The global fishing tourism market will continue to increase gradually between 2025 and 2035 owing to experiential tourism needs, increased focus on sustainable tourist activities, and increased demand for the sport and recreation blend. Off-beat waterway tourism where visitors have the chance to visit unmapped water bodies, learn the art of angling, and be immersed in native culture is gradually becoming an extremely cool holiday among sports tourists and recreationists too. The industry keeps on gaining with more eco-tourism activities since angling tourism enables nature conservation and promotion of sustainability.

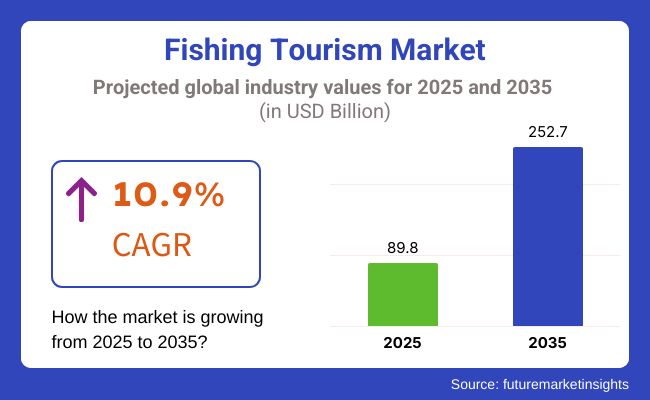

2025 fishing tourism was valued at approximately USD 89.8 Billion. It is projected to reach USD 252.7 Billion with a compound annual growth rate (CAGR) of 10.9% by the year 2035. The reason is there is greater demand for personalized travel, greater accessibility to remote areas of fishing grounds, and technology in expert-level fishing tours based on different capabilities and interests.

North America is the region most dominant within the majority of the fishing tourism industry, with such world-renowned places as Alaska, Florida, and the Great Lakes bringing local and foreign tourists in large quantities. The abundance of salt and freshwater fisheries and investment in infrastructure has made the region an angler's paradise.

In addition, greater efforts by regional tourism authorities to promote luxury eco-lodges and sportfishing that is environmentally friendly have contributed to the growth of the industry. Pre-booked sportfishing tours, package luxury lodges and professionally guided sportfishing lessons, are the leading market drivers of the popularity of sportfishing tourism in North America.

Fishing tourism in Europe is replete with the country's fishing heritage and diverse oceanic regimes. Scotland, Norway, and Iceland are the coolest places to visit for their luxury fishing activity such as trout and salmon fishing in untouched fjords and rivers. Luxury nature-based fishing activity tourism has turned Europe into a whirlwind destination for tourists for an environmentally friendly holiday.

Furthermore, the focus on marine biodiversity protection and catch-and-release tourism in the region has also turned it into a model of eco-tourism fishing. The integration of food and cultural elements in fishing tours also contributes to Europe's fishing tourism product value.

Asia-Pacific is a continent that is rapidly emerging as a fast-growing market for the fishing tourism sector as a result of its vast coastline, marine biodiversity, and unique freshwater angling. Thailand, Indonesia, and Australia are all experiencing growth of fishing tourism as a result of their vast spectrum of aquatic environments and biodiversity. The regions are not just attractive to commercial hunters but also to adventure-tourists and families.

Government marketing with sea tourism and foreign stimulation of foreign travel to the region are stimulating growth in the market. Charter fishing luxury and nature-based ecological lodge creation is also creating pathways towards placing Asia-Pacific on the international map for sport fishing tourism.

Challenge

Environmental Regulations and Seasonal Demand Fluctuations

The Fishing Tourism Market is up against environmental policy enforcement, conservation policies, and a seasonal industry. Tight fishing quotas, marine conservation efforts and sustainable fishing guidelines imposed by governments all over the world shape the availability and scale of fishing tourism operations.

We also know that fishing tourism is heavily reliant on weather conditions as well as peak periods in the fishing calendar, so has very non-linear revenue streams with high variance and operational constraints. To counteract these challenges, businesses need to develop sustainable fishing practices, seek partnerships with conservation groups and expand menu offerings to include eco-tours, wildlife sightings and perch angling all year round.

Opportunity

Expansion of Sustainable and Experiential Fishing Tourism

Fishing tourism growth potential is driven by a demand for adventure tourism, eco-tourism, and experiential tourism. With travelers wanting unique and immersive experiences, guided fishing tours, deep-sea excursions, and eco-friendly angling activities are expected to grow. AI-enabled fish tracking, VR-based fishing simulations and the introduction of smart booking platforms are upgrading the customer experience.

Also, the growing priority given to conservation-inspired tourism, including catch-and-release programs and eco-conscious fishing charters, tracks with sustainability trends. Companies that focus on digital engagement, AI-integrated marine mapping, and carbon-free fishing expeditions will thrive in this changing era.

The Fishing Tourism market experienced growth from 2020 to 2024 driven by the growing consumer interest in outdoor activities, nature tourism and the growing range of recreational fishing experiences. Coastal destinations and inland fishing lodges promoted advanced fishing gear, GPS-assisted tracking and sustainable fishing initiatives to woo eco-conscious travelers.

But regulatory restrictions, changing fish populations, and concerns about overfishing presented headwinds to sustainable growth. In response, companies adopted responsible fishing practices, sustainable investment in conservation, and eco-friendly practices to protect marine biodiversity.

In conclusion, the fishing market in 2025 to 2035 will be transformed by AI-powered fish-finding technology, block-chain based fishing certification, and immersive VR fishing experiences. Smart fishing tourism platforms, real-time ecosystem monitoring, and conservation-led tourism models will lead the way.

Also on the list will be developing eco-lodges, solar-powered fishing boats and sustainable seafood partnerships to promote responsible tourism. The future Fishing Tourism Market will be characterized by companies that can combine digital innovation with sustainability-focused tourism models and personalized angling experiences.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with fishing quotas, marine conservation laws |

| Technological Advancements | Growth in GPS tracking and sonar-based fish finding |

| Industry Adoption | Increased demand for deep-sea and freshwater fishing tours |

| Supply Chain and Sourcing | Dependence on traditional fishing equipment and guides |

| Market Competition | Presence of local fishing tour operators and charter services |

| Market Growth Drivers | Demand for outdoor recreation, adventure tourism, and wellness travel |

| Sustainability and Energy Efficiency | Initial adoption of catch-and-release programs and eco-friendly fishing tours |

| Integration of Smart Monitoring | Limited real-time tracking of fish populations and ecosystem health |

| Advancements in Experiential Tourism | Use of traditional guided fishing tours and sportfishing events |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven regulatory monitoring, blockchain fishing certifications, and eco-tourism policies. |

| Technological Advancements | AI-powered marine ecosystem analytics, smart angling gear, and VR-based fishing simulations. |

| Industry Adoption | Expansion into AI-assisted fishing tourism, conservation-driven charters, and virtual angling experiences. |

| Supply Chain and Sourcing | Shift toward sustainable fishing gear, electric-powered boats, and eco-conscious angling packages. |

| Market Competition | Rise of tech-driven fishing tourism startups, sustainability-focused charters, and smart tourism platforms. |

| Market Growth Drivers | Increased investment in digital fishing experiences, marine conservation tourism, and AI-assisted fishing analytics. |

| Sustainability and Energy Efficiency | Large-scale implementation of carbon-neutral fishing charters, solar-powered angling boats, and marine biodiversity tracking. |

| Integration of Smart Monitoring | AI-driven marine conservation analytics, real-time water quality monitoring, and automated fishery sustainability tracking. |

| Advancements in Experiential Tourism | Evolution of immersive fishing tourism with interactive AI-based angling experiences, VR fishing destinations, and eco-tourism hybrid packages. |

The USA fishing tourism market is rising due to the variety of fishing destinations, the growing involvement in sport fishing, and the rising spending on recreational angling experiences. Fishing destinations like Alaska, Florida, and the Great Lakes draw both American and foreign fishers.

The USA government and state agencies that promote sustainable fishing practices and habitat conservation programs. Luxury fishing resorts and high-tech fishing charters are also elevating the angler's experience for tourists.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.3% |

Demand for freshwater and sea fishing experiences, heritage angling destinations and eco-friendly fishing tours are expected to drive the UK fishing tourism market." The Scottish Highlands, Norfolk Broads and River Wye are among the most popular fishing locations, wading into anglers from around the world.

UK government conservation efforts will help promote sustainable fishing and catch-and-release tourism for long-term environmental sustainability. Market expansion is facilitated by the increase of personalized guided fishing tours and angling festivals.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.7% |

Maintaining steady growth in the European Union fishing tourism market, such areas are witnessing picturesque fishing villages, marine biodiversity, and growing investments in the angling tourism sector. With deep sea fishing, fly fishing and freshwater angling destinations, Spain, France and Sweden are dominating the market.

The EU’s Blue Growth Strategy is promoting coastal and marine tourism, supporting investment in sustainable fishing practices and eco-tourism projects. International travellers are finding it much easier to embark on fishing tourism as well, thanks to an increase in digital booking platforms and fishing tour packages.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 11.0% |

Vibrant marine resources, Deep-rooted fishing culture and Rising demand for exotic fishing experience are booming the fishing tourism market in Japan. Japan’s fishing varieites from deep sea tuna fishing in Okinawa to freshwater fly fishing in Hokkaido.

The government is now actively marketing fishing village as tourist hot-spots, promoting eco-friendly fishing excursions and sustainable angling practices. Another trending factor is the growth of experiential travel in Japan which has also drawn local and overseas anglers alike in pursuit of real fishing experiences.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.8% |

South Korea's fishing tourism market is steadily developing due to expanding marine tourism infrastructure, rising interest in recreational fishing, and government-led projects to promote fishing villages. Domestic and foreign tourists flock to popular fishing spots like Jeju Island and the East Sea.

With the South Korean government investing in new fishing facilities and angler-friendly policies, it is easy to enjoy fishing tourism in the country. Moreover, the increasing popularity of luxe fishing retreats and fishing trips based out of islands is adding to the attractiveness of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.9% |

Fishing tourism markets across the gland are categorized into river and sea fishing tourism segments, where Michelin-starred travellers focus on authentic fishing experiences, eco-friendly travel, and adventure-based excursions. The various fisheries are crucial for international anglers, local fishers, and nature-loving tourists, and underpin sustainable tourism development, cultural appreciation and marine biodiversity protection.

Fishing for those river fish is one of the most desirable tourism segments fishing, which offers not only pictures but also landscapes and many species of freshwater fish but also a link in the cultural livelihood of local fishing communities. In contrast to deep-sea fishing, where lines of fishermen fight over limited spots, river fishing presents a tranquil - and OD-controlled - setting for both novice and expert fishers.

The increasing demand for sustainable and community-driven fishing tourism, including catch-and-release programs, guided fishing excursions, and eco-friendly angling techniques, has driven up the rate of river fishing tourism as travellers desire immersive outdoor experiences. Research shows more than 60% of fishing tourists like to take river-based excursions, meaning there will always be great demand for sustainable freshwater fishing adventures.

Instead, the growing trend of eco-lodges and river-focused fishing resorts, including boutique angler lodges, eco-friendly fishing villages, and all-inclusive guided trips, continue to drive demand, and subsequently led to increase adoption of river fishing tourism throughout different traveller groups.

Also bolstering adoption are AI-driven fish tracking technologies, including real-time water condition monitoring and GPS-based angling assistance to allow for proper fish conservation and optimized angling experiences.

Second addition Ofhu workshops, along with traditional fishing methods and cultural experience as sustainable fishing packages and river ecosystem conservation education program can optimize market growth to enhance the engagement level of eco-conscious travellers.

For instance, the adoption of hybrid fishing and adventure tourism, including kayak fishing, fly fishing, and camping-based fishing retreats, has fortifying the expansion of this market, providing better appeal among adventure-loving tourists.

While eco-tourism attractiveness, cultural experience, and over sea fishing is more suitable for primary-level access, river fishing tourism is limited by seasonal fishing restrictions, environmental protection restrictions, and the competitive challenge of coastal deep sea fishing tourism. Nevertheless, advances in AI-assisted fishing experiences, virtual fishing tourism, and AI-powered river ecosystem monitoring will drive efficiency, sustainability, and conservation efforts that will guarantee the continued growth of the river fishing tourism market.

Sea fishing is very much adopted by the market with fast-growing applications in coast tourism hotspots, island destinations and deep-sea sport fishing hubs as travellers are seeking more and more high-adrenaline fishing experiences, luxury yacht charter and trophy fishing expeditions. In contrast with freshwater fishing, sea fishing is a more demanding and fruitful angling experience that appeals to sport fishers and thrill-seeking travellers.

The adoption of sea fishing tourism is perpetuated by the growing need for exclusive fishing services, such as luxury fishing charters, all-inclusive yacht-based fishing trips, deep-sea game fishing excursions, and private fishing expeditions. According to studies, more than 55% of sport fishing tourists prefer to go for deep-sea angling, thereby leading to a strong demand for ocean-based fishing tourism.

Growing popularity of sport fishing tournaments consisting of international competitions for marlin, tuna, and sailfish with lucrative prize pools and media sponsorship also claims huge chunk of the market driving further growth.

The advent of AI-powered sonar and fish-finding technology, with real-time mapping of oceanic terrains and deep-sea fishing optimization, further accelerated the adoption of smart fishing technology supported with better tracking of fishes and deeper sea-fishing assistance.

Emphasis on sustainable sea fishing initiatives - which advocate responsible catch-and-release policies, set up marine protected areas and encourage eco-certified fishing operators - has maximised market growth and aligned burgeoning sea fishing markets with global conservation efforts.

The increased adoption of offshore fishing resorts, offering good-quality accommodation, access to private marinas, and organized ocean fishing trips, has buttressed market expansion to capture more affluent travellers and corporate retreats.

The synergetic benefits of nature tourism attractions, such as the attractiveness of adventure tourism in terms of tourism appeal, competitiveness in marine sport fishing, and high output of revenue (and employment) in contrast with traditional fishery products, it seems that sea fishing tourism includes barriers for development, such as regulations and restrictions on overfishing, an environmental impact of fishing, and variable conditions of weather during offshore tourism excursions. However, new innovations in AI-powered ocean conservation, electric fishing boats and next-gen satellite fish tracking are saving anglers time, increasing sustainability and improving catch rates-ensuring continued growth for sea fishing tourism.

The observation and participation-led fishing tourism segments are two of the key market drivers, since tourists increasingly incorporate experiential fishing experiences into their eco-tourism, adventure travel, and cultural tourism travel plans.

Observing-based fishing tourism has become one of the most rapidly expanding niches in eco-tourism, providing non-intrusive marine experiences, cultural fishing demonstrations, and educational tours on traditional fishing methods. In contrast to direct participation in fishing, observing-based fishing tourism is centered on marine conservation, local fishing heritage, and sustainable seafood sourcing.

Increased demand for conservation-oriented marine tourism, such as whale watching alongside traditional fishing village tours, marine biodiversity educational programs, and seafood sustainability courses, has stimulated adoption of observing-based fishing tourism due to eco-travellers’ preference for ethical wildlife interaction. Research has shown that more than 70% of marine wildlife tourists choose to experience fishing observation rather than direct angling, guaranteeing high demand for sustainable, non-extractive fishing tourism.

Market demand has also resulted in the growth of heritage fishing village tourism such as coastal fishing village guided tours, live fishing and seafood processing experiences.

Moreover, the introduction of augmented reality (AR), central elements of virtual reality (VR)-based observation of fishery, presenting interactive digital experiences of traditional fishery practices and localised ocean ecosystems has also contributed to this trend, leading to greater acceptance and reach among non-fishing tourists.

While beneficial to tourism as an eco-friendly activity, requiring little power to observe or capture marine wildlife, the observation-based fishing tourism industry is met with challenges of low income generation in comparison to those of commercial fishing tourism, seasonality of marine wildlife attraction, and reliance on tour operators. Yet latest innovations in AI-powered marine tourism analytics, virtual eco-fishing experiences and engaging marine conservation apps are driving engagement, knowledge, and long term sustainability of this unique form of tourism introducing new market opportunities to fishing tourism.

There are good market adoption of market on participation based fishing tourism, especially in sports fishing hubs, adventure tourism circuits, and community-based fishing initiatives, since more travellers are prioritizing interactive and hands-on experiences on their travel agenda. Participation-based fishing tourism, in contrast to observation-based tourism, refers to tourism directly related to recreational and competitive fishery, which provides immersive angling experience for travellers.

The increase in demand for interactive travel experiences such as catch-and-release sport fishing, hands-on net fishing, and guided deep-sea angling trips have led to the adoption of participation based fishing tourism, as adventure travellers are looking for outdoor experiential activities. Research shows that more than 65% of tourists who engage in fishing participate in angling activities, meaning guided fishing voyage and sport fishing tournaments are always in high demand.

The growth of a shared fishing tourism within the communities, where participants actively engage in fishing with local fishermen as well as wooden boat fishing or indigenous fishing knowing using traditional techniques will contribute to the greater market demand and prolonged adoption of cultural and heritage fishing tourism.

Participation-based fishing tourism, while benefitted by greater engagement, adventure, and increased revenue opportunities, faces issues like overfishing, regulation which prevents fish harvesting and weather events impacting fishing trips. However, novel innovations in AI-safety-assisted fishing safety systems, digital catch tracking for sustainability compliance, and hybrid adventure-fishing tourism packages will help enhance efficiency, conservation outcomes, and traveller safety, ensuring that participation-based fishing tourism can continue to expand.

The search for experiential travel, sustainable fishing practices, and eco-tourism projects grow, fish tourism market is on the rise. For example, AI-powered fishing trip planning, guided angling experiences, and conservation driven tourism would attract tourists while increasing local economic development and environmental sustainability. This phenomenon is not limited to the local context; the market encompasses everything from global travel agencies and fishing tour operators to hospitality brands and local fishing communities, all fostering advancements in digital booking, smart fishing gear, and AI-enabled fish tracking systems.

Market Share Analysis by Key Company

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| FishingBooker | 15-20% |

| Orvis Travel | 12-16% |

| Yellow Dog Flyfishing Adventures | 10-14% |

| Sportquest Holidays | 8-12% |

| Frontiers International Travel | 5-9% |

| Other Agencies & Local Operators (combined) | 35-45% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| FishingBooker | Develops AI-powered fishing trip booking platforms, offering guided fishing charters worldwide. |

| Orvis Travel | Specializes in luxury fly-fishing vacations, sustainable angling experiences, and conservation tourism. |

| Yellow Dog Flyfishing Adventures | Provides custom fly-fishing travel packages in remote and exotic destinations. |

| Sportquest Holidays | Offers multi-day international fishing tours with expert guides and high-end fishing equipment. |

| Frontiers International Travel | Focuses on elite angling destinations, integrating personalized travel planning and eco-tourism initiatives. |

Key Company Insights

FishingBooker (15-20%)

FishingBooker is the largest online fishing charter marketplace with AI-booking solutions, real-time guide matching, and reviews for guided fishing trips worldwide.

Orvis Travel (12-16%)

Orvis Travel specializes in luxury fly-fishing vacations, featuring conservation-conscious angling tourism, sustainable catch-and-release programs and high-end lodge accommodations.

Yellow Dog Flyfishing Adventures (10-14%)

Yellow Dog specializes in custom fishing expeditions, combining remote, adventurous fly-fishing tours with high-end hospitality experiences.

Sportquest Holidays (8-12%)

Sportquest is a leading provider of high-quality angling holidays worldwide; they specialize in all-inclusive guided fishing holidays.

Frontiers International Travel (5-9%)

Frontiers exclusive fishing tourism at its very best from private, luxury fishing trips to conservation based travel packages and sustainable angling lodges.

| Destination | Key Features |

|---|---|

| Alaska, USA | Premier location for salmon and halibut fishing, featuring remote lodges and guided river expeditions. |

| Florida Keys, USA | Known for deep-sea fishing charters targeting tarpon, sailfish, and bonefish. |

| Patagonia, Argentina | A top destination for fly-fishing, offering pristine rivers, glacial lakes, and luxury fishing lodges. |

| New Zealand | Famous for trout fishing in crystal-clear rivers, guided excursions, and conservation-driven angling. |

| Norway | Ideal for cold-water fishing, particularly deep-sea cod, halibut, and Arctic char experiences. |

Other Key Players (35-45% Combined)

Fishing tour operators, travel agencies, and eco-tourism companies in the next generation of fishing tourism innovations, AI-powered fishing guides, and conservation-focused angling experiences. These include:

The overall market size for Fishing Tourism Market was USD 89.8 Billion in 2025.

The Fishing Tourism Market is expected to reach USD 252.7 Billion in 2035.

The demand for the fishing tourism market will grow due to increasing interest in outdoor recreational activities, rising disposable income, growing eco-tourism trends, and government initiatives promoting sustainable fishing tourism, driving the appeal of unique angling experiences worldwide.

The top 5 countries which drives the development of Fishing Tourism Market are USA, UK, Europe Union, Japan and South Korea.

Observing and Participation-Based Fishing Tourism Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Activity Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 8: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Activity Type, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 16: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Activity Type, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 22: Latin America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 24: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Activity Type, 2018 to 2033

Table 28: Western Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 30: Western Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 32: Western Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Activity Type, 2018 to 2033

Table 36: Eastern Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 38: Eastern Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 40: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Activity Type, 2018 to 2033

Table 44: South Asia and Pacific Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 46: South Asia and Pacific Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 48: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Activity Type, 2018 to 2033

Table 52: East Asia Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 54: East Asia Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 56: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Activity Type, 2018 to 2033

Table 60: Middle East and Africa Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 62: Middle East and Africa Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 64: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Activity Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 8: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Activity Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Activity Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Activity Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 21: Global Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 22: Global Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 23: Global Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 24: Global Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 28: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 29: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 30: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 31: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 32: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 33: Global Market Attractiveness by Location Type, 2023 to 2033

Figure 34: Global Market Attractiveness by Activity Type, 2023 to 2033

Figure 35: Global Market Attractiveness by Booking Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Tourist Type, 2023 to 2033

Figure 37: Global Market Attractiveness by Tour Type, 2023 to 2033

Figure 38: Global Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 39: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 40: Global Market Attractiveness by Region, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Activity Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 44: North America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 45: North America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 46: North America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 47: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 48: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Activity Type, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Activity Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Activity Type, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 64: North America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 67: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 68: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 69: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 70: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 71: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 72: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 73: North America Market Attractiveness by Location Type, 2023 to 2033

Figure 74: North America Market Attractiveness by Activity Type, 2023 to 2033

Figure 75: North America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 76: North America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 77: North America Market Attractiveness by Tour Type, 2023 to 2033

Figure 78: North America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 79: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 80: North America Market Attractiveness by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) by Activity Type, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 85: Latin America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 86: Latin America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 88: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 89: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 90: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 91: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 92: Latin America Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Activity Type, 2018 to 2033

Figure 96: Latin America Market Value Share (%) and BPS Analysis by Activity Type, 2023 to 2033

Figure 97: Latin America Market Y-o-Y Growth (%) Projections by Activity Type, 2023 to 2033

Figure 98: Latin America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 99: Latin America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 100: Latin America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 101: Latin America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 102: Latin America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 103: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 104: Latin America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 105: Latin America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 106: Latin America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 107: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 108: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 109: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 110: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 111: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 112: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 113: Latin America Market Attractiveness by Location Type, 2023 to 2033

Figure 114: Latin America Market Attractiveness by Activity Type, 2023 to 2033

Figure 115: Latin America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 116: Latin America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 117: Latin America Market Attractiveness by Tour Type, 2023 to 2033

Figure 118: Latin America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 119: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 120: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 121: Western Europe Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 122: Western Europe Market Value (US$ Million) by Activity Type, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 124: Western Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 125: Western Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 126: Western Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 129: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 130: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 131: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 132: Western Europe Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Activity Type, 2018 to 2033

Figure 136: Western Europe Market Value Share (%) and BPS Analysis by Activity Type, 2023 to 2033

Figure 137: Western Europe Market Y-o-Y Growth (%) Projections by Activity Type, 2023 to 2033

Figure 138: Western Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 139: Western Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 140: Western Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 141: Western Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 142: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 143: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 144: Western Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 145: Western Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 146: Western Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 147: Western Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 148: Western Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 149: Western Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 150: Western Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 151: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 152: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 153: Western Europe Market Attractiveness by Location Type, 2023 to 2033

Figure 154: Western Europe Market Attractiveness by Activity Type, 2023 to 2033

Figure 155: Western Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 156: Western Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 157: Western Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 158: Western Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 159: Western Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 160: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 161: Eastern Europe Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 162: Eastern Europe Market Value (US$ Million) by Activity Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 164: Eastern Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 165: Eastern Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 166: Eastern Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 168: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 169: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 170: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 171: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 172: Eastern Europe Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 175: Eastern Europe Market Value (US$ Million) Analysis by Activity Type, 2018 to 2033

Figure 176: Eastern Europe Market Value Share (%) and BPS Analysis by Activity Type, 2023 to 2033

Figure 177: Eastern Europe Market Y-o-Y Growth (%) Projections by Activity Type, 2023 to 2033

Figure 178: Eastern Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 179: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 180: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 181: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 182: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 183: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 184: Eastern Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 185: Eastern Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 186: Eastern Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 187: Eastern Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 188: Eastern Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 189: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 190: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 191: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 192: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 193: Eastern Europe Market Attractiveness by Location Type, 2023 to 2033

Figure 194: Eastern Europe Market Attractiveness by Activity Type, 2023 to 2033

Figure 195: Eastern Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 196: Eastern Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 197: Eastern Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 198: Eastern Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 199: Eastern Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 200: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 201: South Asia and Pacific Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 202: South Asia and Pacific Market Value (US$ Million) by Activity Type, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 204: South Asia and Pacific Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 205: South Asia and Pacific Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 206: South Asia and Pacific Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 208: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 209: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 210: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 211: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 212: South Asia and Pacific Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 213: South Asia and Pacific Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 214: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 215: South Asia and Pacific Market Value (US$ Million) Analysis by Activity Type, 2018 to 2033

Figure 216: South Asia and Pacific Market Value Share (%) and BPS Analysis by Activity Type, 2023 to 2033

Figure 217: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Activity Type, 2023 to 2033

Figure 218: South Asia and Pacific Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 219: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 220: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 221: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 222: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 223: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 224: South Asia and Pacific Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 225: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 226: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 227: South Asia and Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 228: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 229: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 230: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 231: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 232: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 233: South Asia and Pacific Market Attractiveness by Location Type, 2023 to 2033

Figure 234: South Asia and Pacific Market Attractiveness by Activity Type, 2023 to 2033

Figure 235: South Asia and Pacific Market Attractiveness by Booking Channel, 2023 to 2033

Figure 236: South Asia and Pacific Market Attractiveness by Tourist Type, 2023 to 2033

Figure 237: South Asia and Pacific Market Attractiveness by Tour Type, 2023 to 2033

Figure 238: South Asia and Pacific Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 239: South Asia and Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 240: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 241: East Asia Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 242: East Asia Market Value (US$ Million) by Activity Type, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 244: East Asia Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 245: East Asia Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 246: East Asia Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 247: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 248: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 249: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 250: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 251: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 252: East Asia Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 253: East Asia Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 254: East Asia Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 255: East Asia Market Value (US$ Million) Analysis by Activity Type, 2018 to 2033

Figure 256: East Asia Market Value Share (%) and BPS Analysis by Activity Type, 2023 to 2033

Figure 257: East Asia Market Y-o-Y Growth (%) Projections by Activity Type, 2023 to 2033

Figure 258: East Asia Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 259: East Asia Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 260: East Asia Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 261: East Asia Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 262: East Asia Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 263: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 264: East Asia Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 265: East Asia Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 266: East Asia Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 267: East Asia Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 268: East Asia Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 269: East Asia Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 270: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 271: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 272: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 273: East Asia Market Attractiveness by Location Type, 2023 to 2033

Figure 274: East Asia Market Attractiveness by Activity Type, 2023 to 2033

Figure 275: East Asia Market Attractiveness by Booking Channel, 2023 to 2033

Figure 276: East Asia Market Attractiveness by Tourist Type, 2023 to 2033

Figure 277: East Asia Market Attractiveness by Tour Type, 2023 to 2033

Figure 278: East Asia Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 279: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 280: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 281: Middle East and Africa Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 282: Middle East and Africa Market Value (US$ Million) by Activity Type, 2023 to 2033

Figure 283: Middle East and Africa Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 284: Middle East and Africa Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 285: Middle East and Africa Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 286: Middle East and Africa Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 287: Middle East and Africa Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 288: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 289: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 290: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 291: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 292: Middle East and Africa Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 293: Middle East and Africa Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 294: Middle East and Africa Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 295: Middle East and Africa Market Value (US$ Million) Analysis by Activity Type, 2018 to 2033

Figure 296: Middle East and Africa Market Value Share (%) and BPS Analysis by Activity Type, 2023 to 2033

Figure 297: Middle East and Africa Market Y-o-Y Growth (%) Projections by Activity Type, 2023 to 2033

Figure 298: Middle East and Africa Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 299: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 300: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 301: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 302: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 303: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 304: Middle East and Africa Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 305: Middle East and Africa Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 306: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 307: Middle East and Africa Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 308: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 309: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 310: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 311: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 312: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 313: Middle East and Africa Market Attractiveness by Location Type, 2023 to 2033

Figure 314: Middle East and Africa Market Attractiveness by Activity Type, 2023 to 2033

Figure 315: Middle East and Africa Market Attractiveness by Booking Channel, 2023 to 2033

Figure 316: Middle East and Africa Market Attractiveness by Tourist Type, 2023 to 2033

Figure 317: Middle East and Africa Market Attractiveness by Tour Type, 2023 to 2033

Figure 318: Middle East and Africa Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 319: Middle East and Africa Market Attractiveness by Age Group, 2023 to 2033

Figure 320: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in the Fishing Tourism Industry

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fishing Bag Market Growth – Trends, Demand & Forecast 2025-2035

Market Share Breakdown of Fishing Reels Manufacturers

Aluminium Fishing Boat Market Size and Share Forecast Outlook 2025 to 2035

Graphene Coated Fishing Gear Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Global Ecotourism Market Insights – Growth & Demand 2025–2035

Agritourism Market Size and Share Forecast Outlook 2025 to 2035

Art Tourism Market Analysis by, by Service Category, by End, by Booking Channel by Region Forecast: 2025 to 2035

Analyzing War Tourism Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA