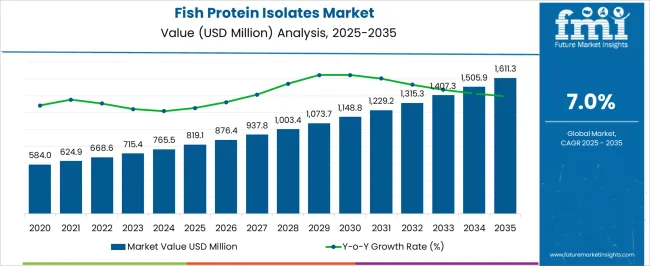

The fish protein isolates market is expected to grow from USD 819.1 million in 2025 to USD 1,611.3 million in 2035, reflecting a CAGR of 7.0%. During the early adoption phase (2020–2024), the market expanded from USD 584.0 million to USD 819.1 million as fish protein isolates were introduced and tested by food manufacturers, nutraceutical companies, and dietary supplement producers. Pilot applications were conducted to evaluate functionality, digestibility, and taste profile. By 2025, the market is expected to reach USD 819.1 million, with broader adoption observed as product formulations are refined and integration into beverages, protein powders, and fortified foods gains acceptance from consumers and industry players. From 2025 to 2035, the market is projected to transition through scaling (2025–2030) and consolidation (2030–2035).

By 2030, the market is forecast to surpass USD 1,073.7 million, driven by expanded applications in sports nutrition, functional foods, and dietary supplements. During the consolidation phase, growth is expected to moderate toward USD 1,611.3 million by 2035 as leading suppliers strengthen market presence and smaller players consolidate or exit. The 7.0% CAGR indicates steady expansion, establishing the market as a reliable source of high-quality protein, with fish protein isolates becoming a preferred ingredient across multiple food and nutrition segments.

| Metric | Value |

|---|---|

| Fish Protein Isolates Market Estimated Value in (2025 E) | USD 819.1 million |

| Fish Protein Isolates Market Forecast Value in (2035 F) | USD 1611.3 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The fish protein isolates market is influenced by several parent markets, each contributing to overall growth. The global seafood processing industry is estimated to drive approximately 30%, as raw fish materials are supplied for protein isolation and processing. Nutraceutical and dietary supplement markets are considered responsible for 20%, as protein isolates are incorporated into protein powders, shakes, and functional formulations. Functional foods and beverages are assessed to account for 15%, as isolates are used to enhance nutritional content and protein enrichment. Sports nutrition products contribute around 10%, as protein isolates are integrated into performance-focused formulations. Food processing and ingredient supply services are evaluated at 8%, as enzymes, stabilizers, and flavoring agents are provided to ensure product quality. Cold storage and logistics services are estimated at 7%, as supply chains are maintained for freshness and consistency. Quality assurance and regulatory compliance services account for 5%, as safety standards, labeling, and certifications are ensured. Finally, research and development services are estimated at 5%, as product formulations, digestibility, and functional properties are optimized.

The Fish Protein Isolates market is experiencing strong growth, driven by increasing consumer demand for high-quality protein sources and the rising focus on health and wellness across global populations. The current market scenario reflects growing adoption of fish protein isolates in food formulations, dietary supplements, and functional nutrition products due to their high nutritional value, low allergenic potential, and superior digestibility.

Technological advancements in protein extraction and purification processes have enabled manufacturers to produce isolates with enhanced solubility, taste, and functional properties, supporting expanded application in food and beverage products. Rising awareness about sustainable protein sources and the nutritional benefits of fish-derived proteins is shaping the future outlook, while investment in research and development for novel applications in sports nutrition and clinical dietary supplements is further driving growth.

As dietary trends continue to shift towards protein-enriched and functional foods, the Fish Protein Isolates market is anticipated to sustain steady growth, providing opportunities for both established players and new entrants to capture value through innovation and targeted product offerings.

The fish protein isolates market is segmented by form, application, distribution channel, and geographic regions. By form, fish protein isolates market is divided into Powder, Liquid, and Others. In terms of application, fish protein isolates market is classified into Food, Beverages, Animal feed, Cosmetic & personal care, Pharmaceuticals, and Others. Based on distribution channel, fish protein isolates market is segmented into Online retail, Hypermarkets/Supermarkets, Specialty stores, Convenience stores, and Others. Regionally, the fish protein isolates industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

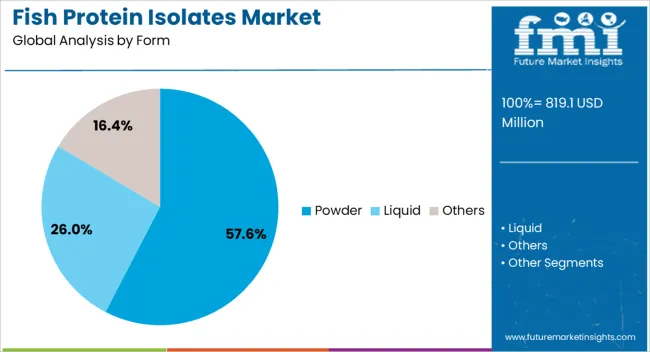

The powder form is projected to hold 57.6% of the Fish Protein Isolates market revenue share in 2025, making it the leading form. This dominance is being attributed to the ease of integration into various food formulations and supplements, where powdered proteins provide flexibility in dosing, mixing, and processing. Adoption has been accelerated by the convenience offered to manufacturers and consumers, as powders are stable, lightweight, and allow precise nutritional control.

The growth of this segment has been reinforced by increased usage in ready-to-drink beverages, protein bars, bakery products, and functional foods, where solubility, flavor neutrality, and texture modification are essential. Powdered isolates can be easily incorporated without altering the sensory profile of end products, which is critical in maintaining consumer acceptance.

Furthermore, the ability to standardize protein content and ensure consistent quality has made powder the preferred form in both industrial and commercial applications As interest in high-protein diets and functional nutrition rises globally, the powder form is expected to maintain leadership due to its versatility, ease of handling, and strong integration potential across food and supplement applications.

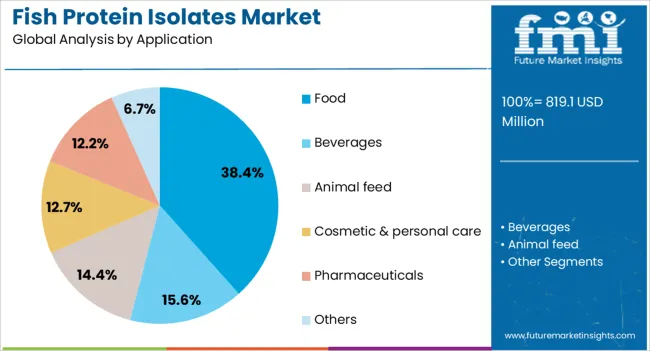

The food application segment is expected to account for 38.4% of the Fish Protein Isolates market revenue in 2025, emerging as the leading application area. This segment’s growth is being driven by the increasing demand for protein-enriched and functional food products, as consumers seek convenient and nutritious dietary options. Fish protein isolates are valued in food applications for their high protein content, neutral taste, and ability to improve texture and emulsification in processed foods.

The adoption of these proteins in bakery, dairy, confectionery, and ready-to-eat products has been accelerated by the shift toward healthier eating habits and protein-fortified formulations. Additionally, the focus on sustainable and alternative protein sources has encouraged manufacturers to incorporate fish protein isolates into mainstream food products.

The segment’s growth is further supported by rising consumer awareness about dietary protein requirements and functional nutrition, making fish protein isolates a preferred ingredient for boosting nutritional profiles As food manufacturers continue to innovate and respond to health-conscious consumer trends, the food application segment is expected to remain a dominant contributor to market revenue.

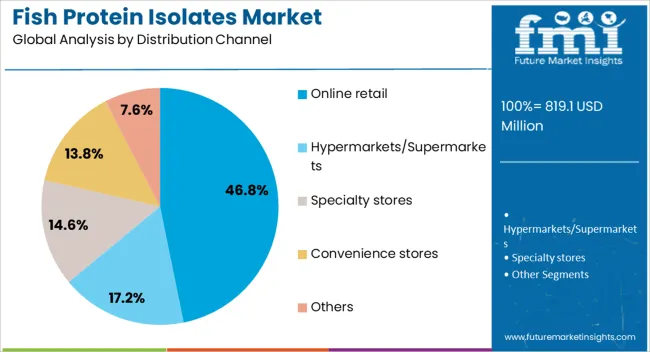

The online retail distribution channel segment is projected to hold 46.8% of the Fish Protein Isolates market revenue in 2025, establishing it as the leading channel. This prominence has been driven by the growing preference of consumers for convenient, direct-to-consumer access to dietary supplements and functional ingredients. The expansion of e-commerce platforms and subscription-based delivery models has enabled fish protein isolates to reach a broader customer base efficiently.

Adoption has been further accelerated by the convenience of comparing products, accessing detailed nutritional information, and purchasing personalized protein formulations online. The growth of this segment has also been supported by increasing awareness of health and wellness trends, which encourages online purchases for specialty dietary products that may not be readily available in traditional retail outlets.

Furthermore, the ability to provide doorstep delivery, flexible order quantities, and product bundles has strengthened consumer trust and loyalty in online channels As digital commerce continues to expand globally and consumers increasingly rely on e-commerce for health and nutrition products, the online retail segment is expected to sustain its leading position in the Fish Protein Isolates market.

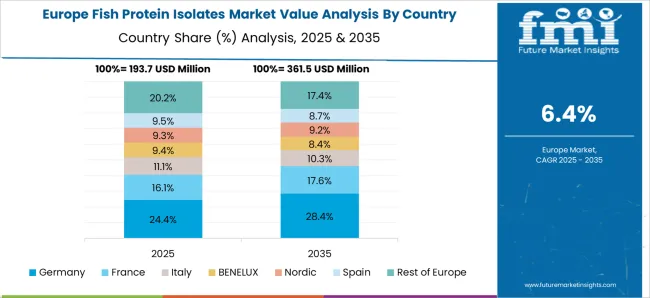

The fish protein isolates (FPI) market is growing due to increasing demand for high-protein, low-fat, and easily digestible ingredients in functional foods, sports nutrition, and aquaculture feeds. North America and Europe lead with high-purity isolates for infant formula, dietary supplements, and clinical nutrition. Asia-Pacific shows rapid growth driven by aquaculture expansion, processed seafood, and rising health-conscious consumption. Manufacturers differentiate through optimized amino acid profiles, solubility, flavor masking, and standardized extraction processes. Regional variations in raw material supply, regulations, and processing technology influence adoption and competitive positioning globally.

Adoption of fish protein isolates depends heavily on extraction techniques and resultant protein purity. North America and Europe prioritize enzymatic hydrolysis and membrane filtration methods to produce high-purity, bioavailable isolates suitable for infant formula, clinical nutrition, and sports supplements. Asia-Pacific markets increasingly adopt cost-effective extraction methods for functional food and aquaculture applications, balancing purity and production scale. Differences in extraction precision affect amino acid profiles, solubility, and allergenicity, directly impacting product performance. Leading suppliers invest in optimized enzymatic processes, filtration technologies, and standardized protocols, while regional manufacturers focus on practical, scalable solutions. Extraction and purity contrasts shape adoption, functional performance, and competitiveness in global fish protein isolate markets.

The amino acid composition, bioavailability, and digestibility of fish protein isolates determine market demand. North America and Europe emphasize high-quality isolates with balanced amino acid profiles, minimal off-flavors, and enhanced digestibility for clinical nutrition and dietary supplements. Asia-Pacific adoption focuses on aquaculture feed enrichment, functional foods, and protein-fortified products with moderate cost considerations. Differences in nutritional quality affect formulation flexibility, health claims, and consumer acceptance. Suppliers providing highly digestible, nutritionally optimized isolates gain premium adoption, while regional producers offer affordable functional alternatives. Nutritional profile contrasts shape adoption, product versatility, and competitive positioning across global fish protein isolate applications.

Regulatory compliance, allergen management, and food safety certifications significantly influence FPI adoption. North America and Europe enforce stringent standards on protein purity, heavy metal content, allergen labeling, and infant formula approvals. Asia-Pacific regulations vary; developed markets adhere to global food safety standards, while emerging markets implement local guidelines emphasizing practical compliance. Differences in regulatory enforcement affect product approval, export potential, and consumer trust. Suppliers providing certified, compliant isolates gain market credibility and higher adoption, while regional manufacturers focus on locally approved, cost-efficient solutions. Regulatory contrasts shape adoption, quality assurance, and market competitiveness in global fish protein isolate markets.

Fish protein isolates are applied across functional foods, beverages, aquaculture feed, dietary supplements, and clinical nutrition. North America and Europe prioritize high-performance isolates with solubility, neutral taste, and stability for infant formula, protein supplements, and specialty foods. Asia-Pacific adoption focuses on feed enhancement, fortified snacks, and beverages balancing functionality with cost. Differences in application versatility and functional properties affect R&D priorities, formulation flexibility, and end-use suitability. Suppliers providing tailored, high-performance isolates gain premium adoption, while regional producers offer multipurpose, affordable options. Functional and application contrasts shape adoption, product differentiation, and growth across global fish protein isolate markets.

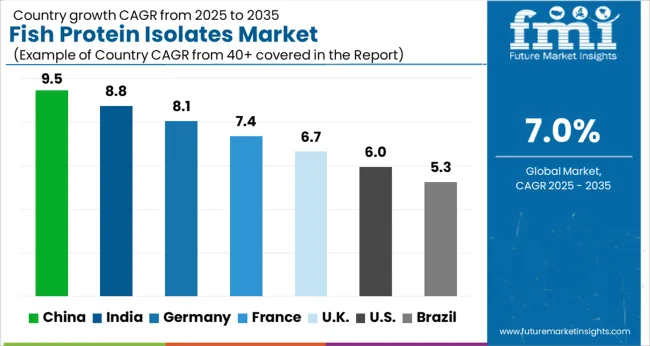

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global fish protein isolates market was projected to grow at a 7.0% CAGR through 2035, driven by demand in food processing, nutritional supplements, and functional ingredient applications. Among BRICS nations, China recorded 9.5% growth as large-scale production and processing facilities were commissioned and compliance with food and safety standards was enforced, while India at 8.8% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 8.1% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 6.7% relied on moderate-scale operations for food and supplement applications. The USA expanding at 6.0%, remained a mature market with steady demand across commercial and functional ingredient segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The fish protein isolates market in China is being driven at a CAGR of 9.5% due to increasing demand from the food, beverage, and nutraceutical sectors. High purity protein powders derived from fish are being adopted to enhance nutritional value in processed foods, supplements, and functional products. Manufacturers are being encouraged to provide high quality, safe, and cost-efficient protein isolates. Distribution through food ingredient suppliers, nutraceutical companies, and e-commerce platforms is being maintained. Government regulations on food safety and protein quality are being followed. Research and development in improved extraction techniques, flavor masking, and solubility is being conducted. Rising consumer awareness of protein benefits, growing health and wellness trends, and increasing demand for sustainable protein sources are being considered key factors driving market growth in China.

Fish protein isolates market in India is being expanded at a CAGR of 8.8% as demand rises in food, beverages, and dietary supplements. Protein isolates extracted from fish are being adopted to improve nutritional content and functional properties of products. Manufacturers are being focused on producing high purity, cost-effective, and safe protein powders. Distribution through ingredient suppliers, supplement manufacturers, and online channels is being ensured. Awareness programs on protein benefits and nutrition are being conducted. Increasing health consciousness, growing processed food consumption, and interest in functional foods are being considered primary drivers of market growth in India.

Fish protein isolates market in Germany is being driven at a CAGR of 8.1% due to strong demand in the food, health, and nutraceutical industries. Protein powders derived from fish are being adopted to enhance nutritional content and functional properties in processed foods and supplements. Manufacturers are being encouraged to provide high quality, flavor-neutral, and safe protein isolates. Distribution through food ingredient suppliers, supplement companies, and authorized distributors is being maintained. Research and development in efficient extraction, flavor masking, and solubility improvement is being conducted. Germany’s focus on health awareness, high protein consumption, and quality standards are being considered major factors supporting adoption of fish protein isolates.

The United Kingdom fish protein isolates market is being expanded at a CAGR of 6.7% as demand for fish protein isolates rises in dietary supplements, functional foods, and beverages. Protein isolates are being adopted to enhance nutritional value and support health-conscious consumption. Manufacturers are being focused on producing safe, high purity, and cost-effective protein powders. Distribution through ingredient suppliers, supplement manufacturers, and online platforms is being ensured. Training programs and awareness campaigns on nutrition and protein benefits are being conducted. Increasing health awareness, functional food consumption, and interest in sustainable protein sources are being considered key factors supporting adoption in the United Kingdom.

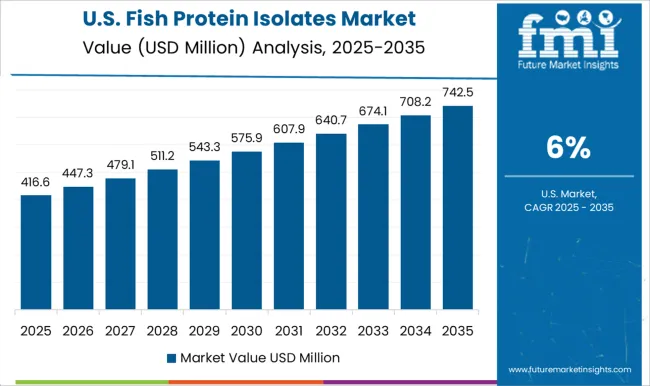

The United States fish protein isolates market is being driven at a CAGR of 6.0% due to growing adoption in food, beverage, and nutraceutical sectors. Protein powders extracted from fish are being adopted to enhance nutritional content and support functional product development. Manufacturers are being encouraged to supply high quality, safe, and flavor-neutral protein isolates. Distribution through food ingredient suppliers, supplement manufacturers, and online platforms is being maintained. Research and development in extraction efficiency, solubility, and taste masking is being conducted. Rising health and wellness awareness, increased protein consumption, and demand for sustainable protein sources are being considered key growth drivers for fish protein isolates in the United States.

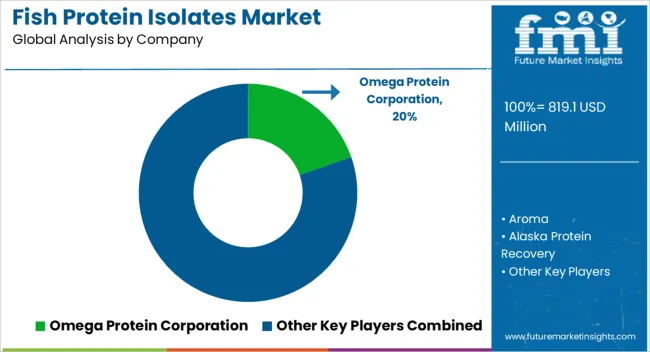

The fish protein isolates market is witnessing steady growth due to increasing consumer demand for high-quality, sustainable, and functional protein sources in food, beverages, nutraceuticals, and animal feed applications. Key suppliers shaping this market include Omega Protein Corporation, Aroma, Alaska Protein Recovery, Bio-marine Ingredients Ireland, Bio-Oregon Protein, Copalis Sea Solutions, Colpex International, Diana Aqua (Symrise), Hofseth BioCare, Janatha Fish Meal & Oil Products, Nutrifish, Scanbio Marine Group, Siam Industries International, Titan Biotech, and TripleNine Group. These companies are engaged in producing highly purified fish proteins with enhanced nutritional properties and minimal environmental impact. The market is driven by innovations in processing technologies that improve protein extraction efficiency, functionality, and solubility while maintaining bioactive compounds. Leading suppliers such as Omega Protein Corporation, Diana Aqua, and Hofseth BioCare are investing in sustainable sourcing of raw materials, including responsibly managed fisheries, to meet global standards and regulatory requirements. Additionally, these suppliers are exploring value-added products tailored for specific applications, including protein-enriched beverages, dietary supplements, and specialty animal nutrition. Strategic partnerships, mergers, and acquisitions are being leveraged to enhance production capabilities, expand geographical reach, and strengthen market presence. Companies are also emphasizing eco-friendly and traceable supply chains, ensuring product quality, transparency, and reduced environmental impact. With rising health awareness, growing demand for high-protein diets, and increased applications in functional foods and nutraceuticals, these suppliers are expected to play a significant role in advancing the fish protein isolates market, delivering innovative and sustainable protein solutions to meet the evolving needs of consumers and industries worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 819.1 Million |

| Form | Powder, Liquid, and Others |

| Application | Food, Beverages, Animal feed, Cosmetic & personal care, Pharmaceuticals, and Others |

| Distribution Channel | Online retail, Hypermarkets/Supermarkets, Specialty stores, Convenience stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Omega Protein Corporation, Aroma, Alaska Protein Recovery, Bio-marine Ingredients Ireland, Bio-Oregon Protein, Copalis Sea Solutions, Colpex International, Diana Aqua (Symrise), Hofseth BioCare, Janatha Fish Meal & Oil Products, Nutrifish, Scanbio Marine Group, Siam Industries International, Titan Biotech, and TripleNine Group |

| Additional Attributes | Dollar sales vary by product type, including concentrates and isolates; by application, such as functional foods, dietary supplements, aquaculture feed, and sports nutrition; by end-use industry, spanning food & beverages, nutraceuticals, and animal feed; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for high-protein diets, clean-label ingredients, and sustainable protein sources. |

The global fish protein isolates market is estimated to be valued at USD 819.1 million in 2025.

The market size for the fish protein isolates market is projected to reach USD 1,611.3 million by 2035.

The fish protein isolates market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in fish protein isolates market are powder, liquid and others.

In terms of application, food segment to command 38.4% share in the fish protein isolates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Sauce Market Growth - Culinary Trends & Industry Demand 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA