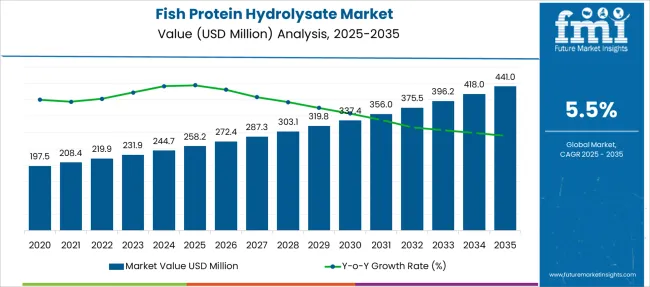

The Fish Protein Hydrolysate Market is estimated to be valued at USD 258.2 million in 2025 and is projected to reach USD 441.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Fish Protein Hydrolysate Market Estimated Value in (2025 E) | USD 258.2 million |

| Fish Protein Hydrolysate Market Forecast Value in (2035 F) | USD 441.0 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The fish protein hydrolysate market is growing steadily due to increased interest in sustainable protein sources and functional food ingredients. Enzymatic hydrolysis technology has improved the extraction process, producing high-quality hydrolysates with enhanced nutritional and bioactive properties.

Consumer demand for natural supplements and health products is driving the use of fish protein hydrolysates in various industries such as food and beverages, animal nutrition, and pharmaceuticals. The preference for powder form has grown due to its convenience, ease of incorporation into formulations, and longer shelf life.

Anchovy remains a key source because of its high protein content and availability in major fishing regions. Expansion of aquaculture and fisheries, along with growing awareness of the health benefits of fish protein hydrolysates, supports ongoing market growth. Innovations in processing techniques and regulatory support for sustainable marine resources are expected to open new opportunities in the future.

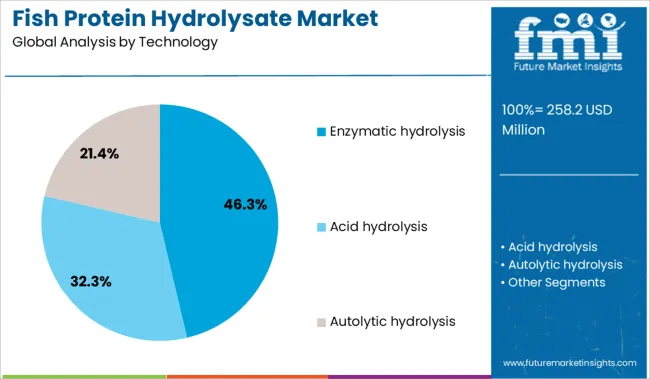

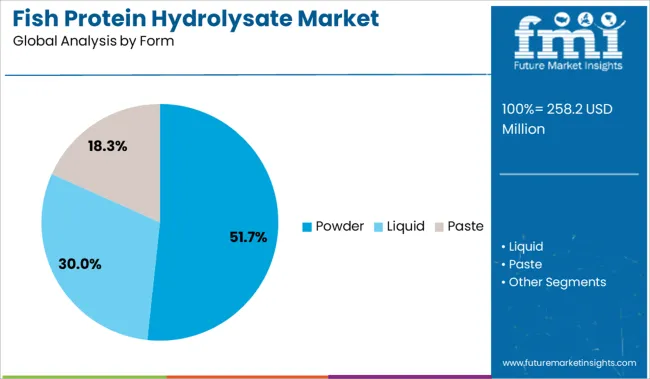

The market is segmented by Technology, Form, Source, Application, and Livestock and region. By Technology, the market is divided into Enzymatic hydrolysis, Acid hydrolysis, and Autolytic hydrolysis. In terms of Form, the market is classified into Powder, Liquid, and Paste.

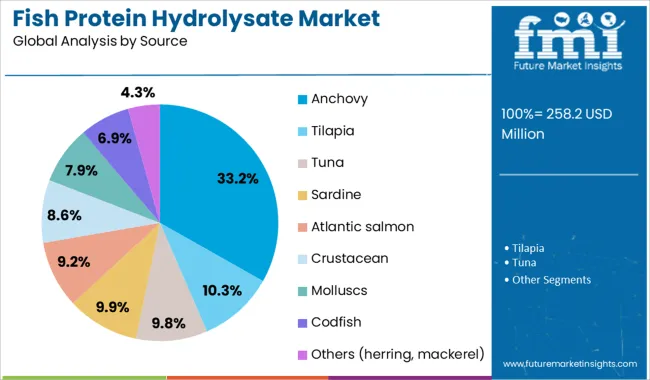

Based on Source, the market is segmented into Anchovy, Tilapia, Tuna, Sardine, Atlantic salmon, Crustacean, Molluscs, Codfish, and Others (herring, mackerel). By Application, the market is divided into Animal feed, Petfood, Cat, and Dog. By Livestock, the market is segmented into Aquaculture, Salmon, Trouts, Shrimps, Others (oysters, crabs, lobsters), Poultry, Broilers, Layers, Swine, Calves, and Equine. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The enzymatic hydrolysis segment is projected to hold 46.3% of the market revenue in 2025. This technology has been preferred for its ability to produce protein hydrolysates with improved digestibility and bioactivity. The process allows precise control over peptide size and composition, resulting in products that offer functional benefits such as antioxidant and antihypertensive effects.

Enzymatic hydrolysis is favored over chemical methods due to its environmental friendliness and product safety. Manufacturers have adopted this technology to meet increasing regulatory and consumer demands for clean-label and natural ingredients.

As interest in functional foods and nutraceuticals grows, enzymatic hydrolysis is expected to remain the dominant technology segment.

The powder form segment is expected to contribute 51.7% of the market revenue in 2025. Its popularity is largely due to ease of handling, transport, and storage. Powdered fish protein hydrolysates can be conveniently incorporated into diverse applications including dietary supplements, functional beverages, and animal feed.

The form also allows for better stability and longer shelf life compared to liquid counterparts. Consumer preference for powdered supplements as a versatile delivery method further drives segment growth.

Manufacturers continue to innovate in powder processing to enhance solubility and flavor masking, supporting wider adoption of this form.

The anchovy source segment is forecasted to hold 33.2% of the market revenue in 2025. Anchovy is valued for its rich protein profile and year-round availability in several major fishing zones. Its relatively low cost and sustainability make it an attractive raw material for fish protein hydrolysate production.

The abundance of anchovy supports consistent supply chains for manufacturers. Additionally, anchovy-based hydrolysates are recognized for their favorable amino acid composition and functional properties.

As sustainable fishing practices continue to evolve, the anchovy segment is expected to maintain a leading role as a raw material source in the fish Protein Hydrolysate Market.

Rising demand in animal nutrition, aquaculture, and sports supplements drives fish protein hydrolysate growth. Opportunities emerge through premium purity products, tailored formulations, and partnerships with feed producers and wellness brands.

Fish protein hydrolysate (FPH) is gaining traction as a highly digestible, amino-acid rich ingredient for aquaculture, livestock feed, and human nutraceuticals. In aquaculture, FPH supports early-stage fish health, improved survival rates, and faster growth.

In poultry and swine production, it enhances feed conversion ratios and immunity. Simultaneously, the sports nutrition sector values FPH for its rapid absorption and bioactive peptides promoting muscle recovery. Rising consumer preference for clean-label proteins in supplements and functional foods is also elevating interest.

As global demand for sustainable protein sources increases, fish protein hydrolysate offers functional and health-promoting benefits across feed and food applications. These combined uses across verticals continue to support steady market expansion.

The fish protein hydrolysate Market offers growth opportunities through product refinement and value-chain collaboration. Manufacturers can differentiate via high-purity hydrolysates, customized peptide profiles, and low-sodium or flavor-neutral formulations ideal for food and supplement brands.

Co-development agreements with aquafeed producers or wellness companies enable tailored blends meeting specific species or nutritional needs. Expansion into pet food, infant nutrition, and clinical nutrition segments further diversifies applications. In emerging economies with growing aquaculture and supplement sectors, local processing facilities and traceable sourcing practices support market trust.

Certifications for sustainability and allergen safety can open premium market tiers. Programs that integrate R&D, marketing education, and co-branded products can help stakeholders capture new niches and drive broader adoption.

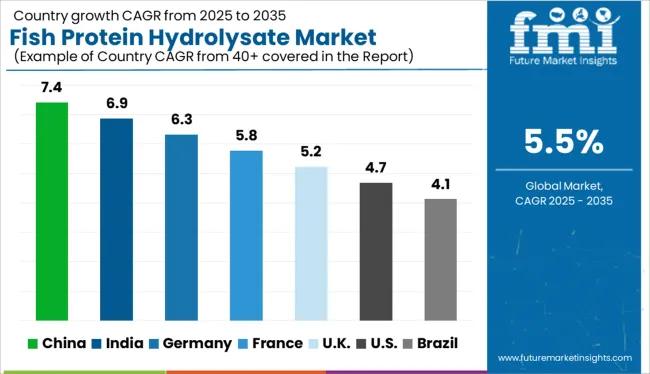

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global fish protein hydrolysate Market is expected to grow at a CAGR of 5.5% from 2025 to 2035, driven by increasing demand for sustainable protein ingredients in animal feed, nutraceuticals, and functional foods. Among BRICS nations, China leads with a 7.4% CAGR, supported by strong aquaculture integration, marine byproduct valorization, and growth in pet nutrition. India follows at 6.9%, fueled by government-backed fisheries development and expansion in agricultural biostimulant applications.

In the OECD group, Germany records a 6.3% CAGR, reflecting rising demand for protein-rich supplements and circular economy practices in food processing. The United Kingdom (5.2%) and the United States (4.7%) show stable growth through innovation in sports nutrition, clean-label formulations, and marine-based health ingredients. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The fish protein hydrolysate Market in China is projected to expand at a CAGR of 7.4%, driven by strong momentum in functional food production and pet nutrition sectors. The ingredient’s high bioavailability is making it a staple in performance supplements and therapeutic formulations. Aquaculture firms are integrating hydrolysates into feedstock to enhance digestibility and growth rates. In parallel, government-backed sustainability initiatives are encouraging the utilization of fish processing byproducts for value-added applications, further supporting the market. Regulatory streamlining for marine-based proteins is also encouraging large-scale manufacturers to scale up investments.

The fish protein hydrolysate Market in India is estimated to grow at a CAGR of 6.9%, fueled by surging demand in agricultural biostimulants and protein-enhanced food categories. Coastal states are witnessing higher investments in marine waste valorization as processors partner with biotech startups. Increasing consumer preference for clean-label and animal-free protein boosters is pushing the ingredient into new product categories. Farmers are also adopting hydrolysates in foliar sprays to stimulate plant health, opening new downstream markets. The blend of low-cost raw material and strong domestic R&D is reinforcing competitiveness.

In Germany, the fish protein hydrolysate market is expected to grow at a CAGR of 6.3%, supported by innovation in circular nutrition and sustainable animal feed solutions. Premium livestock producers are shifting toward protein-rich, digestible alternatives sourced from marine byproducts. The organic food segment is experimenting with hydrolysate inclusion to meet rising protein demands in vegetarian and sports nutrition SKUs. Government subsidies for waste reduction in fisheries are accelerating investment in enzymatic hydrolysis infrastructure. This market is defined by clean processing, origin traceability, and quality certifications.

The fish protein hydrolysate market in the United Kingdom is anticipated to grow at a CAGR of 5.2%, backed by rising interest in marine-derived bioactives for pet nutrition, cosmetics, and agricultural applications. Small-scale coastal processors are being supported by innovation grants to pilot high-purity hydrolysates. Product differentiation is emerging around sustainable sourcing and peptide concentration. Post-Brexit shifts in seafood processing dynamics have led to greater focus on local marine value chains, where fish waste is now increasingly seen as a revenue stream rather than discarded biomass.

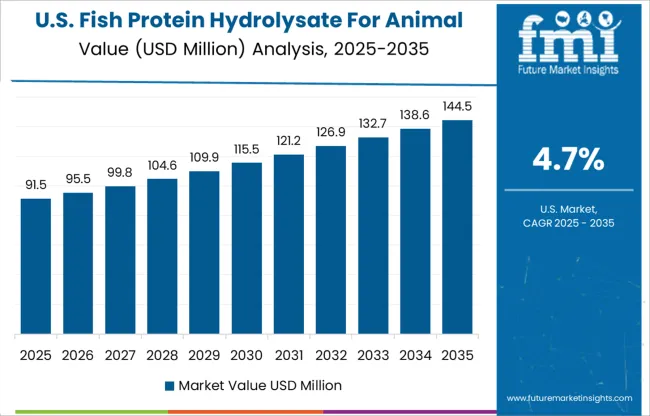

The fish protein hydrolysate market in the United States is forecast to grow at a CAGR of 4.7%, as manufacturers prioritize functional protein formats for health-conscious consumers and livestock nutrition. West Coast seafood processors are leading the transformation of residual biomass into high-value hydrolysates. The growing interest in gut health and clean protein among American consumers is creating space for marine-derived peptides in sports and wellness formulations. However, supply chain complexity and regulatory hurdles remain challenges for scalability. Collaborations between bio-refineries and academic labs are working to improve process efficiency.

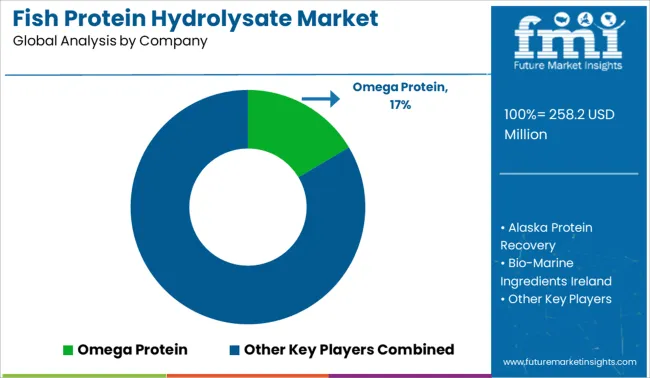

The fish protein hydrolysate market is fragmented, composed of specialized marine ingredient producers and regionally focused suppliers. Tier 1 companies like Omega Protein, Diana Aqua, and Hofseth Biocare lead the market through vertically integrated operations, advanced enzymatic hydrolysis technologies, and global distribution networks catering to aquafeed, pet food, and nutraceutical sectors.

Omega Protein holds a 16.5% market share, driven by its scale, sustainability focus, and broad application base. Tier 2 firms such as Bio-Marine Ingredients Ireland, Copalis Sea, and Scanbio Marine emphasize high-quality protein fractions and functional peptides, particularly in the European and North American markets.

Tier 3 players including Janatha Fish Meal, Nutrifish, and TC Union operate regionally, supplying cost-effective solutions for local feed and fertilizer industries. Market growth is fueled by rising demand for sustainable protein sources and circular economy practices in seafood processing.

On February 21, 2025, Hofseth BioCare ASA announced via GlobeNewswire a strategic partnership with Symrise AG, which provided a €5 million loan to build a second enzymatic hydrolysis plant in Berkåk, Norway, tripling salmon-based hydrolysate production and enabling global distribution.

| Item | Value |

|---|---|

| Quantitative Units | USD 258.2 Million |

| Technology | Enzymatic hydrolysis, Acid hydrolysis, and Autolytic hydrolysis |

| Form | Powder, Liquid, and Paste |

| Source | Anchovy, Tilapia, Tuna, Sardine, Atlantic salmon, Crustacean, Molluscs, Codfish, and Others (herring, mackerel) |

| Application | Animal feed, Petfood, Cat, and Dog |

| Livestock | Aquaculture, Salmon, Trouts, Shrimps, Others (oysters, crabs, lobsters), Poultry, Broilers, Layers, Swine, Calves, and Equine |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Omega Protein, Alaska Protein Recovery, Bio-Marine Ingredients Ireland, Copalis Sea, Diana Aqua, Hofseth Biocare, Janatha Fish Meal & Oil Products, Nutrifish, Rossyew, SAMPI, Scanbio Marine, Sociedad Pesquera Landes, SOPROPECHE, TC Union, and Triplenine |

| Additional Attributes | Dollar sales by form (liquid, powder, paste), source species (cod, tuna, salmon, anchovy, others), and application (animal feed, aquaculture, functional food & beverages, pharmaceuticals, cosmetics, agriculture); regional production and consumption trends driven by fish processing industry scale and sustainability initiatives; innovation in enzymatic hydrolysis techniques and bioactive peptide extraction; regulatory standards impacting feed and food-grade classifications; environmental impact of byproduct utilization and marine resource management; and emerging use cases in pet nutrition, sports supplements, and biostimulants. |

The global fish protein hydrolysate market is estimated to be valued at USD 258.2 million in 2025.

The market size for the fish protein hydrolysate market is projected to reach USD 441.0 million by 2035.

The fish protein hydrolysate market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in fish protein hydrolysate market are enzymatic hydrolysis, acid hydrolysis and autolytic hydrolysis.

In terms of form, powder segment to command 51.7% share in the fish protein hydrolysate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Sauce Market Growth - Culinary Trends & Industry Demand 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA