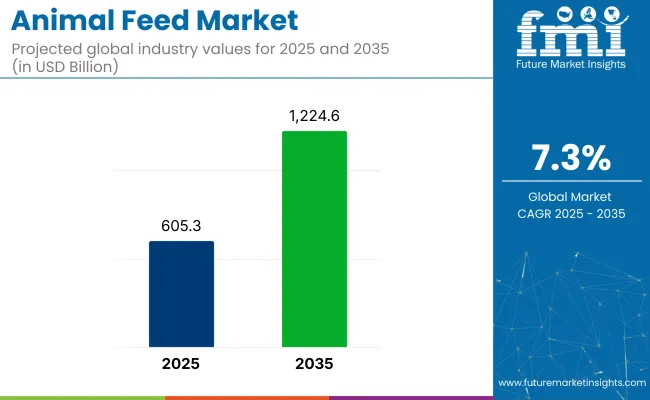

The global animal feed market is estimated at USD 605.3 billion in 2025, and a valuation of USD 1,224.6 billion is projected for 2035. This growth is being driven by intensified livestock production, rising animal protein consumption, and government-led food security agendas.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 605.3 billion |

| Market Value (2035F) | USD 1,224.6 billion |

| CAGR (2025 to 2035) | 7.3% |

Feed supply chains are becoming more integrated, enabling efficient movement of cereals, oilseed meals, and micronutrient additives across borders and production nodes. Feed manufacturers are modernizing mills, automating formulations, and embedding traceability features to meet both regulatory and commercial requirements.

In North America, automation upgrades and enzyme-enhanced formulations are reducing feed conversion ratios and improving operational consistency. The European Union has shifted toward non-antibiotic growth promoters, reinforcing uptake of functional additives that align with clean-label protein requirements.

Asia Pacific continues to lead in volume, supported by integrated poultry and aquaculture operations scaling nutrient-dense rations across domestic and export-oriented channels. Latin America is focusing on feed self-sufficiency, particularly for monogastric and ruminant operations concentrated in Brazil and Argentina.

Animal feed accounts for 10-12% of the agriculture and farming market, 40-45% of the livestock and poultry sector, 5-7% of the pet care industry, 2-3% of agricultural equipment usage, and 8-10% of the food processing ecosystem. These shares reflect its foundational role in supporting productivity, health, and efficiency across the protein value chain.

Commercial operations in broiler, swine, and dairy segments are scaling rapidly, requiring consistent nutrient density to support growth, fertility, and disease resistance. Regulatory oversight is reshaping formulation strategy, with bans on sub-therapeutic antibiotics prompting greater reliance on acidifiers, binders, and non-antibiotic performance enhancers. Feed cost remains the single largest input expense in livestock systems, often accounting for 60-70% of total production cost, making formulation precision and raw-material optimization central to margin retention.

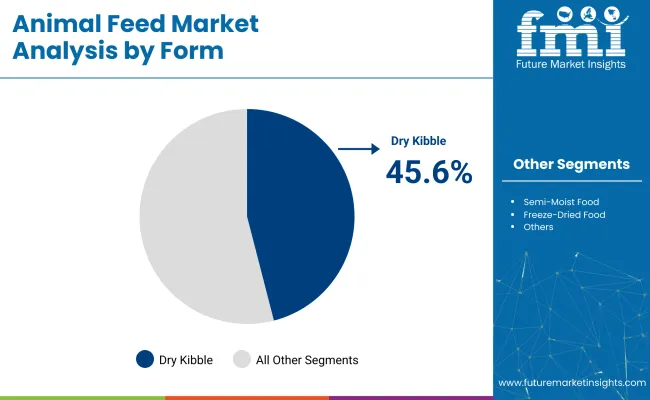

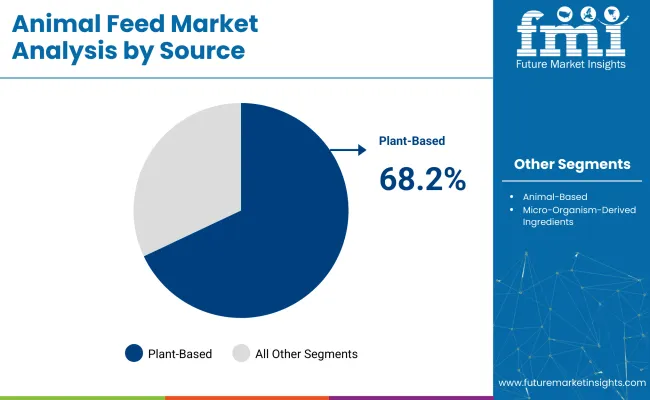

The animal feed market is segmented by species into commercial poultry, backyard poultry, ruminants such as cattle, sheep, and goats, swine, and equine. By form, it includes wet/moist food, dry kibble, semi-moist food, frozen, and freeze-dried food. By source, the industry utilizes plant-based, animal-based, and micro-organism-derived ingredients.

Distribution occurs through direct and indirect sales, including modern trade, animal feed stores, veterinary clinics, and online retailers. The market is segmented regionally into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, and Middle East and Africa.

The poultry (commercial) segment is expected to dominate the global market, holding the largest share of 37.4% in 2025.Demand is driven by the rapid intensification of poultry farming across both developed and emerging economies, where broiler and layer operations are expanding to meet rising consumer demand for affordable meat and eggs.

The dry kibble segment is projected to dominate the market by form, accounting for an estimated 45.6% share in 2025.Dry kibble remains the preferred choice across both commercial and backyard farming due to its ease of storage, cost-effectiveness, and longer shelf life compared to wet or frozen alternatives.

The plant-based segment is expected to lead the market by source, capturing a substantial market share of 68.2%. This dominance is attributed to the wide availability, cost efficiency, and nutritional adequacy of plant-derived ingredients such as corn, soybean meal, wheat bran, and rice polish.

The direct sales segment is projected to dominate the market by sales channel, accounting for an estimated 34.7% share in 2025. Direct sales remain the most preferred route for large-scale commercial farms and institutional buyers, who require consistent supply contracts and customized feed formulations.

Manufacturers are emphasizing precision nutrition, lifecycle-based feed, and functional additives. Strong demand for novel proteins and automated feed systems is shaping product innovation.

Rising Demand for High-Efficiency Feed Solutions

The market is being driven by a global shift toward more efficient and nutritionally optimized feed formulations. As commercial livestock operations scale up, the pressure to maximize feed conversion ratios (FCRs) has grown. Producers are increasingly adopting advanced formulations enriched with amino acids, enzymes, prebiotics, and organic minerals to enhance animal growth, reproductive efficiency, and immunity. Concerns over antimicrobial resistance have accelerated the move toward antibiotic alternatives, including phytogenic feed additives and acidifiers.

Technological Integration and Ingredient Innovation

Precision nutrition platforms, real-time data monitoring, and automated ration balancing systems are allowing producers to tailor feed more accurately to individual animal needs, minimizing waste and optimizing productivity. Concurrently, there is growing exploration of alternative protein sources, such as insect meal, algae-based proteins, and single-cell biomass, to reduce dependency on traditional feed ingredients like soybean meal and fishmeal.

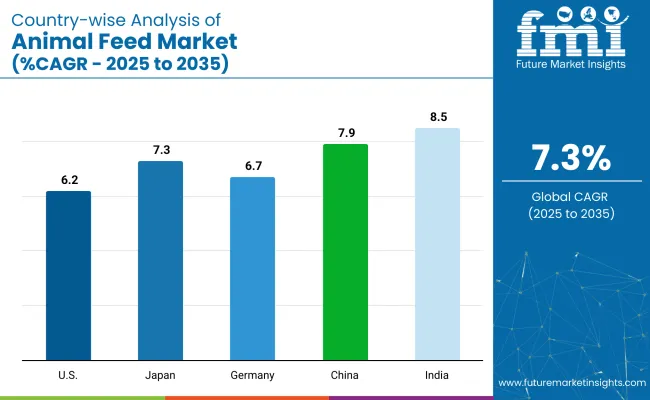

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

| Japan | 7.3% |

| Germany | 6.7% |

| China | 7.9% |

| India | 8.5% |

Sales of animal feed are projected to grow at a 7.3%CAGR between 2025 and 2035. All five countries highlighted out of 40 analyzed are expected to either exceed or closely match the global growth rate. India leads with 8.5%, followed by China at 7.9%, reflecting expanding livestock operations and rising demand for protein-rich diets. Japan (7.3%), Germany (6.7%), and the United States (6.2%) show measured expansion as feed systems mature and shift toward efficiency-focused solutions.

The growth spread ranges from +17% (India) to -15% (United States) relative to the global baseline. Key contributors to divergence include integrated poultry expansion in India, compound feed scale-up in China, precision formulation in Japan, compliance-driven upgrades in Germany, and specialization in high-protein blends in the USA

The USA animal feed market is estimated to grow at 6.2% CAGR during the study period. Growth is being underpinned by the country’s vast commercial poultry, swine, and beef industries, where feed conversion efficiency and bio-security compliance remain decisive cost variables. Expansion is being reinforced by the rebound of the food-service sector, which is pulling larger volumes of meat and dairy through the supply chain and, in turn, stimulating feed demand.

Formulators are increasingly relying on precision-nutrition platforms that process on-farm production data and tailor rations daily, lowering waste and elevating carcass yield. Regulatory pressure from the Food and Drug Administration to curtail routine antibiotic use is prompting accelerated adoption of enzyme complexes, organic acids, and probiotic blends, thereby lifting the average selling price per ton.

Demand for animal feed in Germany is estimated to grow at 6.7% CAGR during the study period. Expansion is being driven by the country’s rigorous animal-welfare regime, which obliges producers to invest in nutrient-balanced rations that support immune competence and reduce veterinary interventions.

Germany’s dominant pork and poultry sectors are shifting towards higher welfare tiers, necessitating feed formulations with enhanced fibre profiles and specific amino-acid ratios that curb aggressive behaviour and improve gut health.

Strong demand for regionally sourced, non-genetically modified cereals is allowing cooperatives to command price premiums while maintaining traceability through the QS quality-assurance framework. Berlin’s climate objectives are encouraging the uptake of feed additives that lower enteric emissions, channeling R&D capital into algae oils and tannin-based methane reducers.

Demand for animal feed in China is estimated to grow at 7.9% CAGR during the study period. Recovery of the nation’s swine herd after African swine fever, coupled with relentless urbanisation, is increasing demand for compound and concentrated feeds suited to intensive production systems.

Provincial governments are promoting scale-up of pig farms to minimise disease risk, and such large units require consistent, high-quality rations delivered under forward contracts. Feed conglomerates are investing heavily in fully automated mega-mills along the Yangtze and Pearl River corridors, leveraging economies of scale that compress per-ton costs while enabling rapid formulation shifts when commodity prices swing.

The animal feed market in Japan is estimated to grow at 7.3% CAGR during the forecast period. Although livestock numbers are comparatively modest, premiumisation trends and stringent food-safety protocols heighten the value captured per ton of feed. High disposable incomes sustain demand for marbled Wagyu beef, free-range eggs, and antibiotic-free broiler meat, each necessitating meticulously balanced rations rich in omega-3 fatty acids, antioxidants, and trace-minerals.

Imports supply more than half of Japan’s grain needs; feed compounders hedge forex risk by diversifying toward alternative ingredients such as rice bran, copra meal, and domestically cultivated sorghum. Government grants under the Feed Innovation Program support the deployment of Internet-of-Things sensors that monitor animal growth metrics, enabling millers to refine nutrient delivery and reduce feed conversion ratios.

The animal feed market in India is estimated to grow at 8.5% CAGR during the forecast period. Expansion is being energised by the country’s surging dairy and poultry sectors, which supply protein to a population undergoing rapid income growth and urban dietary diversification.

Government schemes such as the RashtriyaGokul Mission encourage genetic improvement of cattle herds, and enhanced productivity creates demand for compound cattle feed rich in bypass protein, minerals, and rumen-protected fats.

Poultry integrators in states like Telangana and Tamil Nadu operate vertically linked value chains, enabling steady off-take of high-energy mash and crumble feeds optimised for fast broiler turnover. Investments in cold-chain infrastructure widen distribution of perishable meat and eggs, indirectly boosting feed throughput.

The animal feed additive market is driven by established players and emerging innovators focused on nutritional optimization, sustainable ingredient sourcing, and species-specific formulations. Key companies like DSM N.V. and BASF SE lead with a wide range of vitamins, enzymes, and performance-enhancing compounds.

Fuji Chemical Industries and Divi’s Laboratories are known for their expertise in high-purity carotenoids and specialty feed ingredients. Piveg, Inc. and FenchemBiotek Ltd. offer plant-based solutions including lutein and functional phytochemicals. Alga Technologies and Cyanotech Corporation are advancing algae-based proteins and antioxidants for aquafeed and livestock health. In Asia, Zhejiang NHU Co., Ltd. stands out with cost-effective, high-volume production of vitamins and feed-grade additives.

Recent Animal Feed Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 605.3 billion |

| Projected Market Size (2035) | USD 1,224.6 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in tons |

| Species Analyzed (Segment 1) | Livestock Categories, Including Commercial Poultry, Backyard Poultry, Ruminants Such as Cattle, Sheep, And Goats, As Well As Swine And Equine. |

| Form Analyzed (Segment 2) | Wet/Moist Food, Dry Kibble, Semi-moist Food, Frozen, and Freeze-dried Food. |

| Source Analyzed (Segment 3) | Plant-based, Animal-based, and Micro-organisms. |

| Sales Channel Analyzed (Segment 4) | Direct Sales, Indirect Sales, Modern Trade, Animal Feed Stores, Veterinary Clinics, and Online Retailers. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | DSM N.V, BASF SE, Fuji Chemical Industries Co, Divi’s Laboratories, Piveg, Inc, Fenchem Biotek Ltd., Alga Technologies, Cyanotech Corporation, Zhejiang NHU Co., Ltd. |

| Additional Attributes | Dollar sales, growth rates, segment share, species-specific demand, top regions by volume, feed ingredient trends, competitive share, pricing benchmarks, sales channel share, and regulatory impacts. |

The market caters to various livestock categories, including commercial poultry, backyard poultry, ruminants such as cattle, sheep, and goats, as well as swine and equine.

Animal feed is available in multiple formats, including wet/moist food, dry kibble, semi-moist food, frozen, and freeze-dried food, offering flexibility for different dietary needs.

The feed industry incorporates diverse sources such as plant-based, animal-based, and micro-organism-derived ingredients to ensure nutritional balance.

Distribution takes place through direct and indirect sales, including modern trade, animal feed stores, veterinary clinics, and online retailers, making products widely accessible.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global animal feed market is projected to reach USD 605.3 billion in 2025.

Key players include DSM N.V; BASF SE; Parry Nutraceutical; Fuji Chemical Industries Co; Divi’s Laboratories; Piveg, Inc; Fenchem Biotek Ltd.

It is forecasted to reach USD 1,224.6 billion by 2035.

The industry is forecasted to grow at a CAGR of 7.3% from 2025 to 2035.

Key drivers include rising global demand for high-quality protein sources, increasing use of functional feed additives, and advancements in alternative protein feed production.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Probiotic Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Minerals Market Analysis - Size, Growth, and Forecast 2025 to 2035

Animal Feed Preservative Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Antibiotics Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Analyzing Animal Feed Additives Market Share & Industry Leaders

Animal Feed Processing Equipment Market Analysis & Forecast by Function, Feed Type, End-User, Automation, and Region through 2025 to 2035

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

Animal Feed Prebiotics Market – Growth, Livestock Nutrition & Demand

Animal Feed Sweetener Market – Growth, Innovations & Market Demand

Animal Feed Protease Market

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

UK Animal Feed Additives Market Trends – Growth, Demand & Forecast 2025–2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

USA Animal Feed Ingredients Market Report – Trends & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA