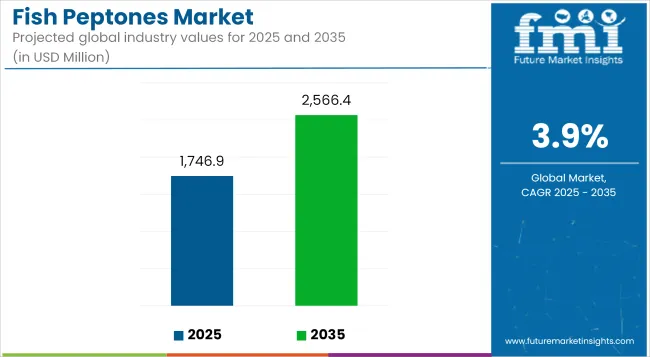

As of 2025, the global fish peptones industry is valued at approximately USD 1,746.9 million and is likely to register a CAGR of 3.9% to surpass USD 2,566.4 million by the end of 2035. The demand for fish-derived peptones has gained steady traction as biotechnology and life sciences industries increasingly rely on animal-free and marine-based protein sources for culture media preparation.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,746.9 million |

| Projected Market Size in 2035 | USD 2,566.4 Million |

| CAGR (2025 to 2035) | 3.9% |

The market's movement has also been shaped by regulatory encouragement for sustainable and traceable marine by-products, reinforcing the adoption of fish peptones in clinical diagnostics, pharmaceutical microbiology, and enzyme production.

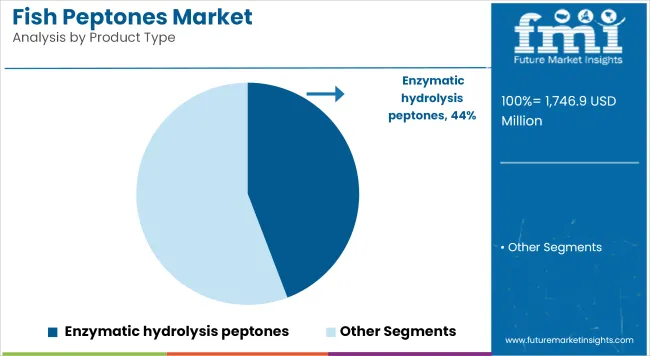

Market performance is being influenced by a convergence of factors. Expansion within the bio and medicine sectors has accelerated demand for clean, protein-rich substrates, especially in the production of recombinant proteins, vaccines, and antibiotics. The efficiency and nutritional profile of enzymatic hydrolysis-based fish peptones has positioned them as critical inputs across microbial fermentation workflows.

However, growth remains constrained by variability in raw material quality, supply chain disruptions linked to seasonal fish availability, and the presence of odor or allergenic residues that limit usage in select applications. Meanwhile, a shift in research priorities toward sustainable and marine-origin ingredients has emerged as a defining trend. Industry participants are being observed investing in process upgrades and automation to enhance extraction yields and control peptide profiles.

Between 2025 and 2035, the fish peptones market is expected to witness continued momentum, bolstered by innovations in downstream processing technologies and increasing consumption in the production of monoclonal antibodies, probiotics, and industrial enzymes.

The market is expected to witness higher penetration into cell culture and nutraceutical formulations by 2035, especially across Europe and Asia-Pacific where marine bioactives are gaining strategic significance. Supply chain diversification, digital tracking systems, and traceable sourcing protocols are projected to emerge as future differentiators for stakeholders seeking scalability and quality assurance.

Holding an estimated 17.6% share of the fish peptones market in 2025, the nutraceuticals and functional food segment represents an emerging yet strategically important area of expansion. The use of fish peptones as a protein-rich, easily absorbable ingredient aligns with consumer demand for natural, marine-based health solutions.

Their role in improving gut microbiota, enhancing bioavailability of amino acids, and delivering functional peptides supports various applications ranging from dietary supplements to functional beverages and sports nutrition powders. With increased investment in marine bioactives across the EU and Asia, especially under clean-label mandates and health claim substantiation (as monitored by EFSA in Europe), fish peptones are increasingly being integrated into B2B ingredient formulations.

Companies such as Copalis (France) and Bioibérica (Spain) have emphasized marine-derived hydrolysates in their functional ingredient portfolios, which include fish peptones. These companies cater to supplement manufacturers seeking high-value protein inputs with traceability credentials.

Regulatory developments around sustainable marine ingredient use under EU’s Blue Economy strategy further support market expansion. However, broader consumer-facing applications are still moderated by organoleptic challenges and allergen concerns, which require advanced deodorization and filtration steps. Ongoing clinical research and encapsulation innovations are expected to enhance product acceptability and unlock wider food use by 2035.

Accounting for approximately 9.4% of global demand in 2025, veterinary and animal health bioproduction represents a specialized but rising application for fish peptones. Their high nitrogen content and balanced amino acid profile make them ideal for cultivating veterinary vaccine strains, probiotic cultures, and biotherapeutic agents used in livestock and aquaculture.

This segment is benefitting from growth in antibiotic alternatives and immuno-enhancement formulations in animal health, supported by veterinary directives from regulatory bodies such as the European Medicines Agency (EMA) and the USDA Center for Veterinary Biologics. Fish peptones offer advantages in supporting robust cell culture environments and fermentation consistency for probiotic feed additives, particularly those used in piglets, poultry, and aquafeed.

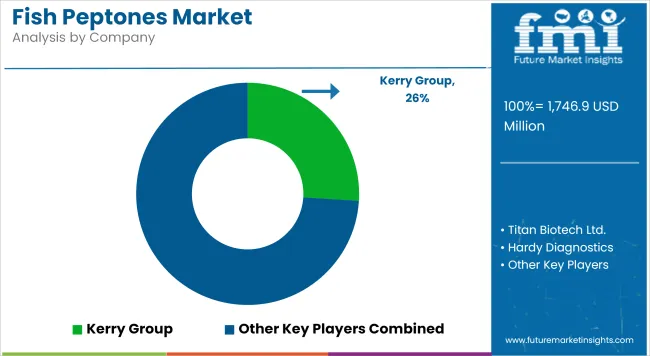

Companies like BioSpringer and Titan Biotech Ltd. are developing tailored fermentation substrates for veterinary bioproduct manufacturers across Europe and Southeast Asia. With rising scrutiny over animal feed additives and the elimination of antibiotic growth promoters (AGPs), the use of marine-origin fermentation media has found favor among compliant bioproduction firms.

Regulatory traceability, absence of terrestrial animal components, and batch reproducibility are critical selection factors in this domain. As more veterinary biologics transition to recombinant and cell-based technologies, fish peptones are poised to play a larger role in cost-effective, scalable media development.

High Production Costs and Supply Chain Issues

High production costs, availability of raw materials, and supply chain disruptions also become challenges reneging the growth of the Fish Peptones Market. Quality fish by-products sourcing for peptone production depends on sustainable fisheries and processing methods; thus they may increase operational costs. Moreover, the supply shocks of fish associated with environmental issues and regulatory measures also affect stability in the market.

Regulatory and Quality Compliance

In pharmaceutical, biotechnology and food industries, manufacturers are required to adhere to strict regulatory requirements as well as quality standards. Different regulations and safety assessments are also presents challenges to product approval and market entry in the world. Organizations need to incur costs in hard-core quality control and certification to follow the rules.

Expanding Applications in Biotechnology and Pharmaceuticals

There are significant opportunities arising from the increasing requirement for fish peptones in microbial fermentation, cell culture media, and biopharmaceutical production process. Used widely within pharmaceutical and biotechnology sectors for vaccine production, antibiotic synthesis and enzyme generation, fish peptones are helping fuel growth in the global market.

Sustainability and Waste Utilization

Escalating awareness about sustainable sourcing of raw materials and by-product utilization has led to increased use of fish waste in peptone production. Environment-conscious consumer and industries would flock towards companies which are deploying circular economy approaches and eco-friendly processing methods.

Demand for fish peptones from biotechnology, pharmaceutical applications and microbiology research is driving the growth of the USA fish peptones market. Driving Market Growth, Increasing Innovations in Bio-based Products and Expansion of Biopharmaceutical Production Facilities The demand for sustainable and animal-free protein has also helped the market grow.

The use of fish peptones is particularly valued in microbiological cultures as a nutrient source, which is increasingly employed as fermentation-based production management among biopharmaceutical companies. In addition, the USA government has raised the funding of research in alternative protein sources, which is anticipated to increase the adoption of fish peptones across various industries.

Additionally, development in fish peptone applications, including applications in probiotic cultures and dietary supplements, by the country strong food processing and nutraceutical sector is another factor surge the growth of fish peptone market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

UK market is growing at a steady pace. Fish peptones, owing to their rich nutrient composition, have emerged as the preference of research institutions and pharmaceutical companies, providing an excellent source of nutrients for microbial fermentation during enzyme and antibiotic production. Additionally, growing emphasis on the UK government’s innovation in bioprocessing and pharmaceutical industries is anticipated to foster the market growth.

As precision medicine and personalized therapies continue to gain traction, there is a corresponding increase in R&D investments in cell culture-based treatments, wherein fish peptones serve as a vital nutrient medium.

Furthermore, sustainability issues, along with regulations advocating non-animal-derived culture media, are expected to further drive adoption. Demand in the UK market is also coming from the food and beverage sector as fish peptones are used for fermentation processes involved in the manufacture of probiotics, enzymes, and functional ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.8% |

The European Union fish peptones market is anticipated to expand due to increased funding towards the biotechnological research, strict regulations promoting sustainable raw materials, and growing application in the bioprocessing industries. The use of animal-free peptone alternatives with superior quality is increasing, especially in the pharmaceutical and food fermentation sectors.

Strict Bans imposed by EU on animal-derived products for pharmaceutical as well as food applications, have aided the market growth in recent times to a greater extent, along with a wider attention towards sustainable as well as ethical manufacturing processes These factors have led to an increased interest in fish peptones as a convenient alternative to animal-derived peptones from poultry, porcine, or bovine sources.

The region’s growing pharmaceutical and vaccine production industries are also important growth enablers, as fish peptones, which are widely used in microbial fermentation systems, help to support them.

Moreover, increased utilization of fish peptones for probiotic and enzyme manufacturing in the European food processing sector is projected to create an added demand segment for fish peptones. Evaluating new applications of fish peptones in regenerative medicine and tissue engineering continues to gain attention among the research institutions in the EU.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.9% |

Growth in South Korea is attributed to technological innovations in biopharmaceutical research, government support for biotechnology, and growing demand for fish peptone as a culture media in diagnostic applications. The growth of the market is primarily aided by the country's strong pharmaceutical industry and also growing fermentation applications in the country.

Various applications of fish peptones have received encouraging support due to extensive investment made by South Korean government in biotechnology and life sciences research. The demand has been further driven by the advent of precision medicine and the evolution of advanced bioprocessing technologies.

Moreover, the robust food and beverage industry in the country is employing fish peptones in fermentations of various substances for the production of bioactive compounds and functional ingredients. Establishments in South Korea’s well-advanced diagnostics and healthcare sectors are also looking at fish peptones for use in bacterial culture media and vaccine development. R&D spending’s are the continuous driving forces for market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

The fish peptones market is witnessing steady growth, driven by increasing demand in biopharmaceuticals, microbiology, and biotechnology industries. Fish peptones, derived from fish protein hydrolysates, serve as essential nutrient sources for microbial culture media and industrial fermentation processes. Their sustainable production and superior amino acid profile make them an attractive alternative to traditional peptones.

The overall market size for fish peptones market was USD 1,746.9 million in 2025.

The fish peptones market is expected to reach USD 2,566.4 Million in 2035.

Growing consumer preference for organic options, diverse flavoured offerings, and rising demand for energy-efficient cooling solutions will drive market growth.

The top 5 countries which drives the development of fish peptones market are USA, European Union, Japan, South Korea and UK.

Organic fish peptones demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA