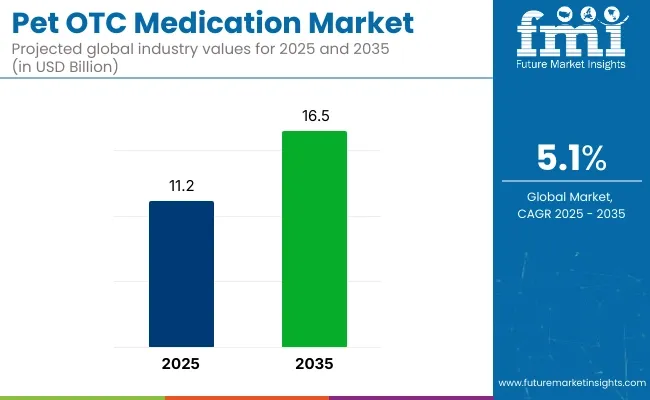

The global pet over-the-counter (OTC) medication market is expected to grow from USD 11.2 billion in 2025 to USD 16.5 billion by 2035, reflecting a steady CAGR of 5.1%. This growth is largely driven by rising pet ownership worldwide, increasing awareness about pet healthcare, and a growing preference for convenient, non-prescription medication options.

Pet owners are treating their animals as family members, leading to heightened demand for accessible and effective OTC treatments. The expanding eCommerce sector is also facilitating greater product availability and consumer reach, further boosting market growth globally.

In 2025, natural and organic pet health products are gaining popularity within the OTC medication segment. Manufacturers are focusing on developing holistic care options that emphasize preventive health benefits, reflecting consumer preferences for safe and sustainable products.

| Metric | Value |

|---|---|

| Industry Size (2025) | USD 11.2 billion |

| Industry Value (2035) | USD 16.5 billion |

| CAGR (2025 to 2035) | 5.1% |

Technological integration in pet healthcare is advancing, with innovations such as AI-powered health monitoring devices and smart medication dispensers improving treatment adherence and personalization. These technological enhancements are expected to revolutionize OTC medication accessibility and efficacy, driving further market expansion in the coming decade.

Recent key developments include the launch of novel natural OTC formulations targeting common pet ailments like joint health, digestive support, and skin conditions. Companies are increasingly investing in digital platforms that offer tele-veterinary consultations paired with OTC product recommendations, enabling personalized pet care remotely.

Additionally, subscription-based models for OTC pet medications have been introduced by several players, ensuring timely product delivery and adherence to treatment regimens. Growth in advanced packaging solutions designed to maintain product efficacy and enhance user convenience is also shaping market trends.

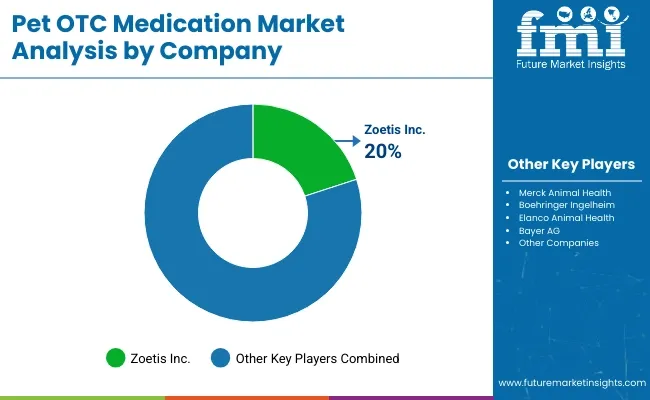

The market is dominated by key players including Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Elanco, and Ceva Santé Animale. These companies emphasize research and development, strategic partnerships, and expanded distribution networks to maintain a competitive advantage. As demand for preventive care continues to rise, the pet OTC medication market is expected to evolve with increased product diversification and personalized healthcare solutions.

Regulatory frameworks are adapting to ensure safety and quality standards for OTC products. Sustainability initiatives and natural ingredient sourcing will further influence consumer choices. Overall, the market is poised for robust, innovation-driven growth through 2035.

The pet OTC medication market is projected to experience significant growth, driven by key segments such as dogs, cats, and flea and tick treatments. The demand for broad-spectrum treatments, preventive care, and innovative products is fueling the growth of these segments, as pet owners increasingly seek effective solutions for a wide range of pet health issues.

Dogs are expected to account for 60% of the total pet OTC medication sales in 2025. This dominance is primarily driven by the premiumization of pet care, more frequent veterinary visits, and the increasing uptake of pet insurance. These factors contribute to the rising demand for OTC medications that address a broad spectrum of health concerns.

Common products in the dog segment include joint supplements, dewormers, pain relievers, and flea and tick treatments. Brands like Bravecto (Merck Animal Health), NexGard (Zoetis), and Simparica Trio (Boehringer Ingelheim) lead the market with long-lasting antiparasitic solutions.

Additionally, growing concerns over canine obesity and arthritis are driving demand for glucosamine-based joint supplements like Cosequin, which help manage pain and improve mobility. As awareness of pet health grows and more pet owners prioritize proactive care, the dog segment is expected to maintain its dominant position, with demand for both new treatments and expanded pet care options contributing to its continued growth.

Flea and tick treatments are expected to capture 40% of the pet OTC medication market share by 2025. This significant share is driven by the increasing prevalence of vector-borne diseases, such as Lyme disease and ehrlichiosis, which are transmitted by ticks.

As pet owners increasingly focus on preventive care, the demand for effective flea and tick treatments has surged. Leading products like NexGard (Zoetis), Bravecto (Merck Animal Health), and Frontline Plus (Boehringer Ingelheim) dominate the market, offering fast-acting and long-lasting solutions.

The rise in resistance to older flea treatments has prompted innovation in the market, leading to the development of isoxazoline-based oral chews and plant-based repellents. These innovations provide pet owners with more options for treating and preventing flea infestations.

As awareness of the health risks associated with fleas and ticks grows, the demand for these treatments is expected to remain strong, with pet owners seeking reliable, accessible OTC solutions to protect their pets from disease transmission and discomfort.

The industry is on the way to being the fastest growing industry is the result of the increase in the number of pet owners as well as the higher degree of awareness of pet health care. The pet owners Neva don't tell anything about the use of the drug without saying its effectiveness, its safety, its affordability, and convenience, they prefer it over trusted brands and the doses that are easy to use such as chewable tablets or liquid drops.

The veterinary clinics commonly prescribe the medications that have to follow the strictest regulations and tests, they are often made of solely natural and organic ingredients that are believed to be the best for pets. On the one hand, the pet stores and pharmacies provide the cheap and easily available to customers OTC drugs while on the other hand, the online retailers sell even more than the pharmacies, as they have the advantages of the simplest buying process, the best prices, and the delivery to customers' homes.

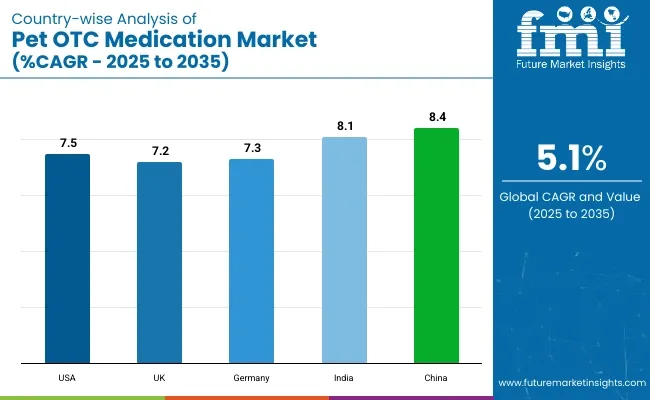

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| UK | 7.2% |

| Germany | 7.3% |

| India | 8.1% |

| China | 8.4% |

The USA industry is expanding due to increasing pet ownership and preventive care expenditure. With over 67% of the population owning a pet, customers are on the lookout for cost-effective, effective solutions to treat pet health.

The industry has been revolutionized through e-commerce, with Chewy and Amazon retailing direct-to-door pet medications. Zoetis, Bayer Animal Health, and PetArmor dominate the industry, introducing new products for flea, tick, and parasite control. FMI is of the opinion that the USA industry is slated to grow at 7.5% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Pet owners' demand for flea, tick, and parasite control products | Pet owners seek easy-to-use products like spot-on and chewable tablet forms to avoid infestation risks. |

| Natural and herbal pet supplement industry popularity | Customers have become aware of overall pet health, and natural and plant-derived supplements like CBD-treated pet items have shown a rise in sales. |

| Web-based and subscription-form pet pharmacies' growth | Flash platforms commoditize products by making them more affordable and accessible, with auto-renewal subscriptions providing improved customer retention. |

The UK industry is fueled by robust veterinary retailing and rising consumer demand for alternative therapy. The pet population is over 50 million, and owners spend a lot of money on preventive medicine.

Industry leadership is retained by brands such as Frontline, Beaphar, and Bob Martin to encourage new pet health solutions through both offline and online store channels. FMI is of the opinion that the UK industry is slated to grow at 7.2% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Upsurge in demand for nutritional and preventive supplements | Pet owners invest in long-term pet health with a focus on vitamins, joint supplements, and immuno-boosters. |

| Growth of online availability of pet medicines at stores and pharmacies | The growing availability of additional OTC pet medicines at stores and neighborhood pharmacies makes access easy. |

| Online veterinary consultation and telemedicine development | Online vet consultation makes diagnosis and online prescription easier with reduced clinic visits. |

Germany's industry thrives after a demand for high-quality veterinarian-approved medicine. Germany has a population of over 34 million pets and features a large and mature pet group that is generating demand for bespoke healthcare products.

Boehringer Ingelheim, Virbac, and Merial are a few of the business entities that harness pet owners needing effective science-proven solutions. FMI is of the opinion that the German industry is slated to grow at 7.3% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Need for joint and digestive health supplements | Older animals require special nutrition, which has been pushing the sale of glucosamine and probiotic supplements. |

| Organic, chemical-free medication for animal growth | Organic, sustainable products attract consumers, propelling demand for herbal medicines. |

| Increased veterinary shopping over the Internet and home delivery | Internet shopping malls provide the luxury of easy access to veterinarian-qualified pet medication. |

India's industry experiences high growth, driven by increasing disposable incomes and increasing pet adoption. The pet care industry is expanding with an increasing demand for herbal and ayurvedic products.

Local players like Himalaya Pet Care, Drools, and Petcare offer cost-effective yet effective solutions that are tailored to regional industries. FMI is of the opinion that the Indian industry is slated to grow at 8.1% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Herbal and Ayurvedic pet drug popularity | Ayurvedic and herbal pet medicines have gained popularity among pet owners. |

| Home and low-priced pet treatments demand | Home brands satisfy middle-class family needs with low-priced treatments. |

| E-commerce and direct-consumer pet health products emergence | Flipkart and Amazon facilitate countrywide coverage for OTC pet medicines. |

China's industry is expanding at an increasing rate because of increased incomes and a move towards premium-quality pet health products. China's pet industry measures up to USD 50 billion, with increasing client demand for high-quality domestic and foreign brands.

Robust competitors like Tianjin Ringpu, Zoetis China, and VetPlus benefit from the rising tide. FMI is of the opinion that the Chinese industry is slated to grow at 8.4% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Increasing demand for probiotics and immune-boosting pet supplements | Pet owners appreciate digestive health and disease prevention through scientifically formulated supplements. |

| Expansion of cross-border e-commerce and overseas pet medicine brands | European and American foreign pet health products become more mainstream among Chinese consumers. |

| Increased role of smart pet healthcare and online consultations with veterinarians | Technology-based solutions, such as AI-based vet consultations, transform pet healthcare access. |

The industry for pet medicine is growing at an accelerated pace, considering factors like rising pet ownership awareness toward preventive healthcare for pets and reasonable demand for OTC medications. Pet owners look forward to these affordable and effective options for addressing various ailments, increasing competition among established and emerging players.

Key players Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, and Bayer Animal Health (Elanco) are marketing products like flea and tick preventives, dewormers, pain relievers, and skin treatments. Startups and niche brands are expanding their portfolios into natural supplements, CBD-based pet wellness products, and AI-driven pet health monitoring solutions.

Industry evolution, with the growth of e-commerce, DTC sales, and increased scrutiny by regulators for product safety and efficacy, is a major force at play. Shifting to organic and chemical-free formulations and subscription-based models in the pet wellness space is also reshaping industry dynamics.

Strategic factors impacting competition entail product efficacy, regulatory compliance, distribution partnerships, and branding strategies. Players investing in innovative formulations, telehealth-integrated pet care solutions, and sustainable packaging will have a stronger footing in this industry.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 11.2 billion |

| Projected Market Size (2035) | USD 16.5 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million doses for volume |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Pet OTC Medicine Market | Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, Bayer AG, Ceva Santé Animale, Virbac S.A., Vetoquinol S.A., Central Garden & Pet, Hartz Mountain Corp., PetIQ, Sergeant’s Pet Care Products Inc., Advecta, Zesty Paws, Durvet Inc., Pet King Brands, Nutramax Laboratories, Inc., Dechra Pharmaceuticals PLC, Norbrook Laboratories Limited, Bimeda Inc. |

| Additional Attributes | Growth in flea & tick, digestive, and joint care segments, OTC innovation across chewable and topical formats, Role of retail and online pharmacies in distribution expansion, Cross-category branding across wellness and preventive pet health, Regional adoption patterns influenced by regulatory leniency |

| Customization and Pricing | Customization and Pricing Available on Request |

By pet type. the industry is segmented by pet type into dogs, cats, birds, fish and reptiles, small pets, and others.

By application, the industry includes fleas & ticks, allergies, pain relief & arthritis, de-wormers, and others.

By form, the industry is categorized into chewables & tablets, capsules & ointment, sprays, and others.

By sales channel, the industry is divided into pet specialty stores, veterinary clinics, drug & pharmacy stores, online retail, and others.

By region, the industry spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

The industry is slated to reach USD 11.2 billion in 2025.

The industry is predicted to reach a size of USD 16.5 billion by 2035.

Ceva Santé Animale Co., Elanco Animal Health Inc., Boehringer Ingelheim International GmbH, Zoetis Inc., Merck & Co., Inc., Virbac SA Co., Bayer AG, IDEXX Laboratories Co., Covetrus Inc., Dechra Pharmaceuticals PLC, Vetoquinol SA, Phibro Animal Health Co., Kyoritsuseiyaku Co., Krka, d. d., Novo Mesto, Sequent Scientific Ltd., Heska Co., and Eco Animal Health Group are the key players in the industry.

China, slated to grow at 8.4% CAGR during the forecast period, is poised for the fastest growth.

Chewables & tablets are among the most widely used forms of pet OTC medication.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing OTC Medication Market Share in the Pet Industry

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA