as their ability to enhance immune function and gut health has made them a valuable additive for livestock producers.

In the pharmaceutical industry, specific yeast-based nutraceuticals are being developed for addressing health concerns, utilizing the natural bioactive present in yeast. This is where the growing consumers' demand for natural and sustainable ingredients in skincare and personal care products is creating market opportunities for yeast extract-based formulations.

Companies such as Lallemand and Kerry Group develop a yeast extract-infused cosmetic and personal care product, capitalizing on the natural properties of yeast, including antioxidant and skin-soothing effects.

Lesaffre, DSM, and Angel Yeast dominate the market, collectively holding 38% of the global market share, with a strong presence across all regions.

The food and beverages sector, accounting for 38.2%, leads due to rising demand for natural flavor enhancers in processed and plant-based foods.

Yeast extracts enhance the flavor of vegan meat and dairy alternatives, addressing the growing consumer demand for plant-based, natural products.

Companies are adopting eco-friendly production methods and offering non-GMO and organic yeast extracts to align with consumer preferences for sustainability.

Angel Yeast and Titan Biotech are leaders in feed-grade yeast extracts, targeting livestock health with innovative, functional products.

Innovations include clean-label products, organic certifications, and the use of yeast extracts in cosmetic and pharmaceutical applications.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

UK Yeast Extract Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Extract Market Growth – Trends, Demand & Innovations 2025–2035

Europe Yeast Extract Market Trends – Growth, Demand & Forecast 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Competitive Overview of Lovage Extract Companies

Market Share Insights for Orange Extract Suppliers

Winning Strategies in the Serrata Extract Market: A Competitive Review

Analyzing Quillaia Extract Market Share & Key Trends

Industry Share Analysis for Licorice Extract Companies

Latin America Yeast Extract Market Growth – Trends, Demand & Innovations 2025–2035

Key Companies & Market Share in the Instant Dry Yeast Sector

Competitive Landscape of Passion Fruit Extract Providers

Key Players & Market Share in Bidens Pilosa Extract Market

Market Positioning & Share in Fenugreek Seed Extract Manufacturing

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA