The Yeast Extract Industry Analysis in USA is projected to rise from a valuation of USD 1.3 billion in 2025 to USD 2.2 billion by 2035, expanding at a steady CAGR of 4.8% throughout the forecast period. Heightened interest in clean-label formulations and natural umami sources has strengthened the positioning of yeast extracts as functional flavor enhancers across processed food categories.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 1.3 billion |

| Projected Value in 2035 | USD 2.2 billion |

| Value-based CAGR from 2025 to 2035 | 4.8% |

Demand has been spurred by the ongoing consumer pivot away from synthetic additives, alongside food processors reliance on yeast extracts for masking off-notes in plant-based proteins and reformulated low-sodium products. However, pricing volatility tied to molasses and sugarcane substrate sourcing continues to present supply-side challenges.

A prominent trend is the integration of yeast extract into hybrid savory blends with spices, hydrolyzed proteins, and fermented ingredients, enabling brands to offer deeper flavor complexity while meeting label-conscious demands. Investment in fermentation technology and controlled autolysis protocols has intensified, aiming to customize peptide profiles for specific applications such as bouillons, broths, and snacks.

Growth over the next decade is anticipated to be shaped by sustained foodservice expansion and greater adoption in meat alternatives, wherein yeast extracts serve both functional and sensory roles. By 2035, yeast extracts are expected to achieve deeper penetration in health-positioned snacks, nutritional yeast formats, and fortified soups.

Novel innovations may include enzymatically modified variants with higher nucleotide content for specific savory intensity. Retail channels will further commercialize regional taste profiles using yeast-based flavor systems. Market expansion will also benefit from R&D efforts toward allergen-free and vegan-compliant extract variants, ensuring broader appeal in clean-label product innovation pipelines.

The table presents semi-annual USA yeast extract market growth trends that demonstrate continuous increases in CAGR across consecutive years. An investigation into market trends demonstrates its ability to shift according to consumer preferences and industrial progress.

The factor driving the steady market growth stems from rising yeast extract adoption by various end-use sectors particularly in food and beverage sectors. The yeast extract market expansion will be supported by technological advances that enhance flavor and nutritional features of yeast extract products.

In 2025, nutritional applications account for 15.2% of the USA yeast extracts market, with growth anticipated due to their adoption in fortified foods and dietary supplements. Yeast extracts rich in B-complex vitamins, beta-glucans, and nucleotides are being utilized in functional food and supplement formulations targeting immunity, energy metabolism, and gut health.

The USA Food and Drug Administration (FDA) permits their inclusion as flavoring agents and nutrient enhancers, but consumer perception of naturalness remains a critical driver. Companies such as Lallemand Bio-Ingredients and BioSpringer (Lesaffre) have expanded their yeast-based nutritional portfolios by offering non-GMO, allergen-free extracts tailored for health-conscious brands.

These ingredients are increasingly featured in vegan broths, sports nutrition powders, and nutraceutical blends. Clinical support for immune-modulating and digestive benefits of specific yeast fractions has catalyzed product development, particularly in the immunity-boosting supplement category.

Functional beverages are another emerging space where yeast extracts are deployed for savory masking and umami layering, notably in meal-replacement drinks. Future growth will depend on clearer distinction between flavoring and functional roles on labels, which remains ambiguous under current USA regulations. Still, advancements in proprietary fermentation have enabled higher purity formats with standardized amino acid or nucleotide levels, enhancing their appeal in precision nutrition and fortified food systems.

In 2025, nutritional applications account for 15.2% of the USA yeast extracts market, with growth anticipated due to their adoption in fortified foods and dietary supplements. Yeast extracts rich in B-complex vitamins, beta-glucans, and nucleotides are being utilized in functional food and supplement formulations targeting immunity, energy metabolism, and gut health.

The USA Food and Drug Administration (FDA) permits their inclusion as flavoring agents and nutrient enhancers, but consumer perception of naturalness remains a critical driver. Companies such as Lallemand Bio-Ingredients and BioSpringer (Lesaffre) have expanded their yeast-based nutritional portfolios by offering non-GMO, allergen-free extracts tailored for health-conscious brands. These ingredients are increasingly featured in vegan broths, sports nutrition powders, and nutraceutical blends.

Clinical support for immune-modulating and digestive benefits of specific yeast fractions has catalyzed product development, particularly in the immunity-boosting supplement category. Functional beverages are another emerging space where yeast extracts are deployed for savory masking and umami layering, notably in meal-replacement drinks.

Future growth will depend on clearer distinction between flavoring and functional roles on labels, which remains ambiguous under current USA regulations. Still, advancements in proprietary fermentation have enabled higher purity formats with standardized amino acid or nucleotide levels, enhancing their appeal in precision nutrition and fortified food systems.

Plant-based meat and dairy alternatives represent 17.6% of the USA yeast extracts market in 2025, a share expected to expand due to formulation challenges in replicating animal-based umami and masking off-notes. Yeast extracts are deployed for flavor rounding, mouthfeel enhancement, and sodium reduction in analog meats, cheeses, and fermented plant-based yogurts.

They are essential in simulating cooked meat flavors through Maillard-type reaction mimicry without artificial additives. Major players such as DSM-Firmenich and Kerry Group have introduced next-generation yeast extracts with high glutamic acid and 5’-nucleotide content, optimized for meat analogues and plant-based soups.

For instance, Kerry’s umami-building yeast platforms have been integrated in plant-forward formulations by leading brands in the USA retail and QSR segments. Regulatory flexibility under GRAS status has enabled swift innovation, though ongoing scrutiny from clean-label certifiers has pushed demand for minimal-process and allergen-free variants.

Future advances will involve hybrid flavor systems blending yeast extracts with fermented botanicals and protein hydrolysates to enhance sensory realism. Growth will be further supported by consumer demand for meat alternatives with complex flavor notes but lower salt and fat content. Additionally, regional flavor customization using yeast extract variants is expected to differentiate premium offerings in the USA flexitarian segment.

| Date | Development/M&A Activity & Details |

|---|---|

| January 25 | Idahoan Foods LLC launched a new line of organic Yeast Extract, responding to the growing consumer demand for healthier, natural food options. |

| December 24 | Lamb Weston Holdings, Inc. expanded its processing capabilities by investing in advanced technology to enhance the quality and efficiency of potato flake production. |

| November 24 | McCain Foods Limited introduced a new range of flavored Yeast Extract aimed at the food service industry, enhancing menu options for restaurants. |

| October 24 | Bob’s Red Mill Natural Foods launched gluten-free Yeast Extract, targeting the increasing number of consumers seeking gluten-free and plant-based alternatives. |

| September 24 | Basic American Foods announced plans to increase production capacity at its facilities to meet rising demand for dehydrated potato products across the USA. |

Hydrolyzed Yeast Extract has established dominance as the market leader

Commercial data indicates that hydrolyzed yeast extract maintains its position as the primary additive component in food alongside animal feed because of its extensive adoption. The umami-rich characteristics together with health benefits have contributed to its commanding leadership in savory market applications.

Hydrolyzed yeast extract attracts increased market interest because of its functional capabilities to mask flavors and better the overall taste profile. The growing consumer demand for natural-origin clean-label formulas will drive future expansion of hydrolyzed yeast extract popularity.

Consumers today prefer to buy transparent foods with healthy profiles which is reflected in this market movement. Hydrolyzed yeast extract maintains market-leading status because it fulfills the current demands of consumers alongside manufacturers.

Food Grade Yeast Extract Leads the Market by Grade

The food-grade yeast extract acts as an essential ingredient for flavor modification throughout the food and beverage manufacturing operation. Food-grade yeast extract serves the food industry by refining convenience and dispersion of flavor during the development of snacks and processed foods alongside ready-to-eat meals. Aside from improving taste, this element helps develop superior product quality.

The limited market presence of feed-grade yeast extract exists because it helps manage livestock health as well as production performance. The trend indicates expansion levels remain steady because premium animal feed producers progressively adopt nutritious ingredient alternatives. Acceleration of yeast extract usage across food and feed sectors is expected as more producers understand its advantages.

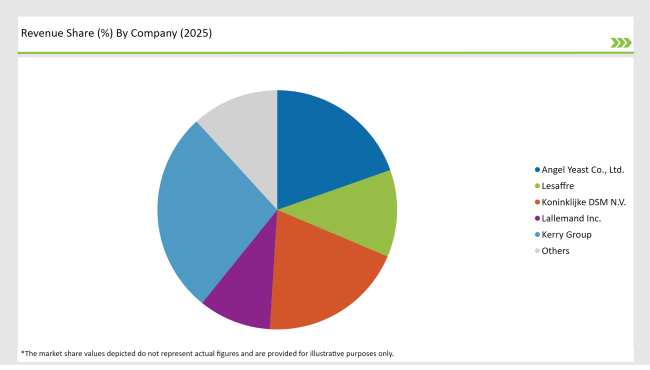

2025 Market share of USA Yeast Market suppliers

Innovation and strategic collaborations of key players dominate the USA yeast extract market. Manufacturers are also enhancing the product flavor and nutritional profile through new extraction techniques. Collaborations with food and beverage companies are now opening up for the applications of yeast extract in savory snacks, ready-to-eat meals, and functional foods.

Sustainability initiatives, such as sourcing non-GMO yeast and adopting eco-friendly production methods, are gaining traction. These efforts resonate with consumers prioritizing environmentally conscious products. Marketing campaigns emphasizing yeast extract’s natural origin and multifunctional benefits are further boosting its appeal.

The market is expected to grow at a CAGR of 4.0% from 2025 to 2035.

The USA yeast extract market is projected to reach USD 632.1 Million by 2035.

Key drivers include rising demand for natural flavor enhancers, functional ingredients, and sustainable food products.

Hydrolyzed yeast extract and food grade yeast extract dominate the market in 2025.

Top manufacturers include Angel Yeast Co., Lesaffre, Koninklijke DSM N.V., and Lallemand Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Yeast Nucleotides Market Analysis by Product Type, Nature, Form and Application Through 2035

Yeast Autolysates Market Outlook - Growth, Demand & Forecast 2024 to 2034

Yeast Flakes Market

Yeast Infection Diagnostics Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Yeast Infection Treatment Market by Drug Type, Distribution Channel, End User, and Region, 2025 to 2035

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

UK Yeast Extract Market Report – Trends, Demand & Industry Forecast 2025–2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

GCC Yeast Market Trends – Growth, Demand & Forecast 2025–2035

USA Yeast Market Analysis – Size, Share & Forecast 2025-2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Korea Yeast Market Analysis by Type, Form, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA