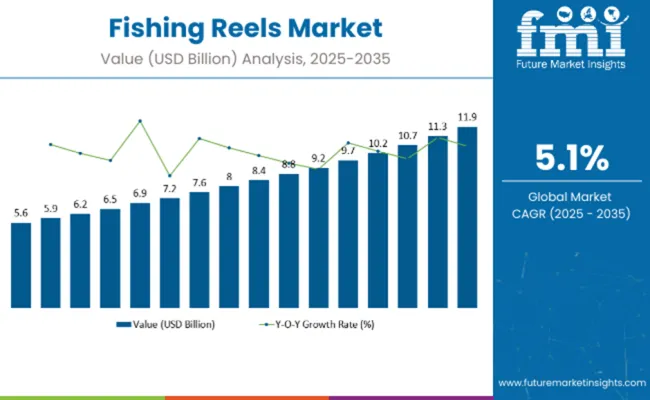

The global fishing reels market is anticipated to experience consistent growth over the forecast period, with its value projected to rise from USD 7.2 billion in 2025 to USD 11.9 billion by 2035, representing a compound annual growth rate (CAGR) of 5.1%.

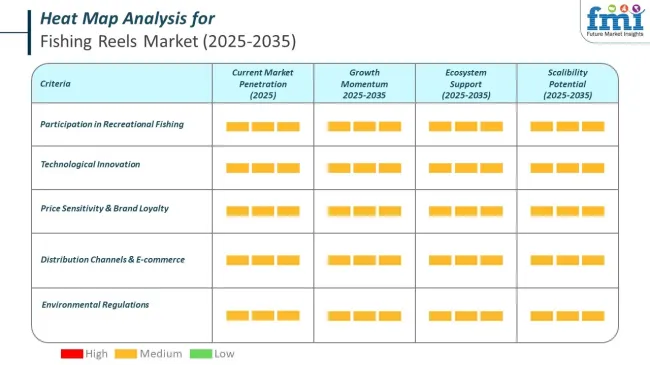

This growth is largely driven by the rising popularity of recreational and sport fishing activities, supported by increasing disposable incomes and the growing emphasis on outdoor leisure and wellness.

The demand for technologically advanced fishing reels offering enhanced performance, precision, and durability has been steadily increasing, as anglers seek equipment that improves their fishing experience across diverse aquatic environments. Lightweight designs and corrosion-resistant materials are being favored, especially in saltwater fishing segments, to ensure long-lasting use and reliability.

Recent developments by leading market participants have played a significant role in shaping the competitive landscape. For example, Shimano North America Fishing launched its Stella SW D spinning reel in January 2025, which incorporates InfinityXross technology to enhance heat resistance and durability under extreme conditions.

This innovation has been well received among professional and recreational anglers alike. Additionally, Daiwa introduced the 2024 Certate LT G spinning reels featuring Magsealed ball bearings and an ultra-light aluminum frame, designed to provide smoother operation and increased sensitivity.

Such advancements reflect the ongoing commitment of manufacturers to integrate cutting-edge technologies and high-quality materials, meeting the evolving expectations of consumers. The expansion of e-commerce platforms has further facilitated product accessibility, broadening market reach globally.

Sustainability concerns have also been increasingly addressed within the fishing reels market. Manufacturers have been focusing on using eco-friendly materials and adopting sustainable manufacturing practices to reduce environmental impact. Efforts to design durable and corrosion-resistant components contribute not only to product longevity but also to responsible fishing practices, which have gained importance among environmentally conscious consumers.

Regionally, North America and Asia-Pacific are expected to dominate market growth due to their substantial base of recreational anglers and favorable economic conditions that support spending on premium fishing gear. As technological innovations continue and consumer preferences evolve towards sustainable, high-performance equipment, the fishing reels market is poised for significant expansion through 2035.

The fishing reels market is increasingly shaped by environmental regulations and safety standards focused on sustainable fisheries and reducing fishing pressure. Governments and international bodies are addressing overfishing, fish stock protection, and safe fishing practices. Key regulations include gear-mesh sizes, engine power limits, and support for sustainable aquaculture. Efforts to reduce fishing subsidies, improve traceability, and enhance vessel safety are also driving market growth.

The fishing reel industry is being quietly transformed by deep materials science, tribology, and smart design—not flashy branding. Hybrid ceramic bearings (Si₃N₄ balls + steel races) cut rolling resistance and resist corrosion but demand pristine fits and lube. Full-ceramics push limits further but are fragile under misalignment. Magnetic braking remains the gold standard simple, effective, and physics-proven while electronic braking adds casting consistency at the cost of weight and service complexity. Saltwater integrity hinges more on IP-rated sealing and grease systems than slogans.

Design innovation also extends to coatings, manufacturing, and smart integration. DLC and PVD coatings improve wear and salt resistance, if applied correctly. Misapplied layers can chip and worsen wear. 3D printing is great for knobs and spacers, not high-load gears unless reinforced polymers with fatigue data are used. Power-assist and telemetry add functionality but introduce new failure modes. Most real-world performance gains come from material selection, sealing, and proper lubrication not digital gimmicks.

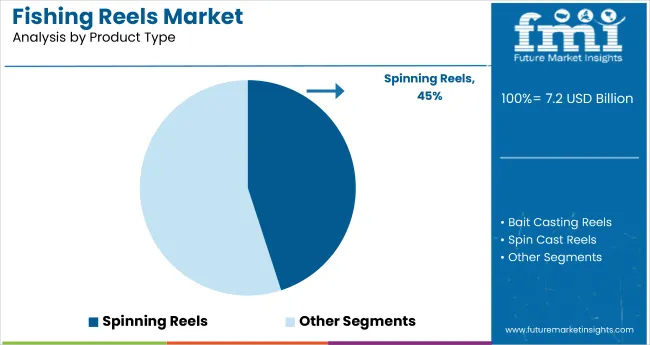

Spinning reels have been recognized as the leading product type in the fishing reels market, accounting for 45% of the market share in 2025. Their widespread adoption is attributed to their versatility and user-friendly design, which appeals to both novice and experienced anglers.

These reels have been designed to offer smooth casting, reduced line tangling, and easy handling, which have been key factors driving their popularity. Industry leaders such as Shimano, Daiwa, and Abu Garcia have been instrumental in innovating spinning reel technology by incorporating corrosion-resistant materials, improved drag systems, and ergonomic handles.

Their products have been used extensively in both freshwater and saltwater fishing applications, enhancing overall angling experiences. Companies like Penn and Okuma have contributed by promoting spinning reels through sponsorships and targeted marketing campaigns, further expanding consumer reach.

The growing trend of recreational fishing and increased outdoor leisure activities globally have supported the sustained demand for spinning reels. Consequently, spinning reels continue to receive significant investment focus for product development and market expansion in the fishing reels industry.

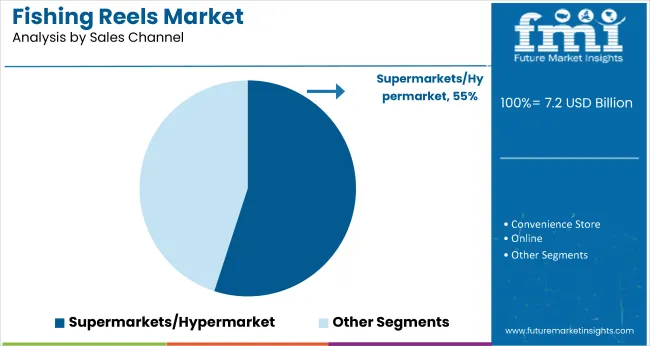

Fishing reels are often sold mainly through hypermarkets and supermarkets. These large retail stores attract a wide and diverse group of customers, including casual buyers and hobbyists who might not visit specialized fishing shops. Hypermarkets provide convenience by allowing customers to buy fishing gear alongside their everyday shopping, which encourages impulse purchases.

They also have plenty of shelf space to offer a wide range of fishing reels, from affordable options to high-end models, catering to different skill levels and preferences. Additionally, hypermarkets benefit from strong supply chains that help keep prices competitive and allow frequent promotions that appeal to budget-conscious shoppers.

The high foot traffic in these stores increases brand visibility and helps manufacturers reach more customers. Finally, the accessibility and longer opening hours of hypermarkets make them a convenient choice for people looking to buy fishing equipment, which is why fishing reels are often sold through these channels. This segment accounts for 55% of the market share.

One of the significant challenges in the fishing rolls request is the proliferation of fake products. Numerous low- quality clones of decoration fishing rolls are available at lower prices, which not only impacts the profit of licit brands but also affects consumer trust in the assiduity. Companies must strengthen therians-counterfeiting measures, similar as incorporating unique periodical canons and authentication technology, to combat this issue.

Environmental enterprises regarding fishing gear pollution also pose a challenge. Lost or discarded fishing rolls and lines contribute to marine debris, harming submarine ecosystems. As sustainability becomes a precedence, manufacturers must invest in biodegradable accoutrements and recyclable factors. Compliance with strict environmental regulations, especially in regions with strict conservation laws, adds to the complexity of product and distribution.

The adding mindfulness of sustainable fishing practices presents a substantial occasion for request players. Consumers are laboriously seeking Eco-friendly rolls made from recycled or biodegradable accoutrements. Companies that prioritize sustainable product, ethical sourcing, and an eco-conscious packaging will gain a competitive edge in the request.

Also, the integration of smart technology in fishing rolls offers a economic growth avenue. Features similar as digital displays, GPS shadowing, and automated drag systems are revolutionizing the fishing experience, attracting tech- expertise grillers.

With the rise of smart out-of-door gear, companies that introduce in this space can tap into a new member of fishing suckers looking for advanced, data- driven fishing results. Likewise, expanding online retail channels and direct- to- consumer deals models can enhance brand visibility and availability, enabling manufacturers to reach a broader followership encyclopaedically.

| Country | Population (millions) |

|---|---|

| United States | 345.4 |

| China | 1,419.3 |

| Japan | 123.3 |

| Australia | 26.4 |

| Canada | 40.3 |

| Country | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 27.40 |

| China | 18.90 |

| Japan | 32.60 |

| Australia | 40.20 |

| Canada | 30.10 |

The USA fishing rolls request thrives due to recreational and competitive fishing culture. With abundant lakes, gutters, and places, the demand for high- quality rolls is strong. Brands like Shimano, Daiwa, and Penn dominate the request, offering advanced rolls for freshwater and saltwater fishing. The rise of e-commerce has further boosted availability and product variety.

China, with its vast consumer base, gests stable demand for fishing rolls, driven by both recreational and marketable fishing. Domestic brands give affordable options, while ultra-expensive transnational brands feed to suckers. Online retail platforms like JD.com and Alibaba play a crucial part in request expansion.

Japan has a mature fishing rolls request, known for its high- end, technologically advanced rolls. Domestic manufacturers like Shimano and Daiwa lead invention with perfection engineering. Fishing is a popular recreational exertion, and demand for feather light, durable rolls remains strong.

Australia’s fishing rolls request benefits from a strong fishing culture, supported by abundant marine and brackish fishing locales. High per capita spending reflects consumer preference for decoration- quality rolls. Saltwater fishing is particularly popular, driving demand for erosion- resistant models.

Canada’s request is driven by its expansive brackish fishing openings. Ice fishing rolls, bait casting rolls, and spinning rolls see strong demand. Sustainability-conscious buyers prefer durable, long- lasting rolls, boosting decoration member growth

The sport fishing reel market is growing steadily with growing sport fishing activity, higher demand for high-quality reels, and innovations in the technology of fishing gear. Trends and industry influences identified by 250 sport anglers, professional anglers, and owners of outdoor stores trend towards significant key areas.

Reeling reels are still the best option, and 63% of the interviewees picked them because they are convenient and universal, especially for beginners and leisure anglers. On the other hand, 41% of professional fishermen use bait casting reels because they are precise and responsive, especially for catching large fish species.

Material innovation also matters as 58% of the customers seek light yet robust reels made from aluminium or carbon fibre to be more performing and strong. Furthermore, 39% of the customers seek coatings that are saltwater-resistant, reflecting greater demand by beach and deep-sea anglers for corrosion-resistance reels.

Smart reels and digitalization are also not behind, with 29% of the survey participants willing to possess digital braking reels with Bluetooth capabilities and adjustable drag in real-time for better fishing. The vintage reel is still the winner, however, as 54% of the anglers prefer mechanical simplicity to technology.

Price and brand awareness are the two that call the shots on the purchasing decision, with 47% paying top dollar for the best brands such as Shimano, Daiwa, and Penn, 35% getting the middle option on price without compromising on quality, and 18% of the buyers using the starter reels for occasional fishing.

Specialty shops and the internet are prime selling points, with 66% of fishers purchasing fishing reels in the store or online to access more options and discounted prices, and 34% purchasing in the store to try equipment prior to purchase. Subscription plans for equipment and individual reel assembly are new among avid anglers.

With increased popularity for sport fishing, manufacturers and retailers are able to capitalize on demand by providing modern, high-performance reels with increased strength, intelligent features, and ergonomics for different fishing applications.

The USA fishing rolls request is witnessing steady growth, driven by adding recreational fishing participation, rising demand for technologically advanced rolls, and expanding e-commerce deals. Major players include Shimano, Penn, and Daiwa.

Market Growth Factors

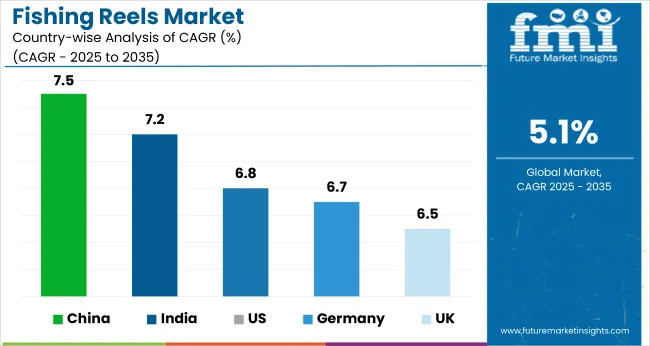

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

The UK fumbling rolls request is expanding due to the rising trend of freshwater and saltwater fishing, adding investments in decoration fishing outfit, and strong consumer preference for eco-friendly gear. Leading brands include Hardy, Okuma, and Abu Garcia.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

Germany’s fishing reels market is growing, with consumers prioritizing durability, versatility, and eco-friendly manufacturing. Key players include DAM, WFT, and Zebco Europe.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.7% |

India’s fishing rolls request is witnessing rapid-fire growth, fueled by adding interest in recreational fishing, expanding littoral tourism, and the affordability of locally manufactured fishing gear. Major brands include Rapala, Shimano, and SureCatch

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

China’s fishing rolls request is expanding significantly, driven by rising disposable inflows, adding fishing culture, and rapid-fire advancements in roll technology. crucial players include Haibo, RYOBI China, and KastKing.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.5% |

Market for fishing reels is expanding with increasing recreational fishing, customer demand for angling as a sport, and innovation in reel design. Brand loyalists among makers focus on lightweight but tough materials and precise engineering to offer better user experience.

Players focus on brand name, product innovation, and sponsorship of professional tournament fishing to gain stronger market presence. Increased popularity of e-commerce and direct-to-consumer business also drives market growth.

Shimano (20-25%)

Shimano dominates the fishing reels industry with high-end and long-lasting designs. It invests in innovative braking systems and wear-resistant materials. Growth in emerging markets and online sales enhances its international market share.

Daiwa (15 to 20%)

Daiwa invests in technological innovation, especially with its Magsealed bearings and light-weight reel designs. The company strengthens its distribution network, both targeting professional anglers and recreational anglers.

Abu Garcia (10-14%)

Abu Garcia pushes deeper into the baitcasting reel category with emphasis on precision engineering and streamlined construction. Abu Garcia spends on advancing digital brake control technology and intensifying relationships with pro anglers.

Penn Fishing (8-12%)

Penn Fishing has a hold on the saltwater fishing reel category, building on the image of the brand as strong and long-lasting. Penn Fishing spends on corrosion-resistance technologies and building product lines for deep-sea anglers

Okuma Fishing (6-10%)

Okuma gains traction in the budget-friendly and mid-range fishing roll request. The brand focuses on invention in drag systems and feather light construction to feed to both casual and professional grillers.

Other Key Players (30-40% Combined)

Several smaller and emerging brands contribute to market diversity, emphasizing specialized fishing reels, affordability, and sustainability. Notable brands include:

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 7.2 billion |

| Projected Market Size (2035) | USD 11.9 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and units for volume (where applicable) |

| Product Type Segments Analyzed (Segment 1) | Spinning Reels, Bait Casting Reels, Spin Cast Reels, Fly Reels, Trolling Reels, Others |

| Material Segments Analyzed (Segment 2) | Aluminium, Graphite, Stainless Steel, Others |

| Sales Channel Segments Analyzed (Segment 3) | Supermarkets/Hypermarkets, Specialty Stores, Online, Sporting Goods Stores, Others |

| End-User Segments Analyzed (Segment 4) | Recreational Fishing, Professional Fishing, Commercial Fishing |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia & New Zealand (ANZ), GCC countries, South Africa |

| Key Players influencing the Fishing Reels Market | Shimano, Daiwa, Abu Garcia, Penn Fishing, Okuma Fishing, Lew's, Pflueger, 13 Fishing, Quantum, Mitchell |

| Additional Attributes | Dollar sales by product type and material, Trends in recreational and professional fishing, Growing demand for durable and lightweight reels, E-commerce sales growth, Regional fishing culture impact, Competitive landscape and innovation trends |

Spinning Reels, Bait casting Reels, Spin cast Reels, Fly Reels, Trolling Reels, and Others.

Aluminium, Graphite, Stainless Steel, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Sporting Goods Stores, and Others.

Recreational Fishing, Professional Fishing, and Commercial Fishing.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Fishing Reels industry is projected to witness a CAGR of 5.1% between 2025 and 2035.

The Fishing Reels industry stand at USD 7.2 billion in 2025.

The Fishing Reels industry is anticipated to reach USD 11.9 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 6.2% in the assessment period.

The key players operating in the Fishing Reels industry include Shimano Inc., Daiwa Corporation, Pure Fishing Inc., Okuma Fishing Tackle Co. Ltd., Abu Garcia, and Penn Fishing.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Fishing Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Fishing Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Fishing Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Fishing Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Fishing Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Fishing Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Fishing Type, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Fishing Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Fishing Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Fishing Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Fishing Type, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Fishing Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Fishing Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Fishing Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Fishing Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Fishing Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Fishing Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Fishing Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Fishing Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Fishing Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Fishing Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Fishing Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Fishing Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Fishing Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Fishing Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Fishing Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Fishing Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Fishing Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Fishing Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Fishing Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Fishing Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Fishing Type, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Fishing Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Fishing Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Fishing Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Fishing Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Fishing Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Fishing Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Fishing Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Fishing Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Fishing Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Fishing Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Fishing Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Fishing Type, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Fishing Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Fishing Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Fishing Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Fishing Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Fishing Reels Manufacturers

Examining Market Share Trends in the Fishing Tourism Industry

Fishing Bag Market Growth – Trends, Demand & Forecast 2025-2035

Fishing Tourism Market Trends - Growth & Forecast 2025 to 2035

Aluminium Fishing Boat Market Size and Share Forecast Outlook 2025 to 2035

Graphene Coated Fishing Gear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA