The UK Animal Feed Additives market is estimated to be worth USD 2,330.6 million by 2025 and is projected to reach a value of USD 5,269.9 million by 2035, growing at a CAGR of 8.5% over the assessment period 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,330.6 million |

| Industry Value (2035F) | USD 5,269.9 million |

| CAGR (2025 to 2035) | 8.5% |

Substantial development has taken place in the UK animal feed additives market, which is achieving this, thanks to the demand for high-quality animal nutrition, better feed efficiency, and livestock health improvement. With a prominent emphasis on optimizing animal productivity and reducing environmental impact, feed additives are central to ensuring balanced and nutrient-dense diets for livestock and poultry.

The sector is being led by Cargill, DSM, BASF, All tech, Evonik, and Nutreco, key manufacturers through their reinvestment in groundbreaking feed additive formulations, digital feed optimization tools, and sustainable livestock nutrition solutions.

These companies are the ones that find resurrection of product to enhance digestibility, feed conversion, and immune system support in animals. They are now also dealing with the long-standing problem of developing antibiotic-free and organic additives in order to meet the UK and EU feed safety regulations.

Continuous compliance with the regulations is the major roadblock for the growth of the market, with authorities of the UK pressing strict rules on feed safety, traceability, and additive usage. On the other hand, the high prices of raw materials and regulatory limits continue to be a challenge; however, the research for enzyme-based and natural additives keeps opening new doors for innovation.

The market is predicted to have a stable growth year on year with the development of technologies in feed formulation, a growing trend for functional feed additives, and a continuous rise in investment in sustainable animal nutrition solutions.

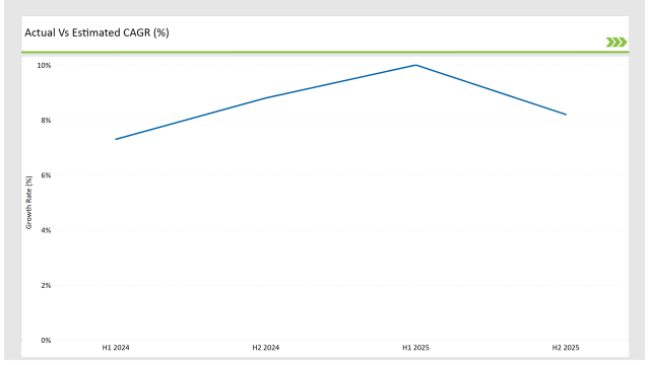

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Animal Feed Additives market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Cargill launched a new range of precision-formulated feed additives for enhanced gut health. The new product line focuses on improving digestibility and reducing feed costs for livestock producers. |

| Oct 2024 | BASF introduced a next-generation phytogenic additive to improve feed digestibility. This plant-based additive aims to replace synthetic growth promoters while maintaining optimal animal performance. |

| Sep 2024 | DSM expanded its UK operations with a new production facility focused on sustainable feed solutions. The facility will focus on producing high-performance probiotic and enzyme-based feed additives. |

| Aug 2024 | Alltech partnered with livestock farmers to develop tailored feed additive programs. The initiative is designed to optimize feed efficiency and reduce antibiotic dependence in UK farming operations. |

| Jul 2024 | Evonik unveiled a high-performance enzyme additive aimed at improving protein utilization in animal feed. The enzyme has been formulated to maximize nutrient absorption and minimize waste output. |

Rising Demand for Functional Feed Additives

The strong plethora of functional feed additives that will be enhancing feed efficiency for better gut health, immune support, and overall well-being of animals. Feed manufacturers are building enzyme-based and probiotic systems for enhanced nutrient absorption and other digestive benefits.

The more recent surge in consumer demand for antibiotics-free-living animals encourages the shift toward functional additives. In addition, livestock farmers are acknowledging the role functional additives play in the reduction of disease outbreaks as well as improving the growth rate and feed conversion ratio (FCR) which subsequently leads to further uptake across poultry, dairy, and aquaculture industries.

Technological Advancements in Precision Nutrition

Feed manufacturers find precision nutrition technologies useful to optimize feed formulations based on the target livestock. Companies use AI-driven analytics paired with real-time monitoring systems and data-dependent feeding strategies to determine when a feed formulation is meeting species-specific nutrient requirements with minimal waste.

The adoption of precision feeding systems is likely to witness reasonable growth as farmers are looking to maximize productivity while minimizing feed costs. The automation of feeding and digital sensors on livestock farms also allows more refined and accurate dosing of feed additives, hence minimizing waste with an overall better effect on livestock health.

Expansion of Sustainable and Natural Feed Additives

The mounting pulls in the UK feed additives market towards demand for natural and eco-friendly additives, with heightened awareness of environmental sustainability. Manufacturers are nowadays offering plant-based emulsifiers, organic acids, and sustainable enzyme solutions designed to reduce the environmental footprint of livestock farming while enhancing feed stability and digestibility.

Sustainability certifications and carbon footprint reduction schemes are at the forefront of new product innovations and marketing. So, insect-based protein additives and algae-derived omega-3 supplements are being studied as sustainable alternatives for replacing traditional fishmeal and synthetic feed ingredients.

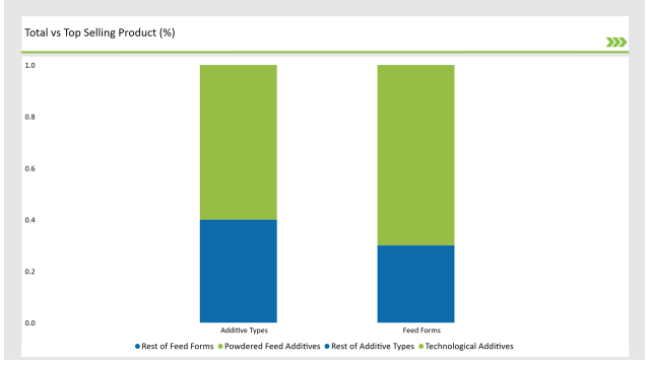

% share of Individual categories by Product Type and Form in 2025

Tech alternatives are the main drive for feed innovation, making sure that the animal nutrition is more stable, more consistent, and more efficient. With the addition of emulsifiers, stabilizers, and anti-caking agents, these additives are the most important in making sure the feed products are of high quality and stay for a longer time.

With the newly set aim to provide cost-effective and fast feeding solutions, manufacturers are shifting their focus on investing in modern formulation techniques. The search for concentrated feeds enriched with vitamins, and minerals initiates the usage of technologically enhanced additives that will benefit the nutritional value as well as the product stability.

Powdered feed additives now dominate the market with a 70% market share due to their greater mixing properties, ease of handling, and long shelf life. The encapsulated probiotics becoming much in demand, heat-stable enzymes, and acidifiers which also are gaining popularity are the factors that are pushing very much the demand for powdered formulations.

Microencapsulated additive solutions are being developed by manufacturers who are releasing them with greater bioavailability and nutritional efficacy. Furthermore, water-soluble powdered additives are a new trend, as they can be mixed into liquid feed formulations easily thus improving the nutrient uptake in dairy and poultry production.

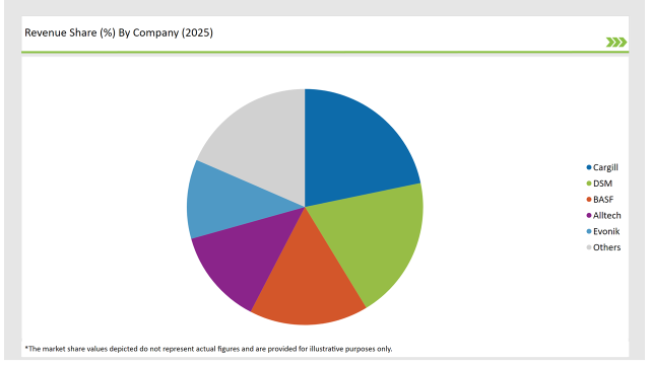

2025 Market share of UK Animal Feed Additives suppliers

Note: above chart is indicative in nature

The animal feed additive market in the UK has become a battlefield with various companies competing primarily on the grounds of product innovation, sustainable formulations, and collaborative strategies. Some of the prominent companies such as Cargill, DSM, BASF, All tech, Evonik, and Nutreco resort to the investment of enzyme-based, probiotic, and functional additive options to outweigh the challenges faced by the livestock producers who are in constant evolution.

These companies are also stepping up their investments in R&D and are constructing new facilities in the attempt to keep up with the intensifying demand for high-performance feed additives. In view of the growing focus on sustainability and a shift towards antibiotic-free policies, the companies have started to introduce natural and environment-friendly alternatives for improving the feed's efficiency, nutrient absorption, and immune system.

Regulatory compliance, technological advancement, and cooperation with the universities take the lead in setting the rules of the game in the competitive area. Moreover, the mergers and acquisitions between the market players are increasing the competitive climate even more as the companies are driving to increase their market share and product portfolios.

Technological Additives, Sensory Additives and Nutritional Additives.

Available in forms like powder, liquid, and granules.

Within the Forecast Period, the UK Animal Feed Additives market is expected to grow at a CAGR of 8.5%.

By 2035, the sales value of the UK Animal Feed Additives industry is expected to reach USD 5,269.9 million.

The growth is driven by increasing demand for antibiotic-free feed solutions, advancements in precision feeding technologies, and the rising adoption of sustainable and functional feed additives.

Prominent players in the UK Animal Feed Additives manufacturing include Cargill, DSM, BASF, Alltech, Evonik, and Nutreco, all of whom are focusing on innovation in probiotics, enzymes, and plant-based additives.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA