The worldwide fish oil market is organized into three broad industry sectors: Multinational Producers (50%), Regional Players (35%), and Specialty/Niche Manufacturers (15%). Global leading multinational players like Omega Protein Corporation, DSM Nutritional Products, BASF SE, and Cargill, Inc. are market leaders with their cutting-edge refining capabilities, large volumes of production, and worldwide distribution networks.

The major players largely serve pharmaceutical, nutraceutical, and aquafeed businesses with high-standard production levels. Local players such as Maruha Nichiro Corporation and GC Rieber Oils share a 35% market share, basing their competition on local fish procurement, environmentally friendly extraction methods, and supply chain optimization.

These firms are mainly concentrated on niche fish oils such as cod liver oil, krill oil, and sardine oil, which are used in specialty applications in functional foods and nutritional supplements. The other 15% is held by specialty and new fish oil producers, including Nordic Naturals and Nutraceutical Corporation, that produce high-purity, high-DHA, and EPA-enriched fish oils for high-end dietary supplements and pharmaceutical uses.

| Market Structure | Top Multinational Producers |

|---|---|

| Industry Share (%) | 50% |

| Key Companies | Omega Protein Corporation, DSM Nutritional Products, BASF SE, Cargill, Inc., Maruha Nichiro Corporation |

| Market Structure | Regional and Mid-Sized Players |

|---|---|

| Industry Share (%) | 35% |

| Key Companies | GC Rieber Oils, Kewpie Corporation, Fish Oil Company (FOC), Nutraceutical Corporation |

| Market Structure | Specialty & Niche Manufacturers |

|---|---|

| Industry Share (%) | 10% |

| Key Companies | Nordic Naturals, premium fish oil suppliers for pharmaceutical, nutraceutical, and cosmetic applications |

| Market Structure | Private Labels & Small-Scale Producers |

|---|---|

| Industry Share (%) | 5% |

| Key Companies | Independent fish oil suppliers, small fisheries focusing on local markets and specialty health products |

The market is moderately consolidated with multinational leaders at the helm, while regional and niche players innovate in sustainability, purity, and specialty fish oil uses.

Feed Grade (45%) leads the market, dominated by the production of aquaculture feed, which is highly dependent on fish oil as a high source of essential fatty acids. Omega Protein Corporation and Cargill are major manufacturers of fish oil feed grade for fish and shrimp farming.

Food Grade (35%) is also commanding a big share because of increasing popularity for fish oil-enriched food products and functional beverages. Kewpie Corporation and Maruha Nichiro Corporation produce high-quality food-grade fish oils that are specifically formulated for human consumption and culinary use.

Pharma Grade (20%) is a premium but specialty segment, used mainly in omega-3 supplements, cardiovascular wellness products, and pharmaceutical-based fish oil products. DSM Nutritional Products, BASF SE, and Nordic Naturals dominate high-purity, pharmaceutical-grade fish oils that service the nutraceutical and pharmaceutical industries.

Salmon Oil (40%) is the biggest segment, with high omega-3 content, rich flavor, and better absorption. GC Rieber Oils and Nutraceutical Corporation are experts in refined salmon oil for dietary supplements and high-end food applications.

Tuna Oil (25%) comes next, commonly used in fortified foods, dietary supplements, and infant nutrition because of its high DHA content. Fish Oil Company (FOC) and DSM Nutritional Products have consolidated their portfolios in tuna-derived omega-3 products.

Other sub-segments are Cod Liver Oil, Sardine Oil, Squalene Oil, Krill Oil, Anchovy Oil, and Menhaden Oil, which have smaller but significant market shares, especially in nutraceuticals, pharmaceuticals, and cosmetics. Nordic Naturals and BASF SE dominate cod liver oil and krill oil refining.

The world fish oil industry has witnessed significant growth in sustainability, product development, and strategic moves. The following are 10 major developments that defined the industry in the last year.

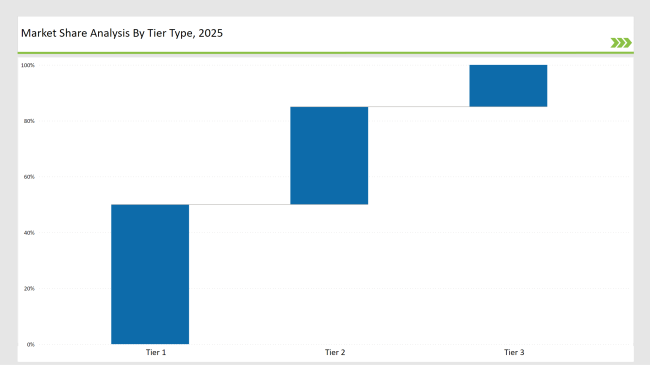

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Omega Protein Corporation, DSM Nutritional Products, BASF SE, Cargill, Inc., Maruha Nichiro Corporation |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 35% |

| Example of Key Players | GC Rieber Oils, Kewpie Corporation, Fish Oil Company (FOC), Nutraceutical Corporation |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 15% |

| Example of Key Players | Nordic Naturals, premium fish oil suppliers for pharmaceutical, nutraceutical, and cosmetic applications |

| Brand | Key Focus |

|---|---|

| Omega Protein Corporation | Expanded sustainable fishery certification programs, ensuring responsible wild fish harvesting and MSC-compliant fish oil production. |

| DSM Nutritional Products | Developed ultra-purified omega-3 fish oil concentrates, targeting cardiovascular health and pharmaceutical-grade supplements. |

| Nordic Naturals | Introduced algae-based omega-3 supplements, expanding its vegan-friendly and plant-based product portfolio. |

| BASF SE | Launched microencapsulated fish oil technology, improving oxidation resistance and nutrient stability in dietary supplements. |

| Cargill, Inc. | Strengthening its precision aquaculture fish oil blends, optimizing feed conversion ratios and disease resistance in farmed fish. |

| GC Rieber Oils | Entered the marine collagen and beauty supplement market, developing squalene-enriched fish oil for skincare applications. |

| Kewpie Corporation | Expanded omega-3 fortification in functional foods, introducing fish oil-enriched dressings, spreads, and sauces. |

The transition to sustainable and traceable sources of fish oil will be prioritized. Certifications from Marine Stewardship Council (MSC) and Aquaculture Stewardship Council (ASC) will be necessary, with organizations such as Omega Protein Corporation and Maruha Nichiro increasing certified sustainable fishing. The use of blockchain-based tracking technologies to enhance supply chain visibility will be incorporated in the industry.

The growth of algae and vegan omega-3 products will pick up pace as environmental issues related to wild fish stocks grow. BASF SE and Nordic Naturals are already leading the way with plant-based DHA and EPA alternatives, which will be a mainstream choice for functional foods and supplements.

Fish oil uses in functional foods and beverages will expand further. Omega-3-fortified foods are already offered by Kewpie Corporation and Nutraceutical Corporation, and broader uses in the future will emerge in dairy products, protein bars, and fortified drinks. There could be obligatory omega-3 fortification decreed by regulators, pushing the market further towards this trend.

The use of fish oil by the cosmetic and beauty industry will be on the rise, especially for squalene-enriched skincare and anti-aging products. GC Rieber Oils is already working on marine collagen and omega-3-based skincare products, and this trend will continue as consumers seek natural, anti-inflammatory beauty products.

Feed Grade, Food Grade, Pharma Grade

Salmon Oil, Tuna Oil, Cod Liver Oil, Sardine Oil, Squalene Oil, Krill Oil, Anchovy Oil, Menhaden Oil and Others

Consumers are prioritizing heart health, brain function, and anti-inflammatory benefits, increasing demand for high-purity omega-3 fish oils from brands like DSM Nutritional Products and Nordic Naturals.

Omega Protein Corporation, DSM Nutritional Products, BASF SE, Cargill, and Maruha Nichiro Corporation lead due to large-scale production, global distribution, and advanced refining technologies.

Companies are moving toward MSC and ASC-certified fisheries, focusing on sustainable fish oil sourcing and reducing overfishing risks, with Omega Protein Corporation and Maruha Nichiro leading efforts.

Omega-3 fortification in dairy, spreads, and beverages is rising, with Kewpie Corporation and Nutraceutical Corporation introducing omega-3-enriched food products.

Salmon oil (40%) and tuna oil (25%) lead the market, followed by cod liver oil, sardine oil, squalene oil, krill oil, anchovy oil, and menhaden oil.

BASF SE and GC Rieber Oils have introduced microencapsulation technology, enhancing stability, shelf life, and oxidation resistance.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

Fish Sauce Market Growth - Culinary Trends & Industry Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA