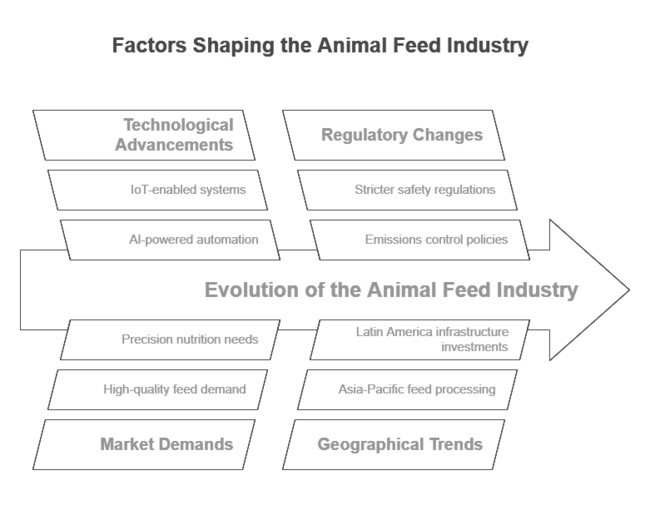

In 2024, the animal feed processing equipment market experienced significant developments driven by changing consumer preferences, regulatory changes, and technological advancements. Regions such as North America and Asia-Pacific facilitated the rise in demand for automated and energy-efficient feed processing solutions.

This the industry growth in the Region, further amplified by the expanding livestock farming industry. Several feed manufacturers have invested in IoT-based monitoring systems to maximize efficiency and reduce operational expenses.

Green chemical processes and sustainable additives saw significant advancements, making sustainability a core focus and an integral part of industry practices. There was a spike in demand for specialty feed-antibiotic-free and nutrient-rich variants-prompting manufacturers to invest in spruced-up processing lines. And while supply chain issues continued impacting 2024, especially related to raw material pricing, trade recovered, with global trade stabilizing mid-year again.

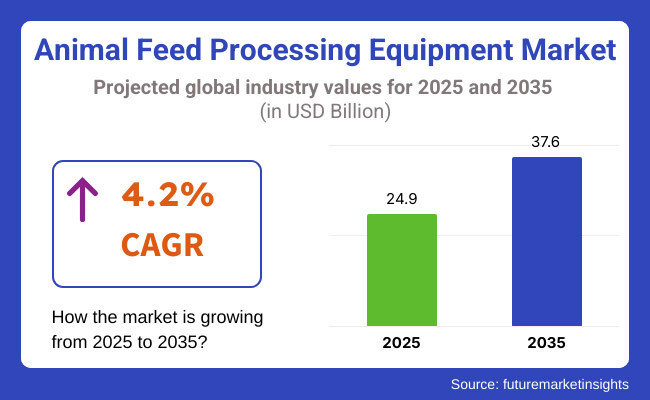

From 2025 on, the industry will also benefit from smart feed processing technologies that will be driven by the development of AI-based techniques (for example, quality control of feed components) and precision selection of nutrient ingredients.

The expansion of aquaculture operations and poultry farms will also promote the adoption of high-performance equipment. Furthermore, government programs supporting sustainable animal agriculture may increase demand for innovative feed processing solutions, further supporting steady growth in the coming decade.

Key stakeholders for equipment used to process animal feed, including equipment suppliers, livestock farmers, and feed manufacturers. 73% of feed producers ranked automation as their top priority. The need for increasing efficiency and reducing costs,the survey noted, drives feed producers to introduce automation in their facilities. Many survey respondents indicated that modern feed mills incorporate IoT-enabled monitoring systems and AI-driven quality control mechanisms.

The second key finding was that sustainability had become a top decision-making factor. More than 65% of equipment suppliers said customers are now looking for energy-saving machinery and processes that reduce waste. Livestock and poultry farmers also showed an increasing interest in customized diets, which created a demand from equipment producers for more diversified processing solutions.

The survey also identified regional differences in technology adoption. While North America and Europe widely value the adoption of sophisticated automation and Compliance, respondents in Asia-Pacific and Latin America cited high costs and a lack of technical know-how as barriers to adopting high-tech solutions. More than 58% of respondents in these regions feel that government incentives and training programs would greatly help increase adoption rates over the next five years.

Finally, both supply-chain disruptions and raw-material costs remained an enduring challenge. Almost 70% of manufacturers surveyed reported that dependable supplier networks and local sourcing have become vital to maintaining consistent production. Companies are now focusing on predictive analytics to prepare themselves for such disruptions and find opportunities to optimize procurement strategies, so their supply chain becomes more resilient in the years to come.

| Country | Regulatory Impact on the Market |

|---|---|

| United States (The USA) | Administered by the Food and Drug Administration (FDA) via the Food Safety Modernization Act (FSMA), it must adhere to strict feed-ingredient traceability and machinery sanitation requirements. |

| United Kingdom (UK) | The FSA and UK Animal Feed Regulations require the production of animal feed to comply with Hazard Analysis and Critical Control Points (HACCP)-a risk-based preventative approach. - Animal Feed Safety. |

| France | Monitored by the French Agency for Food, Environmental, and Occupational Health & Safety (ANSES), the Compliance with strict anti-microbial and additive restrictions in feed production. |

| Germany | The feed law (Futtermittelverordnung) and EU Green Deal strategies require low-emission and energy-efficient feed processing technologies. |

| Italy | Eutrophication risk management. The Ministry of Health and the EU Feed Hygiene Regulation (183/2005) both have rules to ensure that any feed additives are traceable and closely monitored. |

| South Korea | The Feed Control Act, which calls for effective feed safety inspection, while the government is also pushing for automation in feed mills to make them more efficient. |

| Japan | Collocated with Feed Safety Law: Regulated to prevent contamination of what-productions that promote feed processing innovations. |

| China | The Feed and Feed Additives Regulation is a regulatory body that is increasingly focused on lowering feed antibiotics and promoting modern processing technologies. |

| Australia & New Zealand | GM feed restrictions, biosecurity regulations, strict feed mill hygiene standards, and FSANZ oversight. |

| India | Feed production is regulated by the Bureau of Indian Standards (BIS) and by the Food Safety and Standards Authority of India (FSSAI). Still, new policies have promoted the sourcing of indigenous ingredients and quality certification. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| This study attributes to the rising demand for high-quality animal feed and processing automation. | The company is experiencing ongoing growth, with a heavy focus on AI-powered automation and energy-efficient equipment driven by sustainability goals. |

| There were supply chain disruptions due to COVID-19 and raw material price volatility. | The industry has improved supply chain resilience via localization and predictive analytics. |

| There is a rising adoption of Internet of Things (IoT)-enabled monitoring systems for feed production. | The industry is implementing real-time tracking and quality control using AI, IoT, and blockchain technology. |

| There has been an increase in specialized feed, such as antibiotic-free feed and organic feed. | There is a growing need for feed solutions that offer variety and precision nutrition. |

| There should be stricter regulatory policies regarding feed safety and emissions control. | The government has increased its enforcement of sustainability and carbon footprint quotas. |

| Increasing feed processing in Asia-Pacific and Latin America. | Owing to a growing demand for cost-effective and high-quality meat, Asia-Pacific and Africa have become important markets for feed processing infrastructure investments. |

Pelleting machinery holds a strong share due to the rising demand for easily digestible, high-density feed, increasing the adoption of pellet mills, coolers, and conditioners. Pellet mills enhance feed efficiency while coolers and conditioners regulate moisture content and texture. Feed manufacturers are adopting finer particle sizes for better animal digestion; thus, the hammer mill and fine pulverize industries are growing rapidly. Extruders are gaining traction with the aquafeed and pet food, and feed mixers, which are necessary for uniform mixing, are also experiencing increased demand from custom feed formulations.

Growth in dairy and beef farming drives demand for high-fiber formulations, making the ruminant feed segment the leader in terms of share. The fastest-growing segment is poultry feed, fueled by increasing demand and advancements in pelletized and extruded formulations. Swine feed driven by the use of fine pulverizers and feed mixers has moderate growth based on its nutrient-rich products. Aquafeed-fish and shrimp feed-and pet food (apart from poultry and swine feed) are also continuously growing sectors for which extruders make high-protein, custom-made diets.

Large livestock farms dominate the landscape due to their need for mass feed production, which supports the use of automated pellet mills and high-efficiency extruders. They are equipping themselves with Internet-of-Things support feed mixers and fine pulverizers to reach precision feeding. Small Farms or Homes: This segment is gradually on the rise, where the farmers are demanding semi-automatic hammer mills and manual feed mixers to produce low-cost, home-based feed solutions, particularly in the developing industries.

Automatic feed processing machinery drives the landscape, catering to high-volume production plants that seek efficiency and labor savings. This encompasses everything from AI-controlled kibbled mills to automated extruders designed for quality assurance. The semi-automatic segment is experiencing growth, with small/medium farms adopting partial automation as a means of balancing economics and automation levels. Small hammer mills and rudimentary feed mixers, for example, are still in use in rural and developing regions, serving the needs of smallholders in communities with limited access to capital-intensive equipment.

The USA animal feed processing equipment industry is highly mature, owing to the presence of large-scale livestock farms and stringent animal feed safety policies through the Food Safety Modernization Act (FSMA). The animal feed processing equipment market in the USA is the largest in the world, with around 25% of the share globally.

When it comes to pelleting equipment, hammer mills, and extruders, the country already has a stable structure and caters to various livestock. The poultry and ruminant feed industries dominate the scenario due to the high consumption of meat and dairy products. Investments are growing for production efficiency by reshaping feeding processing technologies enabled by AI and the IoT. One of the most significant and exciting trends is the promotion of sustainable feed manufacturing, energy-efficient pellet mills, and alternative protein sources. Furthermore, the USA will continue to exhibit growth at a CAGR of 5.13% from 2025 to 2035.

UK industry regulations are stringent in terms of environmental and feed safety, which is also reflected in the desired low-emission processing equipment. The poultry and swine feed industries heavily consume feed mixers, pelleting machines, and fine pulverizers.

The sector is experiencing a shift toward organic and antibiotic-free feed production, which is impacting demand for innovative feed formulation and extrusion technologies. UK livestock industries, particularly dairy and poultry, are investing in automated and semi-automatic feed mills to enhance efficiency while complying with UK Animal Feed Regulations (AFR) and HACCP.

As one of the largest livestock producers in Europe, France also has a significant need for high-performance feed-processing equipment, with a particular focus on pellet mills, extruders, and feed mixers. With a large milk and beef farming sector, ruminant feed businesses account for most of the industry for specialized equipment for high-fiber formulations.

However, government regulations against antibiotic use have increased the investment in precision feed formulation and nutrient enhancement technologies. French feed mill manufacturers are also using advanced processing equipment to recover energy to meet the sustainability goals of the EU Green Deal. This is helping the development of low-energy pellet mills and automated mixing systems.

Germany launched the Futtermittelverordnung (Feed Regulation) in 1993, driving demand for sophisticated pellet coolers, fine pulverizers, and IoT-equipped feed mixers. Sustainability is also a strong motivator, with studies concentrating on alternative protein sources, such as insect-based feeds and low-emission pellet mill designs. Precision engineering expertise from Germany has made it a world leader in high-tech feed processing technologies.

The nation's reputation for efficiency and innovation has propelled exports, making it a rising center for advanced feed technology. With more automation and digitization, German manufacturers will continue to be leaders in energy-efficient and sustainable feed processing equipment.

Governmental incentives and rigorous environmental policies drive investments in the latest feed machinery even further. Firms are incorporating AI-enabled quality control and blockchain traceability to boost efficiency and Compliance. Moreover, partnerships between research institutions and industry leaders foster the pace of innovation in next-generation feed processing technologies to maintain Germany's leading position in the international market.

Small to mid-sized feed producers, on the other hand, dominate Italy's feed processing market and are increasingly investing in semi-automatic pelleting and mixing equipment. Different livestock farming practices, particularly in the poultry and ruminant feed industries, fuel the demand for custom feed processing solutions. Italy adheres to the EU Feed Hygiene Regulation (183/2005), guaranteeing high feed safety and traceability standards. Sustainability initiatives are also promoting energy-efficient feed mills and low-carbon processing technologies, particularly in Northern Italy, where large-scale dairy farms exist.

In South Korea, the industry for equipment used in animal feed processing is transitioning to automation, supported by the government to modernize feed mills and implement advanced feed processing technologies under the Feed Control Act. The poultry feed sector is the largest consumer of pellet mills, extruders, and feed mixers. The swine feed sector is also expanding due to rising pork consumption. Technology adoption is high; companies are looking for investments in AI-driven formulation and precision mixing. The demand for extrusion machines has also been growing in South Korea, and it anticipates strong growth in aqua-feed production.

Japan has a highly automated and microcomputer orientated feed processing industry, and there is a high demand for manufacturers of precision feed materials and equipment. The poultry and aquafeed industries primarily rely on high-efficiency pellet mills, extruders, and feed mixers. Feed Safety Law highlights contaminant-free processing in its government regulations, driving investments in IoT-based quality control systems. In Japan, sustainable feed production developments include low-energy processing and alternative feedstuffs, such as fermented feed and insect protein.

As the largest animal feed manufacturer in the world, demand for pelleting equipment, hammer mills, and extruders remains high in China. The swine and poultry feed industry is the major driver, owing to substantial government initiatives to minimize antibiotic usage in animal feed under the Feed and Feed Additives Regulation.

Automated feed mills and IoT-based monitoring are quickly becoming popular on large-scale livestock farms in the country. Sustainability solutions are driving investment in low-emission feed processing equipment, and rising aquafeed production is helping drive demand for extruders and fine pulverizers. The estimated value of China's animal feed processing equipment market for 2035 is approximately USD 4.49 billion.

Under FSANZ (Food Standards Australia New Zealand), the ANZ market has stringent biosecurity measures, impacting standards of feed processing. Ruminant and poultry feed are two significant segments where automated pellet mills and hammer mills are commonly used. The production of specialized feeds, such as organic or grain-free feeds, is also on the rise, driving the need for flexible mixing and fine pulverization technologies. Efforts to promote sustainability are prompting investments in energy-efficient feed mills and precision feeding technologies (for optimal livestock nutrition).

The feed processing sector in India is fast growing, owing to growth in the dairy, poultry, and aquaculture sectors. As per the BIS and FSSAI regulations, compliance with strict feed safety is ensured. Pelleting Equipment, Hammer Mills, and Feed Mixers Small to mid-sized farms can have a high demand when it comes to pelleting equipment, hammer mills, and feed mixers.

The market is gradually shifting toward automation through investments in semi-automatic and IoT-enabled processing technologies. The developing aquaculture industry in India is also driving demand for extruders and fine pulverizers, and government incentives to source indigenous feed ingredients are sweeping up future trends.

The equipment sector for feed processing is very competitive, with both global leaders and regional giants operating in the space. The top companies of 2024 are as follows:

Andritz (Austria)-22%

Andritz sets the pace with its full line of feed processing equipment, from grinders to mixers to pellet mills. That focus on innovation and sustainability seems to have worked.

Bühler Group (Switzerland): 20%

Over the years, Bühler Group has established itself as a leading provider of innovative feed processing solutions. Customers have gravitated toward its emphasis on digitization and energy-saving equipment.

Cargill (USA): 15%

Cargill has expanded its presence in the arena of animal feed processing equipment with various collaborations and acquisitions.

Van Aarsen International (Netherlands): 12%

Van Aarsen is well-known in the industry as a supplier of high-quality feed processing machines, including pellet mills and feed milling equipment.

Muyang Group (China)-10%

Muyang Group is the Asian giant that produces feed processing machinery. Success has followed their aggressive pricing and robust regional footprint.

Regional and Niche Players-21%

Players include CPM (USA), Anderson Feed Technology (USA), and Zhengchang Group (China), which are gaining momentum through innovative and cost-effective solutions.

2024 Trends that Shaped the Market

The market for equipment used in animal feed processing is part of the agriculture and agri-machinery sector, as well as the livestock and animal nutrition industry. It is tightly connected with macro events, including global consumption trends for meat and dairy, commodity price development, technology opportunities, and government rules on feed safety and sustainability.

The livestock industry is expanding, particularly in developing countries like China, India, and Brazil. As incomes rise in these regions, the demand for animal feed is increasing to support protein-rich diets. Key drivers in the poultry, swine, and aquaculture sectors are the application and innovations in feed processing automation, extrusion technology, and pelletizing equipment. North America and Europe are at the forefront of such innovations through smart feed mill technologies, IoT and AI-driven quality control, and energy-efficient processing systems.

Due to macroeconomic volatility, such as the increase in raw material prices and the disruption of supply chains, we have also seen growing investment in localized feed production and alternative proteins, such as insect-based feeds and plant substitutes. Sustainability pressures are also transforming the industry, with governments mandating low-emission processing and companies sinking money into carbon-neutral and waste-abating equipment. The increasing demand for meat, dairy, and eggs will drive the need for effective feed-processing equipment, making it an indispensable tool in the fight against food insecurity.

Demand for high-quality animal feed, growing livestock production, and technological innovations will drive the growth of the animal feed processing equipment market. Furthermore, a movement toward precision nutrition and sustainable feed production is driving the demand for advanced processing technologies, including automated pellet mills, IoT-enabled feed mixers, and AI-powered quality control systems.

This growing field offers a lucrative opportunity and a growing demand for extrusion technology to produce high-protein, stable in-water aquafeed. Government incentives also encourage investments in low-emission and energy-efficient feed-processing equipment for sustainable agriculture.

Well-established players are engaging in technological innovation by building smart feed mills, utilizing AI-driven automation, and implementing blockchain technologies for feed traceability to improve competitiveness. Localized partnerships with governments in emerging markets can also boost growth. Investments in sustainability, such as in low-carbon pellet mills and alternative protein processing, will become well-positioned against changing industry regulations.

Farmers in developing economies often lack the finances to invest in sophisticated solutions, so affordable, scalable, and customized feed processing solutions should be the focus area for new entrants. Some companies can achieve differentiation by specializing in niche areas such as organic feed processing, sustainable pelleting, or high protein aquafeed extrusion. Strategically, industry penetration would be aided through alliances with livestock integrators, rapidly emerging agritech startups, and government initiatives. In cost-sensitive markets, where rapid technology uptake is critical, adopting digital sales platforms, leasing models, and financing options can further expand accessibility.

The industry is segmented into pelleting equipment (pellet mills, pellet coolers & pelle), conditioners, hammer mill, fine pulverizer, extruders, and feed mixers.

It is fragmented into the ruminant feed industry, poultry feed industry, swine feed industry, and others.

It is divided into major livestock farms and small farms or domestic settings

It is fragmented into automatic, semi-automatic, and manual

The sector is segmented among North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East, and Africa(MEA)

Automation is enhancing efficiency, accuracy, and consistency by incorporating AI, IoT, and intelligent monitoring systems in feed mills.

Suppliers are emphasizing energy-saving designs, minimizing emissions, and using eco-friendly materials to conform to international environmental policies.

Asia-Pacific, Latin America, and Africa are witnessing accelerated adoption, with rising livestock rearing and industrialized feed manufacturing.

Tighter safety, quality, and sustainability regulations are spurring the creation of compliant and effective feed-processing solutions.

Artificial intelligence-powered formulation, blockchain for traceability, and alternative protein processing are major trends changing the landscape.

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Billion) Forecast by Function, 2017 to 2033

Table 4: Global Market Volume (MT) Forecast by Function, 2017 to 2033

Table 5: Global Market Value (US$ Billion) Forecast by Feed Type, 2017 to 2033

Table 6: Global Market Volume (MT) Forecast by Feed Type, 2017 to 2033

Table 7: Global Market Value (US$ Billion) Forecast by End-User, 2017 to 2033

Table 8: Global Market Volume (MT) Forecast by End-User, 2017 to 2033

Table 9: Global Market Value (US$ Billion) Forecast by Automation Grade, 2017 to 2033

Table 10: Global Market Volume (MT) Forecast by Automation Grade, 2017 to 2033

Table 11: North America Market Value (US$ Billion) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ Billion) Forecast by Function, 2017 to 2033

Table 14: North America Market Volume (MT) Forecast by Function, 2017 to 2033

Table 15: North America Market Value (US$ Billion) Forecast by Feed Type, 2017 to 2033

Table 16: North America Market Volume (MT) Forecast by Feed Type, 2017 to 2033

Table 17: North America Market Value (US$ Billion) Forecast by End-User, 2017 to 2033

Table 18: North America Market Volume (MT) Forecast by End-User, 2017 to 2033

Table 19: North America Market Value (US$ Billion) Forecast by Automation Grade, 2017 to 2033

Table 20: North America Market Volume (MT) Forecast by Automation Grade, 2017 to 2033

Table 21: Latin America Market Value (US$ Billion) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ Billion) Forecast by Function, 2017 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Function, 2017 to 2033

Table 25: Latin America Market Value (US$ Billion) Forecast by Feed Type, 2017 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Feed Type, 2017 to 2033

Table 27: Latin America Market Value (US$ Billion) Forecast by End-User, 2017 to 2033

Table 28: Latin America Market Volume (MT) Forecast by End-User, 2017 to 2033

Table 29: Latin America Market Value (US$ Billion) Forecast by Automation Grade, 2017 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Automation Grade, 2017 to 2033

Table 31: Europe Market Value (US$ Billion) Forecast by Country, 2017 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2017 to 2033

Table 33: Europe Market Value (US$ Billion) Forecast by Function, 2017 to 2033

Table 34: Europe Market Volume (MT) Forecast by Function, 2017 to 2033

Table 35: Europe Market Value (US$ Billion) Forecast by Feed Type, 2017 to 2033

Table 36: Europe Market Volume (MT) Forecast by Feed Type, 2017 to 2033

Table 37: Europe Market Value (US$ Billion) Forecast by End-User, 2017 to 2033

Table 38: Europe Market Volume (MT) Forecast by End-User, 2017 to 2033

Table 39: Europe Market Value (US$ Billion) Forecast by Automation Grade, 2017 to 2033

Table 40: Europe Market Volume (MT) Forecast by Automation Grade, 2017 to 2033

Table 41: East Asia Market Value (US$ Billion) Forecast by Country, 2017 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 43: East Asia Market Value (US$ Billion) Forecast by Function, 2017 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Function, 2017 to 2033

Table 45: East Asia Market Value (US$ Billion) Forecast by Feed Type, 2017 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Feed Type, 2017 to 2033

Table 47: East Asia Market Value (US$ Billion) Forecast by End-User, 2017 to 2033

Table 48: East Asia Market Volume (MT) Forecast by End-User, 2017 to 2033

Table 49: East Asia Market Value (US$ Billion) Forecast by Automation Grade, 2017 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Automation Grade, 2017 to 2033

Table 51: South Asia Market Value (US$ Billion) Forecast by Country, 2017 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 53: South Asia Market Value (US$ Billion) Forecast by Function, 2017 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Function, 2017 to 2033

Table 55: South Asia Market Value (US$ Billion) Forecast by Feed Type, 2017 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Feed Type, 2017 to 2033

Table 57: South Asia Market Value (US$ Billion) Forecast by End-User, 2017 to 2033

Table 58: South Asia Market Volume (MT) Forecast by End-User, 2017 to 2033

Table 59: South Asia Market Value (US$ Billion) Forecast by Automation Grade, 2017 to 2033

Table 60: South Asia Market Volume (MT) Forecast by Automation Grade, 2017 to 2033

Table 61: Oceania Market Value (US$ Billion) Forecast by Country, 2017 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2017 to 2033

Table 63: Oceania Market Value (US$ Billion) Forecast by Function, 2017 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Function, 2017 to 2033

Table 65: Oceania Market Value (US$ Billion) Forecast by Feed Type, 2017 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Feed Type, 2017 to 2033

Table 67: Oceania Market Value (US$ Billion) Forecast by End-User, 2017 to 2033

Table 68: Oceania Market Volume (MT) Forecast by End-User, 2017 to 2033

Table 69: Oceania Market Value (US$ Billion) Forecast by Automation Grade, 2017 to 2033

Table 70: Oceania Market Volume (MT) Forecast by Automation Grade, 2017 to 2033

Table 71: MEA Market Value (US$ Billion) Forecast by Country, 2017 to 2033

Table 72: MEA Market Volume (MT) Forecast by Country, 2017 to 2033

Table 73: MEA Market Value (US$ Billion) Forecast by Function, 2017 to 2033

Table 74: MEA Market Volume (MT) Forecast by Function, 2017 to 2033

Table 75: MEA Market Value (US$ Billion) Forecast by Feed Type, 2017 to 2033

Table 76: MEA Market Volume (MT) Forecast by Feed Type, 2017 to 2033

Table 77: MEA Market Value (US$ Billion) Forecast by End-User, 2017 to 2033

Table 78: MEA Market Volume (MT) Forecast by End-User, 2017 to 2033

Table 79: MEA Market Value (US$ Billion) Forecast by Automation Grade, 2017 to 2033

Table 80: MEA Market Volume (MT) Forecast by Automation Grade, 2017 to 2033

Figure 1: Global Market Value (US$ Billion) by Function, 2023 to 2033

Figure 2: Global Market Value (US$ Billion) by Feed Type, 2023 to 2033

Figure 3: Global Market Value (US$ Billion) by End-User, 2023 to 2033

Figure 4: Global Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 5: Global Market Value (US$ Billion) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Billion) Analysis by Region, 2017 to 2032

Figure 7: Global Market Volume (MT) Analysis by Region, 2017 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Billion) Analysis by Function, 2017 to 2032

Figure 11: Global Market Volume (MT) Analysis by Function, 2017 to 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 14: Global Market Value (US$ Billion) Analysis by Feed Type, 2017 to 2032

Figure 15: Global Market Volume (MT) Analysis by Feed Type, 2017 to 2032

Figure 16: Global Market Value Share (%) and BPS Analysis by Feed Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Feed Type, 2023 to 2033

Figure 18: Global Market Value (US$ Billion) Analysis by End-User, 2017 to 2032

Figure 19: Global Market Volume (MT) Analysis by End-User, 2017 to 2032

Figure 20: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 22: Global Market Value (US$ Billion) Analysis by Automation Grade, 2017 to 2032

Figure 23: Global Market Volume (MT) Analysis by Automation Grade, 2017 to 2032

Figure 24: Global Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 26: Global Market Attractiveness by Function, 2023 to 2033

Figure 27: Global Market Attractiveness by Feed Type, 2023 to 2033

Figure 28: Global Market Attractiveness by End-User, 2023 to 2033

Figure 29: Global Market Attractiveness by Automation Grade, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Billion) by Function, 2023 to 2033

Figure 32: North America Market Value (US$ Billion) by Feed Type, 2023 to 2033

Figure 33: North America Market Value (US$ Billion) by End-User, 2023 to 2033

Figure 34: North America Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 35: North America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 37: North America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Billion) Analysis by Function, 2017 to 2032

Figure 41: North America Market Volume (MT) Analysis by Function, 2017 to 2032

Figure 42: North America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 44: North America Market Value (US$ Billion) Analysis by Feed Type, 2017 to 2032

Figure 45: North America Market Volume (MT) Analysis by Feed Type, 2017 to 2032

Figure 46: North America Market Value Share (%) and BPS Analysis by Feed Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Feed Type, 2023 to 2033

Figure 48: North America Market Value (US$ Billion) Analysis by End-User, 2017 to 2032

Figure 49: North America Market Volume (MT) Analysis by End-User, 2017 to 2032

Figure 50: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 52: North America Market Value (US$ Billion) Analysis by Automation Grade, 2017 to 2032

Figure 53: North America Market Volume (MT) Analysis by Automation Grade, 2017 to 2032

Figure 54: North America Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 56: North America Market Attractiveness by Function, 2023 to 2033

Figure 57: North America Market Attractiveness by Feed Type, 2023 to 2033

Figure 58: North America Market Attractiveness by End-User, 2023 to 2033

Figure 59: North America Market Attractiveness by Automation Grade, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Billion) by Function, 2023 to 2033

Figure 62: Latin America Market Value (US$ Billion) by Feed Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Billion) by End-User, 2023 to 2033

Figure 64: Latin America Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 65: Latin America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Billion) Analysis by Function, 2017 to 2032

Figure 71: Latin America Market Volume (MT) Analysis by Function, 2017 to 2032

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 74: Latin America Market Value (US$ Billion) Analysis by Feed Type, 2017 to 2032

Figure 75: Latin America Market Volume (MT) Analysis by Feed Type, 2017 to 2032

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Feed Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Feed Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Billion) Analysis by End-User, 2017 to 2032

Figure 79: Latin America Market Volume (MT) Analysis by End-User, 2017 to 2032

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 82: Latin America Market Value (US$ Billion) Analysis by Automation Grade, 2017 to 2032

Figure 83: Latin America Market Volume (MT) Analysis by Automation Grade, 2017 to 2032

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Function, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Feed Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Automation Grade, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Billion) by Function, 2023 to 2033

Figure 92: Europe Market Value (US$ Billion) by Feed Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Billion) by End-User, 2023 to 2033

Figure 94: Europe Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 95: Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 97: Europe Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Billion) Analysis by Function, 2017 to 2032

Figure 101: Europe Market Volume (MT) Analysis by Function, 2017 to 2032

Figure 102: Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 104: Europe Market Value (US$ Billion) Analysis by Feed Type, 2017 to 2032

Figure 105: Europe Market Volume (MT) Analysis by Feed Type, 2017 to 2032

Figure 106: Europe Market Value Share (%) and BPS Analysis by Feed Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Feed Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Billion) Analysis by End-User, 2017 to 2032

Figure 109: Europe Market Volume (MT) Analysis by End-User, 2017 to 2032

Figure 110: Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 112: Europe Market Value (US$ Billion) Analysis by Automation Grade, 2017 to 2032

Figure 113: Europe Market Volume (MT) Analysis by Automation Grade, 2017 to 2032

Figure 114: Europe Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 116: Europe Market Attractiveness by Function, 2023 to 2033

Figure 117: Europe Market Attractiveness by Feed Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by End-User, 2023 to 2033

Figure 119: Europe Market Attractiveness by Automation Grade, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Billion) by Function, 2023 to 2033

Figure 122: East Asia Market Value (US$ Billion) by Feed Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Billion) by End-User, 2023 to 2033

Figure 124: East Asia Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 125: East Asia Market Value (US$ Billion) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Billion) Analysis by Function, 2017 to 2032

Figure 131: East Asia Market Volume (MT) Analysis by Function, 2017 to 2032

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 134: East Asia Market Value (US$ Billion) Analysis by Feed Type, 2017 to 2032

Figure 135: East Asia Market Volume (MT) Analysis by Feed Type, 2017 to 2032

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Feed Type, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Feed Type, 2023 to 2033

Figure 138: East Asia Market Value (US$ Billion) Analysis by End-User, 2017 to 2032

Figure 139: East Asia Market Volume (MT) Analysis by End-User, 2017 to 2032

Figure 140: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 142: East Asia Market Value (US$ Billion) Analysis by Automation Grade, 2017 to 2032

Figure 143: East Asia Market Volume (MT) Analysis by Automation Grade, 2017 to 2032

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Function, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Feed Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Automation Grade, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Billion) by Function, 2023 to 2033

Figure 152: South Asia Market Value (US$ Billion) by Feed Type, 2023 to 2033

Figure 153: South Asia Market Value (US$ Billion) by End-User, 2023 to 2033

Figure 154: South Asia Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 155: South Asia Market Value (US$ Billion) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Billion) Analysis by Function, 2017 to 2032

Figure 161: South Asia Market Volume (MT) Analysis by Function, 2017 to 2032

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 164: South Asia Market Value (US$ Billion) Analysis by Feed Type, 2017 to 2032

Figure 165: South Asia Market Volume (MT) Analysis by Feed Type, 2017 to 2032

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Feed Type, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Feed Type, 2023 to 2033

Figure 168: South Asia Market Value (US$ Billion) Analysis by End-User, 2017 to 2032

Figure 169: South Asia Market Volume (MT) Analysis by End-User, 2017 to 2032

Figure 170: South Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 172: South Asia Market Value (US$ Billion) Analysis by Automation Grade, 2017 to 2032

Figure 173: South Asia Market Volume (MT) Analysis by Automation Grade, 2017 to 2032

Figure 174: South Asia Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 175: South Asia Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 176: South Asia Market Attractiveness by Function, 2023 to 2033

Figure 177: South Asia Market Attractiveness by Feed Type, 2023 to 2033

Figure 178: South Asia Market Attractiveness by End-User, 2023 to 2033

Figure 179: South Asia Market Attractiveness by Automation Grade, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Billion) by Function, 2023 to 2033

Figure 182: Oceania Market Value (US$ Billion) by Feed Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Billion) by End-User, 2023 to 2033

Figure 184: Oceania Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 185: Oceania Market Value (US$ Billion) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Billion) Analysis by Function, 2017 to 2032

Figure 191: Oceania Market Volume (MT) Analysis by Function, 2017 to 2032

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 194: Oceania Market Value (US$ Billion) Analysis by Feed Type, 2017 to 2032

Figure 195: Oceania Market Volume (MT) Analysis by Feed Type, 2017 to 2032

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Feed Type, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Feed Type, 2023 to 2033

Figure 198: Oceania Market Value (US$ Billion) Analysis by End-User, 2017 to 2032

Figure 199: Oceania Market Volume (MT) Analysis by End-User, 2017 to 2032

Figure 200: Oceania Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 202: Oceania Market Value (US$ Billion) Analysis by Automation Grade, 2017 to 2032

Figure 203: Oceania Market Volume (MT) Analysis by Automation Grade, 2017 to 2032

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Function, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Feed Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by End-User, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Automation Grade, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Billion) by Function, 2023 to 2033

Figure 212: MEA Market Value (US$ Billion) by Feed Type, 2023 to 2033

Figure 213: MEA Market Value (US$ Billion) by End-User, 2023 to 2033

Figure 214: MEA Market Value (US$ Billion) by Automation Grade, 2023 to 2033

Figure 215: MEA Market Value (US$ Billion) by Country, 2023 to 2033

Figure 216: MEA Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 217: MEA Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Billion) Analysis by Function, 2017 to 2032

Figure 221: MEA Market Volume (MT) Analysis by Function, 2017 to 2032

Figure 222: MEA Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 224: MEA Market Value (US$ Billion) Analysis by Feed Type, 2017 to 2032

Figure 225: MEA Market Volume (MT) Analysis by Feed Type, 2017 to 2032

Figure 226: MEA Market Value Share (%) and BPS Analysis by Feed Type, 2023 to 2033

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Feed Type, 2023 to 2033

Figure 228: MEA Market Value (US$ Billion) Analysis by End-User, 2017 to 2032

Figure 229: MEA Market Volume (MT) Analysis by End-User, 2017 to 2032

Figure 230: MEA Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 232: MEA Market Value (US$ Billion) Analysis by Automation Grade, 2017 to 2032

Figure 233: MEA Market Volume (MT) Analysis by Automation Grade, 2017 to 2032

Figure 234: MEA Market Value Share (%) and BPS Analysis by Automation Grade, 2023 to 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Automation Grade, 2023 to 2033

Figure 236: MEA Market Attractiveness by Function, 2023 to 2033

Figure 237: MEA Market Attractiveness by Feed Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by End-User, 2023 to 2033

Figure 239: MEA Market Attractiveness by Automation Grade, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Probiotic Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Minerals Market Analysis - Size, Growth, and Forecast 2025 to 2035

Animal Feed Preservative Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Antibiotics Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Analyzing Animal Feed Additives Market Share & Industry Leaders

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

Animal Feed Prebiotics Market – Growth, Livestock Nutrition & Demand

Animal Feed Sweetener Market – Growth, Innovations & Market Demand

Animal Feed Protease Market

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

UK Animal Feed Additives Market Trends – Growth, Demand & Forecast 2025–2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

USA Animal Feed Ingredients Market Report – Trends & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA