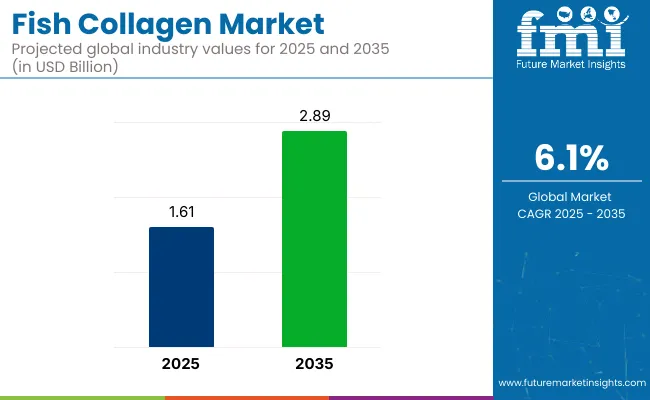

The fish collagen market is expected to grow from USD 1.61 billion in 2025 to USD 2.89 billion by 2035, growing at a CAGR of 6.1%.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.61 billion |

| Industry Forecast Value (2035) | USD 2.89 billion |

| Global CAGR (2025 to 2035) | 6.1% |

Extra capacity is being added with Rousselot’s South-American network now covering 46,000 t of gelatine and collagen a year, while Nitta Gelatin India will lift peptide output to 1,150 t by July 2025, easing supply gaps in ASEAN and BRICS regions.

NIQ flags collagen among the fastest-spreading functional beverage ingredients, with 258 new items launched last year, and notes collagen-infused pet treats rising in premium channels. Long-term contracts for cold-water skins and bones are advised to be secured to protect margins.

On May 12, 2025, Darling Ingredients announced a non-binding agreement with Tessenderlo Group to combine their collagen and gelatin segments into a new company called Nextida™. This joint venture aims to create a top-tier, collagen-based health, wellness, and nutrition products company, positioned to capitalize on global collagen growth. Pending regulatory approvals, Nextida will operate as a joint venture, with Darling Ingredients holding an 85% ownership stake and Tessenderlo Group holding the remaining 15%.

Fish collagen industry share has been distributed across its broader parent industries as follows. Within the global nutraceutical ingredients industry, marine collagen accounts for approximately 1.8-2.2%, owing to its inclusion in joint, bone, and skin health supplements. In the marine-based protein ingredients industry, its share stands at 6-8%, driven by rising demand for hydrolyzed peptides.

Across the functional food and beverage additives industry, it contributes about 1.5-2%, commonly found in fortified snacks, beverages, and protein blends. Within the cosmeceuticals and beauty-from-within ingredients industry, its presence is more pronounced at 8-10%, supported by ingestible skincare trends. In the pharmaceutical-grade bioactive compounds industry, marine collagen holds a modest 0.5-1% share due to regulatory hurdles and clinical evidence requirements.

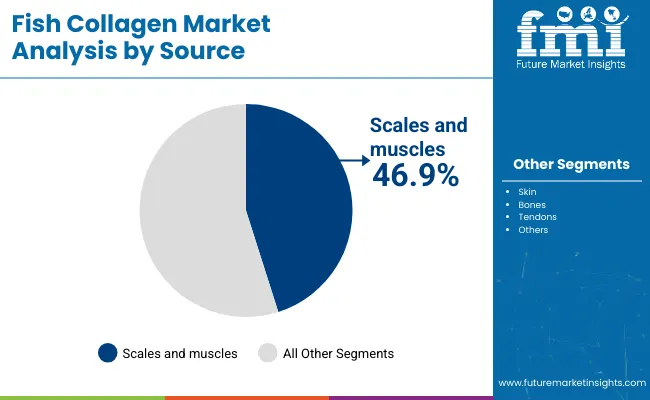

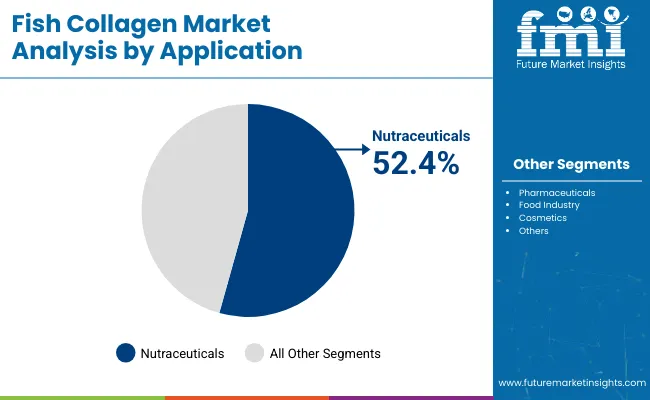

In the industry, scales and muscles lead the source segment with a 46.9% share. The nutraceuticals sector dominates the application segment at 52.4%, driven by demand for dietary supplements. The offline sales channel holds a 65% share, led by retail stores. The industry is expanding across North America, Latin America, Europe, Asia, and the Middle East & Africa.

In 2025, scales and muscles are projected to account for 46.9% of the market. These parts are rich in type I collagen, making them ideal for extraction in various applications such as skincare, joint health, and functional foods.

Their high bioavailability and effectiveness in promoting skin elasticity and joint health are driving increased adoption. As demand for high-quality collagen rises, the extraction process is being refined to improve product quality. This growth is supporting their widespread use in both beauty products and health supplements, contributing to the expansion of the industry.

The offline sales channel is expected to lead the market with a 65% share in 2025. Retail stores, pharmacies, and health food outlets are the primary distribution channels for collagen products, with consumers preferring to buy in person for product validation and expert advice.

Despite the growth of online shopping, physical retail locations continue to drive the majority of collagen sales in key industries such as North America, Europe, and Asia. The offline channel’s prominence remains strong due to consumer trust and the ability to interact directly with knowledgeable sales representatives.

Nutraceuticals are expected to capture a 52.4% share in 2025. Fish collagen’s superior bioavailability makes it highly effective in supplements targeting joint, skin, and bone health. As consumers increasingly seek natural, bioavailable ingredients, marine collagen is becoming a key component in functional foods.

The rising demand for health-focused, all-natural products is propelling the nutraceutical sector's expansion, as collagen is increasingly used to support overall wellness. The segment’s growth is further bolstered by the trend towards natural ingredients in supplements and fortified foods.

The industry is expanding due to enhanced sourcing efficiency and supply chain improvements, reducing spoilage and boosting turnover. Clinical studies validating its benefits in skincare and functional foods are driving growth. Retailers have increased shelf space for collagen products, while premium pricing and demand rise in sports-nutrition sectors.

Enhanced Sourcing and Efficient Supply Chain Practices

Fish collagen supply chains have been streamlined by retailers and manufacturers to reduce spoilage and improve efficiency. Storage times have been reduced by 25% in key industry in 2025 due to advanced preservation and cold-chain monitoring. Faster turnover rates in North America and Europe have led to a 15% increase in shelf space for premium collagen products. Traceability technologies have reduced rejection rates by 8%, while foreign material contamination has decreased by 10%.

Cosmetic and Functional Food Segments Gain Industry Validation

Fish collagen peptides have been shown to significantly improve skin elasticity, hydration, and reduce wrinkle depth, as demonstrated by clinical studies in 2024. The EU allocated EUR 12 million for research, promoting its use in cosmetics and functional foods.

Retailers in Europe and North America have reported a 20% increase in sales of collagen-based beauty products, while sports-nutrition distributors have introduced marine collagen peptides into protein shakes, driving premium pricing and higher consumer demand.

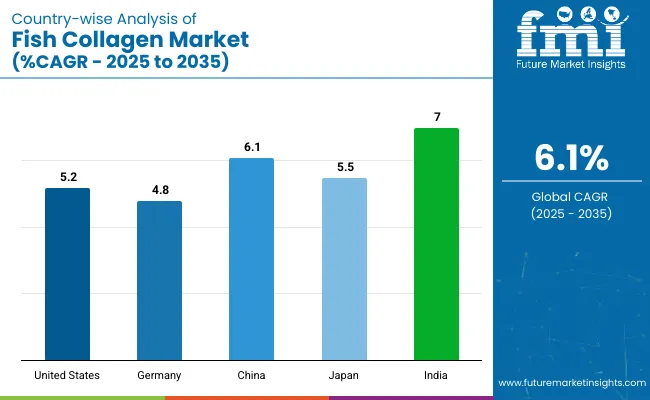

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

| Germany | 4.8% |

| China | 6.1% |

| Japan | 5.5% |

| India | 7.0% |

Global fish collagen demand is projected to grow at a 6.1% CAGR from 2025 to 2035. India, a BRICS nation, outpaces the global average with a 7.0% CAGR, driven by rising health awareness and growing demand for functional foods and supplements. China, also in BRICS, follows with a 6.1% growth rate, fueled by increasing popularity of collagen-based beauty and wellness products in urban areas.

Both countries are expanding local production to meet rising demand. The United States, part of the OECD, shows a 5.2% CAGR, with steady demand primarily from the beauty and nutraceutical sectors. Germany, another OECD country, records a 4.8% growth rate, limited by regulatory constraints and a developed industry. Japan, with a 5.5% CAGR, is benefiting from its aging population, leading to increased demand for collagen in health and skincare.

The requirement for fish collagen in the United Statesis growing at a CAGR of 5.2% from 2025 to 2035. Rising consumer awareness about the health benefits of collagen, particularly for skin, joints, and bones, is driving the demand for collagen-based products.

Despite slower growth compared to other regions, the industry remains strong, with sustained demand for fish collagen-based supplements and functional foods. Retailers are expanding their offerings, focusing on bioavailable and natural ingredients to meet growing consumer expectations. Collagen is being incorporated into a variety of products aimed at improving health and beauty.

Demand for fish collagen in Germany is expected to grow at a CAGR of 4.8% through 2035. Increasing demand for collagen in the beauty and nutraceutical sectors is driving industry growth. Consumers in Germany are becoming more focused on natural, bioavailable products, and marine collagen is being increasingly preferred in skincare and dietary supplements.

The growth of the German industry is being supported by the rising consumer interest in natural health products, with collagen being incorporated into a variety of formulations aimed at enhancing beauty, health, and wellness.

Sales of fish collagen in Chinaare projected to experience a CAGR of 6.1% from 2025 to 2035. The rising middle class and increased health awareness are contributing to a growing demand for collagen supplements, particularly in urban areas. collagen is increasingly used in beauty and skincare products due to its high bioavailability and effectiveness.

Despite facing local sourcing challenges and a preference for domestic collagen sources, the demand for collagen continues to grow. This growth is being driven by an expanding consumer base that is becoming more health-conscious. The expansion is supported by the increased focus on beauty and wellness products enriched with fish collagen.

The adoption rate of fish collagen in Japan is set to grow at a CAGR of 5.5% through 2035. The aging population is a major factor driving demand for collagen-based products, particularly for joint and skin health. Marine collagen is increasingly incorporated into beauty products and functional foods, contributing to industry growth.

Despite the developed industry in Japan, collagen-based products continue to see rising demand due to innovations in product formulations and growing interest in natural health supplements. The aging demographic is expected to continue fueling demand for collagen, with consumers seeking products to improve skin elasticity and support joint health.

India is projected to grow at a CAGR of 7.0% from 2025 to 2035, leading the market growth among the analyzed countries. The expanding middle class and increasing health awareness are major drivers of the rising demand for marine collagen in supplements and functional foods. Additionally, growing interest in natural, plant-based products and skincare solutions is boosting the consumption of marine collagen.

The wellness trend is positioning collagen as a key ingredient in the health and beauty sectors, further accelerating its adoption. As consumer awareness around the benefits of collagen continues to rise, the demand for collagen-based products is expected to see significant growth in the coming years.

Leading Company - Gelita AGMarket Share - 11.4%

The industry is segmented into dominant, key, and emerging suppliers, where competitive advantage has been determined by hydrolysis precision, peptide absorption rates, and global formulation partnerships. Gelita AG has been recognized as the leading company, with its market share driven by pharmaceutical-grade peptide chains and broad application in nutraceuticals and cosmeceuticals. Ashland and Nitta Gelatin have been positioned as dominant suppliers, enabled by strong bioavailability research and regional distribution contracts.

Key players such as Hangzhou Nutrition Biotechnology, Titan Biotech Limited, and Tai Ai Peptide Group have built scale through OEM-based collagen solutions and clean-label ingredient certifications. Emerging firms like Certified Nutraceuticals, ETChem, and BHN have been growing through innovation in functional beverage formats and customized skin-health blends.

Recent Fish Collagen Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 1.61 billion |

| Projected Industry Size (2035) | USD 2.89 billion |

| CAGR (2025 to 2035) | 6.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Sources Analyzed (Segment 1) | Scales and Muscles, Skin, Bones and Tendons, Others |

| Sales Channels Analyzed (Segment 2) | Online, Offline |

| Applications Analyzed (Segment 3) | Nutraceuticals, Pharmaceuticals, Food Industry, Cosmetics |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, Middle East & Africa |

| Key Players | Ashland, Gelita, Hangzhou Nutrition Biotechnology, Titan Biotech Limited, Certified Nutraceuticals, Darling Ingredients, Tai Ai Peptide Group, ETChem, BHN, Nitta Gelatin |

| Additional Attributes | Dollar sales, share by source and application, collagen peptide integration in dietary supplements, rising cosmetic and pharmaceutical formulations, supply diversification across marine raw material types |

The industry is categorized into Scales and Muscles, Skin, Bones and Tendons, and Others.

The industry is categorized into Online and Offline.

The industry is categorized into Nutraceuticals, Pharmaceuticals, Food Industry, and Cosmetics.

The industry is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The industry is projected to reach USD 1.61 billion in 2025.

The industry is expected to grow at a CAGR of 6.1% from 2025 to 2035.

Nutraceuticals are expected to capture 52.4% in 2025.

South Asia & Pacific, led by India, is projected at 7.0% CAGR.

The industry is projected to reach USD 2.89 billion by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Collagen Peptides Market Analysis by Source, Application and Region Through 2035

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA