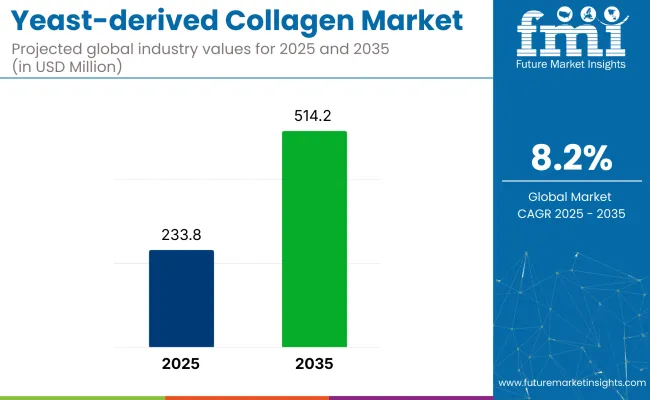

The yeast-derived collagen market is projected to grow from USD 233.8 million in 2025 to USD 514.2 million by 2035, expanding at a CAGR of 8.2%.

| Attribute | Value |

|---|---|

| Industry Value (2025) | USD 233.8 million |

| Industry Value (2035) | USD 514.2 million |

| CAGR (2025 to 2035) | 8.2% |

Demand is being shaped by a shift toward ethical, non-animal collagen alternatives across nutraceutical, cosmetic, and personal care applications. Known for its purity, compatibility, and bio activity, yeast-derived collagen is gaining traction for its benefits in skin elasticity, joint support, and digestive health.

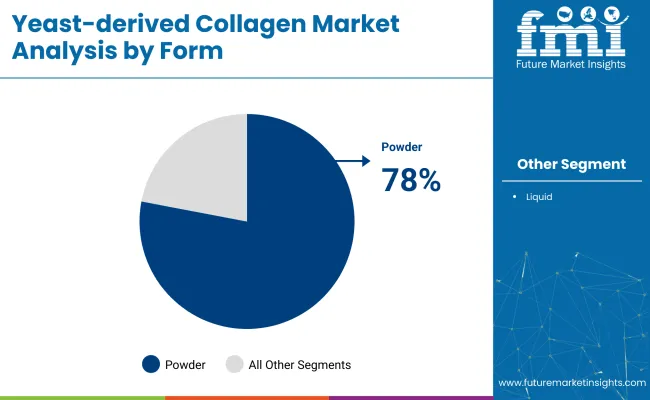

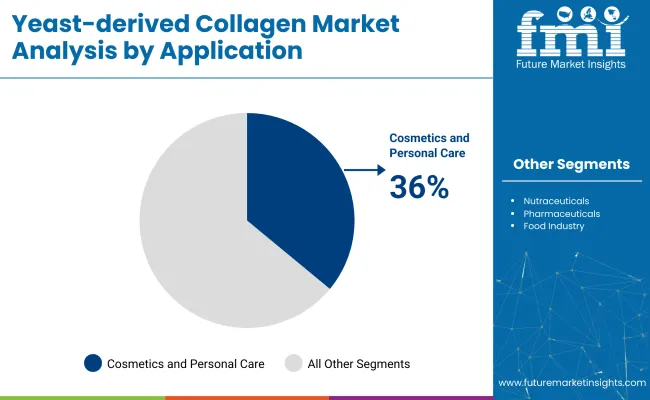

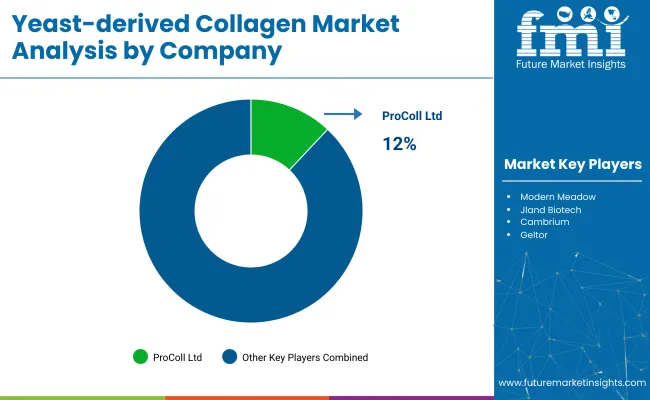

In 2025, powdered forms dominate with a 78% market share due to their ease of formulation. Cosmetics and personal care lead end-use demand with 36% share, while India stands out as the top growth market, advancing at 9.6% CAGR. Leading producers such as ProColl Ltd. hold a 12% share, focusing on bioengineered solutions to meet clean-label and cruelty-free consumer expectations.

Within its parent categories, yeast-derived collagen accounts for 3-4% of the cosmetics and personal care market, roughly 2% of the nutraceuticals segment, and 1.5-2% in biotechnology. Penetration in pharmaceuticals and food ingredients remains below 1%, though functional nutrition use is rising gradually. CEO Alex Lorestani of Geltor notes that its product PrimaColl-classified as Type 21 collagen-delivers high potency in smaller doses, giving it a cost-performance advantage over animal-based counterparts.

Strategic partnerships, such as the Evonik-Jland Biotech collaboration, are helping scale production and expand commercial use in anti-aging and hydrating skincare. This positions yeast-derived collagen as a key innovation across sustainable beauty and wellness platforms.

Alex Lorestani, CEO of Geltor, commented on the company’s yeast-derived offering PrimaColl, stating, “Customers love that it's a Type 21 collagen and therefore a concentrated bioactive, meaning the beneficial effects can be accessed by using less of it in a formulation than you would with an animal-derived collagen.”.

The global cosmetics industry has taken strategic steps to commercialize yeast-derived collagen, as demonstrated by Evonik’s partnership with Jland Biotech. Through this alliance, Evonik aims to supply vegan collagen in commercial volumes for cosmetic applications such as anti-aging and hydrating skincare products. With its compatibility across formulations and rising demand for cruelty-free wellness solutions, yeast-derived collagen is being positioned as a central innovation in the future of sustainable health and beauty markets.

Global demand for yeast-derived collagen is centered around segments offering plant-based alternatives in cosmetic and supplement applications. The industry is shaped by the popularity of Saccharomyces Cerevisiae, preference for powdered formats, and strong demand from cosmetic formulators targeting collagen-replacement skincare.

Saccharomyces cerevisiae is projected to lead with a 34% share of the yeast-derived collagen market in 2025. Its well-established role in fermentation, stable protein expression, and compatibility with commercial bioreactors make it the preferred strain for producers.

Firms like Geltor and Evonik use it to create bio-identical collagen suited for skincare, benefiting from smaller peptide chains that support better skin absorption. Its GRAS status across multiple markets also streamlines approvals for nutraceutical applications, helping shorten time-to-market for new product development.

Powdered yeast-derived collagen is expected to hold a dominant 78% market share in 2025. Its versatility across formats, extended shelf life, and cost-effective shipping make it ideal for use in cosmetics and dietary supplements.

Players like HumaColl21 and MycoTech supply freeze-dried powders for both contract manufacturing and branded applications, including sachets, creams, and capsules. Powdered forms also suit climate-sensitive regions, ensuring consistent quality in Asia and Africa while supporting private-label expansion in North America and Europe.

Cosmetics are expected to account for 36% of market revenue in 2025, driven by strong demand for cruelty-free and vegan alternatives in beauty care. Yeast-derived collagen is being used in anti-aging creams, serums, and masks that target ingredient transparency and clean-label claims.

Leading beauty companies like L’Oréal and Beiersdorf are integrating microbial collagen into their skincare innovation pipelines to phase out animal-based inputs. Products aimed at the 25-40 demographic increasingly rely on yeast-sourced collagen to anchor "clean beauty" positioning.

Yeast-derived collagen’s market share rose from 8.1% in 2022 to 12.4% in 2025, driven by cosmetics and supplement demand. Production costs exceed animal-derived collagen by 28-35%, while regulatory restrictions and concentrated patent ownership limit wider adoption and industry entry, mainly outside North America and Europe.

Recent Trends in the Yeast-derived Collagen Market

Between 2023 and 2025, yeast-derived collagen expanded its share in the alternative collagen segment from 8.1% to 12.4%. Powder-based formats reached 78% of global product volume, favored by manufacturers for their compatibility with existing supplement delivery systems.

Demand from cosmetics applications accounted for 36% of overall usage in 2025, driven by interest in plant-origin peptides for topical formulations. Products developed using Saccharomyces cerevisiae comprised 34% of global supply, due to its consistent yield in fermentation cycles. Online collagen offerings containing yeast-derived variants recorded a 31.2% increase in SKUs, led by skincare and joint health categories.

Top Yeast-derived Collagen Market Challenge

Cost efficiency remains a constraint, with yeast-derived collagen production priced 28-35% above bovine equivalents due to upstream fermentation scale and downstream protein purification. Regulatory frameworks in markets such as the EU and Japan restrict collagen labeling for non-animal sources, limiting retail flexibility.

Over 60% of related patents are held by a small cluster of firms, raising entry barriers for new players. Access to bioreactors and purification infrastructure is concentrated in North America and Western Europe, limiting production growth in other regions and constraining supply-chain expansion beyond niche or premium-priced segments.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

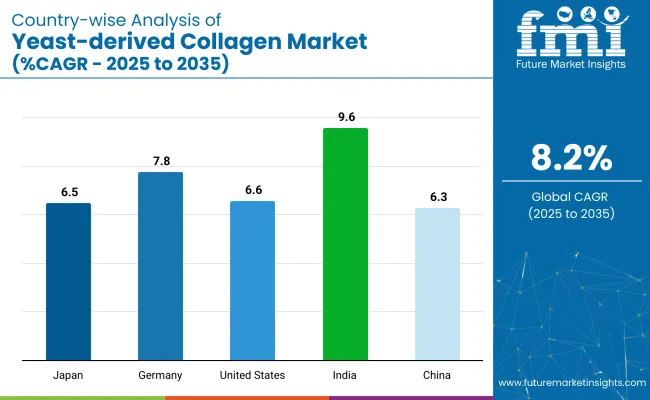

| Countries | CAGR Forecast (2025 to 2035) |

|---|---|

| India | 9.6% |

| Germany | 7.8% |

| United States | 6.6% |

| Japan | 6.5% |

| China | 6.3% |

The global yeast-derived collagen market is set to expand at an 8.2% CAGR between 2025 and 2035. Among the five key markets analyzed from a total of 40, India stands out with the highest growth rate at 9.6%, followed by Germany at 7.8%. The United States, Japan, and China show moderate increases with CAGRs of 6.6%, 6.5%, and 6.3%, respectively.

Compared to the overall average, India exceeds growth expectations by 17%, while Germany, the USA, Japan, and China fall behind by 5% to 23%. This variation stems from India’s rapidly growing biotech industry, Germany’s strong production infrastructure, and steady market demand in the other countries as they adapt to evolving consumer preferences.

India is projected to register the highest CAGR of 9.6% through 2035, with increasing uptake across nutricosmetics, joint health supplements, and functional powders. Between 2023 and 2025, the share of yeast-derived collagen in the ingestible beauty segment grew from 3.1% to 7.4%, driven by D2C brands and Ayurveda-integrated offerings. Market participation expanded across 11 metro clusters, with sachet-based formats priced below ₹60 contributing to over 48% of sales volume in 2024.

China’s yeast collagen market is forecast to grow at a CAGR of 6.3% from 2025 to 2035. Functional nutrition products using yeast peptides expanded their category share from 5.8% to 10.6% between 2023 and 2025.

As marine collagen saw a 19% drop in usage due to consumer allergy concerns, yeast-based formats gained traction, particularly in ready-to-consume formats such as gummies and jellies. Zhejiang and Guangdong provinces accounted for 68% of production output in 2024.

The industry is set to grow at a CAGR of 6.6% through 2035. Between 2020 and 2024, yeast collagen’s share in vegan collagen supplements rose from 4.2% to 9.1%, driven by athlete-focused formulations and skin health verticals.

California, Oregon, and Colorado host over 65% of yeast collagen biotech fermentation facilities in the USA Average retail pricing of yeast-based collagen fell by 18.4% during 2023, attributed to economies of scale and fermentation tech adoption.

Japan’s yeast-derived collagen market is projected to grow at 6.5% CAGR from 2025 to 2035. In 2025, 41% of collagen supplements sold in urban pharmacies contained non-animal peptides, up from 27% in 2024.

Product development focused on palatable, low-odor, quick-absorption formats has shortened time-to-consumption across age groups. Yeast peptide jelly sticks and sachets contributed to 53% of all new collagen launches in the past two years.

Germany’s yeast collagen industry is likely to reach at a CAGR of 7.8% through 2035. In 2024, dermatology-focused formulations contributed to 44% of yeast collagen consumption, with the remainder distributed between beverage, snack, and pharma-grade formats.

Germany accounted for 28% of Europe’s yeast collagen production capacity as of Q1 2025. Large pharmacy chains and specialty retailers reported a 3.4× increase in collagen-linked basket value compared to 2025.

ProColl Ltd., Modern Meadow, and Geltor lead the yeast-derived collagen market with distinct product strategies and R&D pipelines. Geltor has developed designer collagen tailored for cosmetics and personal care, while Modern Meadow leverages biofabrication to develop protein materials for skin applications.

Cambrium and Jland Biotech are expanding their reach by investing in formulation partnerships and exploring alternative collagen structures to differentiate their offerings. The space remains moderately consolidated, with a few specialized players driving most of the commercial progress. High R&D costs, IP concentration, and regulatory complexities act as entry barriers for new entrants.

Recent Yeast-derived Collagen Industry News

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 233.8 million |

| Projected Market Size (2035) | USD 514.2 million |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Segments by Source | Saccharomyces Cerevisiae, Candida Utilis, Pichia Pastoris, Others |

| Segments by Form | Powder, Liquid |

| Segments by Application | Cosmetics & Personal Care, Nutraceuticals, Pharmaceuticals, Food Industry |

| Regions Covered | North America, Latin America, East Asia, South Asia, Europe, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, United Kingdom, Germany, France, Italy, China, Japan, South Korea, India, Indonesia, UAE, Saudi Arabia, South Africa |

| Key Manufacturers | ProColl Ltd., Modern Meadow, Jland Biotech, Cambrium, Geltor |

| Additional Attributes | Dollar sales, share by application and source, rising demand for animal-free ingredients in skin care and wellness, expanding nutraceutical formulation base, country-specific regulatory drivers and labeling norms |

The industry has been categorized into Saccharomyces Cerevisiae, Candida Utilis, Pichia Pastoris, Others

As per Form, the industry has been categorized into Powder, Liquid

As per Application, the industry has been categorized into Cosmetics and Personal Care, Nutraceuticals, Pharmaceuticals, Food Industry

Industry analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia Europe and Middle East & Africa.

The market is expected to reach USD 514.2 million by 2035.

The industry is projected to grow at a CAGR of 8.2%.

Powder form dominates with a 78% industry share in 2025.

Saccharomyces cerevisiae leads with a 34% share.

India is expected to grow at the highest CAGR of 9.6%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Collagen Supplement Market Size and Share Forecast Outlook 2025 to 2035

Collagen Water Market Forecast and Outlook 2025 to 2035

Collagen Skin Matrix Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Collagen Market Size and Share Forecast Outlook 2025 to 2035

Collagen Peptide Market Analysis - Size, Growth, and Forecast 2025 to 2035

Collagen Drinks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Collagen Casings Industry

Collagen Derivatives Market Analysis by Source, Dosage Form and Application Through 2035

Market Share Insights for Collagen Peptide Providers

Collagen Gummy Market Analysis by Flavor Type, Source, Functionality, Sales Channel and Region through 2035

Collagen Casings Market Analysis - Product Type & End Use Trends

Collagen Hydrolysates Market Analysis - Size, Share, and Forecast 2024 to 2034

UK Collagen Peptide Market Analysis – Size, Share & Forecast 2025–2035

UK Collagen Casings Market Insights – Demand, Size & Industry Trends 2025–2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pro Collagen Ingredient Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

USA Collagen Casings Market Analysis – Size, Share & Forecast 2025–2035

Atelocollagen Market Forecast and Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA