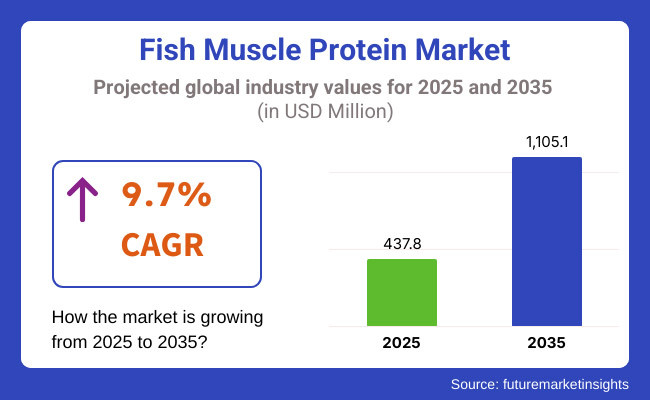

World market for fish muscle protein was USD 366.7 million in 2023. Fish muscle protein demand grew at a rate of 9.7% y-o-y in 2024, so the world market would be USD 437.8 million in 2025. Sales in the forecast period (2025 to 2035) would attain a CAGR of 9.7% globally to reach the sales value of USD 1,105.1 million by the end of 2035.

Fish muscle protein is taking centre stage with its health advantage, richness of essential amino acids, and usage in muscle well-being, growth, and recovery. It is making inroads in the animal nutrition industry, especially in aqua culture and pet animal feed. Its use in nutraceuticals and supplements is also increasing as increasing numbers of individuals take an interest in healthy protein to ensure proper health and wellbeing.

Growing consumer consciousness about the need to utilize protein for muscle recuperation and health is highly likely to keep propelling demand for fish muscle protein in the coming years.

The rising need for fish muscle protein is driven by its growing usage as a highly digestible and complete protein. It has an ideal amino acid pattern of the essential amino acids and thus is a revolutionary healthy source of protein to be used by humans and animals. As a result of the surge in the utilization of natural and protein-rich food ingredients, fish muscle protein is being converted into nutraceutical foods, protein supplements, and functional foods to a greater extent than ever.

Additionally, as a result of the emphasis being given to environment-friendly and sustainable sources of food, fish muscle protein is becoming more and more sought after as a sustainable source of protein over land. Hence, demand for fish muscle protein will grow at a very high pace in the next decade.

The following is a comparative snapshot of the difference in CAGR between the initial year (2024) and final year (2025) of half a year globally for the fish muscle protein market. The snapshot provides extreme variations when it comes to performance and trend in the success of revenue, thereby giving stakeholders better insight into the growth pattern for the time of the year. First half year (H1) lies between January to June and the second half year (H2) lies between July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 9.4% |

| H2 (2024 to 2034) | 9.5% |

| H1 (2025 to 2035) | 9.5% |

| H2 (2025 to 2035) | 9.7% |

During the first half (H1) of the period 2025 to 2035, the market will progress at a CAGR of 9.5%, while during the second half (H2) of the period it will progress a little higher at 9.7%. The latter half of the decade registers growth acceleration based on growth in demand for sustainable protein-rich food. In H1 of the decade, the company accelerated 10 BPS, and in H2 of the decade, the company will register a growth acceleration of 20 BPS.

This increasing growth trend on the health benefits, sustainability, and increasing demand for protein sources boosts the fish muscle protein market to grow well in the forecast period. The Fish Muscle Protein Market will increase steadily due to increasing demand from consumers for healthy and sustainable protein sources and for protein extraction methods.

As it spreads ever broader in the emerging economies and follows international food and nutrition trends, it will have to combat raw material cost and sustainability challenges. But continuous innovation, intelligent sourcing, and rising consumer awareness for the green cost of protein production will keep fish muscle protein a leader in the global protein chain for decades to come.

Domestic players are value-chain leaders to process and export fish proteins to domestic markets and export markets. Home industry companies have access to share with giant North American, European, and Asian-Pacific markets. USA and North American industries produce pharmaceutical-grade fish muscle protein as a food ingredient for a dietary supplement, a therapy nutrition ingredient, and food fortification product for the North American market.

Home industry companies apply state-of-the-art processing and extraction with proteins supplemented with bioavailability and desired fish attributes. Home processing has also been driven by the need for alternative and sustainable proteins. There are Icelandic, Danish, and Norwegian enterprises in Europe, though, which are storming European markets.

Denmark, Iceland, and Norway all have seafood processing companies that include good-quality firms processing good-quality salmon muscle proteins, herring, and cod. Clean-label protein foods and sustainable proteins are Europe's backburner because consumers desire more natural and greener proteins. Europe's rigorous food quality and food safety regulations are stringent as much as food for retailing is concerned.

Behind-stage high-tech is with domestically-owned capital firms in processing. Asia-Pacific nation including India, Thailand, and Vietnam leading has established home-based firms with improved fish muscle protein manufacturing plants. Indian domestic industry is being supplemented by high-quality seafood to process and manufacture the fish protein for food, animal feed, and nutraceutical purposes.

Vietnam and Thailand, with record-size in-bulk shipments of seafood, process domestically a portion of the fish protein concentrate and isolate for export shipment and domestically for local consumption. Regional demand is augmented by rising regional sophistication in protein diets.

Fish muscle protein business has witnessed the whole region controlled by Chinese companies in all the processes of fish processing and mass production, cost-saving-production models. China is the world leader in fish protein and feedstuff production and export for application in food, animal feeds, and pharmaceutical industries. Chinese companies are price makers and quantity setters and participated in the global value chain.

Shift towards Hydrolyzed Fish Muscle Protein for Medical & Sports Nutrition

Shift: Fish muscle protein hydrolysate is increasingly in demand in the sports and pharmaceutical sectors on account of increased bioavailability, rate-of-absorption, and enhanced amino acid profile. Surgical patients, the elderly, athletes, etc., are interested in highly bioavailable proteins that aid muscle healing and health. This ranks only second to increasing knowledge about fish muscle protein bioactive peptides, associated with better recovery of muscles, enhanced metabolism, and lowered inflammation.

Strategic Response: To meet this new requirement, Hofseth BioCare (Norway) has launched hydrolyzed salmon protein food supplements for sportsmen and elderly people. Enzymatically hydrolyzed fish proteins are sold by Nissui Corporation of Japan for hospital nutrition schemes to improve post-surgical recovery and muscle nutrition.

Peptan, the leader in collagen and protein, has also ventured into bioactive fish muscle peptides, e.g., manufacturing functional mixtures of proteins for medical nutrition and performance markets. Such advances are placing fish muscle protein on the map as a high-value specialist nutrition ingredient.

Demand Towards Ethical and Traceable Fish Muscle Protein Sourcing

Shift: Consumers increasingly seek greater transparency along the supply chain because ethical issues of overfishing, illegal fishing, and loss of ocean biodiversity become more pervasive. Consumers increasingly seek traced, certified fish muscle protein so they can be sure their consumption will ensure that sustainability and sustainable harvesting are being realized. Certifications like Marine Stewardship Council (MSC) and Aquaculture Stewardship Council (ASC) become high-quality and trust marks.

Strategic Response: Thai Union responded to these challenges by implementing blockchain fish protein tracing, enabling customers to authenticate the origin and sustainability level of their protein products. Royal DSM introduced ASC-certified fish muscle proteins, which ensure compliance with rigorous environment and ethical standards.

PureSea (UK) diversified its range of sustainably sourced fish proteins, further growing its European and North American market share. With the advent of traceability programs and sustainable sourcing programs, companies are winning customer trust and premium product sales.

Increasing Demand for Hybrid Fish-Based Protein Foods in Plant-Forward Diets

Shift: Consumers are looking for more hybrid protein sources based on fish-based proteins and vegetable-based ingredients as flexitarian and plant-based consumption grows in popularity. It is spurred by sustainability, food diversification, and clean-label protein requirements. Hybrid fish proteins are gaining rapidly in alternative seafood, meal replacement, and functional foods.

Strategic Response: For penetrating this market, Good Catch Foods (USA) introduced hybrid seafood products of fish muscle peptides with plant proteins for texture and protein content. Maruha Nichiro (Japan) is producing fish muscle protein blends with added soy and pea proteins for human consumption by consumers seeking sustainable high-protein content. Equally, Nestlé's Garden Gourmet applied fish muscle protein to its seafood-replacement product line as a dietary substitute for fit-demanding consumers. All these trends are propelling the popularity and accessibility of fish muscle protein to mainstream dieting practices.

Fish Muscle Protein Innovation into Skincare and Beauty Nutrition

Shift: The nutricosmetics industry is seeing increasing demand for bioactive fish muscle peptides that possess anti-aging, moisturizing, and hair-strengthening functions. Other collagen-strengthening foods and functional beauty foods made from fish proteins are in demand to render the skin more elastic and improve its appearance.

Strategic Response: Top brands are formulating beauty-from-within products containing fish muscle protein. Rousselot launched Peptan Marine, a bioactive fish muscle protein ingredient used to promote skin elasticity and hydration and added to beauty powders and nutricosmetic capsules in general.

Vital Proteins launched a mixture of sea protein to improve luster in skin and hair strengthening directed towards Gen Z and millennial. Shiseido (Japan) invested in fish protein-derived peptides that are added to collagen drinks and nutricosmetic tablets. Such realignment strategy includes reshaping fish muscle protein into a prestige skincare personal care product globally in the skincare market.

Diversification of Fish Muscle Protein into Other Meat Uses

Shift: The alternative protein landscape is shifting, and fish muscle protein is under the spotlight as the superior ingredient for high-protein clean-label meat substitutes. As consumers move towards alternative sources of protein from cellular meat and plant, fish proteins are being used in hybrid meat substitutes, cultured seafood, and plant-based meat with higher protein content.

Strategic Response: Fish muscle protein is being used by companies in meat substitutes of the next generation. BlueNalu (USA) is leading with cell-based seafood from actual fish muscle protein as a sustainable choice over traditionally raised fish. Hooked Foods (Sweden) has cultivated seafood from plant-based origin that has been enriched with fish muscle protein to improve flavor and texture.

Singapore-made products by Shiok Meats involve incorporating fish muscle protein into their cell-cultured seafood, offering an homogeneous, sustainable product. New fish muscle protein companies entering the market as alternative proteins is that they are entering new and newly emerging food markets.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of fish muscle protein through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 10.5% |

| Germany | 7.0% |

| China | 9.4% |

| Japan | 7.6% |

| India | 9.2% |

Growing health consciousness among consumers to consume clean-label high-quality protein sources to meet their health, fitness, and general well-being needs is boosting the demand in the USA fish muscle protein market. With the rising trend of functional food and sports nutrition, fish protein hydrolysates, peptides, and isolates can find greater demand as they are more digestible and bio-available than regular protein sources.

As interest in innovative protein formulations continues to expand, fish-based proteins are becoming common in protein bars, meal replacements, and fortified snacks for health-oriented consumers and athletes.

Furthermore, the regulatory support for sustainable fisheries and extraction of marine-based protein also fuels innovations in fish protein hydrolysates and isolates for dietary supplements. At the same time, the USA Food and Drug Administration (FDA) and other environmental agencies are encouraging responsible fishery practices and full utilization of byproducts, driving investments in environmentally friendly, precision-extracted fish proteins.

With sustainability continuing to drive consumer buying choices, manufacturers are utilizing eco-friendly sourcing techniques and traceable supply chains to meet market demand.

Several factors are driving the stable growth of the fish muscle protein market in Germany, including stringent EU regulatory policies that support sustainable marine ingredient sourcing, as well as transparency and traceability of the source.

Fish protein peptides, bioavailable collagen formulations, and high-protein functional foods are in demand, as European consumers, who place a strong emphasis on product origins, look to high-quality, bioavailable sources. Marine-source proteins are popular active ingredients in anti-aging supplements, gut health products, and skin-rejuvenating nutraceuticals.

Influencing product innovation in Germany, too, is the ongoing rise of plant-based and flexitarian diets. So, manufacturers are looking to invest in hybrid fish-and-plant protein blends, which offer improved digestibility and a more balanced amino acid profile. Fish peptides based on plant proteins such as pea or rice are used in formulations that appeal to flexitarians looking for sustainable and ethical alternatives to protein.

Moreover, the beauty and wellness industry in Germany is experiencing increased demand for marine collagen as collagen peptides are becoming well-known for their health benefits for skin, hair, and joints. As clean-label and organic certifications have gained ground, German manufacturers have concentrated on high-class protein products from fish from sustainably managed stocks.

These factors have fuelled the emerging global fish muscle protein market where China is likely to be a major player. Due to increasing health awareness among consumers, a range of health-oriented products have now started to incorporate fish collagen peptides, enzymatically hydrolyzed proteins as well as bioactive fish protein extracts.

Another crucial factor contributing to the market growth is the presence of fish proteins in traditional Chinese medicine and modern medicine. In addition to the basic vitamins and minerals that fish meat and byproducts provide, fish protein hydrolysates and peptides are receiving research attention for their laboratory-studied, possible therapeutic effects such as wound healing, immune modulation, and metabolic support. Thanks to an aging population and increasing awareness about health, demand for these functional ingredients should stay robust.

Moreover, the demand for high-purity fish protein isolates for applications in clinical nutrition and pharmaceuticals is being driven by China’s state-sponsored progress in marine biotechnology. Investments in precision extraction, enzymatic hydrolysis, and sustainable aquaculture are putting China at the forefront of marine protein innovation. The booming fish-derived protein market in China is supported by domestic companies improving production scale and quality standards.

| Segment | Value Share (2025) |

|---|---|

| Fish Protein Hydrolysates & Peptides (By Type) | 65.1% |

Peptides and fish protein hydrolysates is the largest segment of the fish muscle protein market, accounting for a whopping 65.1% (2025) market share. The protein sources are highly bioavailable and are readily absorbed, making them suitable for use in sports nutrition, medical foods and nutraceuticals. This segment covers enzymatically hydrolyzed fish proteins, collagen-enriched products, and bioactive peptides, all of which support muscle recovery, joint health, and metabolic health in general.

As a growing number of consumers look for sustainable, highly digestible sources of protein, manufacturers are moving up a gear in marine-based protein innovation. Quality hydrolysis techniques are being utilized to improve protein purity, amino acids matrix balance, and functional properties for specialized dietary applications.

In addition, fermented whole fish protein hydrolysate with improved amino acid profiles have garnered interest as gut health and metabolic health supplements. The products offer superior digestibility and bioactivity, and now they are already applied more and more in functional foods, anti-aging assisting products, and customized nutrition products for maximal well-being.

| Segment | Value Share (2025) |

|---|---|

| Fish Protein Concentrates (By Type) | 34.9% |

The demand for alternative sources of protein is growing with the demand for a sustainable source of meat substitutes, and the fish protein concentrate market is expected to take approximately a 34.9% market share in the year 2025. Fish protein concentrates are a source of highly digestible and high-quality protein content, and are used extensively in fortified breakfast cereals, plant-based meat alternatives, and dairy alternative formulations.

As consumers seek functional foods with enhanced nutritional profiles, the use of fish protein concentrate in ready-to-eat foods, protein bars and meal replacement food products is increasing. As sustainability approaches become more pressing challenges for companies, precision-extracted fish protein concentrates increasingly meet the need for clean-label, allergen-free food applications. Advanced extraction technologies are being used for purification on an advanced level, improving bioavailability and making seafood processing cleaner.

Fish protein powders enriched with micronutrients are emerging in sports nutrition and immune-boosting food products. Fortified protein concentrates, containing additional essential amino acids, omega-3s and minerals from the sea, are becoming increasingly applicable to protein shakes, functional beverages and specialty diets for athletes, seniors and those focused on health.

Industry Overview of Fish Muscle Protein Market: The fish muscle protein market is highly competitive due to several companies emphasizing marine protein innovation along with sustainable sourcing and expanding the full range of applications for health and wellness nutrition. For improved bioavailability, companies are investing in advanced protein extraction, enzymatic hydrolysis, and microencapsulation.

High purity fish protein isolate, functional protein blends, bioactive marine peptides and so on segments the market into types. Several firms are building operations in North America and Europe to meet the increasing demand for sustainable marine proteins.

Some key strategies are through collaboration with nutraceutical brands, investing in alternative protein fermentation, and creating fish-protein based clinical nutrition. Moreover, producers are focusing on low-carbon processing technologies and sustainable packaging solutions.

For instance

The market includes protein products derived from various fish species, such as Tuna, Salmon, Cod, Tilapia, and others, catering to diverse nutritional and industrial needs.

These proteins are available in different forms, including Concentrates, Isolates, and Hydrolysates, ensuring versatility for various applications.

The products are offered in both Powder and Liquid forms, providing flexibility for formulation and usage across industries.

Fish-derived proteins are widely used in industries such as Food & Beverages, Nutraceuticals & Supplements, Pharmaceuticals, Cosmetics & Personal Care, and Animal Feed, with additional applications in other specialized sectors.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global fish muscle protein industry is projected to reach USD 437.8 million in 2025.

Key players include Omega Protein Corporation; Pacific Seafood Group; The Scoular Company; Scanbio Marine Group; Copalis Sea Solutions.

Asia-Pacific is expected to dominate due to high demand for marine-based protein ingredients in functional foods and dietary supplements.

The industry is forecasted to grow at a CAGR of 9.7% from 2025 to 2035.

Key drivers include rising demand for functional marine protein supplements, increasing use in health and wellness applications, and advancements in enzymatic protein hydrolysis technologies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Species, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Species, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Species, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Species, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Species, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Species, 2018 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 58: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Species, 2018 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 68: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: MEA Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 74: MEA Market Volume (MT) Forecast by Species, 2018 to 2033

Table 75: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 76: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 77: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 78: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 79: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Species, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Species, 2023 to 2033

Figure 27: Global Market Attractiveness by Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Species, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Species, 2023 to 2033

Figure 57: North America Market Attractiveness by Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Species, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Species, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Species, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Species, 2023 to 2033

Figure 118: Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Species, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 131: East Asia Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 133: East Asia Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 139: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Species, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Species, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 161: South Asia Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 165: South Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 169: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 180: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 181: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 182: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 183: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 184: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 185: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 186: South Asia Market Attractiveness by Species, 2023 to 2033

Figure 187: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 188: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 189: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Species, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 191: Oceania Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 195: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 199: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Species, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 220: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 221: MEA Market Value (US$ Million) by Species, 2023 to 2033

Figure 222: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 224: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 225: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 227: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 228: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 229: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 230: MEA Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 231: MEA Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 233: MEA Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 234: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 235: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 236: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 237: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 238: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 239: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 233: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: MEA Market Attractiveness by Species, 2023 to 2033

Figure 237: MEA Market Attractiveness by Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by Form, 2023 to 2033

Figure 239: MEA Market Attractiveness by Application, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Sauce Market Growth - Culinary Trends & Industry Demand 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA