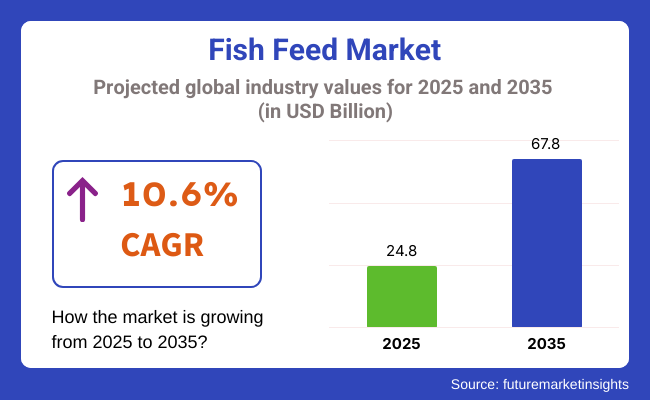

The fish feed market is projected to reach USD 24.8 billion in 2025 and is expected to grow to USD 67.8 billion by 2035, registering a CAGR of 10.6% over the forecast period. The development of eco-friendly feed formulations, increasing adoption of insect-based and plant-based proteins, and government regulations promoting sustainable aquaculture practices are shaping the industry’s future. Additionally, growing concerns over overfishing and depletion of wild fish stocks are accelerating the shift toward sustainable fish feed solutions.

The Fish Feed Market will grow a lot from 2025 to 2035. This happens because more people want fish from farms and want to grow fish in a way that helps the planet. As more people eat fish, fish farmers need better food for fish.

This special food helps fish grow big, stay healthy, and gives more fish to sell. Many new places are starting to farm fish, making the market grow faster. The government and private money help too by supporting good ways to farm fish. Rules about food quality, food safety, and how it affects our world also push the use of good and green fish food.

Advances in fish feed tech, like new protein from bugs, algae, and plants, are changing the market. These green feed ingredients tackle worries about too much fishing and the impact of old fish feed on nature. Plus, new feed additives, probiotics, and smart nutrition improve fish feed use while cutting waste and helping water stay clean.

Automated feeding systems and digital fish farming tools help optimize feed use, cut costs, and increase output. More research on better feed conversion and disease resistance shows the fish feed field will grow and keep getting better in the coming years.

Fish and fish products, like fish meal and fish oil, are often used as key protein sources in fish feed. They provide easy to digest protein, important amino acids, and omega-3 that help farm fish grow, stay healthy, and eat efficiently.

More fish feeds now use fish products for fish like salmon, trout, and tuna due to their good nutrition, improved feed use, and big role in fish farming. New ways to treat fish meal, wrap fish oil, and use other marine proteins like krill and algae help make fish feeding more sustainable and less reliant on wild fish.

While fish products are good, issues like overfishing, changing prices, and sustainability still exist. Yet, new ways to replace fishmeal, create marine proteins with precise fermentation, and use AI to make better feed are likely to improve supply and market strength.

More and more people are using fish feed made from plants like soybeans, corn, wheat, and algae. This choice helps save the sea and is cheaper too. Fish farmers use it for fish like tilapia, catfish, and shrimp because it costs less and is easier for fish to digest. Rules and new ways of making the feed even better help as well.

Scientists have found ways to make plant feeds healthy and full of protein for fish. They work to cut down bad stuff in the feed and make it taste better. Changes like adding special plant proteins and GM soy help fish eat and grow well.

But there are still some problems. The taste is not always great, some feeds have bad stuff that fish do not need, and they lack some needed food parts. New ideas like mixing feeds just right, adding more good stuff from algae, and making better plant proteins should help fish feed work better for all kinds of fish.

Fish food pellets are the most common type. They last long, make less water mess, and help fishes eat more food. Pellets made to sink or float depend on how fish eat. This way, fish get all they need with less waste.

Big fish farms use pellets more now. Pellets help fish grow fast, keep water clean, and give the right nutrients to types like carp, catfish, and salmon. New tech, like better pellet coatings and added health boosters, makes pellets easier to digest, keeps fish from getting sick, and helps fish stay healthy.

Even with good points, making pellets costs more, they can break up in water, and some nutrients can be lost by heat. But new ways to make pellets with less heat, tiny nutrient covers, and smart feeders help improve pellets and make them more popular.

Small fish food in the form of granules is commonplace in hatcheries and for young fish. It is easy to digest, has regular particle size, and spreads nutrients well. The granules help small fish grow by giving needed protein and lessening feed fights among them.

Freshwater and marine fish farms need more granulated feed because it's good for auto-feeding systems, aids uniform growth, and lowers feed waste. Better formulas such as micro-granules, slow-release granules, and those with special ingredients are helping feed uptake, immune strength, and survival of the young fish.

Yet, problems like nutrients washing away, storage troubles, and costlier fortified granules remain. New types of water-stable granules, diets enriched with microalgae, and AI-driven feeding plans may boost performance and widen market use.

Challenges

Rising Raw Material Costs and Sustainability Concerns

One of the major challenges of the fish feed market is the changing price of fishmeal and fish oil that are vital for any conventional aquafeed formulation. Wild overfishing can lead to extinction for these fish stocks, which originally provided material fish meals and animal feedstuffs. It is also harmful for future sustainability of our oceans.

Meanwhile, water pollution problems related to overfeeding and general lack of waste management have regulatory authorities tightening up feed management rules with much emphasis on increased vigilance in feeding practice too.

Opportunities

Alternative Protein Sources, AI-Powered Feed Optimization, and Functional Feeds

Despite Challenges, the fish feed market in general are presented with considerable growth potential Development of alternative protein sources such as insect-based or algae-based as well as single cell proteins has increased feed sustainability and reduces dependence on fishmeal.

The introduction of AI-based feed optimization systems, which use real-time data to adjust feeding schedules and avoid wasting feed, can raise the efficiency of aquaculture. Furthermore, mounting demand for functional feeds enriched with Omega-3 or probiotics, as well as immune-boosting compounds is generating opportunities for high-value aquafeed solutions.

The development of precision aquaculture, increasing investment in sustainable feed production, and rising consumer demand for environmentally friendly seafood have further increased innovation in fish feed production.

The fish feed market in the USA is growing well. People want better fish products, and there’s more money going into eco-friendly fish farms, plus feed is getting better. Rules set by the FDA and NOAA make sure feeds meet healthy and green standards.

More plant and bug proteins are being used in feed. Precise farming tech is also a big part, along with probiotics and helpful additives. There is also a push for organic and GMO-free fish feed, making feeds more advanced.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

The fish feed market in the UK is growing. This is because people want eco-friendly fish farming, fewer fishmeal uses, and more money is going into new feed options. The UK Marine Management Organisation (MMO) and Food Standards Agency (FSA) have strict rules on feed safety and keeping the environment safe.

There is a move towards feeds rich in omega-3, algae-based proteins, and more organic fish feed. These changes help the market grow. Also, more money going into closed-loop fish farming means more need for special feed solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.8% |

The fish feed market in the EU is growing steadily. Strict rules on sustainable fish farming help. More studies on new protein types and more people wanting responsibly farmed fish boosts growth. The European Food Safety Authority and Common Fisheries Policy support eco-friendly and healthy fish feed options.

Germany, France, and the Netherlands lead with insect-based, microalgae-based, and single-cell protein feeds. More money for research on fish health and nutrition, plus new antibiotic-free and useful fish feed, also drive trends.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.0% |

The fish feed market in Japan is growing. There is more need for good seafood. There is more money put into high-tech fish farming. Better fish food is being made. Japan's Ministry of Agriculture, Forestry, and Fisheries (MAFF) helps make fish food that's good for the earth. This new food is to use fewer wild fish.

Japanese companies make special feeds. They use smart tech to manage fish nutrition. They add healthy stuff to the food to help fish grow and stay well. More people want strong fish food for tuna, yellowtail, and eel farms. So, the market gets bigger.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

The fish feed market in South Korea is growing steadily. This growth is due to increased help from the government for fish farming, adopting better feed formulas, and more need for fish feed without antibiotics. The South Korean Ministry of Oceans and Fisheries and the National Institute of Fisheries Science are encouraging the making of eco-friendly fish feed and helping lower the carbon footprint of fish farming.

New smart feeding tools, more aquaponics fish farms, and the need for special feed mixes for high-value fish are pushing new ideas in the market. Investing in local fishmeal production and algae-based proteins also boosts market sustainability. The outlook for South Korea's fish feed market looks promising with these advancements in place.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.3% |

The fish feed market is characterized by a fragmented structure with prominent players across multiple tiers. Tier 1 companies like Cargill, Archer Daniels Midland (ADM), Alltech, Biomin, Ridley, Sonac, BioMar, Nutreco, and Skretting are global leaders. These multinational corporations leverage vast resources, extensive R&D, and global supply chains to maintain market dominance. Their ability to innovate in feed formulations, optimize feed efficiency, and engage in strategic acquisitions helps them maintain a competitive edge. For example, Skretting produces over 2 million tonnes of feed annually, underscoring its global presence.

Tier 2 companies are regional players like Zeigler Bros., which focus on niche markets such as ornamental fish and specialized aquaculture species. While they lack the scale and resources of Tier 1 companies, they differentiate themselves through high-quality products and personalized services. These companies can adapt quickly to market changes and cater to local preferences, though they face challenges in scaling production. Despite the dominance of Tier 1 players, the market remains fragmented, with significant barriers to entry, including high capital requirements and regulatory hurdles.

Recent Fish Feed Industry News

Recent developments in the fish feed industry have been marked by strategic mergers and acquisitions that are reshaping the market. A notable move was made by IFB Agro Industries Ltd., which acquired Cargill India's commercial shrimp feed and freshwater fish feed business. This acquisition includes manufacturing facilities in Vijayawada and Rajahmundry, which will significantly enhance IFB's production capabilities and expand its presence in the growing aquafeed sector. Similarly, Cargill expanded its footprint in the U.S. by acquiring two feed mills from Compana Pet Brands in Denver, Colorado, and Kansas City, Kansas. These acquisitions are expected to strengthen Cargill's feed production and distribution capacity in key regions.

These strategic decisions reflect a broader trend of consolidation within the aquaculture feed market. Companies are increasingly focused on enhancing their production capabilities and expanding their geographic reach to meet the growing demand for sustainable and efficient aquafeed solutions. As sustainability continues to be a priority, these mergers and acquisitions are likely to drive innovation and competitive advantages, shaping the future landscape of the industry.

The overall market size for the fish feed market was USD 24.8 billion in 2025.

The fish feed market is expected to reach USD 67.8 billion in 2035.

Increasing global seafood consumption, advancements in aquaculture practices, and rising demand for high-nutrient and sustainable fish feed formulations will drive market growth.

China, India, Indonesia, Norway, and the USA are key contributors.

Extruded pellets are expected to dominate due to their high digestibility, longer shelf life, and better water stability compared to other feed types.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Form, 2023 to 2033

Figure 28: Global Market Attractiveness by End Use Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Form, 2023 to 2033

Figure 58: North America Market Attractiveness by End Use Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End Use Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End Use Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End Use Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End Use Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End Use Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End Use Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Zero-Fishmeal Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Plant-Based Fish Feed Business

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA