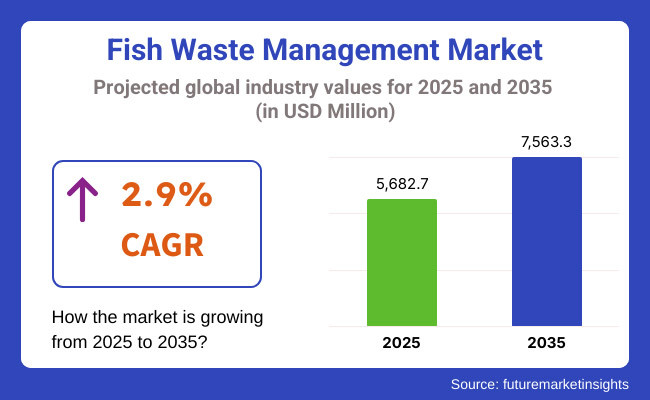

Global fish waste management market worth was USD 5,412 million in 2023. Fish waste management demand grew by 2.9% YoY in 2024, thereby indicating that the entire global market will be worth USD 5,682.7 million in 2025. Foreign sales in the forecast period (2025 to 2035) will be growing at a 2.9% CAGR, finally reaching a value of USD 7,563.3 million in 2035.

Dumping of fish waste is currently sustainable fishing. Fishing industry waste, fish bone, skin, and organs need to be treated in order to reduce the environment impact of fishing. The waste is converted to value-added forms of fishmeal, fish oil, and fertilizer used in animal feed, farming, and bioenergy. With increasing global demand for sustainability, the demand for sustainable sources such as fish waste management will be increasing as people need more of such, propelling the market.

Fishmeal and fish oil with nutritional content including omega-3 fatty acids will be driven by demand mainly spearheading the market. The two products are being highly demanded by aquaculture, poultry, and pet foods segments of animal feed markets. Growing demand for organic waste-based fish wastes fertilizers is also driving the market forward, which green farmers are increasingly looking to use as organic alternatives to chemical fertilizers.

Along with the development in technology, waste management of fish is also developing. New equipment for processing waste from fish and producing high-value by-products are entering the market, which is driving the business. Therefore, the fish waste management business will develop moderately to 2035 as increasing demand for green technology and new techniques will drive it.

Fish waste use is a twofold advantage because it minimizes environmental waste and yields valuable products. Part of the market stimulus involves the constant increasing demand for renewable and organic products, especially in agricultural and animal feed industries. Fish oil and fishmeal, which are by-products of fish waste, have been used in animal nutrition for over several decades, and demand continues to increase with their favourable nutrient quality.

Second, bioenergy production from fish waste is increasingly becoming a renewable resource. Therefore, technological innovations in treating fish waste will continue to offer new opportunities to the market. The fish waste treatment market will increase steadily during the forecast period due to the fact that there is increasing and more emphasis on circular economies where waste is turned into resources.

The following table presents comparative performance contrast of the variation in CAGR between the base year (2024) and the year under consideration (2025) of the global fish waste management market. Upon calculation, the variation in performance is determined and trends are observed in realization of revenues are thus presented to the stakeholders a clear view of the direction of the growth of the year. H1 is Jan to June, and H2 is Jul to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.4% |

| H2 (2024 to 2034) | 2.6% |

| H1 (2025 to 2035) | 2.7% |

| H2 (2025 to 2035) | 2.9% |

During the first half (H1) of 2025 to 2035, the market will grow at a CAGR of 2.7%, and in the second half (H2) of the period, at a marginally higher CAGR of 2.9%. The latter part of the decade will experience more growth as a result of the ongoing development of green and organic waste fish technology, as well as growing demand for natural and sustainable products. The company increased 30 BPS in H1 of the decade, while in H2 of the decade it will experience improved growth of 20 BPS.

This positive growth pattern fueled by sustainability, waste reduction, and increasing fish by-product demand puts the fish waste management market on the success and growth track in the predicted period.

Tier 1 Players, They are regional with cutting-edge waste processing technology and established logistics networks in the North American, European, and Asia-Pacific regions. They are giants in colossal fish waste recycling and transformation of fish by-products into value-added items such as collagen, fishmeal, fish oil, and biodiesel.

Tier 1 players are R&D focused in an effort to maximize waste utilization and adhere to international environmental regulations. They have more market coverage and funds, enabling them to establish strategic alliances with seafood processing plants and hence secure them with a constant supply of raw materials.

Tier 2 players are regionally market-based where successful fish waste processing technologies become accessible to domestic seafood processors. Tier 2 players mainly operate in coastal areas whose seafood production is regionalized, i.e., Norway, Iceland, India, China, and Southeast Asia.

Tier 2 players trade in specialty products such as collection, processing, and conversion into mid-market commercial products such as fish protein hydrolysates and organic fertilizers. They do not have Tier 1 players' international reach but are expanding at a very fast pace with technology partnerships and government-backed green initiatives.

Tier 3 Players are Small companies, cooperatives, and independent companies with artisanal and community-scale fish waste processing facilities come under this category. These operators operate at the grass roots level, making use of fish waste for the production of ordinary fertilizers, animal feed products, or the production of low-concentration biofuels.

Depending on having fewer components of deep funds and specialized knowledge, Tier 3 operators have to depend on government incentives, philanthropy, and local seafood groups to provide the capital for the business. They acquire but through means of low market size spread the zero wastes culture at grass root levels. Management of fish waste is a thriving sector and has local players implementing new and more sustainable ways of minimizing environmental effects.

Scaling Up Circular Economy Approach to Utilization of Fish Waste

Shift: In the past, disposal of fish waste has been preceded by circular economies in which everything about fish waste is given a value to create products with added values. Rather than wasting fish heads, bones, skin, and entrails, companies are utilizing them as fertilizers, biofuels, animal feed, and ingredients for food with function like collagen and gelatin. Initiating the shift is tighter environment control and increased need for greener waste disposal.

Strategic Response: BioMar, a Danish company, produced fish waste-based protein aquaculture feeds that reduced the environmental impact and saved 30% of expenses. Auchan Retail, a French company, introduced fish waste-based organic farming fertilizers promoting local sustainability practice.

Norwegian Biomega uses salmon waste to produce valuable protein and oil to be utilized in pet food manufacturing, enhancing resource efficiency. Big firms are investing in bioprocessing technologies to transform waste into valuable products, and fish waste becomes an economic and sustainable feedstock.

Enzymatic Processing of High-Value Fish By-products

Shift: Industries' enzyme hydrolysis is used to hydrolyze fish waste into protein, peptides, and bioavailable oils. The process is increasingly becoming popular as it can improve recovery of products, achieve high nutritional value, and remove toxic residues. Fish waste-derived bioactive peptides are entering nutraceuticals, medicines, and functional foods in ever-increasing demand due to their antioxidant and anti-inflammatory activity.

Strategic Response: Norway's Arctic Bioscience produced pharmaceutical-grade fish oil from enzymatically hydrolyzed cod liver waste and boosted market demand by 40%. Sopropeche (France) constructed its enzymatic hydrolysis plant to produce marine collagen from fish skin and won new orders from the cosmetic industry.

Neptune Wellness Solutions (Canada) is applying enzymatic hydrolysis for fish-derived supplements in order to achieve higher bioavailability and absorption levels. With the help of enzymes, companies are converting waste into high-quality health ingredients with maximum utilization of resources.

Higher Production of Bioplastics from Fish Waste Products

Shift: Growing demand for environmentally friendly packaging solutions to petroleum-based plastic is pushing industry towards using bioplastics made from fish waste. Fish skin, bones, and scales are rich in chitin and collagen, which are bio-polymer materials of value for bio-packaging. With the world closing in on plastic waste, fish-based bioplastics are offering a suitable substitute for food packaging, medical implants, and biodegradable films

Strategic Response: MarinaTex in the UK produced biodegradable bioplastic films from fish waste and was recognized in the field of green packaging. Atlantic Biopolymers in Canada developed a fish collagen-based substitute for synthetic polymers and formed alliances with world FMCG leaders.

Nissei Eco in Japan launched bioplastics from fish scales, minimizing food industry plastic wastage by 20%. The market for bioplastics is trending towards fish waste as a green, compostable replacement for traditional packing materials.

Fish Processing Waste as the Chief Source of Renewable Bioenergy

Shift: While the world's demand for renewable energy keeps surging, fish processing waste is increasingly being processed into biofuels and biogas through anaerobic digestion and microbial fermentation. The shift provides minimized dependence on fossil fuels while keeping fish industry waste to a bare minimum. Leading seafood countries like Norway, Chile, and Thailand spearhead the fish waste-to-energy developments.

Strategic Response: Swedish firm Scandinavian Biofuels has produced biodiesel from fish oil, cutting carbon emissions in the supply chain by 30%. Chilean firm Camanchaca is producing energy from salmon waste as biogas and fueling 20% of its processing plants.

Norwegian firm Biokraft had a fish-waste biorefinery to produce renewable methane for local power grids. The large seafood companies are adopting the fish waste bioenergy option for cost reduction as well as cleaner environmental efficiencies.

Growth of Fish Waste-Based Pet Food and Animal Feed

Shift: Because the demand for green animal feed and pet food continues to expand, fish waste is increasingly processed into protein-dense meal, omega-3 oils, and essential amino acids for use as pet, poultry, and aquaculture feed. Fish waste is a high-density, nutrient-dense, green substitute for soy and land animal protein that eliminates the dependence on intensively farmed feedstocks.

Strategic Response: Symrise Pet Food in France introduced a range of high-protein pet food from fish waste-derived proteins, cutting raw material costs by 25%. CPF Group of Thailand is using salmon and tuna waste in chicken feed, enhancing health and growth in flocks.

Mowi in Norway has converted fish waste into aquafeed, cutting industry use of wild fishmeal by 40%. Businesses are harvesting fish waste as an affordable, renewable source of protein, keeping with the trend towards green, ethical pet foods.

Fish Waste Cosmetics and Skincare

Shift: With the shift in the beauty trend towards ocean-derived green ingredients, fish waste is a valid cosmetic and skincare ingredient: it's packed with collagen, elastin, and omega oils. Conventional sources of marine collagen are fish scales and skin, but technology has come so far that waste fish can be used more efficiently. Customers demand cruelty-free, eco-friendly, and effective skincare products, and thus companies are using bioactive compounds derived from waste fish and incorporated into their products.

Strategic Response: Unilever and L'Oréal have partnered with ocean biotech companies to obtain collagen peptides from fish by-products and cut back on bovine and porcine ones. Codex Beauty, a Norwegian brand, launched a range of fish-based elastin skin care products that are selling naturally aging products.

Shiseido, a Japanese company, has manufactured omega-3-infused serums from waste salmon skin waste in response to increased interest in marine-derived skin care. Utilizing fish waste-sourced ingredients as part of cosmeceuticals is not only eco-friendly but also gives rise to functioning skincare products which are in congruence with the clean beauty movement.

The following table shows the estimated growth rates of the top five territories expected to exhibit high adoption of fish waste management solutions through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 2.4% |

| Germany | 2.9% |

| China | 4.3% |

| Japan | 1.5% |

| India | 2.9% |

With increasing sustainability initiatives, a growing number of regulatory directives, and circular economy measures to reduce waste and optimize the use of resources, the USA fish waste management market is expanding. There is a growing demand for the used fish carcasses as value-added by-products like fish oil, fish meal, and biofertilizers especially in aquaculture, pet food, and agricultural sectors. Omega-3 dietary supplements and nutraceuticals are derived from fish oil, whereas fish meal is used as a protein-rich feed ingredient for aquaculture and livestock.

Technologies for enzymatic hydrolysis, bioconversion also fermentation processes are driving the growth of high-value fish protein extraction. Companies are also moving into waste-to-energy projects, using fish processing residues to produce biofuels, biogas, and organic fertilizers.

As demand for and adoption of sustainable waste management increases, supported by the USA government’s push, and with an increase in eco-conscious consumerism, market growth is on the rise. With sustainability at the forefront, partnerships among seafood processors, biotechnology companies and waste management groups are enabling the creation of efficient, low-emission and scalable solutions for the utilization of fish waste.

The fish waste management market in Germany is experiencing a decent rate of expansion, with the driving factors being the EU regulations surrounding the waste reduction, environmental sustainability, and responsible seafood processing. With government rules and industry standards driving more sustainable fish use, seafood processors are increasingly zeroing in on zero-waste seafood processing, composting solutions and marine collagen extraction.

Germany’s focus on green technologies and renewable resources has led its manufacturers to invest in fish-waste biodegradable packaging and packaging alternatives based on algae. Fish gelatin obtained from by-products is gaining lots of attention in various sectors like pharmaceuticals, nutraceuticals and cosmetics, fuelling the demand for natural bioactive ingredients.

Overall, Germany's engagement and promotion of circular economy principles have, in particular, resulted in organic fertilizers, composting systems, and bio-based coatings from fish processing by-products. The domestic seafood processing industry is implementing technologies for waste management such as enzymatic treatment, anaerobic digestion, and microbial fermentation to minimize waste disposal and maximize resource recovery.

The growth of aquaculture production, incentives for a circular economy, and emerging waste processing regulations have led to rapid expansion in the fish waste management market in China. As one of the world’s largest seafood industries, fish waste is being used more and more to create fermented fish waste fertilizers, omega-rich fish oil extractions, and alternative plant proteins from fish waste.

As the world’s largest producer of aquaculture meat shifts to sustainable feed alternatives, waste-to-value opportunities are growing. Enzymatic digestion techniques are being employed by companies to process fish waste into high-protein hydrolysates for inclusion in formulations for shrimp, fish, and livestock feeds.

Marine biotechnology companies are also dealing with methods for extracting bioactive compounds from fish waste such as collagen peptides for cosmetics, pharmaceutical-grade fish proteins, chitosan-based biopolymers, etc.

China’s massive seafood industry and dynamic export markets are driving demand for sustainable fish processing, advanced enzymatic hydrolysis techniques and waste-to-biofuel conversion projects as well. To align with the government’s sustainability ambitions and renewable energy initiatives, numerous Chinese seafood processors are installing waste recovery systems that produce biogas, biodiesel and organic compost from discarded fish parts.

With increasing consumption of seafood around the world, fish by-product utilization is necessary in the fish processing sector to provide environmental sustainability, resource optimization and economic efficiency. The United States of America, Germany, and China are at the forefront of this transformation, implementing circular economy principles, adopting innovative processing technologies, and developing value-added applications that can reduce waste and maximize the value of fish byproducts.

| Segment | Value Share (2025) |

|---|---|

| Fish Meal & Animal Feed (By Application) | 58.6% |

The fish meal and animal feed segment dominates the market for fish waste management due to its relevance in livestock nutrition, aquaculture feed, and sustainable protein supply. The category, which includes processed fish protein meal, fermented fish feed supplements and omega-rich fish oil extracts, is projected to account for 58.6% of the market share by 2025.

Processors are also improving fishmeal extraction methods, enzymatic protein hydrolysis and developing fish waste feed formulae to create more sustainable, high-protein fishmeal animal feed solutions, in increasing demand. Animal feeding has become more efficient, through technological improvements in processing such as bio-fermentation and hydrolyzed fish protein, that increases digestibility and nutrient retention.

Furthermore, regulatory initiatives promoting circular economy approaches are set to transform fish waste into nutrient-rich feed components. Due to the trend of reducing reliance on traditional feed components, like soybean and land-based proteins, its utilization offers an eco-friendly alternative. Continued demand for sophisticated drying and purification technologies also enhances product quality and is thus an important driver for market development.

| Segment | Value Share (2025) |

|---|---|

| Biofertilizers & Bioplastics (By Application) | 41.4% |

Owing to the rising demand for organic cultivation solutions, marine waste upcycling, and compostable packaging, the bioplastics and biofertilizers segment holds a major 41.4% share in the market in 2025. Fish waste-derived bioplastics are finding applications in biodegradable containers, agricultural films, and food packaging, which reduce the reliance on traditional plastics.

With the issue of sustainability on the rise, businesses are looking towards fish-based nitrogen-rich compost, polymers based on fish oil, and marine collagen-enriched fertilizers as environmentally friendly alternatives to synthetic products. Furthermore, hydrolyzed peptides based on marine products are being used in natural growth promotographics and soil rejuvenation, enhancing plant health and increasing crop yield.

Biotechnology is also delivering a technological driver towards high-performance bioplastics that are tougher and compostable and can be sourced from fish waste. Such initiatives are government- and eco-organization-backed financially through various incentives and legislations that support marine waste valorization.

Thus, as manufacturers in sectors ranging from agriculture and packaging to cosmetics are starting to embrace marine-based bio-based alternatives, the move towards a circular economy and green resource use is picking up speed.

The competitive landscape of the fish waste management market is driven by increasing demand for sustainable seafood waste valorization, alternative food sources, and diverse applications in aquaculture, agriculture, and biopharmaceuticals. Companies are also investing in precision fermentation, enzymatic bioprocessing, and scalable fish waste-to-energy solutions.

The sector provides diverse options among major industry players including TripleNine Group, BioMar, Pelagia, SFP Group, and Ocean Harvest Technology, who have specialized in fish waste protein extraction, omega-3 recovery, as well as marine-derived bioproduct innovations. As demand for sustainable fish waste applications increases, many companies are developing their Asia-Pacific and European distribution networks.

Some of the key strategies you can pursue include: partnerships with aquaculture farms, investments in biodegradable fish waste plastics and development of organic fish-derived soil conditioners. But manufacturers are also focusing on zero-waste fish processing and circular economy models.

For instance

The market includes products derived from various marine sources, including Fish, Shrimp, and Squid, catering to diverse industrial applications.

These marine-derived products are widely used across multiple industries, including the Fish Meal and Fish Oil Industry, Animal Feed, Pet Food, Organic Fertilizers, Energy Generation, Cosmetics, and Pharmaceuticals.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global fish waste management industry is projected to reach USD 5,682.7 million in 2025.

Key players include Scanbio; SAMPI; Biomax Technologies Pvt. Ltd; Sorbwater; Blue Ocean Technology; Scottish Sea Farms; Vinh Hoan Corporation.

Asia-Pacific is expected to dominate due to high seafood processing volumes, rising aquaculture production, and government-backed waste utilization initiatives.

The industry is forecasted to grow at a CAGR of 2.9% from 2025 to 2035.

Key drivers include rising demand for sustainable seafood waste utilization, increasing use in aquaculture feed and bioplastics, and advancements in marine waste bioconversion technologies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End-use Industry, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by End-use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by End-use Industry, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by End-use Industry, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by End-use Industry, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by End-use Industry, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Source, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by End-use Industry, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by End-use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by End-use Industry, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 16: Global Market Attractiveness by Source, 2023 to 2033

Figure 17: Global Market Attractiveness by End-use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by End-use Industry, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness by Source, 2023 to 2033

Figure 35: North America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by End-use Industry, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by End-use Industry, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 70: Europe Market Attractiveness by Source, 2023 to 2033

Figure 71: Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by End-use Industry, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End-use Industry, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 92: South Asia Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by End-use Industry, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Source, 2023 to 2033

Figure 107: South Asia Market Attractiveness by End-use Industry, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ Million) by Source, 2023 to 2033

Figure 110: Oceania Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 111: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 117: Oceania Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 120: Oceania Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 121: Oceania Market Volume (MT) Analysis by End-use Industry, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Source, 2023 to 2033

Figure 125: Oceania Market Attractiveness by End-use Industry, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 128: MEA Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 135: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 136: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 138: MEA Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 139: MEA Market Volume (MT) Analysis by End-use Industry, 2018 to 2033

Figure 140: MEA Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 141: MEA Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 142: MEA Market Attractiveness by Source, 2023 to 2033

Figure 143: MEA Market Attractiveness by End-use Industry, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

E-Waste Management Market Growth - Trends & Forecast 2025 to 2035

Food Waste Management Market Analysis - Size, Share, and Forecast 2025 to 2035

Smart Waste Management Market Growth - Trends & Forecast 2025 to 2035

Liquid Waste Management Market

The Medical Waste Management System Market is segmented by Medical Waste Treatment, and Disposable Medical Waste Management from 2025 to 2035

Demand for Food Waste Management in EU Size and Share Forecast Outlook 2025 to 2035

Municipal Solid Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Containment and Handling Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat Power Generation Boiler Market Size and Share Forecast Outlook 2025 to 2035

Waste Wood Recycling Market Size and Share Forecast Outlook 2025 to 2035

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Waste-derived Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Wastewater Heavy Metal Treatment Agent Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Wastewater Treatment Aerators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA