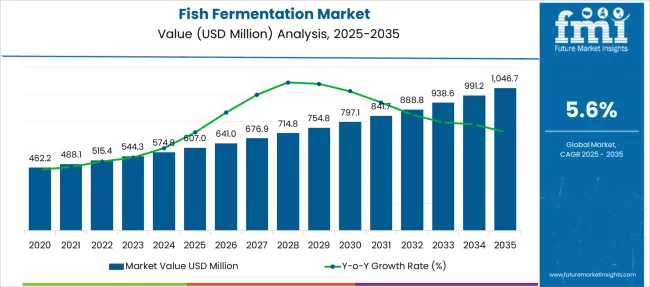

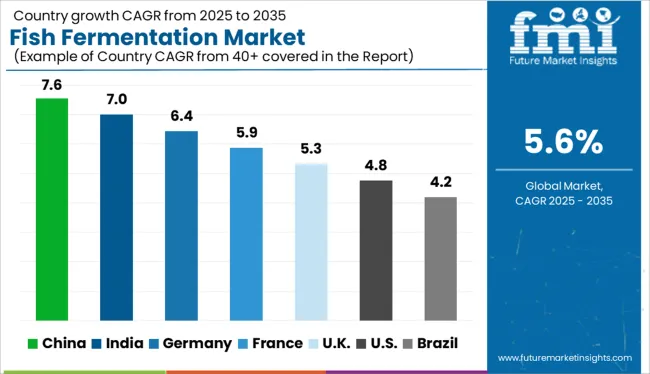

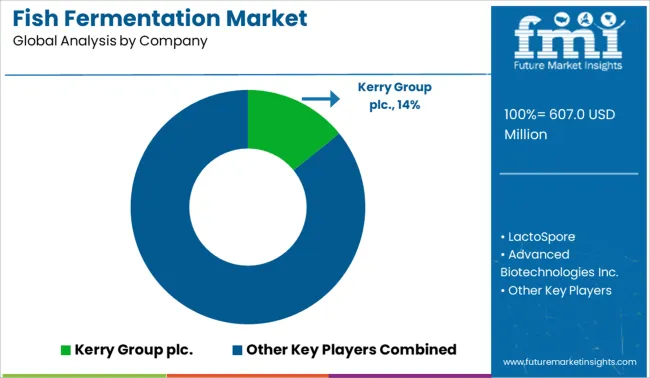

The Fish Fermentation Market is estimated to be valued at USD 607.0 million in 2025 and is projected to reach USD 1046.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Fish Fermentation Market Estimated Value in (2025 E) | USD 607.0 million |

| Fish Fermentation Market Forecast Value in (2035 F) | USD 1046.7 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Fish Fermentation market is steadily expanding, supported by growing global interest in traditional preservation methods, functional foods, and protein-rich diets. Increasing awareness of the nutritional and probiotic benefits associated with fermented fish products is encouraging wider acceptance across health-conscious consumer groups. Industry announcements and food technology updates have emphasized the rising use of fermentation to improve shelf life, flavor complexity, and digestibility of fish-based products.

Moreover, cultural and regional culinary practices, particularly in Asia and Northern Europe, have played a key role in sustaining demand. Future market potential is expected to be influenced by innovations in sustainable seafood sourcing and fermentation process optimization to ensure safety, quality, and compliance with food regulations.

Companies are also investing in modernizing packaging and expanding distribution reach to meet the evolving expectations of global consumers With increasing attention toward gut health and natural preservation, fermented fish products are poised to gain broader traction, driving steady growth in this specialized segment of the seafood market.

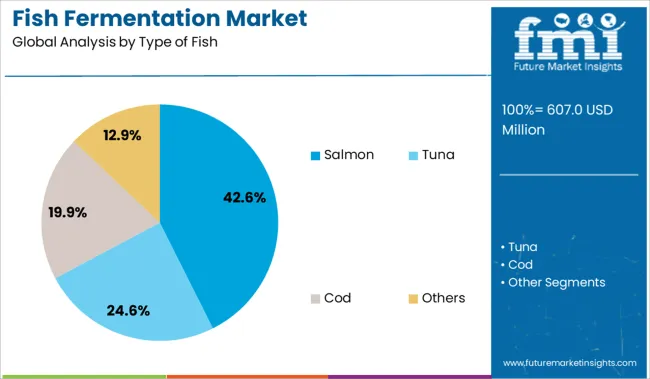

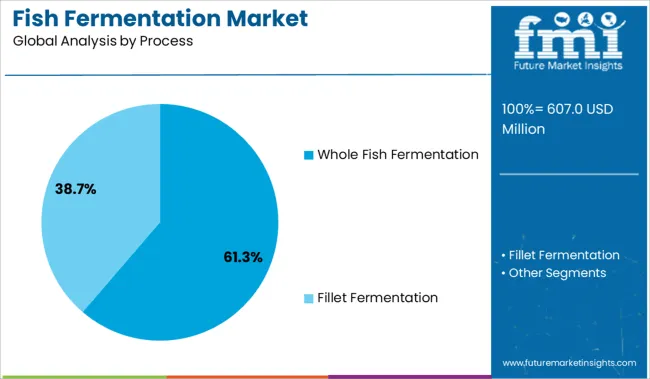

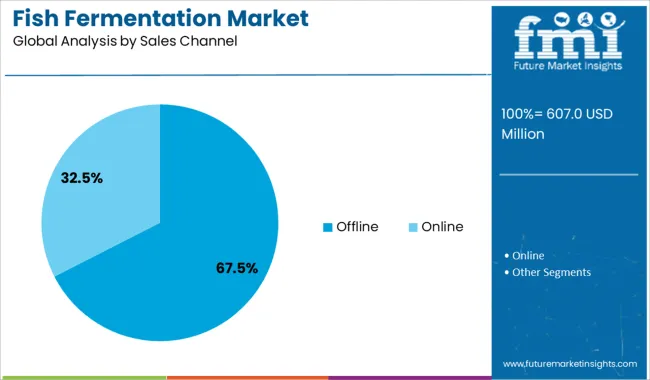

The market is segmented by Type of Fish, Process, and Sales Channel and region. By Type of Fish, the market is divided into Salmon, Tuna, Cod, and Others. In terms of Process, the market is classified into Whole Fish Fermentation and Fillet Fermentation. Based on Sales Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The salmon segment is expected to account for 42.6% of the Fish Fermentation market revenue share in 2025, making it the leading type of fish used for fermentation. Its dominance is being driven by high consumer acceptance, nutritional richness, and superior texture retention during fermentation. Salmon is widely preferred due to its omega-3 fatty acid content and appealing flavor profile, which are enhanced through fermentation.

Food processing reports and product launch summaries have indicated that the ability of salmon to retain structure and flavor complexity under fermentation conditions has made it a top choice for both traditional and modern fermented products. Producers have also been favoring salmon due to consistent availability and established supply chains that support scalability.

The rising demand for high-value, gourmet, and health-oriented fish products has contributed to increased usage of salmon in fermented formats These advantages have positioned the salmon segment as the most commercially viable and technically suitable option within the fish fermentation industry.

The whole fish fermentation process segment is projected to hold 61.3% of the Fish Fermentation market revenue share in 2025, marking it as the dominant processing method. This growth is being attributed to its preservation efficiency, traditional authenticity, and minimal processing requirements. Whole fish fermentation has been widely adopted in regional practices for its ability to retain maximum nutritional content and deliver bold, developed flavors over extended fermentation periods.

Food science publications and culinary heritage reports have highlighted its role in reducing waste and simplifying preparation methods, particularly in artisanal and rural settings. The technique’s compatibility with local fish species and cultural recipes has further sustained its relevance.

Producers favor this method for its low operational complexity and alignment with traditional and sustainable production values These factors have made whole fish fermentation the most preferred process in both commercial and small-scale settings, ensuring its leading share in the market.

The offline sales channel is forecasted to contribute 67.5% of the Fish Fermentation market revenue share in 2025, maintaining its position as the primary distribution mode. This dominance is being reinforced by the preference for physical inspection of freshness, texture, and aroma in fermented fish products, particularly in traditional markets and specialty food stores.

Distribution through fish markets, gourmet retailers, and ethnic grocery chains has been favored due to established consumer trust and the ability to offer local and region-specific fermented varieties. Industry communications and food distribution updates have emphasized that buyers in this category often rely on direct vendor interaction and sampling to assess quality.

Offline channels have also benefited from their integration into established cold chain logistics and regional supply networks These factors have continued to support the offline channel’s dominance in reaching target consumers, especially where cultural and sensory attributes are essential to purchase decisions.

A number of influential factors have been identified that are expected to spur growth in the global fish fermentation market during the projection period (2025 to 2035). Besides the proliferating aspects prevailing in the market, the analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can somehow influence sales.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Rising Demand for Healthy and Nutritious Food Products Boosting Market in the USA

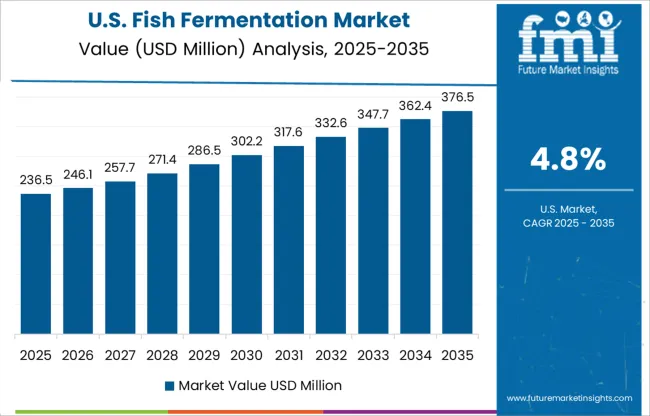

As per FMI, the USA currently holds around 68% revenue share of the North American fish fermentation industry and it is set to expand at a significant CAGR over the projection period (2025 to 2035).

The major factor driving the growth in the USA market is the increasing demand for healthy and nutritious food. Moreover, the growing popularity of fermented fish products among consumers is another key factor that is propelling the demand for fish fermentation in the country.

Fermented fish is becoming widely popular among Americans owing to its high nutritive value, the bioavailability of minerals, easy digestibility, and organoleptic characteristics. As a result, there has been a rapid surge in demand for fermented fish products in the country and this trend will continue during the forecast period.

Growing Popularity of Fermented Foods to Fuel Sales in the UK

The UK is expected to account for over 22% share of the Europe market in 2025. Furthermore, sales of fermented fish products in the country are likely to rise at a steady pace as consumer preference towards healthy and nutritional food products continues to increase.

FMI predicts the UK market to grow rapidly over the next ten years, with new players and products entering the market every year. This growth is being driven by the increasing popularity of fermented foods, as well as the health benefits associated with fermentation.

Increasing Awareness About the Health Benefits of Fermented Fish Items Pushing Demand in China

According to Future Market Insights, with around 32% market share, China will continue to dominate the Asia Pacific market during the forecast period. Factors such as the high consumption of seafood in China, the rapidly rising population, and increasing disposable income are driving the demand for fish products, which in turn is fueling the growth of the fish fermentation industry.

Similarly, growing health consciousness among consumers is also boosting the market as fermented fish products are rich in omega-3 fatty acids, vitamins, and minerals.

Whole Fish Fermentation to Hold Substantial Share Through 2035

Based on the process, the global market for fish fermentation is segmented into whole fish fermentation and fillet fermentation. Among these, whole fish fermentation will continue to dominate the global market during the forecast period. This can be attributed to the growing popularity of fermenting whole fish rather than just fillets across various countries.

Several companies across countries like the USA, China, Germany, and Mexico use the process of whole fish fermentation as it allows them to produce large amounts of fermented fish products in quick intervals of time.

Key players in this market space include LactoSpore (India), Danisco A/S (Denmark), Advanced Biotechnologies Inc. (USA), Kerry Group plc (Ireland), and Associated British Foods plc (UK).

These players are focused on increasing their revenue shares by launching new products and investing in research and development. Furthermore, they are adopting strategies such as partnerships, acquisitions, mergers, facility expansions, and collaborations to expand their global footprint. For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 607.0 million |

| Projected Market Size (2035) | USD 1046.7 million |

| Anticipated Growth Rate (2025 to 2035) | 5.6% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa (MEA); RoW |

| Key Countries Covered | The USA, Germany, The UK, France, Spain, Italy, Brazil, Argentina, China, India, Japan, UAE,= Australia, New Zealand |

| Key Segments Covered | Type of Fish, Process, Sales Channel, Geography |

| Key Companies Profiled | LactoSpore; Danisco A/S; Advanced Biotechnologies Inc.; Kerry Group plc.; Associated British Foods plc; FMC Corporation; Omega Protein Corporation; TripleNine Group A/S; Corpesca S.A.; TASA; Colpex International; American Marine Ingredients; Pesquera Diamante S.A.; FF Skagen A/S |

| Report Coverage | DROT Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, Competitive Landscape, and Strategic Growth Initiatives |

The global fish fermentation market is estimated to be valued at USD 607.0 million in 2025.

The market size for the fish fermentation market is projected to reach USD 1,046.7 million by 2035.

The fish fermentation market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in fish fermentation market are salmon, tuna, cod and others.

In terms of process, whole fish fermentation segment to command 61.3% share in the fish fermentation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA