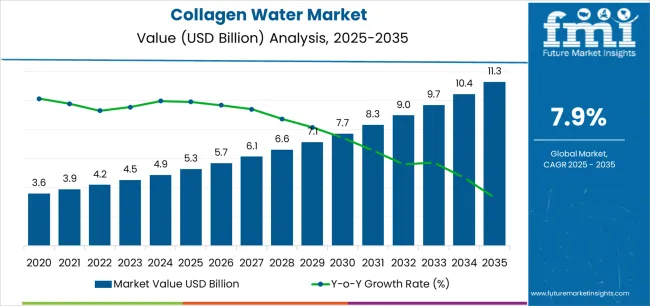

The Collagen Water Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 11.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

The Collagen Water market is experiencing steady growth, driven by the increasing consumer focus on health, wellness, and beauty-oriented beverages. Rising awareness regarding the benefits of collagen for skin, hair, nails, and joint health is supporting widespread adoption of collagen-infused drinks. The market is being further fueled by advancements in formulation technologies that enhance the bioavailability and taste of collagen water, making it more appealing to a broader demographic.

Growing demand from the cosmetics and personal care industry as an ingestible beauty solution has reinforced the market’s expansion, creating opportunities for product differentiation and premiumization. Urban populations with disposable income and a preference for functional beverages are increasingly seeking convenient formats like bottled drinks.

Regulatory support and standardization in labeling and ingredient safety have increased consumer confidence As health-conscious lifestyles continue to rise and interest in preventative wellness solutions grows globally, collagen water is expected to maintain sustained demand, with innovations in sourcing, flavor, and functional benefits driving continued growth in both established and emerging markets.

| Metric | Value |

|---|---|

| Collagen Water Market Estimated Value in (2025 E) | USD 5.3 billion |

| Collagen Water Market Forecast Value in (2035 F) | USD 11.3 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

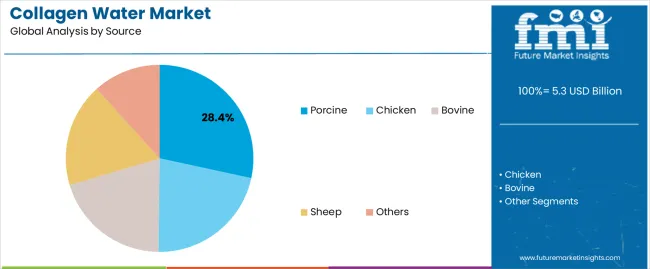

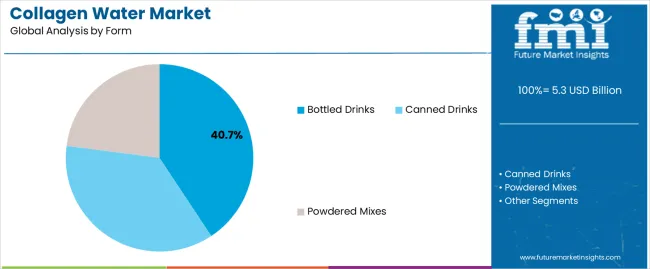

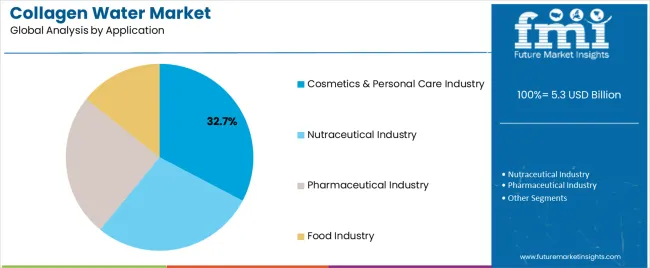

The market is segmented by Source, Form, Application, and Sales Channel and region. By Source, the market is divided into Porcine, Chicken, Bovine, Sheep, and Others. In terms of Form, the market is classified into Bottled Drinks, Canned Drinks, and Powdered Mixes. Based on Application, the market is segmented into Cosmetics & Personal Care Industry, Nutraceutical Industry, Pharmaceutical Industry, and Food Industry. By Sales Channel, the market is divided into Specialty Stores, Drug Stores, Online Retail Stores, Modern Trade, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The porcine source segment is projected to hold 28.4% of the Collagen Water market revenue in 2025, establishing it as the leading source type. Growth in this segment is being driven by the high availability and cost-effectiveness of porcine collagen, which provides superior functional properties such as solubility and bioavailability in beverages. Manufacturers are leveraging porcine collagen for its consistent quality and performance, particularly in bottled drinks and health-focused formulations.

The ease of processing and compatibility with flavoring agents further enhance its adoption. Additionally, porcine collagen has been widely studied and recognized for its safety and effectiveness, which reinforces consumer trust and regulatory acceptance.

The ability to support large-scale production without compromising quality or nutritional benefits has contributed to its leading position As consumer demand for functional and beauty-oriented beverages continues to rise, the porcine source segment is expected to maintain its dominance, supported by technological advancements in extraction, purification, and integration into innovative beverage products.

The bottled drinks form segment is expected to account for 40.7% of the market revenue in 2025, making it the leading product form. Growth is being driven by consumer preference for convenient, ready-to-consume functional beverages that integrate collagen for wellness and beauty benefits. Bottled drinks allow for precise dosing of collagen and incorporation of additional functional ingredients such as vitamins, minerals, and plant extracts.

The format’s portability, shelf stability, and flavor customization enhance appeal across urban and health-conscious consumers. Strong retail and e-commerce distribution networks further support adoption.

Rising interest in preventative healthcare and daily nutritional supplementation has made bottled collagen beverages a popular choice for sustained consumption As awareness of the synergistic benefits of ingestible collagen and functional hydration increases, the bottled drinks segment is expected to retain its market leadership, reinforced by continuous innovation in flavor profiles, packaging design, and ingredient fortification.

The cosmetics and personal care industry application segment is projected to hold 32.7% of the market revenue in 2025, establishing it as the leading application. Growth in this segment is being driven by increasing consumer interest in beauty-from-within solutions that combine hydration with collagen supplementation to improve skin elasticity, hair strength, and nail health. Integration of collagen water into beauty routines has become an attractive value proposition for consumers seeking multifunctional wellness products.

Strong marketing campaigns emphasizing anti-aging and skin health benefits, coupled with endorsements from health and beauty influencers, have accelerated adoption. Regulatory approvals for safe consumption and scientifically backed efficacy further reinforce market confidence.

The ability to offer innovative, premium products that appeal to both health and beauty-conscious consumers is strengthening market share As the demand for ingestible beauty products continues to rise globally, the cosmetics and personal care industry segment is expected to remain a primary driver of growth, supported by ongoing product innovation, targeted marketing, and expanded distribution channels.

The historical figures suggest that the global collagen water market propelled at a CAGR of 7.6% from 2020 to 2025. The market size increased from USD 3.57 billion to USD 4.77 billion during this period.

The increased prevalence of diseases caused by sedentary and ill-structured lifestyles surged the demand for healthy food products. A surge was observed in the pharmaceutical and food industry for such products. As an integral component of these products, collagens pushed the market during the historical period.

The lack of protein content was observed to have spiked significantly. Hence, it was essential to fill this gap with the help of relevant products. Collagen water, fulfilling the demand, resolved the patients’ complaints of joint pains. Hence, this is another important market driver.

The forecasted period is concerned with the growing cosmetic and personal care industry. The growth of the sector surges the demand for moisturizer products. Collagen, being an excellent water binder, provides better semi-solid liquids. Hence, this is likely to drive the subject market.

| Historical CAGR from 2020 to 2025 | 7.6% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 8.3% |

Various regions actively contribute toward the development of the collagen water market. Asia-Pacific promises to be the highest-growing market in the forecasted period. Due to the emergence of new markets, new prospects for the subject market have become visible. This fuels its growth.

North America holds a significant market share, which fuels the growth of the subject market. Developed countries like Canada, the United States of America, etc. provide lucrative growth opportunities to the market. Apart from this, Europe also contributes substantially to the market progress.

Forecast CAGRs from 2025 to 2035

| Countries | Forecasted CAGR |

|---|---|

| Canada | 6.7% |

| France | 6.2% |

| Spain | 6.6% |

| China | 12.8% |

| India | 9.4% |

Based on the application, the cosmetic and personal care industry will secure the largest market in 2025, equalling 32.7%.

| Category | Application (Cosmetics & Personal Care Industry) |

|---|---|

| Market Share in 2025 | 32.7% |

| Market Segment Drivers |

Due to its great water-binding capacity, collagen often finds demand in preparing moisturizers, which is currently being surged., Rising skincare awareness is surging the skin care products, whose collagen is an integral part., Therefore, these factors drive the subject market segment, furling its substantial market share. |

Based on sales channels, specialty stores are estimated to secure the largest market share of 23.5% by 2025.

| Category | Sales Channel (Specialty Stores) |

|---|---|

| Market Share in 2025 | 23.5% |

| Market Segment Drivers | Due to different organizations' bolstered distribution channel network, efficient store supply of collagen water can be ensured., Apart from this, specialty stores have a better consumer reach, supporting efficient branding., Therefore, these factors drive the subject market’s sales channel segment, ensuring its significant market share. |

The global collagen water market is highly exploited, evident from its growing size. However, the presence of competitors in the competitive landscape creates a fierce competitive force.

The new entrant must innovate and develop its products to withstand the force. Moreover, it is crucial to emphasize marketing and branding strategies to gain a competitive edge.

Key marketers create a strong presence through their innovative products. Also, they use different strategies to expand in the market. Strategic collaborations, partnerships, mergers and acquisitions, global expansions, etc., are key strategic initiatives helping these businesses acquire a sustainable competitive edge.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 5.3 billion |

| Projected Market Valuation in 2035 | USD 11.3 billion |

| Value-based CAGR 2025 to 2035 | 7.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | By Source, By Form, Application, Sales Channel, Region |

| Key Countries Profiled |

The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

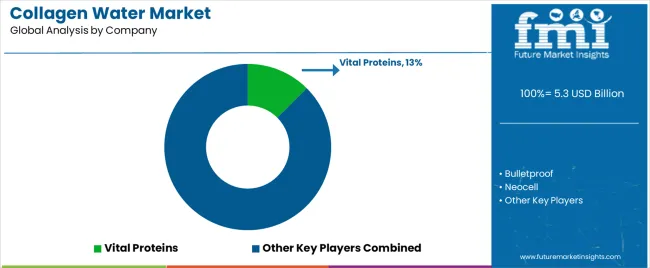

| Key Companies Profiled | Vital Proteins; Bulletproof; Neocell; Youtheory; Reserveage Nutrition; Health Logics; BioCell Technology; Great Lakes Gelatin Company; Zint; Ancient Nutrition; Applied Nutrition; BUBS Naturals; Primal Kitchen; Nordic Naturals; Collagen Matrix |

The global collagen water market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the collagen water market is projected to reach USD 11.3 billion by 2035.

The collagen water market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in collagen water market are porcine, chicken, bovine, sheep and others.

In terms of form, bottled drinks segment to command 40.7% share in the collagen water market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Collagen Skin Matrix Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Collagen Market Size and Share Forecast Outlook 2025 to 2035

Collagen Peptide Market Analysis - Size, Growth, and Forecast 2025 to 2035

Collagen Drinks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Collagen Casings Industry

Collagen Derivatives Market Analysis by Source, Dosage Form and Application Through 2035

Market Share Insights for Collagen Peptide Providers

Collagen Gummy Market Analysis by Flavor Type, Source, Functionality, Sales Channel and Region through 2035

Collagen Casings Market Analysis - Product Type & End Use Trends

Collagen Hydrolysates Market Analysis - Size, Share, and Forecast 2024 to 2034

Collagen Supplement Market Insights – Beauty & Wellness Boom 2024-2034

UK Collagen Peptide Market Analysis – Size, Share & Forecast 2025–2035

UK Collagen Casings Market Insights – Demand, Size & Industry Trends 2025–2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pro Collagen Ingredient Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

USA Collagen Casings Market Analysis – Size, Share & Forecast 2025–2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Peptides Market Analysis by Source, Application and Region Through 2035

Market Share Breakdown of Atelocollagen Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA