The global fish-based pet food market could grow by tremendous rates during the period from 2025 to 2035, the proliferation of pet ownership has increased demand for pet nutrition education, resulting in growing attention towards good quality pet food and health benefits from fish-based diets.

With its high protein content, essential fatty acids, and digestibility, fish-based pet food has proved not only beneficial to the health of the animals that eat it but also aids in their skin care and joint health. It continues to grow rapidly as pet owners pay ever greater attention to the dietary needs of their companions.

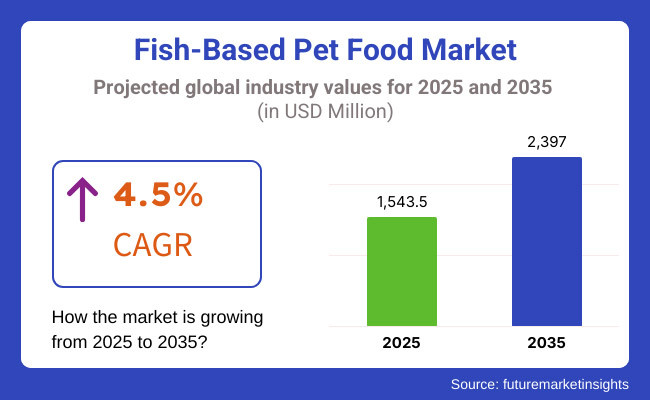

The market is expected to be worth almost USD 2,397 Million by 2035, and is predicted to grow at a compound annual growth rate (CAGR) of 4.5% during the forecast period. Greater demand for omega-rich pet food One of the recent market trends causing this upward trend in pet ownership is the demand for GMO and grain-free pet food.

The result is that companies are developing further production capacities with the use of fish resources side by in order to keep sustainable growth and protect the environment at the same time.

The fish-based pet food market is dominated by North America in terms of revenue, driven by the high number of pet ownership and super premium and organic pet food products. Rising pet health and wellness trends in the region, coupled with novel fish-based formulations, foster market growth. Moreover, the existence of leading pet food manufacturers and increasing demand for sustainable seafood sourcing are expected to drive growth in the region.

The fish-based pet food market in Europe is experiencing a consistent growth during the projection period, owing to the rising demand of premium and wholesome pet food across the region. Such trends are especially the case in the UK, Germany & France, where pet owners prefer to feed their pets natural and holistic diets. In addition, government policies to promote sustainable seafood sourcing practices and strict pet food quality standards support the market development.

Asia-Pacific is quickly becoming a burgeoning market for fish-based pet food, spurred on by increasing pet adoption rates and higher disposable incomes in regions such as China, Japan and Australia. Trend of humanization of pets and their preference for premium pet diets is driving the demand. Regional manufacturers are broadening their product portfolios to meet the changing consumer needs for high-protein, grain-free, and allergy-friendly pet food.

The fish-based pet food market is gradually growing in regions like Latin America, the Middle East, and Africa. The major factors fuelling the growth of the market includes urbanization and rising pet ownership rates across these regions. Despite challenges such as economic pressure and low consumer knowledge of fish-based pet food, the widespread availability of premium pet food products and growth in e-commerce penetration can create demand.

Challenge

Sustainability and Sourcing Challenges

Widespread Industry use and the extensive range of species are driving the growth of the Fish-Based Pet Food Market, but also pose challenges for sustainable sourcing environmental impact and concerns over the overfishing of some species Pet food manufacturers are faced with increasingly strict regulations, ethical fishing practices, and supply chain constraints.

It also includes practices for brands to adopt traceable and sustainable sourcing practices, with the growing demand for transparency in ingredient origin putting pressure on brands.

High Costs and Market Competition

The sourcing complexity and quality assurance processes tend to see premium fish-based pet food products in a higher price range. That means affordability is a major issue for consumers. The presence of expensive alternatives can hinder growth, as brands need to set themselves apart from competitors and invest in quality to survive in multiple markets dominated by non-meat pet food products.

Opportunity

Growth in Premium and Functional Pet Nutrition

The growing attention towards pet health and nutrition creates lucrative opportunities for the Fish-Based Pet Food Market. Demand among pet owners for premium nutrition is being driven by omega-3-rich formulations, grain-free options, and hypoallergenic offerings. Brands that invest in functional ingredients and tailor pet diets will put themselves ahead of the rest.

Expansion of Sustainable and Ethical Pet Food Solutions

As consumer recognition of sustainability continues to increase, pet food manufacturers can present eco-friendly, responsibly sourced fish-based products. Eco-friendly pet products that promote sustainable fishing, alternative fish proteins, and recyclable packaging will gain traction among environmentally aware pet owners.

Fish-Based Pet Food Market Overview: During the period of 2020 to 2024, the fish-based pet food market grew steadily due to the increasing pet humanization trend, the adoption of premium pet food products, and the growing awareness of the benefits of fish-based nutrition.

Well-known product types which support dietary hypersensitivity in cats and dogs, include salmon, tuna, and whitefish-centered pet food, Market stability was impacted by sourcing challenges, regulatory obstacles, and fluctuating fish prices. Brands had to strengthen their relationships with suppliers, invest in alternative sources of fish and increase transparency around their products.

Building for the future in line with the trends, expected innovations and new opportunities 2025 to 2035 as marketplace innovates from the trend towards sustainable pet food production, alternative protein production, and nutritional formulations.

New entrants such as lab-grown fish protein and plant-fish hybrid mixture, as well as functional pet food supplements, will define the landscape going forward. Market growth will be dictated by leading companies prioritizing sustainable practices, pet health research, and sourcing responsibly.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with sustainable fishing regulations, ingredient labelling requirements |

| Pet Food Growth | Growth in premium fish-based pet food, demand for grain-free and hypoallergenic formulas |

| Industry Adoption | Increased preference for omega-3-rich pet diets and functional health benefits |

| Supply Chain and Sourcing | Dependence on wild-caught and farm-raised fish, concerns over overfishing and sustainability |

| Market Competition | Presence of premium pet food brands, growth of niche hypoallergenic pet food categories |

| Market Growth Drivers | Rising pet ownership, increasing awareness of pet nutrition, and demand for high-quality protein sources |

| Sustainability and Energy Efficiency | Initial focus on responsibly sourced fish, limited eco-friendly packaging adoption |

| Integration of Digital Planning | Limited use of digital pet nutrition tracking, basic online pet food subscription models |

| Advancements in Pet Nutrition | Traditional fish-based pet food formulations, focus on protein-rich diets |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of stricter traceability measures, block chain-based sourcing verification, and ethical fishing policies |

| Pet Food Growth | Expansion of lab-grown fish protein, hybrid pet food options, and personalized pet nutrition |

| Industry Adoption | Rise of customized pet meal plans, AI-driven pet nutrition analysis, and eco-friendly packaging innovations |

| Supply Chain and Sourcing | Shift toward alternative fish proteins, responsibly farmed seafood, and upcycled fish ingredients |

| Market Competition | Entry of lab-grown fish protein startups, AI-driven pet food customization platforms, and direct-to-consumer brands |

| Market Growth Drivers | Investments in sustainable pet food production, ethical sourcing initiatives, and regulatory advancements |

| Sustainability and Energy Efficiency | Widespread implementation of biodegradable packaging, carbon-neutral pet food production, and ethical fisheries |

| Integration of Digital Planning | Expansion of AI-powered pet health monitoring, subscription-based personalized meal plans, and smart pet food dispensers |

| Advancements in Pet Nutrition | Evolution of science-backed functional pet food, probiotic-enhanced formulas, and disease-specific pet nutrition |

Growing pet ownership, rising demand for high protein and grain free pet diet and increasing consumer preference for premium and natural ingredients are some of the factors driving the United States fish-based pet food market. The market is further propelled by sustainable sourcing practices and a focus on pet nutrition innovations, with top pet food brands designing premium fish-based recipes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

The UK market is steadily growing in the UK due to the pet-loving culture, increased growth awareness on pet nutrition, and a desire to purchase hypoallergenic and omega-rich pet foods. The growth of raw fish pet food is facilitated by regulatory emphasis on sustainable fishing methods and the provision of premium fish micro pet foods.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

Growing pet humanization trends, increased emphasis on pet health, and the rising preference for sustainable, eco-friendly food items are driving the demand for fish-based pet food in the European Union (EU). Major manufacturers are working to include responsibly sourced fish ingredients to comply with EU sustainability rules.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

The South Korea market is growing due to the premiumization trend in pet care, rising disposable income among pet owners, and increased awareness concerning nutritional benefits of fish-based pet food. A strong penetration of e-commerce platforms also supports the growth of this market, making the niche pet food more accessible.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The Fish-based Pet Food Market is rapidly growing owing to the rising demand of protein and nutrient rich diet for pets. Fish-based pet food is rich in omega-3 fatty acids, which are important for a pet's skin, coat and overall health. As pet owners become increasingly aware of the dietary requirements of their pets, a greater demand continues for natural and organic food products of higher standards for pets.

The increasing trend of premiumization in the pet food market has also boosted the demand for fish-based pet food products. Respecting the Best Practices of Sustainability in the processing of Fish: Manufacturers are now stepping help to incorporation of sustainably sourced fish currently, the ingredient must cater to environmentally conscious Consumers.

Moreover, the increase in pet allergies and sensitivities to conventional meat proteins has propelled a shift towards fish-based diets, which are frequently perceived as hypoallergenic and easy to digest.

By nature, the market is segmented into organic and conventional. As an increasing number of people are seeking chemical- and preservative-free alternatives for their pets, food that is derived from fish is becoming more popular, resulting in an upsurge of organic fish-based pet food. These products appeal to health-conscious pet owners who demand clean-label, non-GMO and ethically sourced ingredients.

Traditional fish-filled pet food still reigns supreme in the marketplace for its low cost and commonality. Though it may use preservatives and artificial additives, which is still cheaper than organic alternatives and remains popular among pet owners.

The product type segment for the market includes dry, wet, and treat & chew types. The largest market share of pet food is dry fish-based, they are convenient, long shelf-life and easy to store. It is favoured by pet owners looking for balanced, affordable feeding alternatives.

Wet fish-based pet food is preferred for its higher moisture content, which is beneficial for pets needing hydration or dental support. Premium quality ingredients are often used in its formulations to make the product more palatable while at the same time offering vitamins and minerals in a more bioavailable form.

Fish-based ingredients in treats & chews make for satisfying snacks or dietary supplement matrixes, encouraging good oral health of pets while meeting their dietary enrichment needs. As interest in functional pet treats continues to evolve, the segment is expanding quickly..

The fish-based pet food market is driven primarily by cats, dogs, and birds, as Nutrition is a key aspect of a pet's health and well-being. Of these, cats show a marked preference for fish-flavoured diets owing to their instinctual tendency towards seafood.

The protein sources being mostly fish provide the best for the cat as fish is a naturally rich source of the amino acid taurine, a key reasoning why cats need to eat meat as a key part of its growth and maintaining good cardiovascular health and vital vascular health and development. The rich protein and omega-3 fatty acid content also promote a cat’s coat health, decreasing inflammation and improving skin health.

When it comes to dogs, fish-based pet food is especially good for dogs with food allergies or sensitive stomachs. Fish are a rich hypoallergenic solution because many dogs are intolerant to such common protein sources as chicken or beef. EPA and DHA, two omega-3 fatty acids found in fish, also optimize joint health, as well as cognitive function and immune system performance. This may be particularly beneficial for older dogs or those with arthritis and other inflammatory conditions.

Birds, as a niche new segment, make up another category, including exotic species that require fish-based diets due to protein-positive nutrition. Some birds (seabirds and raptors, for example) require fish as part of their diet and therefore fish & fish products appear in their formula. Fish-based pet food is complete for several species of pet animals and promotes their health by providing a high-quality protein as well as essential nutrients.

In the fish-based pet food arena, sustainability is emerging as a primary consumption contributor, and brands that prioritize responsibly sourced seafood and eco-friendly packaging are finding their way into consumers' shopping carts. Emerging ethical sourcing practices - using by-products from the human food industry, for example - are minimizing waste and promoting sustainability.

With the ongoing progress in the development of pet food products, packaging, and sustainability, the fish-based pet food market has us set for significant growth. With consumers becoming more mindful, brands that focus on transparency, quality, and sustainability will have a competitive advantage in these changing market dynamics.

Fish-based foods for pets are mainly targeted towards cats, dogs, and birds providing species specific dietary benefits. Among these, cats show a strong preference towards fish-flavoured diets because they tend to evolve as seafood predisposed (Akhtar et al.

That said, they do contain significant sources of taurine, an amino acid critical for feline heart and eye functions that is less prevalent in land-based meat sources than it is in fish! The high protein and omega-3 fatty acids content also promote a cat’s coat health by lowering inflammation and improving skin condition.

Fish-based pet food is especially life-saving as a dog becomes allergic to grains, chicken and/or beef. Many dogs can have intolerances to protein sources like chicken or beef, so fish is a great hypoallergenic protein alternative.

Furthermore, there are also omega-3 fatty acids present in fish, including EPA and DHA, they are also known to provide joint health benefits, enhance cognitive functions, and aid in immune system functioning. This is a major benefit for senior dogs and dogs with arthritis and inflammatory disease.

Birds are a smaller segment, but they also eat fish-based diets, especially exotic species that require high-protein nutrition. Some types of birds-seabirds and raptors, for instance-obtain fish-based ingredients to satisfy their dietary requirements.

Although pet food comes in an amazing array of forms, fish pet food gives various varieties of pet owners an entire and balanced eating regimen that consists of high-high quality protein as well as essential nutrients which permit their pets to get pleasure from a wholesome way of life.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Nestlé Purina PetCare | 20-25% |

| Mars Petcare | 15-20% |

| Hill’s Pet Nutrition | 10-15% |

| Blue Buffalo (General Mills) | 8-12% |

| Spectrum Brands (IAMS) | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Nestlé Purina PetCare | Premium fish-based pet food formulas with enhanced taurine and omega-3 fatty acid content. |

| Mars Petcare | Hypoallergenic fish-based pet food options catering to dogs and cats with dietary sensitivities. |

| Hill’s Pet Nutrition | Veterinary-recommended fish-based diets focused on digestive health, skin conditions, and heart health. |

| Blue Buffalo (General Mills) | Grain-free fish-based pet food rich in high-quality protein and natural ingredients. |

| Spectrum Brands (IAMS) | Specialized fish-based pet nutrition with a focus on coat health, joint support, and overall wellness. |

Key Market Insights

Nestlé Purina PetCare (20-25%)

Nestlé Purina dominates the fish-based pet food segment with scientifically formulated diets that support overall pet health and well-being.

Mars Petcare (15-20%)

Mars Petcare offers a variety of fish-based pet food options tailored for pets with dietary restrictions and specific nutritional needs.

Hill’s Pet Nutrition (10-15%)

Hill’s Pet Nutrition specializes in prescription-based fish diets for pets with digestive and skin sensitivities.

Blue Buffalo (8-12%)

Blue Buffalo provides natural and grain-free fish-based pet food solutions with high protein content for optimal health.

Spectrum Brands (5-9%)

Spectrum Brands focuses on pet food formulations that enhance skin and coat health, alongside joint and immune system benefits.

Other Key Players (30-40% Combined)

The market is expanding with emerging brands and innovative offerings in the fish-based pet food segment, including:

The overall market size for fish-based pet food market was USD 1,543.5 Million in 2025.

The fish-based pet food market is expected to reach USD 2,397 Million in 2035.

Rising pet ownership, premiumization trends, and demand for organic, high-protein diets will drive fish-based pet food market growth.

The top 5 countries which drives the development of fish-based pet food market are USA, European Union, Japan, South Korea and UK.

Dry fish-based pet food demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 44: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 56: MEA Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Nature, 2023 to 2033

Figure 27: Global Market Attractiveness by Pet Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Nature, 2023 to 2033

Figure 57: North America Market Attractiveness by Pet Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Pet Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 117: Europe Market Attractiveness by Pet Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 131: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Pet Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 161: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 165: MEA Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 169: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 177: MEA Market Attractiveness by Pet Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA