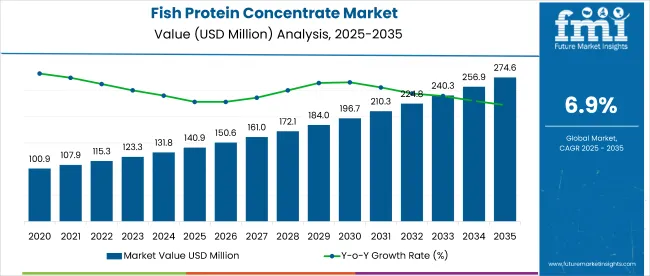

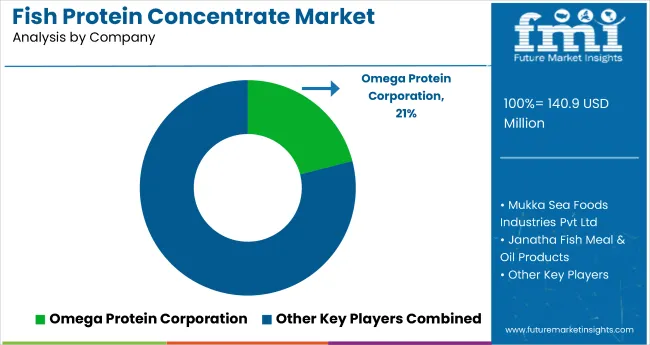

The global fish protein concentrate market is projected to grow from USD 140.9 million in 2025 to USD 274.6 million by 2035, registering a CAGR of 6.9%.

Growth in the market is primarily driven by rising consumer demand for high-quality, sustainable protein sources and increasing awareness of the health benefits of marine-derived nutrition. The incorporation of fish protein concentrates into food and beverage products, along with growing usage in cosmetics and personal care applications, is significantly boosting market penetration.

The market holds an estimated 100% share within the fish-based protein ingredient segment. It accounts for 38% of the marine protein market and around 14% of the animal nutrition protein additives market. In the broader protein ingredients space, it contributes nearly 3%, while its share in the global dietary supplements market is about 1.8%. Within the functional food and beverage segment, it holds nearly 1.2%, and around 2% in the collagen and gelatin market. Its contribution to the cosmetic ingredients market is modest at 0.9%, and it represents less than 0.02% of the global food ingredients market.

Government regulations impacting the market are focused on food safety, sustainability, and marine resource utilization. Regulatory frameworks such as the United States FDA’s GRAS (Generally Recognized as Safe) guidelines, the European Union’s Novel Food Regulation (EU 2015/2283), and Codex Alimentarius standards govern product formulation and labeling of fish protein concentrates.

Additionally, marine conservation policies and certifications like MSC (Marine Stewardship Council) promote responsible fishing practices, encouraging manufacturers to source sustainably and comply with environmental standards. These evolving regulations are fostering the adoption of traceable and nutrient-rich fish protein concentrate products across multiple industries.

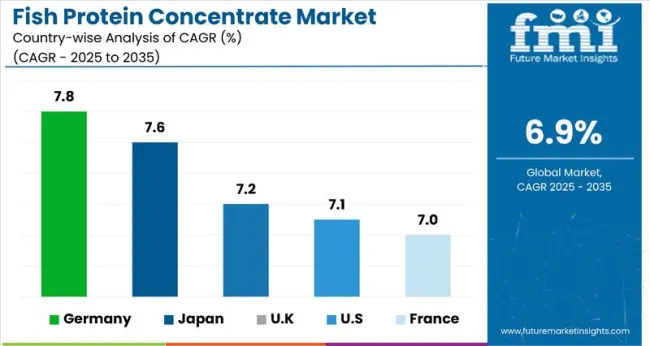

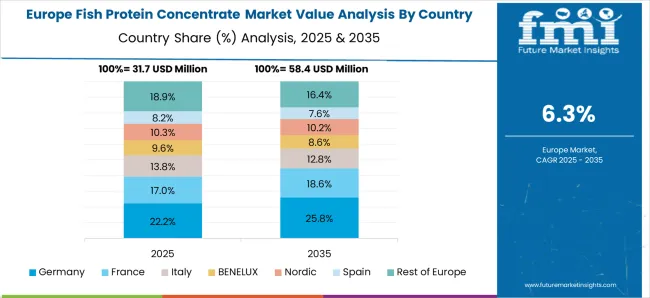

Germany is projected to be the fastest-growing market, expected to expand at a CAGR of 7.8% from 2025 to 2035. Powder form will lead the form segment with a 96% share, while type C will dominate the type segment with an 80% share. The USA and Japan markets are expected to grow steadily at CAGRs of 7.1% and 7.6%, respectively. The UK and France are also projected to grow at CAGRs of 7.2% and 7.0%, respectively.

Aquaculture nutritionists evaluate fish protein concentrate specifications based on crude protein content optimization, digestibility coefficient enhancement, and amino acid profile completeness when formulating feeds for salmon farming, shrimp cultivation, and marine finfish production requiring high-performance nutrition sources. Ingredient selection involves analyzing protein solubility characteristics, palatability factors, and storage stability parameters while considering cost-per-unit protein ratios, supply chain reliability, and regulatory approval factors necessary for commercial aquaculture operations. Formulation decisions balance protein concentrate costs against feed conversion efficiency gains, incorporating growth performance improvement, immune system enhancement, and mortality reduction benefits that justify premium protein source adoption through measurable aquaculture productivity advancement.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 140.9 million |

| Industry Value (2035F) | USD 274.6 million |

| CAGR (2025 to 2035) | 6.9% |

The global market is segmented by form, type, end use, and region. By form, the market is divided into powder and liquid. In terms of type, the market includes type A, type B, and type C. Based on end use, the market is classified into food & beverages, sport nutrition & dietary supplement, cosmetic & personal care, pharmaceuticals, and others (pet food, aquafeed, livestock feed, and animal health products). Regionally, the market is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Powder is projected to dominate the form segment, capturing 96% of the market share by 2025. It remains the preferred format among food and supplement manufacturers due to its superior solubility, ease of formulation, longer shelf life, and compatibility with encapsulation, functional beverages, and nutraceutical blends. Manufacturers also benefit from reduced transportation costs and improved dosage precision in powder format.

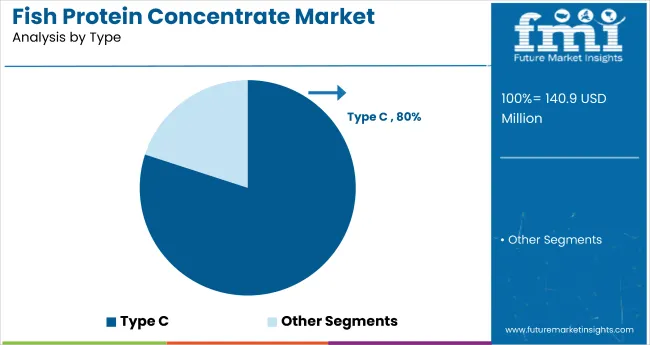

Type C is projected to dominate the type segment in 2025, capturing 80% of the market share due to its suitability for human consumption and its widespread use in food applications such as pasta and noodles. Its high protein content, consistent texture, and regulatory approval for food-grade use make it ideal for processed food manufacturers. Additionally, its mild flavor and ease of integration into existing formulations enhance its versatility across functional foods, dietary supplements, and fortified products.

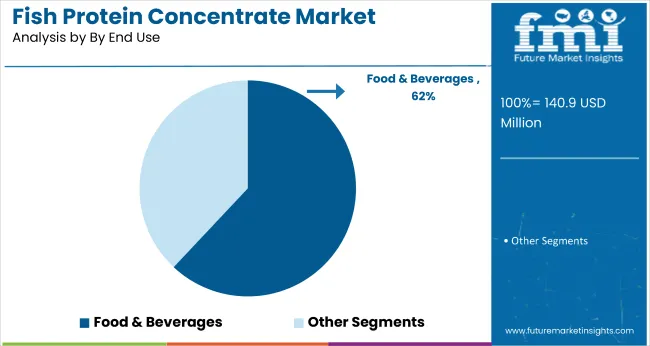

Food & beverages are expected to lead the end use segment in 2025, accounting for 62% of the global market share, driven by rising demand for protein-rich and functional food products. Increasing consumer preference for clean-label ingredients and natural bioactive compounds has boosted the use of fish protein concentrate in fortified foods and beverages. Its proven benefits for joint, skin, and gut health make it highly attractive for health-conscious consumers. Additionally, manufacturers are incorporating it into meal replacements, energy bars, and functional drinks to capitalize on the growing wellness trend.

The global market is experiencing consistent growth, fueled by increasing consumer focus on high-protein diets, sustainable nutrition, and marine-based health products. Fish protein concentrate plays a vital role in fortifying food, supplements, and cosmetics with essential amino acids and collagen.

Recent Trends in the Fish Protein Concentrate Market

Challenges in the Fish Protein Concentrate Market

Germany’s momentum is rooted in marine innovation, nutraceutical-grade processing, and cosmetic applications powered by high-collagen marine proteins. France and Japan demonstrate stable demand, driven by consumer preference for clean-label protein sources and EU-backed research into sustainable marine nutrition. Meanwhile, developed economies such as the USA (7.1% CAGR), UK (7.2% CAGR), and Germany (7.8% CAGR) are growing at 1.03-1.10x the global rate of 6.9%.

Japan is the fastest-growing country in the market, supported by high demand in collagen skincare and marine wellness products. Germany follows, driven by fortified foods and sustainable marine protein sources. The United States and United Kingdom exhibit similar growth rates, with strong demand for flavored protein supplements, breakfast cereals, and cosmeceuticals.

France records steady expansion, fueled by marine collagen innovations and premium beauty powders. All five countries are outpacing the global average, signaling strong OECD-led momentum in shaping marine-based protein demand across food, supplement, and personal care applications in the market.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan fish protein concentrate market is growing at a CAGR of 7.6% from 2025 to 2035. The rise is attributed to high demand for anti-aging and collagen-enhanced products across the beauty and wellness sectors. Japan’s marine food technologies enable precise extraction of bioactive peptides, aligning with clean-label expectations in both food and cosmetics. While domestic seafood supplies are managed sustainably, demand is met through innovative processing and product variety.

Sales in Germany are expected to expand at a CAGR of 7.8% during the forecast period, outperforming the global average. The market is driven by the popularity of protein-rich bakery and ready-to-eat products. Fish protein concentrate is widely used for its functional benefits in food formulations. Consumer trust in traceable marine sources and regulatory oversight ensures stable demand, especially in food manufacturing and personal care segments.

The French fish protein concentrate market is projected to grow at a CAGR of 7% from 2025 to 2035. Growth is driven by increasing demand for functional foods and marine-based skincare innovations. Key applications include dietary supplements, meal replacements, and collagen-based beauty powders. France leverages its biotech clusters to develop marine protein ingredients that align with EU food safety norms and anti-aging wellness products.

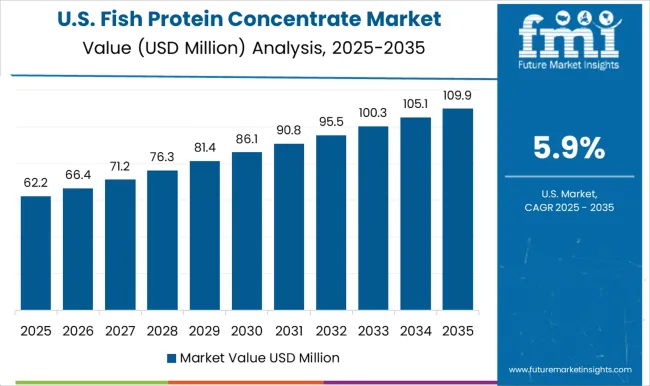

The USA fish protein concentrate market is forecast to grow at a CAGR of 7.1% from 2025 to 2035, slightly ahead of the global average. The USA leads in fish protein-based omega-3 formulations and flavored protein supplements. Consumer interest in fitness, joint health, and anti-inflammatory benefits supports demand. Coastal processing facilities and advanced formulation technologies contribute to the development of premium products.

The UK fish protein concentrate revenue is projected to expand at a CAGR of 7.2% between 2025 and 2035, growing slightly faster than the global rate. Demand is concentrated in fortified breakfast cereals, collagen powders, and cosmeceuticals. Post-Brexit food safety alignment has created unique formulation standards, but consumer demand for clean marine protein sources remains strong across the skincare and health food segments.

The Fish Protein Concentrate Market is expanding steadily, driven by rising global demand for high-quality, sustainable protein sources in food, feed, and nutraceutical applications. Leading producers such as Janatha Fish Meal & Oil Products, Bevenovo Co. Ltd., and Bio-Oregon Protein Inc. are leveraging advanced extraction technologies to enhance protein yield and purity. Omega Protein Corporation and Colpex International Inc. are focusing on sustainable sourcing practices and traceable supply chains to meet stringent global regulatory standards for marine-derived ingredients.

Asian manufacturers like Shenzhen Taier Biotechnology Co. Ltd. and New Alliance Dye Chem Pvt. Ltd. are expanding capacity to cater to the growing aquafeed and dietary supplement markets in emerging economies. PeterLabs Holdings Berhad and Mukka Sea Foods Industries Pvt. Ltd. are emphasizing innovation in product formulations to enhance digestibility and nutritional performance. Meanwhile, Scanbio Marine Group AS and Apelsa Guadalajara S.A. de C.V. are diversifying applications into pet nutrition and functional foods, contributing to market stability and growth.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 140.9 million |

| Projected Market Size (2035) | USD 274.6 million |

| CAGR (2025 to 2035) | 6.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/volume in metric tons |

| Form Analyzed | Powder and Liquid |

| Type Analyzed | Type A, Type B, and Type C |

| End Use Analyzed | Food & Beverages, Sport Nutrition & Dietary Supplement, Cosmetic & Personal Care, Pharmaceuticals, Others (Pet Food, Aquafeed, Livestock Feed, Animal Health Products) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | Janatha Fish Meal & Oil Products, Bevenovo Co. Ltd., Bio-Oregon Protein Inc., Omega Protein Corporation, Colpex International Inc., Shenzhen Taier Biotechnology Co. Ltd., New Alliance Dye Chem Pvt. Ltd., PeterLabs Holdings Berhad, Mukka Sea Foods Industries Pvt. Ltd., Scanbio Marine Group AS, Apelsa Guadalajara S.A. de C.V. |

| Additional Attributes | Dollar sales by form, share by type and end use, regional demand variation, sustainability influence, marine sourcing trends, competitive benchmarking |

The global fish protein concentrate market is estimated to be valued at USD 141.0 million in 2025.

The market size for the fish protein concentrate market is projected to reach USD 274.7 million by 2035.

The fish protein concentrate market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in fish protein concentrate market are type a, type b and type c.

In terms of form, powder segment to command 62.4% share in the fish protein concentrate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Sauce Market Growth - Culinary Trends & Industry Demand 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA