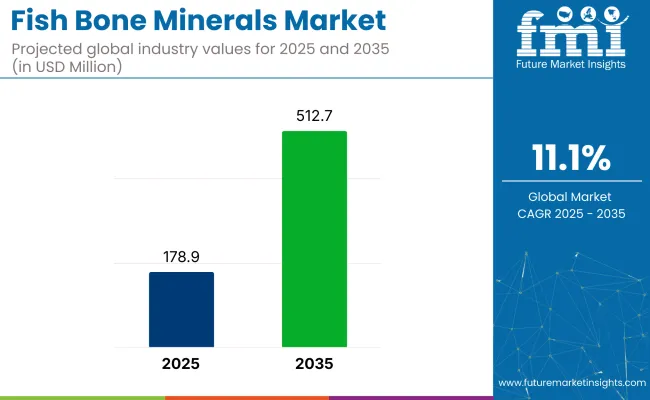

The fish bone minerals market is expected to be valued at USD 178.9 million in 2025 to USD 512.7 million by 2035, reflecting an 11.1% CAGR. Hofseth Biocare is building a second enzymatic hydrolysis plant, backed by a EUR 5 million Symrise loan, with output expected to triple by 2026, easing supply constraints in Europe.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 178.9 million |

| Industry Value (2035F) | USD 512.7 million |

| CAGR (2025 to 2035) | 11.1% |

Nano salmon bone powder shows improved calcium absorption, enabling reduced dosages. Pet food fortified with soluble minerals is expanding at 5.8% annually, surpassing USD 18 billion by 2035. EU phosphorus regulations and China’s 2026 mineral limits are altering sourcing. Manufacturers are advised to secure inputs via trawler deals and adopt low-temperature drying.

A February 27, 2023,Seafood Source article reported that Finnish food-tech firm Super Ground had moved its up-cycling technology into seafood applications. Founder and Chief Innovator Santtu Vekkeli stated, “People are developing plant-based alternatives to help save the planet, but not everyone wants to eat these. Many people want to keep eating real seafood, but with a clear conscience.

”The seven-stage process softens, heat-treats, and grinds fish bones, skin, scales, and other hard tissue into a nutrient-rich paste for fish sticks, nuggets, soups, and similar products. Machines can produce up to 1.5 million kilograms per year. Vekkeli estimated a 20-60% yield increase depending on species.

Fish bone minerals account for 0.1-0.2% of the natural calcium and mineral supplements sector, which remains the core parent market. Their role within the global nutraceutical ingredients space is also limited to around 0.1%, overshadowed by synthetic and plant-based minerals. In functional food and beverage additives, the share falls below 0.05%, mostly tied to dairy alternatives and protein drinks.

A stronger presence exists in animal nutrition, holding a 0.8-1.0% share due to aquafeed and premium pet applications. In organic and natural fertilizer inputs, fish bone minerals represent 5-6%, used primarily in phosphorus-rich biofertilizer formulations replacing chemical phosphate inputs.

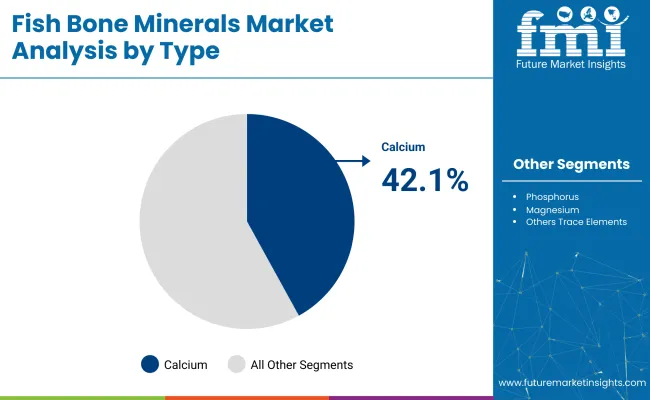

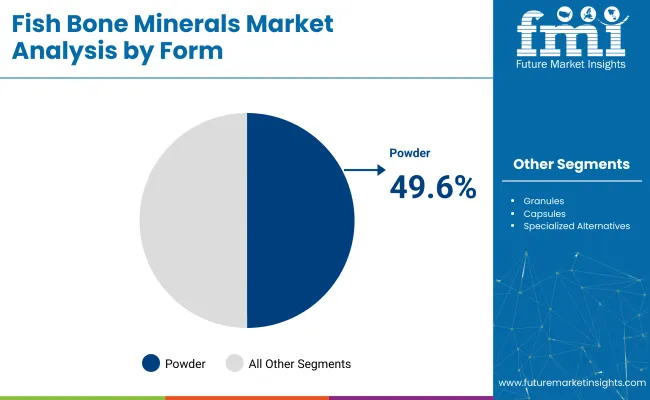

In the fish bone minerals industry, calcium leads the type segment with a 42.1% share. The powdered form dominates the form segment with a 49.6% share. The food & beverages sector leads the application segment with a 37.9% share, while salmon-based sourcing dominates the source segment with a 31.2% share. The market is growing across North America, Latin America, Europe, East Asia, and other regions.

Calcium holds the largest share, accounting for 42.1% in 2025. This segment is driven by the increasing demand for bone health supplements and its widespread application in the functional food industry. Calcium-based supplements from companies such as GNC and Nature Made are prominent in this segment.

Additionally, calcium's bioavailability from fish bones is promoted for superior absorption compared to other sources like coral and dairy. Research by Osaka University (2024) demonstrated enhanced calcium absorption in micronized powder formulations, which has led to higher adoption in functional nutrition.

The powdered form of fish bone minerals holds a dominant share of 49.6% due to its convenience and versatility. This format is primarily used in dietary supplements, fortifying beverages, and functional foods. Companies like Herbalife and Amway have integrated powdered marine derivative minerals into their product lines.

The form is favored by manufacturers for its ease of incorporation into various products, ranging from shakes to energy bars. This segment has gained traction as consumers increasingly demand clean-label products and bioactive nutrients that support overall well-being.

The food & beverages sector remains the leading application for fish bone minerals, capturing 37.9% share in 2025. Fish bone minerals, particularly calcium and phosphorus, are widely used in fortifying beverages and snacks.

Companies like Nestlé and PepsiCo have incorporated fish-derived minerals into their products to meet the growing demand for functional foods. Innovations such as fortified dairy, plant-based drinks, and collagen-infused beverages are becoming more common as they cater to health-conscious consumers seeking bone and joint health benefits.

Salmon accounts for 31.2% of the market share as the primary source of fish bone minerals. Due to its nutrient-dense profile, salmon has been identified as an ideal species for mineral extraction. Companies like Marine Harvest and Skretting focus on sourcing fish bones from salmon fisheries, ensuring high-quality mineral products.

Investments in vertical integration have been made by these companies to control supply chains and reduce costs. Salmon-based fish bone mineral products are increasingly accepted in industry for their effective nutrient profile.

Shorter shelf lives, expanding nutraceutical formulations, and bioavailability concerns have accelerated changes across the marine-derived minerals value chain. These shifts have affected inventory cycles, raw material sourcing, and value-added applications, especially in the calcium and phosphorus supplement segment.

Thermal Stabilization Reduces Spoilage and Holding Time

Thermal stabilization techniques were adopted to reduce spoilage and improve inventory efficiency in fish-processing regions. By Q1 2025, average storage durations were cut from 42 to 26 days in Vietnam and Chile through the use of low-moisture vacuum dryers and ozone-assisted microbial controls. In India, pre-cleaned skeletons were sourced from integrated filleting units, and QR-coded pallets were deployed, enabling cost savings and minimizing cross-border shipment losses across ASEAN destinations.

Micronized Powders Gain Ground in Functional Nutrition Channels

Micronized fish bone minerals have been positioned as high-absorption ingredients in functional nutrition. Research from Osaka University confirmed a 22% absorption improvement with peptide-bound calcium.

Japan’s regulatory support under the FOSHU framework enabled new drink SKUs, while Australian and Southeast Asian brands expanded into bars and gummies. Nano-milling in Indonesia supported wider applications, especially in senior-targeted wellness products.

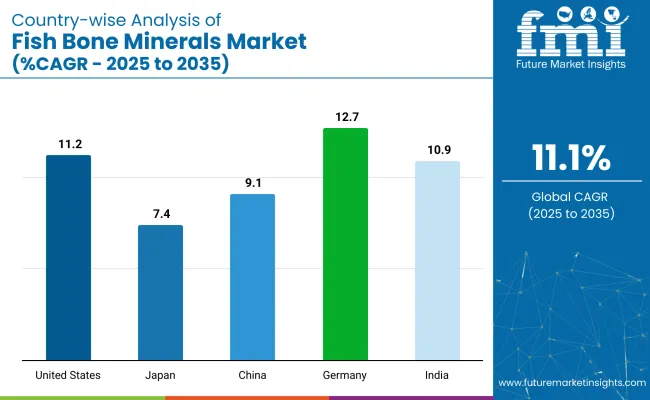

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 11.2% |

| Germany | 12.7% |

| China | 9.1% |

| Japan | 7.4% |

| India | 10.9% |

Global fish bone minerals demand is projected to rise at an 11.1% CAGR from 2025 to 2035. Germany leads with a 12.7% CAGR, surpassing the global average, driven by robust research investments and the growing adoption of fish-derived minerals in health supplements. The United States follows closely with 11.2%, benefiting from a well-established nutritional supplement industry.

India, a key player in South Asia, shows a 10.9% growth, propelled by increased demand for fortified foods and wellness products. China’s CAGR of 9.1% is driven by the consumption of health products, though it lags due to regulatory challenges. Japan, with a lower 7.4% CAGR, faces slower growth due to regulatory constraints, but its innovation in micronized powders continues to provide niche opportunities.

Demand for fish bone minerals in the USA is expanding at a CAGR of 11.2% from 2025 to 2035. An increase in demand for bone health supplements is being seen, particularly in the nutraceutical sector. Advanced healthcare infrastructure and consumer preference for high-quality products are contributing to this robust growth.

Innovations in micronized fish bone powder are being focused on by research-driven companies, driving higher adoption. Growing awareness around bone health and the potential of fish-derived minerals is positioning the USA industry for expansion compared to other regions.

Demand for fish bone minerals in Germany is projected to experience a 12.7% CAGR from 2025 to 2035, leading among OECD countries. The country’s strong regulatory environment and high demand for premium health products are driving the growth of this industry. Fish-derived minerals, particularly in powder form, are gaining traction due to their high bio availability and nutritional benefits.

The trend toward functional foods, especially those enriched with fish bone minerals, is supporting the industrial growth. Germany’s commitment to research and product development in the wellness sector continues to outpace other European countries.

The China market is expected to grow at a CAGR of 9.1% from 2025 to 2035. Despite being a key player in the industry, its growth lags behind the USA. and Germany. The demand for bone health supplements and functional foods is rising in urban areas, driven by the expanding middle class and increasing health awareness.

However, regulatory challenges in supplement production and consumer preference for locally sourced products are hindering the industry's full potential. Innovations in micronized powders are expected to drive demand in the coming years.

Adoption rate of the fish bone minerals in Japan is forecast to grow at a 7.4% CAGR from 2025 to 2035. While slower than other countries, Japan's industry is still driven by the demand for high-quality supplements and functional food products. The aging population’s increased focus on joint and bone health has been a key factor in boosting demand.

However, the country’s developed industry and regulatory constraints are limiting broader adoption. Japan remains a niche player in the market, with a strong focus on product purity and innovative health solutions targeted at the elderly population.

Sales of fish bone minerals are growing at a CAGR of 10.9% from 2025 to 2035. The market is gaining momentum due to increasing consumer awareness of health benefits and the rising demand for functional foods. India’s large population and growing middle class are major contributors to this growth.

The rising popularity of natural and plant-based supplements, combined with government initiatives to promote nutrition, is helping expand the industry. Fish bone minerals, especially in powdered form, are being incorporated into dietary supplements and fortification products to meet the evolving needs of health-conscious consumers.

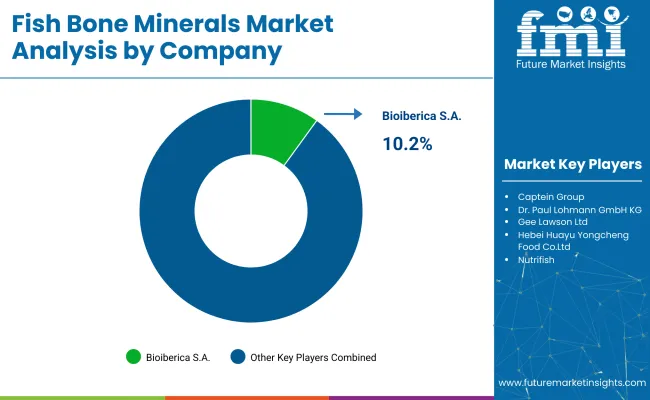

Leading Company - Bioiberica, S.A.Industry Share - 10.2%

The market features a competitive landscape, segmented into dominant players, key suppliers, and emerging firms. Dominant players such as Bioiberica, Dr. Paul Lohmann GmbH KG, and Nutrifish hold leading positions due to their vertically integrated sourcing, pharmaceutical-grade mineral refinement, and diversified application in nutraceuticals and food fortification.

Key players including Alaska Protein Recovery LLC, Gee Lawson Ltd., and Shaanxi Green Bio-Engineering Co., Ltd. focus on marine byproduct utilization, bone-derived calcium extraction, and regional processing networks. Emerging players such as Zhejiang Green Day Bioengineering Co., Ltd., Radhika Enterprises, and Silverstream SEZC are scaling presence through bioavailable mineral innovations, export-oriented production, and formulation support for dietary supplements.

Recent Fish Bone Mineral Industry News

A July 2025 article by Health.com (July 2, 2025) confirmed that soft, edible bones in tinned fish are safe for consumption and rich in bioavailable calcium, boron, and other nutrients. The article noted that these properties enhance their value in functional food formulations, particularly for bone health support.

An April 2025 feature by EatingWell (April 25, 2025) highlighted canned salmon with bones as a superior protein source for bone health. It stated that a 3-ounce serving delivers up to 25 times more calcium than boneless fillets, along with vitamin D, phosphorus, protein, and omega-3 fatty acids.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 178.9 million |

| Projected Industry Size (2035) | USD 512.7 million |

| CAGR (2025 to 2035) | 11.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and metric tons for volume |

| Types Analyzed (Segment 1) | Calcium, Phosphorus, Magnesium, Other Trace Elements |

| Forms Analyzed (Segment 2) | Powder, Granules, Capsules, Specialized Alternatives |

| Applications Analyzed (Segment 3) | Food & Beverages, Pharmaceuticals, Nutraceuticals, Animal Feed, Others |

| Sources Analyzed (Segment 4) | Salmon, Trout, Tuna, Cod, Other Oceanic Species |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Alaska Protein Recovery LLC, Bioiberica, S.A., Captein Group, Dr. Paul Lohmann GmbH KG, Gee Lawson Ltd., Hebei Huayu Yongcheng Food Co., Ltd., Nutrifish, Pioneer Enterprise, Radhika Enterprises, Shaanxi Green Bio-Engineering Co., Ltd., Silverstream SEZC, Zhejiang Green Day Bioengineering Co., Ltd., Zhengzhou Ruipu Biological Engineering Co., Ltd. |

| Additional Attributes | Dollar sales, share by mineral type and form, rising usage in nutraceutical and functional food segments, growth in animal feed-grade mineral sourcing, innovation in micronized and bioavailable formats, marine-sourced supply advantages |

The industry comprises distinct mineral categories, including Calcium, Phosphorus, Magnesium, and other trace elements.

The minerals are offered in formats such as Powder, Granules, and Capsules, along with specialized alternatives.

The segmentation includes sectors like Food & Beverages, Pharmaceuticals, Nutraceuticals, Animal Feed and Others.

The minerals are extracted from Salmon, Trout, Tuna, Cod, and other oceanic species.

The segmentation includes North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The industry is projected to reach USD 178.9 million in 2025.

The industry is expected to grow at a CAGR of 11.1% from 2025 to 2035.

Calcium is projected to lead with a 42.1% share in 2025.

Western Europe, led by Germany, is forecasted to grow at a 12.7% CAGR.

The industry is projected to reach USD 512.7 million by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA