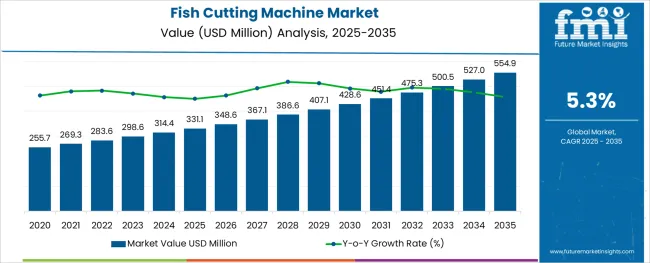

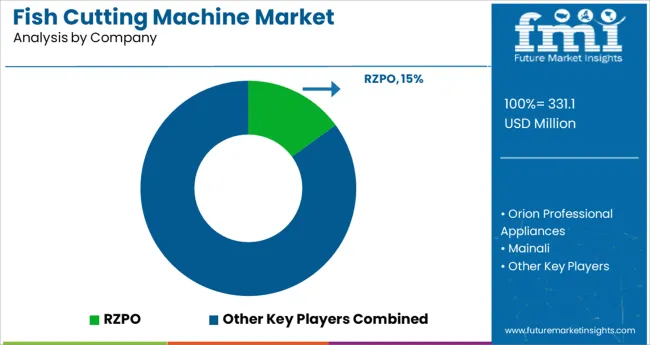

The Fish Cutting Machine Market is estimated to be valued at USD 331.1 million in 2025 and is projected to reach USD 554.9 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The fish cutting machine market is undergoing steady growth as automation, hygiene requirements, and processing efficiency become critical priorities across the seafood industry. Rising demand for processed fish, labor shortages in fish processing plants, and stringent food safety regulations have driven the adoption of specialized cutting equipment that ensures precision and consistency.

Improvements in material durability and blade technologies are making machines more suitable for high-volume operations while maintaining product quality. Future expansion is expected to be supported by investments in automation-friendly plant layouts, integration of digital monitoring systems, and the push toward value-added seafood products.

Growing awareness of workplace safety and the need to reduce manual handling are also paving the path for increased deployment of advanced fish cutting machines across different scales of operation.

The market is segmented by Mechanism / Technology, Capacity (Kg/h), Fish Type, End User, and Sales Channel and region. By Mechanism / Technology, the market is divided into Automatic and Manual. In terms of Capacity (Kg/h), the market is classified into 50-150, <50, 150-300, and >300. Based on Fish Type, the market is segmented into Fresh Fish and Frozen Fish.

By End User, the market is divided into Food Processors and Food Service Sector. By Sales Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by mechanism technology the automatic segment is anticipated to hold 58.50% of the total market revenue in 2025 emerging as the leading technology segment.

This leadership has been strengthened by the seafood industry’s focus on minimizing human intervention to improve hygiene and reduce processing time. Automatic machines have been increasingly deployed as they enable continuous and consistent operations which are crucial for meeting large-scale production requirements.

Their ability to deliver uniform cuts while reducing dependency on skilled labor has significantly improved operational efficiency. Furthermore the adoption of automatic systems has been encouraged by their compatibility with integrated processing lines and the enhanced safety they offer to operators. These factors collectively have solidified the automatic segment’s position at the forefront of the market.

Segmented by capacity the 50 to 150 kg per hour segment is projected to account for 34.20% of the market revenue in 2025 establishing itself as the preferred capacity range.

This prominence has been driven by its suitability for small to medium sized processors who require a balance between throughput and footprint. Machines within this capacity range have been favored as they align with the operational needs of regional processing units and fish markets where space and budget constraints are common.

The segment’s growth has also been supported by its versatility in handling varying fish sizes and its ability to deliver efficient output without necessitating high capital investment. These attributes have reinforced the demand for 50 to 150 kg per hour machines particularly in emerging markets and decentralized processing facilities.

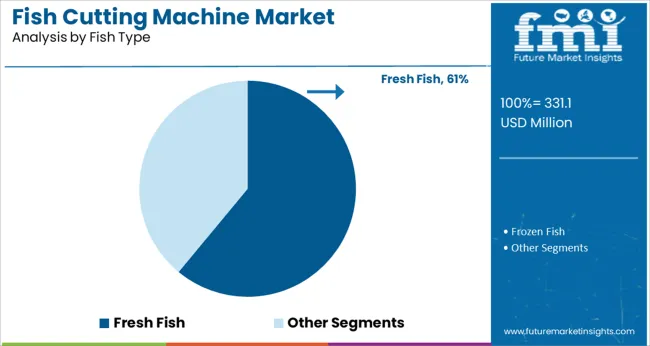

When segmented by fish type the fresh fish segment is expected to command 61.00% of the total market revenue in 2025 maintaining its leading share. This dominance has been underpinned by the strong consumer preference for fresh seafood and the operational focus of processors on maintaining freshness throughout the supply chain.

Fresh fish processing has continued to prioritize machines that minimize tissue damage and preserve texture and appearance which has encouraged the adoption of specialized cutting equipment tailored for fresh catch. Additionally the perishability of fresh fish has necessitated rapid and hygienic processing which these machines effectively facilitate.

The segment’s leadership has also been sustained by the growing presence of fresh fish counters in retail and foodservice outlets where on demand processing is a critical requirement.

Developing economies, such as India and Indonesia, are increasing their fish output, which is a major factor propelling the fish cutting machine market. Rising urbanization and personal income have both contributed to greater demand for fresh fish, which is in high demand due to its high protein content.

In addition, the fish cutting machine market expansion is anticipated to be boosted throughout the forecast period by the rising demand for premium-grade food products due to the freshness and diversity of the products.

However, in recent years, foreign trade has become increasingly important due to increased government assistance and improved transport infrastructure. To guarantee the traceability and quality control of their exports, the Marine Products Export Development Authority (MPEDA) in India has begun work on a GPS-based database of aquaculture farms with an eye toward export.

In May of 2024, the Indian government authorized the Pradhan Mantri Matsya Sampada Yojana (PMMSY) as part of the Aatmanirbhar Bharat COVID-19 Relief Programme, with the goal of developing the fisheries sector in a sustainable and responsible manner.

In the same vein, Indonesia has its PROTEKAN (Program to Increase Fisheries Exports) initiative, which also seeks to boost cutting equipment exports. As a result, more fish is likely to be farmed with an eye toward export, which is likely to lead to a rise in both cutting equipment production and consumption.

The tremendous opportunity for international trade is what really moves the Indian fish market. About 6 percent of global output is sold in this market. There is little doubt that the country is currently one of the world's leading seafood suppliers. The Indian fish market has been bolstered by the rapid expansion of both domestic consumption and fish exports in recent years. A rise in recent years has also been seen in the quantity of fish eaten per person.

Many reasons are currently pushing up demand for fish cutting machines in India. Some of these factors are the general trend toward a healthier diet, the ever-increasing price of meat, and the growing recognition that fish is a good source of digestible protein, cholesterol-lowering capabilities, and polyunsaturated fatty acids (PUFA).

Fish's positive effects on human health are increasingly being recognized.

As more people learn about the benefits of fresh fish for their health, such as reducing the risk of chronic diseases and regulating hormone levels, the fish cutting machine market is predicted to show development prospects throughout the forecasted period.

Since many people are looking to cut back on calories, diets high in protein are becoming increasingly popular, driving up demand in the market. As a low-fat protein source crucial for muscle growth, as well as a source of iron and vitamins like omega-3 fatty acids, fish food has been a driving force in the fish cutting machine industry's growth.

Market expansion is being driven by rising demand in both developed and developing economies.

In both developed and emerging countries, demand, and consumption of fresh fish products are on the rise, which is expected to drive the fish cutting machine industry. The FAO found that the global rise in fish eaten for sustenance has far outpaced the rise in the world's population. Rising industrial cutting equipment output in emerging economies like India and Indonesia is the main factor propelling the market forward.

Rising urbanization and personal income have led to an increase in the demand for protein-rich fish meals, which in turn has led to a surge in the fresh fish market. Market growth in the next years is also expected to be fuelled by the wide range of products available and the rising demand for high-quality meals.

Boosted government investment in fishing has led to a rise in exports, which is fuelling the market.

The rising global output of fish products, enhancements to the cold chain, transportation, and distribution channels, and subsequent increases in demand have all contributed to the current state of the fish product market.

Recent years, however, have seen an uptick in the significance of international trade as a result of improved transit infrastructure and expanding government support, and increasing the growth in fish cutting machine market share.

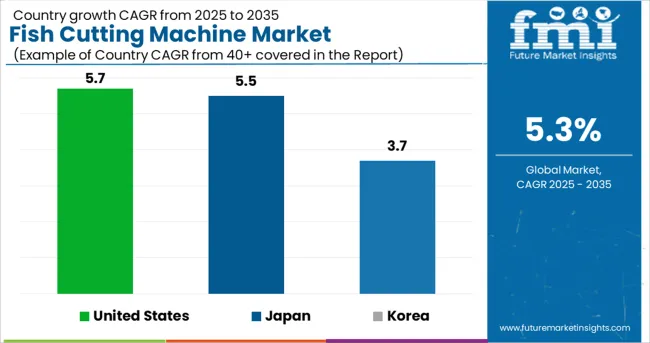

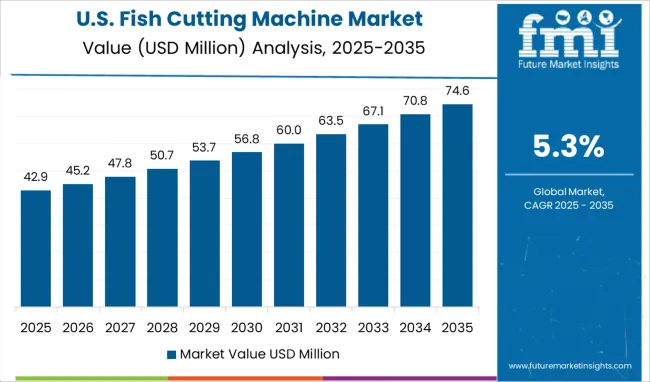

United States:

| Market Value (2035) | USD 554.9 million |

|---|---|

| CAGR (%) | 255.7 |

Canned, frozen, and chilled fish are some of the most popular forms of processed fish consumed in the USA significant growth in the global fish cutting machine market can be attributed to several factors, including rising consumer awareness of the health benefits of seafood, rising demand for organic fish products, many restaurants and cafes, deeper market penetration by packaged food and top food processing companies, and rising demand for convenience food products.

Japan:

| Market Value (2035) | USD 31.5 million |

|---|---|

| CAGR (%) | 5.5 |

Now, Japan is one of the world's largest marketplaces for fish. The country currently has the second-highest per capita seafood intake in the world. The growing interest in eating more nutritiously is a key aspect of Japan's fish cutting machine market.

Because of Japan's rapidly aging population, demand is expected to rise for fish cutting machines and fish products that provide health benefits such as reduced cholesterol levels, increased micronutrient intake, and increased intake of vital fatty acids. The expanding number of single-person homes and women in the workforce is also contributing to the growth of the country's fish cutting machine market.

The market is predicted to develop as a result of several factors, including the increasing popularity of ready-to-eat meals, semi-processed items, and seafood products that require minimal preparation time, as well as shifts in consumer preferences and spending on healthcare.

Korea:

| Market Value (2035) | USD 12.5 million |

|---|---|

| CAGR (%) | 3.7 |

Due to domestic and regional limits on local production, South Korea is increasingly reliant on imports to meet its fish and seafood demands. Strong market growth is being seen for imported items that offer value, quality, nutritional benefits, novel flavors, and convenience.

With an increase of 28% over 2020, South Korea spent USD 255.7 billion importing fish and shellfish in 2020. Even though over a hundred other countries provided fish and seafood for Korea's imports, the countries of China, Russia, Vietnam, and Norway accounted for most of the country's supply. These four countries accounted for a whopping 78.1% of the republic's total export market share. This is also impacting the fish cutting machine market outlook.

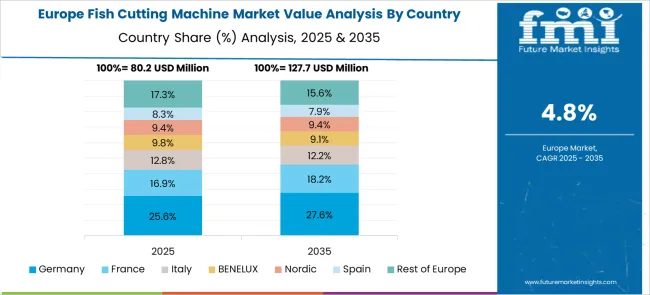

Europe:

The European fish cutting machine market is growing rapidly because of the region's expanding consciousness of the health benefits and rising appeal because of sustainability. In addition, the growing awareness of the link between poor diet and accelerated aging of the skin and bones, as well as the epidemic of cardiovascular disease, is driving up the demand for industrial cutting equipment across Europe.

In addition, the market expansion is anticipated to be boosted throughout the forecast period by the rising demand for premium-grade fish products due to freshness, diversity of the goods, and convenience for food safety.

New Entrants to Foster Innovation in the Global Market

The startups in the fish cutting machine market are adding a new edge to the properties of excavators by curating innovations beyond the imagination. They are continually upgrading the fish cutting machine with advanced technology and curating innovative types of bags that are gaining consumer attention, like bright and vibrant colors and greater accessibility. Start-up firms are triggering the expansion of the fish cutting machine market with their unique attempts.

In order to boost profits and solidify their foothold in the fish cutting machine market, major players in the industry have turned to mergers and acquisitions, as well as strategic partnerships.

2 Iconic Companies Having Major Dominance

| Attributes | Details |

|---|---|

| RZPO | Manufacture of Food-Related Processing Machinery (RZPO). The company has 2 factories to make a variety of process equipment, including smoke and defrost climatic and thermal cameras, injectors, hygiene stations, shrink tanks, and more. An extensive assortment of non-standard food processing machinery. The created equipment is of the same caliber as the best in the world. In addition, they provide the highest quality imported processing machinery for a wide variety of foods, including fish, meat, cheese, and vegetables. This includes filleting machines, slicers for slicing, skinning machines, industrial cutting equipment, skinning machine, washing machines for fish or containers, conveyors for industrial cutting equipment, injectors, refrigerated containers, and much more. They have a division devoted to designing and installing industrial refrigeration systems for use in the cooling and climate control of factories and warehouses and can provide estimates for any size of the refrigeration system in Bitzer, Frascold. |

| Mainali | Mainali has been making equipment for the food sector for over 20 years. The company specializes in the production of cutting and pressing machines for a wide variety of products. The company has become an industry standard by pioneering cutting-edge machinery and leading the way in the development of durable technology. The organization has been able to expand internationally because of its history and past successes. |

The global fish cutting machine market is estimated to be valued at USD 331.1 million in 2025.

It is projected to reach USD 554.9 million by 2035.

The market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types are automatic and manual.

50-150 segment is expected to dominate with a 34.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Sauce Market Growth - Culinary Trends & Industry Demand 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA