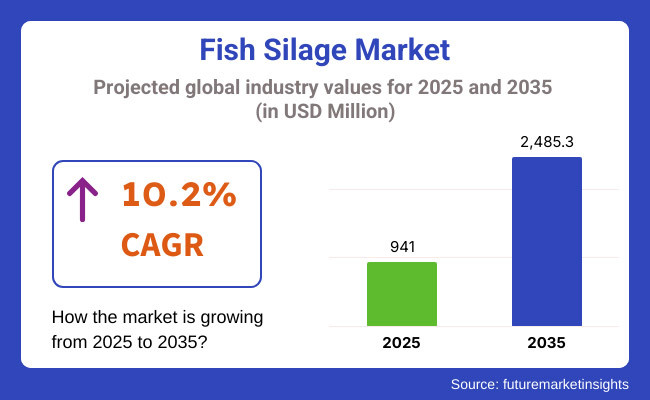

The market for fish silage in 2023 was USD 780.9 million globally. The year-by-year demand for fish silage grew by 10.2% in 2024 and estimated that the market for fish silage worldwide will be USD 941 million by 2025. Global sales will see a 10.2% CAGR between the forecast years (2025 to 2035) and ultimately reach USD 2,485.3 million in sales by 2035.

Fish silage, as a value-added food item produced through fish and other aquatic foods fermentation, is well accepted by people because it is highly nutritious and also offers the advantage of the versatility of its use in various industries like animal feed, fertilizer, and nutraceutical. Fish silage is rich in protein, omega-3 fatty acids, and other nutrient content and is therefore in great demand to be used for enhancing livestock feed as well as soil value of land.

Increased focus on environmentally friendly cultivation practices, green feedstuffs ingredients, and quality fertilizer specifications is expected to fuel fish silage demand in the upcoming two years.

Fish silage is quickly gaining traction as a potentially feasible solution in some industries, e.g., fertilizers and animal feed. Fish silage is one of the by-products of fish processing industry with a feasible way of processing fish materials otherwise lost. It is also useful in adding value to animal feed because of its richness in nutrients, and also has applications in organic agriculture.

Apart from this, fish silage is of high growth potential in the nutraceuticals sector since it possesses a health benefit, i.e., good quality of amino acids and omega-3 fatty acids, both of which are beneficial for cardiac health and overall health. Since demand for sustainable as well as healthy crops is increasing day by day, so will be the business of fish silage in the coming decade.

The below table demonstrates the relative performance of six-month variation of CAGR difference between the base year (2024) and the observed year (2025) of the global fish silage market. The report presented indicates broad difference in performance and indicates revenue generation patterns, therefore informing stakeholders to some degree about where growth is going during the year. H1 represents January to June and H2 represents July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 9.9% |

| H2 (2024 to 2034) | 10.0% |

| H1 (2025 to 2035) | 10.0% |

| H2 (2025 to 2035) | 10.2% |

The market will expand in the first half (H1) of the decade between 2025 to 2035 at a CAGR of 10.0% and then at a faster CAGR of 10.2% in the second half (H2) of the decade. The growth rate will increase as fish silage becomes increasingly popular and sustainable in an increasing number of industries. During the first half of the period (H1), the company recorded a 10 BPS growth, and during the second half (H2), the company is likely to record a higher growth of 20 BPS.

Such a trend, fueled by sustainability and health-led trends, propels the market for fish silage to grow in the next period. The Fish Silage Market will keep on growing steadily till 2025 and even more, with increasing demand for sustainable feedstuffs, the circular economy, and improved technology in the manufacturing of silage.

Since the global aquaculture and agricultural industries are focusing all their energies on sustainability, fish silage will be a need for feed material, preventing wastage and adding nutrients to the farm animals. New production technologies, opting for policies towards sustainable production techniques, and improved penetration in the economies of growth will be the forces driving the market.

Domestic business dominates the big markets such as North America, Europe, and Asia-Pacific. Canadian and North American companies provide high-quality fish silage for aquaculture, animal feed, and organic manure. Domestic business effectively manages environmental waste by recycling worthless fish to create healthy ingredients in the form of silage, managing environmental degradation.

Growing demand for fish silage as alternative animal protein in animal feed has also promoted local capital investment in fish silage production. Scotland, Denmark, and Norway players are Europe's pioneers. These players have developed seafood and aquaculture sectors, and therefore silage fish is involved in circular economy activities. Clean and accessible processing is European companies' top priority, and because of this reason they come under stringent EU sustainability standards.

Organic and natural feed products to the European market also indicated greater applications of fish silage on native livestock and aqua farming. Asia-Pacific, India, Vietnam, and Thailand are headed high regional fish silage producers' market share.

The two largest seafood processing hubs in the world, Thailand and Vietnam, produce humongous quantities of fish waste, which are being utilized to the hilt by indigenous players to make silage for domestic markets and export. Chinese conglomerates developed very quickly in fish silage business based on huge seafood processing factories and low-cost production methods.

China produces and exports fish silage worldwide, with high-protein, high-value feedstuffs providing aquaculture and livestock industry. Low-cost, cutting-edge processing technology, and tremendous output capacity are Chinese companies' strategies to be in the market on a global level. Internationally, the market for fish silage is competitive with regional local players dominating the market position followed by Chinese and multinational players.

Due to the growth in demand for circular economy and green products, the local market players can push the level of production, increase processing efficiency, and introduce new uses of fish silage to other industries.

Advances in Fish Silage Manufacturing with Better Shelf Life

Shift: One of the challenges facing fish silage uptake has been shortened shelf life and storage capacity, resulting in wastage. But with advances in enzymatic hydrolysis, lactic acid fermentation, and antioxidant stabilization, preservation processes are becoming better, enhancing fish silage use to commercial feed and fertilizer uses.

Strategic Response: Biomega Group (Norway) created an antioxidant-stabilized fish silage that increased shelf life by 30% and favored feed manufacturers by saving them on storage. Symrise Aqua Feed (Germany) launched enzyme-processed fish silage with longer freshness, resulting in 25% greater adoption among small-scale aquaculture farmers.

Alltech (USA) created a probiotic-enhanced fish silage fermentation process that avoided spoilage and improved product stability by 20%. Such technology innovations are making fish silage commercially viable.

Fish Silage Integration into Circular Economy Projects

Shift: The international seafood industry is being challenged to reduce processing waste, and numerous companies have adopted zero-waste production. Fish silage supports circular economy principles by transforming fish processing by-products into useful feed, fertilizer, and bioproducts, reducing environmental impact and maximizing overall resource utilization.

Strategic Response: Mowi (Norway) incorporated fish silage production into its seafood processing operations, cutting waste by 28% and disposal expenses. Thai Union Group (Thailand) partnered with aquafeed manufacturers to convert fish waste into silage-based feed, enhancing sustainability ratings by 19%.

Pacific Bio (Australia) created a fish silage-based biostimulant, enabling coastal fisheries to gain zero-waste certification and driving 15% revenue growth. These uses in circular economies are solidifying the long-term sustainability of fish silage on a broad spectrum of industries.

Increasing Demand for Sustainable Sources of Protein in Animal Feed

Shift: Growing pressure on aquaculture and livestock to turn to sustainable alternative feed, fish silage is being found to be a low-cost and nutrient-dense protein feed. Conventional fishmeal manufacturing is energy intensive, leading to a move toward fermented fish silage with high protein levels yet reduced waste output. Governments and policymakers are urging the adoption of the principles of the circular economy, thereby driving demand for application of fish silage in fish and animal feed.

Strategic Response: Skretting of the Netherlands supplemented aquafeeds with fish silage, contributing 16% protein digestibility and reducing raw material cost by 12%. Norway's Aker BioMarine developed high-omega-3 fish silage blends that improved salmon aquaculture feed efficiency by 14%.

Norway's Biomega Group joined forces with producers to market enzyme-treated fish silage, hence increasing amino acid absorption in chickens by 9% and piglets by 11%. These developments are rendering fish silage a plausible substitute for conventional fishmeal, lessening reliance on wild fish resources.

Growing Use of Fish Silage in Organic Agriculture

Shift: The organic livestock market is shifting towards natural, chemical-free animal feed supplements, and thus fish silage is in growing demand as a sustainable source of protein and minerals. With higher levels of essential fatty acids, peptides, and bioactive compounds, fish silage is at par with organic certifications and a perfect solution for poultry, swine, and dairy farms adopting organic feed alternatives.

Strategic Response: BioMar (Denmark) introduced a fish silage feed ingredient with organic certification, and demand rose by 22% in organic fish farming. Hubbard Feeds (USA) used enzymatically treated fish silage in organic poultry rations to enhance gut health and growth by 15%. Nutreco (Netherlands) made liquid supplements from fish silage to introduce to organic dairy cows, raising milk output by 8% and omega-3 by 10%. These products are leading to expanded use of fish silage for organic and sustainable agriculture.

Growing Demand of Fish Silage in the Pet Food Segment

Shift: As pet owners continue to want higher-protein, sustainable, and functional content for their animals, fish silage is poised as a highly profitable alternative protein for use in more premium pet foods. Rich in bioactive peptides, essential amino acids, and omega-3 fatty acids, fish silage promotes pet coat quality, digestive tract health, and digestibility of the pet. Even better, due to its environmentally friendly production levels, it offers an appealing ingredient for brands targeting the eco-friendly pet food channel.

Strategic Response: Nestlé Purina (Switzerland) launched fish silage-based wet cat food, boosting premium pet food market sales by 14%. Mars Petcare (USA) launched sustainable fish silage dog food, boosting environmentally friendly pet owner retention by 17%. Ziwi (New Zealand) manufactured freeze-dried pet treats from fish silage protein, boosting demand for high-protein pet snacks by 22%. These innovations are broadening fish silage applications in the pet nutrition industry.

Encouragement and Policy Support for Fish Silage Adoption by Governments

Shift: Governments worldwide are encouraging fish processing waste utilization by providing subsidies, tax credits, and research grants to support fish silage production. Circular economy approaches, food safety, and green policies in aquaculture are influencing institutional and commercial uses of fish silage in all sectors. Waste reduction policies and environmental legislation also are compelling seafood processors to adopt fish silage as part of their sustainability initiatives.

Strategic Response: The Blue Bioeconomy program of the European Union funded research in fish silage, which translated to 30% higher commercial production grants to aquafeed companies. Tax incentives were given by the Canadian government to fish processors for utilizing silage-based fertilizers, and this resulted in a 19% higher adoption among farm cooperatives.

The fish silage subsidy program was initiated in India by its Ministry of Fisheries, which hastened domestic feed production and lowered dependence on imports by 12%. These policy initiatives that provide incentives are accelerating the adoption of fish silage into new business uses.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of fish silage through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 10.3% |

| Germany | 9.8% |

| China | 11.2% |

| Japan | 7.5% |

| India | 10.0% |

The USA fish silage market is increasing, led by demand for sustainable, high-protein alternatives for aquaculture and livestock nutrition. In the animal nutrition and organic fertilizer industry, there are increasingly mentions of the application of fish silage, an economical and environmentally friendly alternative to fish meal.

USA - In general inspiration provided by World Food Day, parts of United States aquaculture and livestock are pondering how fish silage can fit into the feed side of the equation to enhance efficiency in the use of nutrients, and animal health - and with an eye towards sustainability of the feed source. The growing pet food market is also looking to fish silage as a high-protein content ingredient for premium pet nutrition.

Gasco, with training data through October 2023 (including: high-quality data on retailers and suppliers), though operations are set up in a number of countries, including Canada, sales from fish silage fuel demand by government policy favoring waste reduction in fisheries and sustainable seafood processing available in the circular economy nexus.

This growing acceptance stems from regulatory prompting to allow sustainable aquafeed choices, leading to more fermented fish protein, amino acid-bearing liquid concentrates and enzyme-treated varieties of fish silage. In addition, there is growing interest in regenerative agriculture as well, and fish silage is being rediscovered more and more as a biofertilizer capable of enhancing soil health and agricultural productivity.

The German market for fish silage grows slowly due to the EU-policy which suggest sustainable feed mixtures, application of marine by-products and organic agriculture. European consumers are increasingly looking for animal-friendly and sustainable food production, creating consumers' demands for fermented fish proteins, silage enriched with amino acids, and marine livestock feed.

Now, silage solutions made from fish find their way into feed formulations of German aquaculture and livestock farmers, who commit to high sustainability requirements while providing animals with a simultaneous quality diet.

The growing consumer interest in sustainable meat and dairy production has prompted manufacturers to invest in precision fermentation and in microbial upgrades of fish silage to develop improved digestibility, bioavailability and nutrient retention.

Today, high purity fish protein hydrolysates are being processed further and used for specialty feeds in organic poultry production and eco-friendly aquaculture. The robust organic farming sector in Germany is creating interest in fertilizers and soil conditioners made from fish silage, thus increasing the scope of application of this green marine byproduct.

The growth of fish silage in China is propelled by the vast aquaculture industry of the country, along with government efforts to reduce waste in seafood processing. As a major producer and consumer of fish products, China is keenly promoting the use of fish byproducts, including fish silage, to create low-cost, high-nutrient feed. Rising feed costs are being met with a push for more sustainable aquaculture feed options, and therefore fish silage is being considered an attractive protein source by fish and poultry farming enterprises.

However, China's aquaculture industry is also being pressured, by the upward trend of liquid fish protein hydrolysates and fish silage, that are rich in nutrients, which were driven by growth in Japan's aquaculture industry, to offer high-performance feed to promote fish growth, immunity and reduce reliance on fishing vessels for fish meal.

Moreover, China is investing heavily in biotechnology and optimization of marine resources, which is driving the demand for value-added fish silage products enriched with probiotics, enzyme, and essential fatty acids. Also, fish silage is becoming a digestible and economical alternative to conventional feed proteins in animals and poultry industries in China, and helps in large-scale livestock rearing projects.

The fish silage market is likely to see further growth in 2024 owing to China’s continued focus on food security, sustainability, and waste reduction.Emerging techniques for fish silage processing, fermentation technologies, and bioactive enrichment will propel this market to grow, and the nation can achieve its long-term aspirations of having an efficient and sustainable food production line.

| Segment | Value Share (2025) |

|---|---|

| Aquaculture & Livestock Feed (By Application) | 65.4% |

Based on its economic feasibility, high protein content, and used as a sustainable alternative to fish meal, the fish silage market is dominated by aquaculture and animal feed segment. This segment includes fermented fish silage in fish farming, poultry, and ruminant nutrition, with 65.4% held in 2025.

Therefore, fish silage is an excellent source of digestible proteins, essential amino acids, and omega-3 fatty acids, and is widely used in high-performance animal feed formulation. In response to rising demand for circular economy-based feed, producers are cultivating precision-fermented fish silage and enzyme-enhanced protein extracts designed for optimal nutrient absorption and feed efficiency.

These powerfully formulated nutrients promote animal growth, immune status and well-being, while reducing the burden of wild fish in the feed manufacturing process. In addition, liquid fish protein concentrates are becoming popular in high-performance animal nutrition, particularly in aquafeed and monogastric animal feed.

There is now growing awareness worldwide of the need for sustainable food production systems that minimize wastage and environmental impact, and fish silage is likely to be increasingly adopted as an environmentally friendly, nutrient-rich ingredient in aquaculture and livestock industries.

| Segment | Value Share (2025) |

|---|---|

| Organic Fertilizers & Soil Enhancers (By Application) | 34.6% |

The demand for organic agriculture and regenerative soil health goods is growing rapidly and in 2025 the organic soil enhancers and fertilizer category holds a market share of 34.6%. Fish silage has high concentration of nutrients and natural growth promoting properties which makes it useful in biofertilizers, soil conditioners and microbial-based farming inputs.

Heliotropium unconstrained fish silage-based fertilizers are a green alternative for synthetic fertilizers which being a soil-enhancing agent promotes soil structure and improved microbial activity and can deliver sustainable production of crops. Fertilizers and biostimulants made from fermented fish waste are quickly gaining favor with growers, driven by sustainability concerns.

These fertilizers also provide important amino acids, peptides, and trace minerals that promote disease resistance, enhanced yield, and soil fertility remediation. Liquid fish silage fertilizers with amino acid content are also increasingly used in organic gardening and large-scale agriculture and at a larger extent for high-value crops such as fruits, vegetables, and vineyards. With increasing research on the microbiome of the soil, it is kind of formulation based on fish silage that will hold the key to the future of sustainable agriculture.

Major players in the fish silage market are focused on the valorization of marine byproducts, extraction of high-protein fish silage, and formulations of sustainable fish feed and silage. Focusing on enzyme-assisted fish silage processing, microbial fermentation technologies and nutrient-optimized feed production, companies are investing in these traditional protein sources.

The sector is led by players like TripleNine Group, Biomega Group, Scanbio Marine Group, Aker BioMarine, and Sonac who are proficient in fish-derived protein hydrolysates, bioactive marine feed additives, and sustainable aquafeed manufacturing. The company and many other expanding their Asia-Pacific and North American operations to meet growing demand for sustainable animal feed and organic fertilizers.

Key opportunities comprise partnerships with aquaculture companies, investment in high-value fish protein extraction, and low carbon fish silage solutions. Manufacturers are also focused on circular economy initiatives and the sustainable use of marine ingredients.

For instance

The market includes two primary types of fish silage Dry Silage and Wet Silage each suited for different storage and application needs.

Fish silage is produced from various fish species, including Salmon, Tuna, Sardine, and Mackerel, along with other fish varieties used in processing.

It is widely used in Aquaculture Feed, Pet Food, and Agriculture Feed, with additional applications in other industries.

Fish silage products are available in different forms, such as Pellets, Powder, and Liquid, offering flexibility for various feeding and processing methods.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global fish silage industry is projected to reach USD 941 million in 2025.

Key players include BioMar Group; Calysta, Inc.; Biomega AS; Alltech Coppens; Skretting; Nutreco N.V.; Ridley Corporation Limited.

Asia-Pacific is expected to dominate due to high demand for sustainable aquafeed and organic fertilizers.

The industry is forecasted to grow at a CAGR of 10.2% from 2025 to 2035.

Key drivers include rising demand for sustainable aquaculture feed, increasing use in organic farming, and advancements in enzyme-enhanced silage processing.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Fish Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Fish Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Fish Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Fish Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Fish Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Fish Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Fish Type, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Fish Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Fish Type, 2018 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Fish Type, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Fish Type, 2018 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Fish Type, 2018 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 58: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Fish Type, 2018 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Fish Type, 2018 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 68: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: MEA Market Value (US$ Million) Forecast by Fish Type, 2018 to 2033

Table 74: MEA Market Volume (MT) Forecast by Fish Type, 2018 to 2033

Table 75: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 76: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 77: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 78: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 79: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Fish Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Fish Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Fish Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Fish Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Fish Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Fish Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Fish Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Fish Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Fish Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Fish Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Fish Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Fish Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Fish Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Fish Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Fish Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Fish Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Fish Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Fish Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Fish Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Fish Type, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Fish Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Fish Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Fish Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Fish Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Fish Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Fish Type, 2018 to 2033

Figure 131: East Asia Market Volume (MT) Analysis by Fish Type, 2018 to 2033

Figure 133: East Asia Market Value Share (%) and BPS Analysis by Fish Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Fish Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 139: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Fish Type, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Fish Type, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Fish Type, 2018 to 2033

Figure 161: South Asia Market Volume (MT) Analysis by Fish Type, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Fish Type, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Fish Type, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 165: South Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 169: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 180: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 181: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 182: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 183: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 184: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 185: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 186: South Asia Market Attractiveness by Fish Type, 2023 to 2033

Figure 187: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 188: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 189: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Fish Type, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Fish Type, 2018 to 2033

Figure 191: Oceania Market Volume (MT) Analysis by Fish Type, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Fish Type, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Fish Type, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 195: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 199: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Fish Type, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 220: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 221: MEA Market Value (US$ Million) by Fish Type, 2023 to 2033

Figure 222: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 224: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 225: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 227: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 228: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 229: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 230: MEA Market Value (US$ Million) Analysis by Fish Type, 2018 to 2033

Figure 231: MEA Market Volume (MT) Analysis by Fish Type, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by Fish Type, 2023 to 2033

Figure 233: MEA Market Y-o-Y Growth (%) Projections by Fish Type, 2023 to 2033

Figure 234: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 235: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 236: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 237: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 238: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 239: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 233: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: MEA Market Attractiveness by Fish Type, 2023 to 2033

Figure 237: MEA Market Attractiveness by Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by Form, 2023 to 2033

Figure 239: MEA Market Attractiveness by Application, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA