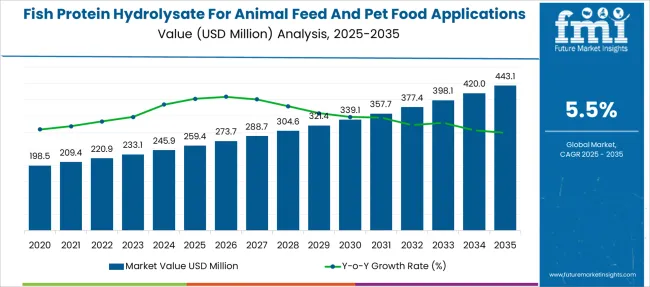

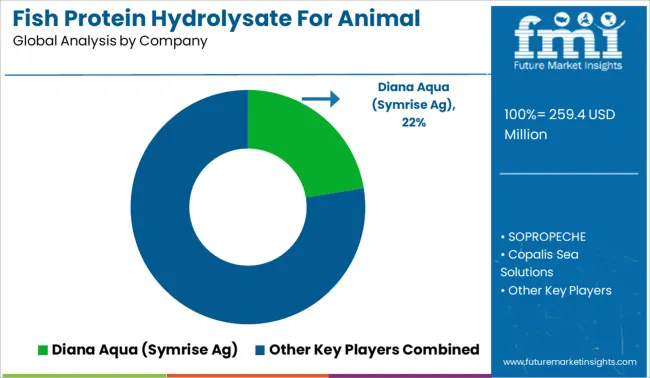

The Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market is estimated to be valued at USD 259.4 million in 2025 and is projected to reach USD 443.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Estimated Value in (2025E) | USD 259.4 million |

| Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Forecast Value in (2035F) | USD 443.1 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The fish Protein Hydrolysate Market is expanding steadily, driven by the growing demand for high-quality, sustainable protein sources in animal feed and pet food sectors. Advances in processing technologies have improved the efficiency and nutritional quality of protein hydrolysates, making them attractive ingredients for enhancing animal health and growth.

Increased awareness about sustainable sourcing and eco-friendly feed alternatives has raised interest in fish-derived proteins. Regulatory focus on reducing the use of antibiotics and promoting natural feed additives has also boosted adoption.

The rising pet ownership and intensifying focus on pet nutrition have further contributed to market growth. As the aquaculture and livestock industries expand globally, the market is expected to benefit from continued innovation in protein extraction and processing methods. Segmental growth is expected to be led by enzymatic hydrolysis technology, powder form products, and anchovy as a primary raw material source.

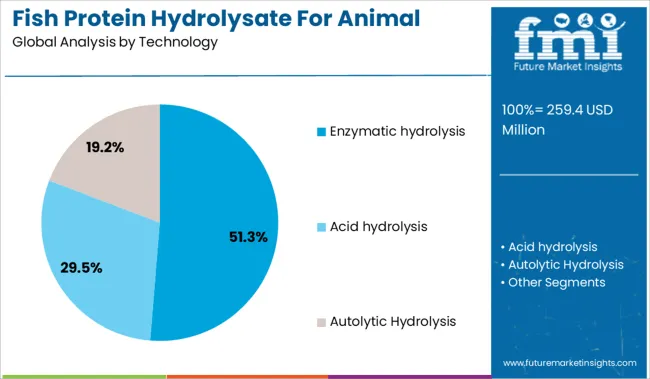

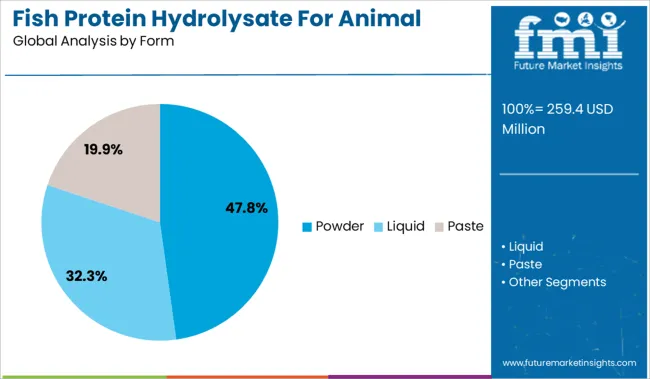

The market is segmented by Technology, Form, Source, Application, and Livestock and region. By Technology, the market is divided into Enzymatic hydrolysis, Acid hydrolysis, and Autolytic Hydrolysis. In terms of Form, the market is classified into Powder, Liquid, and Paste.

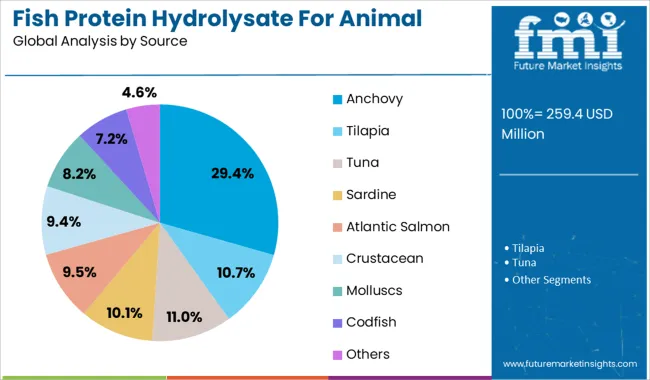

Based on Source, the market is segmented into Anchovy, Tilapia, Tuna, Sardine, Atlantic Salmon, Crustacean, Molluscs, Codfish, and Others. By Application, the market is divided into Animal Feed, Petfood, Cat, and Dog. By Livestock, the market is segmented into Aquaculture, Salmon, Trouts, Shrimps, Others, Poultry, Broilers, Layers, Swine, Calves, and Equine. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The enzymatic hydrolysis segment is projected to account for 51.3% of the market revenue in 2025, reflecting its dominance as the preferred processing method. This technology is favored because it allows precise control over protein breakdown, resulting in high-quality hydrolysates with enhanced digestibility and bioavailability.

Enzymatic processes operate under mild conditions that preserve functional peptides and minimize nutrient loss. Producers prefer enzymatic hydrolysis for its efficiency and scalability, which meets the increasing demand from feed manufacturers.

Furthermore, this method produces products with improved palatability and reduced allergenicity, which are important for animal health. Given these advantages enzymatic hydrolysis is expected to remain the leading technology segment in fish protein hydrolysate production.

The powder form segment is expected to contribute 47.8% of the market revenue in 2025, maintaining its position as the leading product form. Powdered fish protein hydrolysates offer advantages including ease of handling, longer shelf life, and compatibility with diverse feed formulations.

Manufacturers prefer powder products for their convenience in storage and transport, as well as their ability to mix uniformly with other feed ingredients. The form supports dosing accuracy and flexibility in both pet food and animal feed applications.

Additionally, the powdered form facilitates incorporation into dry feed pellets, which are popular in aquaculture and livestock industries. The growing preference for powdered hydrolysates is aligned with production and supply chain efficiencies, sustaining the segment’s market leadership.

Anchovy is projected to hold 29.4% of the market revenue in 2025, establishing it as the primary raw material source segment. The popularity of anchovy is due to its widespread availability, high protein content, and suitability for enzymatic hydrolysis processes.

Its use supports sustainable fishing practices in many coastal regions where anchovy is abundant. The fish’s composition allows for efficient extraction of bioactive peptides and essential amino acids that enhance the nutritional profile of the hydrolysate.

Feed producers value anchovy-based hydrolysates for their consistent quality and cost-effectiveness. As demand for sustainable and high-nutrition protein sources grows, anchovy is expected to remain a key raw material in the fish Protein Hydrolysate Market.

Fish protein hydrolysate is gaining traction in aquaculture and pet nutrition due to its digestibility, bioavailability, and functional benefits. In aquafeed, it enhances growth, feed efficiency, and larval development, especially in shrimp and salmon diets across Asia Pacific and Latin America. In pet food, FPH supports clean-label, hypoallergenic formulations with benefits for gut health and palatability. Its marine traceability and suitability for sensitive diets position it as a preferred ingredient in premium, single-protein pet food lines in North America and Europe.

Fish protein hydrolysate is being rapidly integrated into aquaculture feed formulations due to its superior digestibility, solubility, and nutrient density. Unlike conventional fishmeal, FPH provides bioactive peptides and amino acids in a pre-digested format, improving feed intake and absorption in finfish and crustaceans. This leads to better feed conversion ratios and faster growth, particularly during early developmental stages. Enzymatically produced hydrolysates are favored for hatchery diets and high-efficiency commercial feeds. Shrimp, salmon, and seabass sectors are at the forefront of this adoption. The Asia-Pacific and Latin American markets are spearheading this trend, where aquaculture scale and performance optimization are top priorities. FPH's water solubility also reduces waste, making it ideal for recirculating aquaculture systems and controlled environments.

Fish protein hydrolysate is emerging as a core ingredient in premium pet food offerings, valued for its hypoallergenic profile and traceable marine origin. It is particularly suited to single-protein and veterinary diets formulated for dogs and cats with sensitivities. Its low molecular weight peptides improve gut health, nutrient absorption, and overall palatability. As clean-label and functional pet foods gain traction, brands are promoting FPH as a solution that supports skin, coat, and digestive wellness. The North American and European markets are driving innovation through species-specific hydrolysates and limited-processing claims. Powder and liquid forms are being utilized in a variety of wet and dry formats, spanning adult, senior, and prescription products.

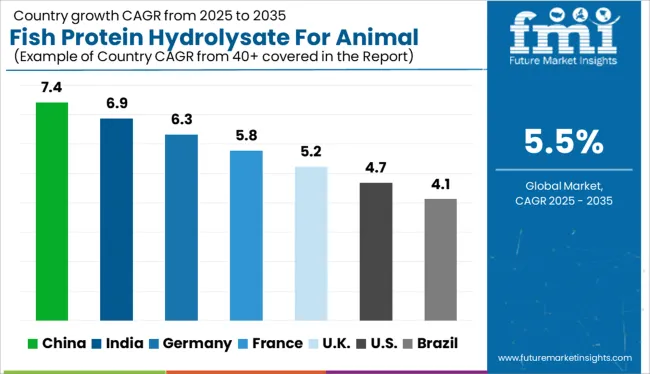

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

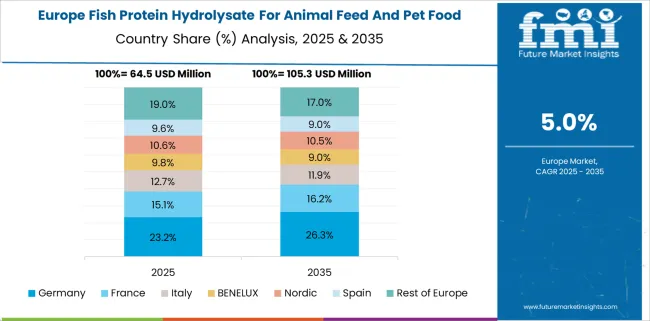

The global fish Protein Hydrolysate Market for animal feed and pet food applications is expected to expand at a CAGR of 5.5% from 2025 to 2035. Among the top contributors, China is projected to lead at 7.4%, driven by intensified aquafeed production and expanded pet food manufacturing capacity. India follows at 6.9%, with rising use of enzymatic hydrolysates across poultry and ruminant formulations. Germany and France, recording 6.3% and 5.8% respectively, are witnessing demand from premium pet food and functional livestock feed segments. The United Kingdom, at 5.2%, is seeing growing use in hypoallergenic pet food and grain-free formulations. BRICS markets show supply-side scale-up, while OECD countries exhibit value-added application growth. The report includes analysis of over 40 countries, with five profiled below for reference.

Sales of fish Protein Hydrolysate Market for animal feed and pet food applications are forecast to grow at a CAGR of 7.4% between 2025 and 2035. From 2020 to 2024, significant volumes were used in tilapia and carp feed, particularly in Shandong and Guangdong. Moving forward, market expansion will be shaped by rising feed conversion efficiency requirements and health-oriented pet food segments. Fish-derived peptides are being increasingly included in dry extruded pet formulations to enhance digestibility and palatability. Hydrolysates sourced from enzymatic and thermal processing methods are seeing greater preference in integrated aquafeed mills.

Demand for fish protein hydrolysate is expected to expand at a CAGR of 6.9% from 2025 to 2035. Between 2020 and 2024, growth was driven by its use in poultry pre-starter diets and ruminant bypass protein blends across coastal states. With improved access to cold chain for raw material, enzymatic hydrolysates are being adopted in monogastric and aquafeed production. Future demand will be centered on cost-competitive fish peptide formulations and rising use in pet food brands focused on immune health. Feed manufacturers are transitioning from meat meal-based protein to hydrolysate-rich blends to improve animal productivity.

Sales for fish protein hydrolysate in animal nutrition are projected to grow at a CAGR of 6.3% through 2035. From 2020 to 2024, premium pet food led the demand surge, with fish peptides integrated into hypoallergenic and mobility-enhancing formulas. Regulatory compliance with EU feed material legislation has guided the shift toward enzymatically processed marine peptides. Into the forecast period, livestock feed manufacturers are targeting gut health and protein efficiency through low-ash hydrolysates. Adoption in swine creep feed and functional canine treats is expected to see notable growth.

France is expected to post a CAGR of 5.8% in fish protein hydrolysate usage for feed and pet food from 2025 to 2035. Between 2020 and 2024, poultry and pet food producers drove demand for odor-neutral hydrolysates made via enzymatic hydrolysis. Regulatory backing for marine protein inclusion and interest in immune-boosting animal diets supported this growth. In the coming decade, fish hydrolysate blends are anticipated to be used in specialty piglet feed, aquafeed starter diets, and pet food brands targeting digestion support. Stakeholders are focusing on cleaner label formulations and marine origin traceability.

Demand for fish protein hydrolysate in the United Kingdom is expected to expand at a CAGR of 5.2% through 2035. From 2020 to 2024, demand was primarily influenced by pet food manufacturers favoring hypoallergenic marine proteins in grain-free and sensitive-stomach formulations. During the forecast period, preference is projected to shift toward enzymatic hydrolysates in layer poultry feed and soft chew dog treats. Contract manufacturers in the UK are assessing fish-derived peptides for their applicability in functional feed additives aimed at gut health and post-illness recovery. The market continues to be led by veterinary-certified formulations and tailored protein blends.

Diana Aqua, a subsidiary of Symrise AG, leads the global fish protein hydrolysate industry. Its stronghold stems from proprietary enzymatic hydrolysis technologies and a wide portfolio serving aquaculture and pet food producers across Europe, North America, and Southeast Asia. Companies such as SOPROPECHE, Copalis Sea Solutions, and Scanbio Marine Group have been actively expanding production capacities, focusing on extraction processes and fish side-stream valorization. Irish and Nordic firms including Bio-Marine Ingredients Ireland Ltd and Hofseth Biocare ASA emphasize traceability and nutritional consistency, serving functional feed markets with digestible marine peptides. Asia-based players such as Janatha Fish Meal & Oil Products, TC Union Agrotech, and SAMPI are targeting cost-competitive segments in aqua feed and poultry feed additives. Meanwhile, Omega Protein and Triplenine Group A/S focus on the North American and Scandinavian export trade, driven by integrated fishmeal and hydrolysate facilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 259.4 Million |

| Technology | Enzymatic hydrolysis, Acid hydrolysis, and Autolytic Hydrolysis |

| Form | Powder, Liquid, and Paste |

| Source | Anchovy, Tilapia, Tuna, Sardine, Atlantic Salmon, Crustacean, Molluscs, Codfish, and Others |

| Application | Animal Feed, Petfood, Cat, and Dog |

| Livestock | Aquaculture, Salmon, Trouts, Shrimps, Others, Poultry, Broilers, Layers, Swine, Calves, and Equine |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Diana Aqua (Symrise Ag), SOPROPECHE, Copalis Sea Solutions, Scanbio Marine Group, Bio-Marine Ingredients Ireland Ltd, Hofseth Biocare ASA, Janatha Fish Meal & Oil Products, SAMPI, Nutrifish, TC Union Agrotech, Alaska Protein Recovery, Rossyew, Sociedad Pesquera Landes Sa, Triplenine Group A/S, and Omega Protein |

| Additional Attributes | Dollar sales vary by protein source and processing method, with enzymatic hydrolysates leading across pet and aquaculture feed categories. Demand continues to grow for highly digestible proteins tailored for companion animals and aquatic species. Growth is being shaped by expanded use in functional formulations, increased engagement from contract processors, and a regional pivot toward certified, odor-neutral marine hydrolysates in North America and Europe. |

The global fish protein hydrolysate for animal feed and pet food applications market is estimated to be valued at USD 259.4 million in 2025.

The market size for the fish protein hydrolysate for animal feed and pet food applications market is projected to reach USD 443.1 million by 2035.

The fish protein hydrolysate for animal feed and pet food applications market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in fish protein hydrolysate for animal feed and pet food applications market are enzymatic hydrolysis, acid hydrolysis and autolytic hydrolysis.

In terms of form, powder segment to command 47.8% share in the fish protein hydrolysate for animal feed and pet food applications market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Sauce Market Growth - Culinary Trends & Industry Demand 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down Fish Oil Market Share & Consumer Trends

Analysis and Growth Projections for Fish Gelatin Market

Market Leaders & Share in the Fish Meal Industry

Fish Collagen Peptides Market Analysis by Source, Application and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA