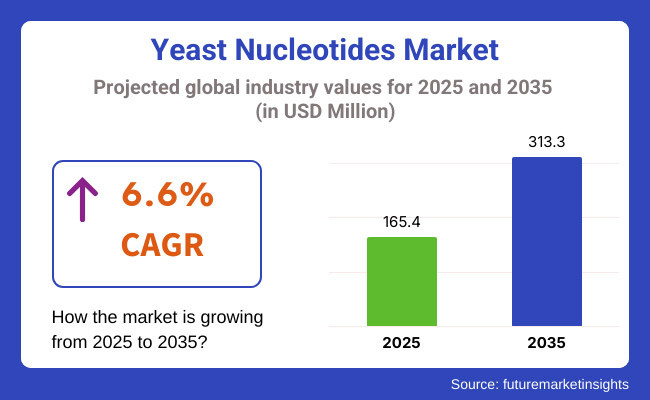

World consumption of yeast nucleotides in 2023 was USD 146.7 million. Yeast nucleotides revenue grew at a 12.7% year-over-year pace in 2024, and therefore it would make sense that the world market for yeast nucleotides in 2025 would be USD 165.4 million. World revenue between 2025 to 2035 will increase with a CAGR of 6.6% and will be worth a market value of USD 313.3 million in 2035.

Yeast nucleotides are applied in the food, animal feed, and pharmaceutical industries due to the fact that they are more nutritious. With extremely high concentrations of essential nucleotides, they are the cause of triggering cell division and growth in the animal and human body. In the food and beverages industry, yeast nucleotides are applied on a wide scale to impart the umami flavor, as flavor enhancers, and to formulate the flavor of processed foods.

Animal feed yeast nucleotides are also growing as these can improve the health and immunity of the cattle, and thus the increase in productivity and efficiency. Poultry and meat demand is growing across the world, and thus there is the need for such a product, yeast nucleotides used in animal nutrition and health improvement.

Growing requirements on the consumers' side for health and well-being are leading the food industry to seek yeast nucleotides as an attempt at nutritionally enriching food. Yeast nucleotides are a healthy commodity in the sense that they serve as the foundation of well-being, possess immunocompetence at optimal level, and hasten energy metabolism.

As much as the consumer needs more functionally valuable food with progressively higher quality in terms of health, yeast nucleotides will soon be among the finest ingredients available. The change towards sustainable processes is also influencing the yeast nucleotides market.

The ingredients of yeast nature are biodegradable in nature and naturally occurring and hence nature-friendly in nature compared to the synthetic ones. Although demand for natural, clean-label ingredients has increased, even the yeast nucleotides are gaining popularity even though they are highly sustainable in nature.

Following is comparative six-month CAGR difference between base year (2024) and target year (2025) of global yeast nucleotides market. Study is noted to indicate productive variation in performance and to express trends in attaining revenues, and thereby meaningfully illustrating snapshot to stakeholders of trend of growth for period. First half-year, or H1, is January to June. Second half, H2, is July to December.

| Particular | Value CAGR |

|---|---|

| H1( 2024 to 2034) | 6.1% |

| H2 (2024 to 2034) | 6.3% |

| H1( 2025 to 2035) | 6.4% |

| H2 (2025 to 2035) | 6.6% |

The company's growth rate will be 6.4% of CAGR for the first-half period H1 of 2025 to 2035 and the second half period H2, and it will grow at a rate of 6.6%. To the next five years, H1 2025 to H2 2035, CAGR is anticipated to jump to 6.4% in the first half and remain unusually high at 6.6% in the second half. Industry registered 30 BPS growth in the first half (H1) while the company registered incremental growth of 20 BPS in the second half (H2).

Yeast nucleotides market is growing day by day in terms of the growing consumer requirement for natural functionality food ingredients in order to keep healthy, together with to gain better flavor. With more diversified uses for the ingredient being observed across the entire food, drink, animal feeding stuffs, and drug markets, yeast nucleotides are emerging as one of the priority list best sellers globally

Multinational Companies - They are international giants with the best R&D facilities, incredibly vast production capacity, and with operations at the global level. They are distributing bulk food, drug, and feed makers worldwide.

Angel Yeast Co., Ltd. (China, International), Angel Yeast is a well-known company globally that manufactures yeast products with international business operations that can produce high-quality yeast nucleotides for use in infant formula, functional food, and animal nutrition.

It is the global market leader as a more R&D- and innovation-savvy company of yeast extraction technology. Lesaffre Group (France), as a global yeast and fermentation technology industry leader, Lesaffre manufactures nutritional yeast extracts.

Regional Leaders - They are operating with geographic regions under review, food, pharma, and animal nutrition companies. Cost cutting, regional management, and product concentration are their approaches. Ohly GmbH (Germany), A European excellence yeast ingredient company, Ohly is supplying infant nutrition, functional foods, and pharma companies nucleotides.

GMP-controlled and compliant high-quality fermentation is the company's major focus area, mainly in Europe. Kerry Group (Ireland), Kerry Group is involved in the manufacture of yeast extracts such as nucleotides as functional food ingredients and healthy product ingredients. Manufacturing methods to manufacture taste and nutrition solutions for business make it one of the leading functional food and feed manufacturers.

Chinese Dominant Players - Low-cost manufacturing, large-volume supply, and export-growth are led by China's role in yeast nucleotide manufacture as corporate objectives. Zhuhai Yitong Industrial Co., Ltd. (China), with biotechnology-associated yeast extraction, Zhuhai Yitong supplies nucleotides in the form of animal nutrition and food.

The organization supplies primarily the global market with competitive prices. Lallemand China (China, Global Operations), Part of Lallemand Inc.'s subsidiary company, the group is a world-known producer of yeast-based products such as nucleotides for global food, feed, and health industries. The company has a background in quality control as well as fermentation technology research.

Increasing Use of Yeast Nucleotides in Infant Nutrition

Shift: Increasing numbers of yeast nucleotides are being incorporated in infant nutrition companies' products as a means of mimicking the chemical structure of human milk because nucleotides play a key role in both immune function and intestinal development.

Evidence indicates that naturally occurring nucleotides present in breast milk are implicated in intestinal development, brain function, and immunity. There is a growing global need for bioactive components such as yeast nucleotides in infant foods. North American and European parents want formulae with addition levels of immune-stimulating components, thus urging the addition of functional components in infant food.

Strategic Response: Market leaders among infant formula companies are Nestlé (Gerber), Danone Nutricia, and Mead Johnson (Reckitt Benckiser), which have changed their infant formulae to contain yeast-derived nucleotides. Nestlé Gerber Good Start introduced nucleotides derived from yeast in its high-end line of formulas, driving 14% market share increase in 2023.

Danone Aptamil Gold+ in the EU emphasized nucleotides for best gut health, driving 9% sales gain among health-concerned parents. Feihe Dairy in China introduced a nucleotide-enriched formula based on infant immunity, driving 16% growth among first-time buyers in 2023.

Increasing Application in Sports and Functional Nutrition

Shift: While sports nutrition companies concentrate on muscle recovery, endurance, and digestion, yeast nucleotides are more in demand as a natural bioactive. Nucleotides have been found to stimulate muscle recovery and immune functions and are hence of interest to athletes and bodybuilders. Although demand for available recovery agents is growing within the global market for sports nutrition, especially among endurance sport athletes and bodybuilders, application of yeast nucleotides is more being realized.

Strategic Response: Glanbia Performance Nutrition (Optimum Nutrition) and MuscleTech introduced yeast nucleotides into post-workout recovery products, achieving 12% higher customer retention with high-level athletes.

MyProtein's PRO Series introduced nucleotide-enhanced protein shakes and saw European sales rise by 9% in 2023. Dymatize Nutrition in Asia introduced a nucleotide-enhanced amino acid supplement, enabling it to achieve a 15% purchase increase among endurance athletes.

Increasing Utilization in Pet Food for Immune Function

Shift: Pet owners look for immune-strengthening food items in pet foods, and nucleotides feature prominently in the list of resistance to diseases as well as the health of the gut. Based on scientific findings, animals get a boost from nucleotide supplements in antibody levels and in rendering them infection resistant. The worldwide pet food industry is set to increase its activities with functional as well as immune-strengthening ingredients taking center stage.

Strategic Response: Major pet food companies such as Hill's Science Diet, Purina Pro Plan, and Royal Canin launched yeast nucleotides in specialty-formula pet food. Purina boosted sales by 13% on marketing FortiFlora, a probiotic supplement to immune system fortification nucleotide.

Royal Canin launched a nucleotide-enriched vet-formulated diet product, whose vet-recommended sales improved by 20%. Hill's Pet Nutrition, meanwhile, launched a gut-health-based kibble containing nucleotides, increasing its market share by 11% in premium pet food segments.

Growing Demand for Functional Beverages for Brain and Gut Health

Shift: The consumer is seeking more functional drinks with brain and gut benefits, and this has driven demand for yeast nucleotides. It has been proven through research that nucleotides support gut microbiome balance and increase neurotransmitter production, making them ideal for drinks that focus on cognitive health. The global market for functional drinks is expanding strongly with the addition of bioactive ingredients.

Strategic Response: Functional beverage brands such as Health-Ade Kombucha and Olipop are testing nucleotide-fortified gut health beverages, which has driven 8% repeat purchase growth. Kirin Beverage, Japan, introduced a nucleotide-fortified clarity of mind beverage, which drove first-time sales by 14%. PepsiCo's LIFEWTR+ brand is testing nucleotide-fortified hydration beverages to reach cognitive function and gut health-focused consumers.

Greater Application in Pharmaceutical and Medical Nutrition

Shift: Yeast nucleotides are being used more and more by the pharmaceutical and medical nutrition sectors in immune-support nutriceuticals, digestive health treatments, and surgical recovery supplements. Nucleotides stimulate tissue repair and immune modulation and therefore are clinically relevant immediately, studies show.

Strategic Response: Nutrition health companies such as Abbott (Ensure), Nestlé Health Science, and Fresenius Kabi have launched yeast nucleotide-enriched products for immunocompromised patients. Nestlé's Boost+ for postoperative recovery achieved 9% hospital recommendation boost.

Abbott's Ensure Clinical+ contained nucleotides for tissue repair, achieving 12% senior patient adoption boost. In the meantime, Fresenius Kabi also released a nucleotide-enriched tube-feeding formula, achieving 10% additional medical facility buys in Europe.

Increasing Application of Yeast Nucleotides as an Alternative to Protein Structure

Shift: As the alternative protein and plant-based foods market continues to grow, yeast nucleotides are increasingly being used as a flavoring and nutritional supplement. Nucleotides are responsible for the creation of umami-flavored, meaty tastes in plant-based meat alternatives, imparting sensory characteristics without additives. As the global plant-based meat manufacturers look to incorporate natural ingredients that enhance taste, nutrition, and texture, yeast nucleotides are increasingly taking center stage in alternative protein manufacturing.

Strategic Response: Beyond Meat and Impossible Foods initiated researching yeast-based nucleotide options for optimizing umami flavor strength in plant meat substitutes and achieved a 7% increase in taste test consumer acceptability scores.

Motif FoodWorks, a food technology company, introduced nucleotide-enriched plant protein blends, achieving a 12% adoption rate of higher-tier plant-based food products. Nestlé Garden Gourmet employed yeast nucleotides in its latest range of plant-based burgers and observed a 9% uplift in repeat purchase in Europe.

Rising Demand for Yeast Nucleotides in Senior Nutrition

Shift: As the world is going through an unprecedented boom in aging populations, elder nutrition is also going through a massive boom in demand for nutrients that contribute to immune function, brain function, and gut health. Nucleotides have been found to aid cell regeneration, energy metabolism, and maintenance of gut microbiota and are hence the focal point of medical and functional senior nutrition

Strategic Response: Abbott Nutrition's Ensure Gold+ and Nestlé's Resource SeniorActiv both introduced yeast nucleotides to support cognitive performance and immune resilience, stimulating a 10% increase in sales of senior-specific supplements. Danone's Fortisip medical nutrition line contained nucleotides in protein-fortified beverages, stimulating an 8% increase in healthcare professional recommendation. Yili Group in China introduced nucleotide-enriched milk formula for the elderly and experienced a 14% increase in uptake among the elderly.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of yeast nucleotides through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 6.2% |

| Germany | 4.7% |

| China | 7.9% |

| Japan | 5.3% |

| India | 8.5% |

In particular the growing demand for functional foods, dietary supplements and infant nutrition are all contributing to the growth of the USA yeast nucleotides market. Yeast nucleotides are rising to prominence as health awareness grows around gut health, immune support and brain function and see usages across fortified dairy, sports nutrition and probiotics. Furthermore, growth of sustainable and fermentation based food ingredients is acting as a catalyst to demand seeking for high purity yeast nucleotide formulations.

Germany Yeast Nucleotides market is anticipated to grow due to food safety regulations in the European region and demand for yeast-based nutraceuticals. Yeast nucleotides are included at recent in functional beverages, dietary supplements and infant formula with the implementation of plant-based, non-GMO, and bioactive ingredients. German manufacturers are focused on fermentation-based nucleotide production due to government support in developing sustainable food production and biotechnological applications.

The yeast nucleotides market in China is seeing significant growth owing to increasing demand from premium infant formula, animal feed additives, and pharmaceutical applications. Competitively, as government policies emphasize early-life nutrition and gut health, domestic manufacturers are expanding yeast nucleotide capacity for use in fortification of baby formula and probiotics. As the livestock production, companion animal and aquaculture industries continue to grow, use of yeast nucleotides as an ingredient in functional animal feed is on the rise to promote growth and immunity.

Japan’s yeast nucleotides sector leverages the nation’s established strength in fermentation-derived functional materials, gut health and longevity-oriented nutrition, he said. Japanese consumers have a research-based preference for functional foods, driving growth in nucleotide-rich probiotics, dietary supplements, and anti-aging formulations. Moreover, advances in biotechnology and enzymatic processing have resulted in high-purity yeast nucleotide extracts for pharmaceuticals and specialty health foods in Japan.

The rising consumer demand for protein-rich food products, functional nutrition and high-performing animal feed is spurring growth of yeast nucleotides market in India. Yeast-based immune stimulators, probiotics, and nutrient-enriched food formulations are in demand.

Government-backed initiatives that promote sustainable animal nutrition and bio-based food additives have resulted in manufacturers investing significantly in cost and environmentally friendly, high-purity yeast nucleotide production.

| Segment | Value Share (2025) |

|---|---|

| Functional Food & Nutraceuticals (By Application) | 68.4% |

Based on application, the functional food and nutraceuticals segment leads in terms of value share and it is expected to remain the highest contributor to the global yeast nucleotides market with a value share of 68.4% in 2025. This rise in growth is primarily due to the growing consumer preference for gut health, immune support, and cognitive enhancement, thereby increasing the demand for yeast nucleotides in probiotics formulations, sports nutrition, and infant formula.

As bioactive ingredients and fortified food products gain traction among consumers, manufacturers are prioritizing yeast nucleotides that are non-GMO and derived from fermentation to target premium nutrition segments. Vital nucleotides for cell repair, metabolic function and microbiome balance bioactivity make them a critical ingredient in many high performance dietary supplements and functional beverages.

With more scientific studies laying emphasis on the benefits of yeast-derived nucleotides towards digestion, immune modulation, and cognition, longer term, the focus may shift to premium nutrition products, elderly wellness, and pediatric formulations. The product segment is also witnessing an adverse race growth due to the growing demand for natural, clean-label, and bioavailable nutrient solutions.

| Segment | Value Share (2025) |

|---|---|

| Animal Feed & Pet Nutrition (By Application) | 31.6% |

By nutrients, the animal feed & livestock nutrition segment is expected to maintain a value share of 31.6% during 2025 end, due to rising demand for immune boosting feed additives and gut health promoters. In livestock, aquaculture, and companion animal feed, yeast nucleotides are widely used as feed additives to promote intestinal development, immune modulation, and animal performance.

As the world moves towards antibiotic-free animal nutrition, the demand for natural and fermentation-derived yeast nucleotides has increased significantly. All these bioactive compounds promote digestive health, minimize stressful reactions, and bolster disease resistance, and have thus become indispensable elements of functional feed formulations that are used in the farming of poultry, swine, cattle, and fish.

With increasing scientific research demonstrating the beneficial role yeast nucleotides play in achieving a balanced gut microbiome, optimum nutrient absorption and immune protection, feed manufacturers are prioritizing non-GMO, highly bioavailable yeast co-products. I believe that growth in this segment should continue to accelerate and be driven by the expansion of sustainable and performance-enhancing animal feed solutions.

The market for yeast nucleotides is fragmented, with several prominent competitors concentrating on fermentation-based manufacturing, sustainable ingredient sourcing, and widening functional applications. Diverse companies are pouring in resources towards high-purity yeast nucleotide extraction, biotech research, and tailor-made formulations.

Leading firms in the sector include Angel Yeast, Lesaffre, Lallemand, Ohly, and Kerry Group that produce yeast-derived bioactives, functional food constituents, and synergistic animal feed additives. The increased demand for yeast nucleotides for dietary and pharmaceutical uses have resulted in the expansion of several companies in the Asia-Pacific and European regions.

Important strategies consist of partnerships with health and wellness brands, investment in nucleotide extraction using biotechnology methods and getting more fermented food ingredients into the market to enhance digestive health. Moreover, the specialty nutrition sub-category prioritizes precision fermentation and bioengineered nucleotide solutions by manufacturers.

For instance

The market offers a diverse range of yeast-based products, including Yeast Autolysate, Yeast β-glucan, Yeast Mannan Oligosaccharide (MOS), Baker’s Yeast, Torula Yeast, Brewer’s Yeast, and Nutritional Yeast, catering to various industrial and consumer needs.

Yeast products are available in different categories based on their production methods, including Organic, Non-GMO, and Conventional varieties, ensuring options for health-conscious and sustainability-focused consumers.

These yeast products are available in multiple forms, including Powder and Liquid, allowing for versatile applications across different industries.

Yeast-based products serve a wide range of industries, including Food, Beverages, Dietary Supplements, Pharmaceuticals, and Animal Feed & Pet Food. Additionally, they find use in other specialized applications.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global yeast nucleotides industry is projected to reach USD 165.4 million in 2025.

Key players include Lessafre Group; Angel Yeast; Alltech; AB Mauri; The Archer Daniels Midland Company; Chr. Hansen A/S.

Asia-Pacific is expected to dominate due to high demand for functional foods, pharmaceuticals, and sustainable feed additives.

The industry is forecasted to grow at a CAGR of 6.6% from 2025 to 2035.

Key drivers include rising demand for gut health solutions, increasing applications in infant nutrition and animal feed, and advancements in fermentation-based bioactive ingredient production.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 17: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 27: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 37: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: East Asia Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 47: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 48: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 49: East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 51: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: South Asia Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 57: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 58: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 59: South Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 60: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 61: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 65: Oceania Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 67: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 68: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 69: Oceania Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 70: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 71: Middle East & Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 72: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East & Africa Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East & Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 75: Middle East & Africa Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 76: Middle East & Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 77: Middle East & Africa Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 78: Middle East & Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 79: Middle East & Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 80: Middle East & Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 14: Global Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 23: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Nature, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ million) by Nature, 2023 to 2033

Figure 33: North America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 44: North America Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Nature, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) by Nature, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 74: Latin America Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ million) by Nature, 2023 to 2033

Figure 92: Europe Market Value (US$ million) by Product Type, 2023 to 2033

Figure 93: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 94: Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Europe Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 118: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 122: East Asia Market Value (US$ million) by Nature, 2023 to 2033

Figure 123: East Asia Market Value (US$ million) by Product Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 124: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 125: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 131: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 133: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 134: East Asia Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 135: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 139: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 143: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ million) by Nature, 2023 to 2033

Figure 152: South Asia Market Value (US$ million) by Product Type, 2023 to 2033

Figure 153: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 154: South Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 155: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 161: South Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 164: South Asia Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 169: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 180: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 181: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 182: South Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 183: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 184: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 185: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 186: South Asia Market Attractiveness by Nature, 2023 to 2033

Figure 187: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 188: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 189: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ million) by Nature, 2023 to 2033

Figure 182: Oceania Market Value (US$ million) by Product Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 184: Oceania Market Value (US$ million) by Application, 2023 to 2033

Figure 185: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 191: Oceania Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 194: Oceania Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 195: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 199: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 202: Oceania Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 203: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Nature, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 220: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 221: Middle East & Africa Market Value (US$ million) by Nature, 2023 to 2033

Figure 222: Middle East & Africa Market Value (US$ million) by Product Type, 2023 to 2033

Figure 223: Middle East & Africa Market Value (US$ million) by Form, 2023 to 2033

Figure 224: Middle East & Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 225: Middle East & Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 226: Middle East & Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 227: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 228: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 229: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 230: Middle East & Africa Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 231: Middle East & Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 233: Middle East & Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 233: Middle East & Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 234: Middle East & Africa Market Value (US$ million) Analysis by Product Type, 2018 to 2033

Figure 235: Middle East & Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 236: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 237: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 238: Middle East & Africa Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 239: Middle East & Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 230: Middle East & Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 231: Middle East & Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 233: Middle East & Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 233: Middle East & Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 234: Middle East & Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East & Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East & Africa Market Attractiveness by Nature, 2023 to 2033

Figure 237: Middle East & Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East & Africa Market Attractiveness by Form, 2023 to 2033

Figure 239: Middle East & Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Yeast Infection Diagnostics Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Yeast Infection Treatment Market by Drug Type, Distribution Channel, End User, and Region, 2025 to 2035

Yeast Autolysates Market Outlook - Growth, Demand & Forecast 2024 to 2034

Yeast Flakes Market

UK Yeast Extract Market Report – Trends, Demand & Industry Forecast 2025–2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

GCC Yeast Market Trends – Growth, Demand & Forecast 2025–2035

USA Yeast Market Analysis – Size, Share & Forecast 2025-2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Yeast Extract Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA