The ASEAN Yeast Extract market is set to grow from an estimated USD 413.9 million in 2025 to USD 829.5 million by 2035, with a compound annual growth rate (CAGR) of 7.2% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 413.9 million |

| Projected ASEAN Value (2035F) | USD 829.5 million |

| Value-based CAGR (2025 to 2035) | 7.2% |

The rapid growth of the ASEAN yeast extract market highlights the higher functional and nutritious ingredients required by the food, beverage, and animal feed industries. An extract that is derived from yeast and has the nutrition yeast is also highly rich in proteins, vitamins, and amino acids. Because of the fact that the ASEAN region is more and more populated with health-oriented buyers yeast extract is widely used in food and beverage applications as a flavor, nutritional supplement, and natural preservative.

The consumption of yeast extract has increased due to health awareness and wellness trends being one of the significant aspects promoting its intake. As the public turns to cleaner labels and more natural ingredients, yeast extract has become a common alternative for artificial substances such as MSG (monosodium glutamate) and other synthetic additives.

The trend for plant-based and vegan foods increased the consumption of yeast extract, as it is in keeping with the plant-derived protein that is now so popular.

In addition, the use of yeast extract in the foodstuffs and pharmaceutical industries has also widened its market. The growing animal husbandry sector, especially in countries like Thailand and Malaysia, has now sought yeast extract as food for animals to enhance abundance, improve digestion, and develop the immune system.

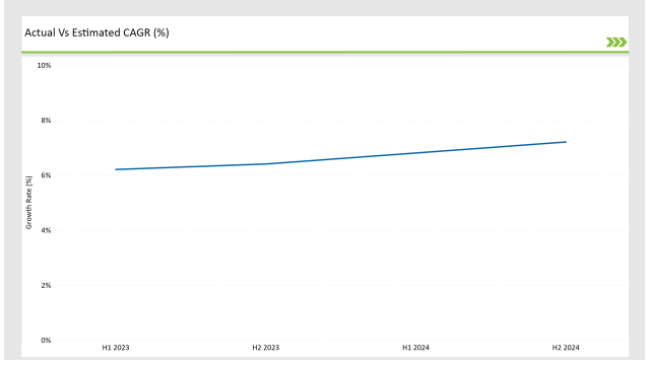

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the ASEAN Yeast Extract market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Yeast Extract market, the sector is predicted to grow at a CAGR of 6.2% during the first half of 2023, with an increase to 6.4% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 6.8% in H1 but is expected to rise to 7.2% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| August 2023 | DSM Nutritional Products launched a new line of yeast extract-based flavor enhancers in Malaysia, targeting the growing demand for clean-label ingredients. |

| November 2023 | Lesaffre expanded its yeast extract production capabilities in Thailand, aiming to meet the increasing demand from the animal feed industry. |

| September 2023 | Cargill introduced a yeast extract-derived immune-boosting ingredient for dietary supplements in Singapore, capitalizing on the wellness trend. |

| July 2022 | Angel Yeast began offering customized yeast extract formulations in Malaysia to cater to the specific needs of the local food industry . |

| January 2025 | AB Mauri launched a new yeast extract product in Vietnam for use in savory food applications, including sauces and ready meals. |

Increasing Demand for Natural and Clean Label Ingredients

The prominent driver for the yeast extract market expansion in the ASEAN region is the food industry's rising preference for natural and clean-label ingredients. The increasing concerns of consumers in the area regarding the possible health hazards related to artificial additives and preservatives have compelled them to choose products that disclose only straightforward and transparent content.

This gradual transition to natural and clean-label products has resulted in incredible prospects for yeast extract, which is regarded as an alternative to synthetic flavor enhancers including MSG being it natural, nutritious, and versatile.

Yeast extract is an excellent source of essential nutrients like amino acids, vitamins, and minerals. Therefore, it is an appealing choice for food manufacturers who are looking to create healthier and more nutritious products.

The yeast extract can act as a flavor enhancer in a multitude of foods ranging from soups, sauces, dairy products, and non-alcoholic beverages to snacks. With an increasing number of people choosing clean-label products over others, food manufacturers are now adding yeast extract to their products to give back healthier alternatives to consumers.

Growth in the Animal Feed Industry

The animal feed sector is one other fundamental force behind the growth of the ASEAN yeast extract market. Apart from that, yeast extract has become a popular choice as a high-quality animal feed component because it improves the nutrition and well-being of the animals. In the ASEAN region, the demand for meat, dairy, and other animal-based products has been growing, a fact attributed to population growth and a rise in household income thus more focus has been diverted toward livestock nutrition.

In nowadays animal feed, yeast is used to stimulate better digestion, immunity, and overall growth and development in animals. It exposes animals to essential nutrients like proteins, amino acids, and B vitamins which are indispensable for growing animals. Along with the transformation of husbandry strategies, the addition of yeast extract in the feed mixtures has turned out to be a strategic tool for farmers in boosting quantity and quality.

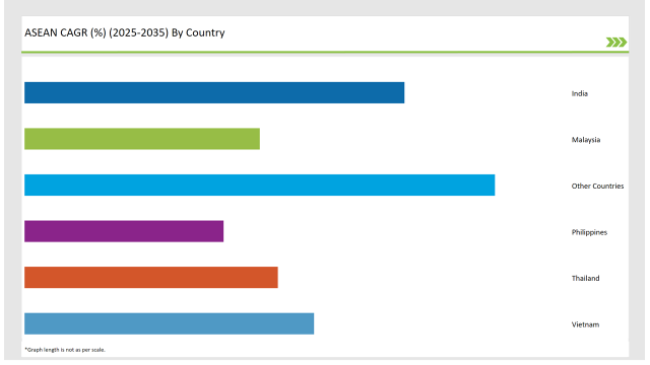

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

India is facing the enhanced demand for yeast extract due to the developing food and beverage sector, as well as the animal feed industry. In the course of the growth of the middle class in India, consumers are becoming more and more concerned about health and that is why they are constantly looking for nutritive ingredients, such as yeast extracts, which also serve as natural flavor enhancers. Yeast extract is particularly rousing to food manufacturers as it brings them a clean-label and natural alternative to MSG which is an artificial flavor enhancer.

Moreover, the increasing rate of animal husbandry in India is the main factor for the gain of yeast extract in animal feed. To find practical and ecological methods to nurture livestock and increase productivity, the farmers are integrating yeast extract into feed premixes, which helps in better digestion, immunity support, and growth in animals overall.

Malaysia is experiencing a yeast extract boom owing to two main forces: the green-label products grabbing the market and the increased attention on healthy foods. With the youth of Malaysia getting knowledge of the health issues linked to artificial substances and preservatives, it is the yeast extract that comes out of the lab that is the main choice for producers who want to present the product as natural and healthier.

The beverage and food sector in the country strives to draw up and sell eatables that are tasty and have more nutrition in them owing to the clean-label trend. By adding natural umami taste and being a source of vitamins and amino acids, yeast extract is an important ingredient for producers who want to attract customers who pay attention to their well-being. Also, plant-based diets and vegan food products which are increasingly being liked in Malaysia make things even better for yeast extract in terms of the high demand, given it is a natural protein and nutrient source.

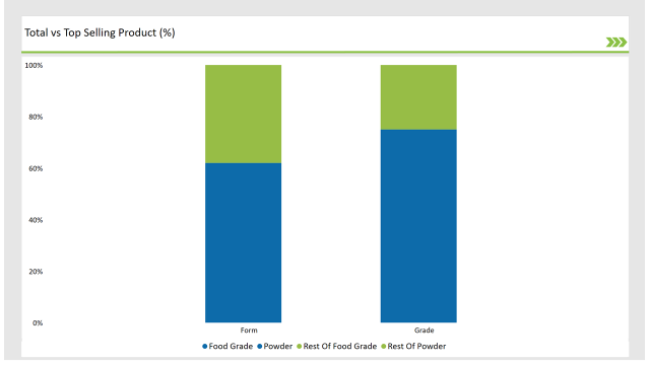

The case of food-grade yeast extract is the most popular segment in the ASEAN market due to the ever-increasing need for natural and clean-label components in food and beverage products. Food-grade yeast extract can be found a lot in it as it is commonly used in ready-made meals such as soups, sauces, and canned goods, where it functions as a natural flavor enhancer.

The fact that it can impart a rich flavor that is very similar to the umami taste helped it become a necessary component of a lot of food applications, particularly when people are starting to find substitutes for chemical additives.

While the increasing popularity of plant-based diets drives the demand for food-grade yeast extract, it is also used in conjunction with yeast extract as a source of protein and other essential nutrients. Furthermore, it is very often found in plant-based meat substitutes, dairy-free products, and functional beverages, where it contributes both flavor and nutritional value. The clean-label movement has also been a big factor in the promotion of food-grade yeast extract, as it is the choice of the consumer for simple and natural ingredients.

In the ASEAN market, powdered yeast extract has been among the most sought-after yeast extract choices. Generally utilized in food, beverage, and animal feed applications, this yeast variety is a top-selling product. Manufacturers of food prefer this powdered form due to its long shelf life, ease of use, and the straightforward way to incorporate it into various formulations. Powdered yeast extract is included in diverse food products such as soups, sauces, canned meat, dairy products, and chips being the usual flavoring and nutritional supplement.

The powder form was popular among customers who were demanding the convenience of the use of versatile product formulations. It can be simply mixed into liquids, added to dry ingredients, or incorporated into blends for applications in ready-to-eat meals, seasonings, and dietary supplements. Besides that, powdered yeast extract has been widely used in animal feed as an anti-microbial to enhance gut health, improve growth, and support immune system function in livestock.

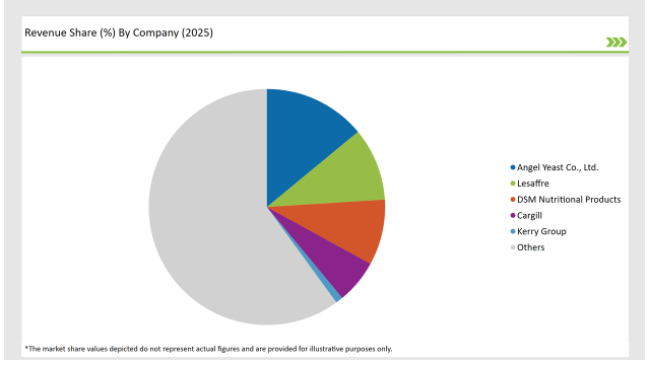

The ASEAN yeast extract market is a bust with both local and global participants engaged in a battle for the market share. The largest companies are DSM Nutritional Products, Lesaffre, Cargill, and Angel Yeast all of which are suppliers in the region proving the strength of the company.

By using their advanced R&D facilities, they are the ones who introduce the new yeast extract products in the market that are mainly the response to the natural clean label ingredient movement. Their concern about the quality of the product, the environment, and getting necessary certifications such as organic and non-GMO has all helped them to be in a stable position in the market.

ASEAN states also have local manufacturers who are contributing more and more to the market and the majority of them are yeast extract solutions producers which are specifically designed for client needs in the region. Many of these local producers are focusing on providing yeast extract products that are cost-effective and at the same time meet the requirements of SMEs (small and medium-sized enterprises) in the food industry.

By Type: Autolyzed Yeast Extract, Hydrolyzed Yeast Extract

By Grade: Food Grade and Feed Grade

By Form: Powder, Liquid, Paste, and Flakes

Food & Beverages, Animal Feed, Cosmetics & Personal Care, Pharmaceuticals, and Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Yeast Extract market is projected to grow at a CAGR of 7.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 829.5 million.

India are key Country with high consumption rates in the ASEAN Yeast Extract market.

Leading manufacturers include Angel Yeast Co., Ltd., Lesaffre, DSM Nutritional Products, and Cargill are the key players in the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA