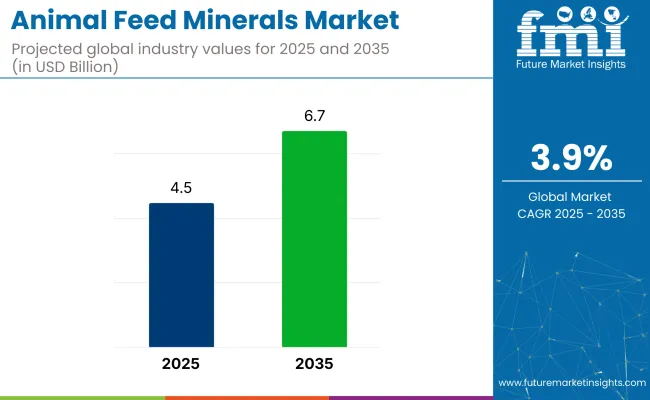

The global animal feed minerals market is valued at USD 4.5 billion in 2025 and is expected to reach USD 6.7 billion by 2035, reflecting a CAGR of 3.9%.

• Market Value (2025): USD 4.5 billion

• Forecast Value (2035): USD 6.7 billion

• Forecast CAGR: 3.9%

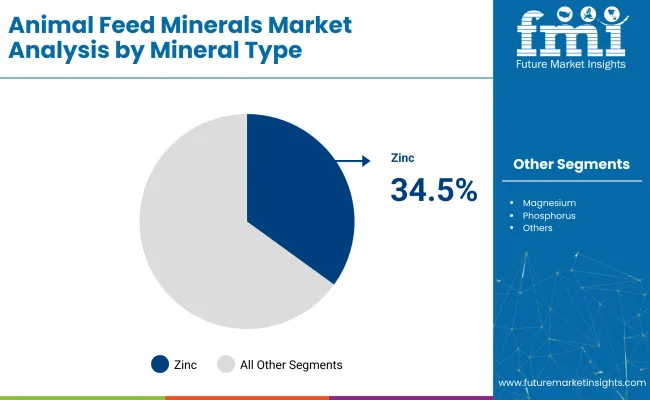

• Mineral Leader in 2025: Zinc Minerals (34.5% market share)

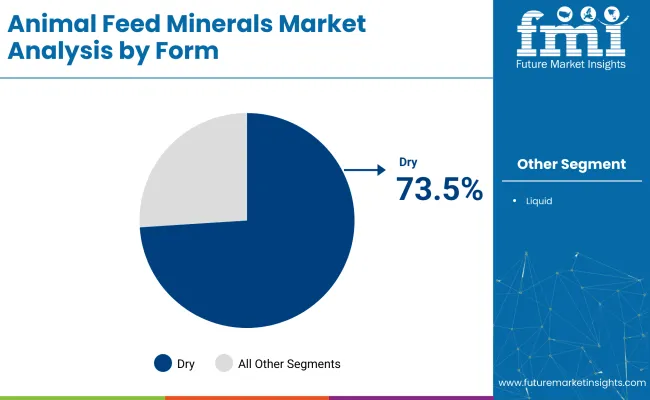

• Top Form Segment: Dry Form (73.5% market share)

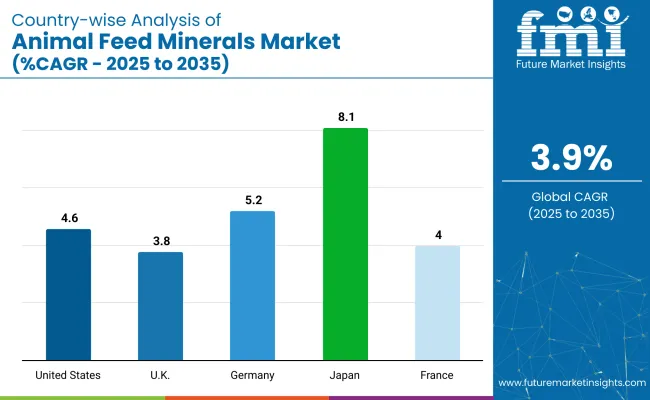

• Key Growth Region: Asia Pacific (fastest-growing market in Japan with 8.1% CAGR)

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 4.5 billion |

| Projected Value (2035F) | USD 6.7 billion |

| CAGR (2025 to 2035) | 3.9% |

This growth is being driven by increasing demand for high-quality meat, dairy, and egg products, particularly in developing economies with rising disposable incomes and changing dietary preferences. The market is also benefiting from greater awareness among livestock producers regarding mineral deficiencies and their impact on animal health and productivity.

The USA is expected to maintain the largest market share, growing at a CAGR of 4.6%. Meanwhile, Japan and Germany are expected to register significant growth with CAGRs of 8.1% and 5.2% respectively. Zinc minerals are likely to remain the top segment,accounting for a market share of 34.5% in 2025, while dry form feed minerals are projected to continue dominating with 73.5% market share.

The animal feed minerals market accounts for approximately 6-8% of the overall animal feed market, reflecting its essential but smaller share relative to bulk feed ingredients like grains and proteins. Within the animal nutrition market, it holds an estimated 12-15% share, given its role as a core micronutrient segment supporting animal health and productivity.

In the livestock feed additives market, feed minerals constitute around 25-30%, as this category includes vitamins, amino acids, enzymes, and probiotics alongside minerals. Its share within the broader feed ingredients market remains under 5%, highlighting its specialized, value-added position in global livestock production systems.

The animal feed minerals market is segmented by mineral type, animal type, form, sales channel, and region. By mineral type, it is segmented into magnesium, calcium, phosphorus, iron, zinc, and others (copper, potassium, etc.). By animal, it includes poultry, swine, ruminants, aquaculture, equine, and other animals (pets, small animals).

By form,it is segmented into dry and liquid. By sales channel, it is segmented into direct sales, indirect sales, modern trade, animal feed stores, veterinary clinics, and online retailers.By region,it covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia,the Pacific, the Middle East and Africa.

Zinc is expected to remain the most lucrative mineral type segment, accounting for a 34.5% share in 2025. Its dominance is attributed to its crucial role in enhancing immunity, reproduction, hoof integrity, and milk production in dairy and poultry animals. Magnesium and calcium are also gaining traction due to their benefits for bone development and muscular functions.

Among animal types, poultry is anticipated to lead consumption with a 35.5% market share in 2025. This dominance is driven by the sector’s rapid growth, short production cycles, and high demand for balanced mineral supplementation to support meat and egg productivity. Swine and ruminants follow closely due to their significant feed volume requirements and commercial farming expansion. Calcium and phosphorus are critical for milk production

The dry form of feed minerals is set to dominate the market with a 73.5% share in 2025. This is due to ease of handling, longer shelf life, and cost-effectiveness compared to liquid forms. Dry powders are preferred by manufacturers and distributors for their stable formulation and reduced moisture content, which enhances storage efficiency. Liquid forms, although efficient for quick absorption, incur higher storage and transport costs.

Direct sales are anticipated to remain the leading sales channel, accounting for an estimated 45% market share in 2025. This dominance is supported by large-scale procurement by integrated farms and cooperatives that prefer direct sourcing for bulk mineral feed purchases. Feed stores and online retailers are gaining momentum due to accessibility and diversified product ranges targeting small and medium-scale farmers.

Recent Trendsin Animal Feed Minerals Market

Challengesin the Animal Feed Minerals Market

Among the top five countries, Japan is projected to record the fastest growth with a CAGR of 8.1% from 2025 to 2035, driven by rising meat and dairy consumption and advanced feed processing technologies. Germany follows with a CAGR of 5.2%, supported by innovation in mineral chelation and sustainability-focused formulations.

The USA market is expected to grow steadily at 4.6% CAGR, underpinned by stringent food safety regulations and high dairy demand. France is projected to expand at a CAGR of 4.0%, while the UK records the slowest growth at 3.8% CAGR, driven by structured livestock practices and eco-friendly feed solutions.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The animal feed minerals revenue in the USA is projected to grow at a CAGR of 4.6% from 2025 to 2035. Growth is being driven by rising demand for high-quality dairy, meat, and egg products, coupled with stringent regulations ensuring animal health and food safety.

The dominance of zinc and calcium minerals continues, with major manufacturers prioritizing innovation in chelated and organic mineral blends to meet nutritional standards and support the expanding livestock sector’s sustainability goals.

The sales of animal feed minerals in the UK arepredicted to rise at a CAGR of 3.8% from 2025 to 2035. Growth is being supported by increasing investments in sustainable livestock farming and the adoption of bioavailable mineral blends for ruminants and poultry. There is rising awareness regarding mineral deficiencies affecting animal productivity, which drives demand for balanced formulations.

The animal feed minerals industry in Germany is projected to expand at a CAGR of 5.2% from 2025 to 2035. Demand is being driven by a focus on enhancing feed efficiency and improving gut health in livestock, particularly dairy cattle and swine.

The revenue from animal feed minerals in France is anticipated to flourish at a CAGR of 4.0% from 2025 to 2035. Growth is supported by increasing consumer demand for premium-quality dairy and meat products, pushing farmers to adopt balanced mineral supplementation to enhance productivity.

The animal feed minerals market in Japan is estimated to grow at a CAGR of 8.1% from 2025 to 2035. Market growth is driven by rising consumption of meat and dairy products, leading to increased mineral supplementation in feed formulations.

The market is moderately consolidated, with a few global leaders holding a significant share. Tier-one companies such as Cargill Inc., Royal DSM NV, Phibro Animal Health, Yara International, and Archer Daniels Midland Co. are competing based on product innovation, specialized mineral blends, and expanded distribution networks to strengthen their market presence globally.

These companies focus on developing bioavailable and chelated mineral formulations, investing in sustainable sourcing, and expanding their presence in emerging markets through strategic acquisitions and partnerships.

Company strategies revolve around pricing competitiveness, formulation innovations to enhance mineral absorption, and partnerships with regional feed manufacturers to tailor solutions for local livestock nutrition needs.

Recent Animal Feed Minerals Industry News

Phibro Animal Health completed the acquisition of Zoetis’ medicated feed additive (MFA) product portfolio and certain water-soluble products in October 2024, significantly expanding its product lineup and global reach.

In March 2024, Novus International acquired BioResource International Inc., a USA-based enzyme firm to bolster its innovation pipeline.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 4.5 billion |

| Projected Market Size (2035) | USD 6.7 billion |

| CAGR (2025 to 2035) | 3.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Mineral Type | Magnesium, Calcium, Phosphorus, Iron, Zinc, Others (Copper, Potassium, etc.) |

| By Animal | Poultry, Swine, Ruminants, Aquaculture, Equine, Others (pets, small animals) |

| By Form | Dry, Liquid |

| By Sales Channel | Direct Sales, Indirect Sales, Modern Trade, Animal Feed Stores, Veterinary Clinics, Online Retailers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Yara International (Bolifor ®), Phibro Animal Health, Zinpro Corp., Royal DSM NV, Pancosma SA, Nutrco NV, Novus International Inc., Mercer Milling Co. Inc., Cargill Inc., Tanke International Group, Biochem, Archer Daniels Midland Co., Alltech Inc., Kemin Industries Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

By Size, the segment has been categorized into Magnesium, Calcium, Phosphorus, Iron, Zinc, and Others (Copper, Potassium, etc.)

Different Animal types Dairy Animals (Goat, Buffalo, Cow, etc.), Poultry, and Swine, Aquaculture, Equine and Others (pets, small animals)

Different Forms included Dry and Liquid

Different sales channels which included Direct Sales, Indirect Sales, Modern Trade, Animal Feed Stores, Veterinary Clinics, and Online Retailers

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa

The market is valued at USD 4.5 billion in 2025.

The market is forecasted to reach USD 6.7 billion by 2035, reflecting a CAGR of 3.9%.

Zinc minerals are expected to lead the market with a 34.5% share in 2025.

Poultry animals are expected to hold a 35.5% share of the market in 2025.

Japan is anticipated to be the fastest-growing market with a CAGR of 8.1% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Probiotic Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Preservative Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Antibiotics Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Analyzing Animal Feed Additives Market Share & Industry Leaders

Animal Feed Processing Equipment Market Analysis & Forecast by Function, Feed Type, End-User, Automation, and Region through 2025 to 2035

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

Animal Feed Prebiotics Market – Growth, Livestock Nutrition & Demand

Animal Feed Sweetener Market – Growth, Innovations & Market Demand

Animal Feed Protease Market

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

UK Animal Feed Additives Market Trends – Growth, Demand & Forecast 2025–2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

USA Animal Feed Ingredients Market Report – Trends & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA