About The Report

The global pet food palatants market is valued at USD 2.4 billion in 2025 and is projected to expand further to USD 4 billion by 2035. This growth reflects a CAGR of 5.2% over the forecast period. The market’s steady expansion is driven by the increasing demand for high-quality pet food ingredients that enhance the taste, aroma, and overall palatability of pet food products, encouraging pets to consume their food more eagerly and consistently.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.4 billion |

| Industry Value (2035F) | USD 4 billion |

| CAGR (2025 to 2035) | 5.2% |

This trend is reflective of the growing pet ownership worldwide and a rising willingness among pet owners to invest in premium nutrition to support the health and well-being of their animals.

The pet food industry has witnessed significant innovation in recent years, focusing on palatants as key additives that improve the sensory appeal of food products for pets. Pet owners are increasingly treating their pets as family members, leading to a surge in demand for nutritious, tasty, and safe pet food options.

This shift has pushed manufacturers to develop advanced palatants that cater to diverse dietary needs and preferences. Moreover, with the rise of urbanization and busy lifestyles, convenience and product appeal have become crucial factors, making palatants an essential component for pet food manufacturers striving to maintain customer loyalty and increase market share.

One of the major driving factors behind the growth of the pet food palatants market is the increased awareness about pet health and nutrition. Pet owners today are more informed and conscious of the ingredients in pet food, demanding products that not only meet nutritional requirements but also appeal to their pets’ taste buds.

Additionally, the expansion of the pet care industry in emerging markets, alongside the development of new palatant manufacturing facilities such as the one inaugurated by Symrise in Brazil, highlights the industry’s commitment to serving both local and global demand. This expansion is further supported by ongoing research and development efforts aimed at producing natural, sustainable, and effective palatants, ensuring continued market growth in the coming years.

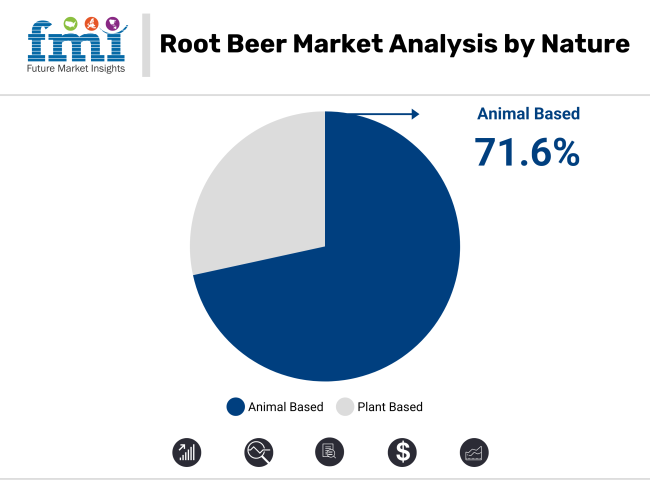

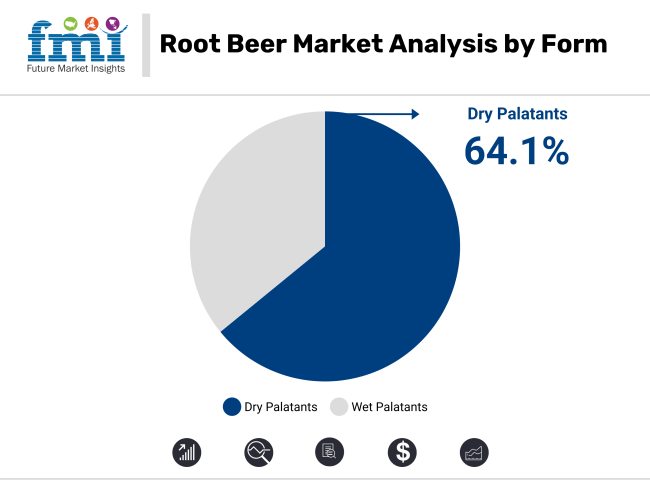

India is expected to be the fastest-growing market for pet food palatants, with a projected CAGR of 6.2%. Animal-based will dominate the nature segment, holding 71.6% of the market share by 2025. Dry segment will lead form with a 64.1% share. China and Japan are also expected to experience notable growth, with projected CAGRs of 5.5% and 5.0%, respectively.

The following table summarizes the analysis of the change in CAGR over a period of 6 months for the base year (2024) and current year (2025) for the global pet food palatants industry. This analysis outlines these important performance shifts over time and shows revenue recognition trends to give stakeholders a clearer view of the trajectory of this growth over the course of 12 months.

| Particular | Value |

|---|---|

| H1 (2024 to 2034) | 4.3% |

| H2 (2024 to 2034) | 4.6% |

| H1 (2025 to 2035) | 5.1% |

| H2 (2025 to 2035) | 5.2% |

Over the five-year period, the North American VMS market is expected to grow at a CAGR of 5.1% as the North American VMS market continues to expand in the first half (H1; 2025 to 2030) of the decade, and slightly faster at 5.2% in the second half (H2; 2030 to 2035) of the same decade. 2024 H2 grew by 30 BPS as compared to H1, 2025 H2 only grew by 10 BPS, thus pushing us to believe the market momentum is on the rise, but also suggests strong stability in the trend.

In 2025, the Animal-Based segment will dominate the Pet Food Palatants Market with a substantial 71.6% value share, driven by the demand for protein-rich and digestible diets for pets. Meanwhile, Dry Palatants will lead the Form segment, capturing 64.1% of the market share, owing to their superior shelf stability, ease of handling, and compatibility with dry pet food formulations.

Animal-based palatants are projected to maintain their dominance in the Pet Food Palatants Market by Nature, holding a commanding 71.6% market share in 2025. This dominance is fueled by pet owners’ growing preference for protein-rich diets that closely mimic the natural feeding patterns of animals in the wild. These palatants deliver superior digestibility, bioavailability of amino acids, and enhanced palatability, making them a key component in premium pet food products.

Innovations such as hydrolyzed meat-based palatants, developed by companies like AFB International and Kemin Industries, are helping pet food manufacturers meet the dual demands of health and taste without compromising product integrity. Animal-based palatants are widely incorporated into therapeutic diets, addressing conditions like appetite loss, recovery needs, and age-related nutritional demands in pets.

As trends of pet food premiumization and personalization gain momentum globally, the demand for animal-based palatants continues to rise. Their proven ability to stimulate appetite and improve the acceptability of both dry and wet pet food formats ensures that they remain the top choice in high-quality pet nutrition products.

The Dry Palatants segment is forecast to dominate the Form category in the Pet Food Palatants Market with a projected 64.1% market share in 2025. This prominence is largely attributed to their exceptional shelf life, ease of use, and adaptability in high-volume pet food production lines, particularly in dry kibble formulations.

Dry palatants, available in powder or granule forms, can be applied topically or mixed during processing to enhance aroma and flavor retention, crucial for maintaining pet food appeal over extended storage periods. Their resilience under diverse transport and storage conditions-especially in humid or warm climates-makes them a preferred choice among manufacturers aiming for long-lasting effectiveness.

The cost-efficiency and compact packaging advantages of dry palatants further contribute to their widespread adoption. They are also increasingly being used in therapeutic and specialized diets for pets with sensitivities, helping mask less palatable functional ingredients and improving voluntary food intake. Recent advancements in microencapsulation and controlled flavor-release technologies are expected to enhance the intensity and functional benefits of dry palatants, ensuring their continued market leadership in the pet food industry.

Tier 1, there exists a (very small) competitive group of players that, in terms of revenue, global coverage & market saturation, represent a multidimensional real estate to all intents and purposes. These players hold significant proportional market share of pet food palatants and invest in new innovations, strategic acquisitions, and advertising.

Tier 1 e.g. companies such as Kemin Industries, Inc., AFB International, ADM, Symrise, and DSM. They have strong relationships with major pet food manufacturers and maintain robust global supply chains, leading advances in taste science, protein enhancement and natural flavor technologies. In addition to their vast product portfolio, these companies also have a leading sustainability agenda and offer customized palatant solutions for various species and formulations.

Tier 3 Companies: Generated Revenue up to USD 3 billion. These brands can be specialists in pet nutrition or flavor solutions and may specialize in regional or niche markets. Examples include Ohly, BRF Ingredients, Kerry Group plc., Pet Flavors. These companies are often smaller than Tier 1 companies, expanding in innovative ways in an agile market.

They also tend to have their own bespoke formulations, like yeast-based palatants, organic mixes or breed-targeted taste boosters. Their strength comes from retaining quality yet concentrating on functional and palatability improvement in dry and wet pet food formats.

Tier 3 - includes emerging players and small-scale firms that are making their presence felt in palatants. Others, such as Profypet, Trilogy Flavors, Lyka and Susheela Group, tend to be regional pressure cooker players with small distribution networks. These companies probably don’t have the broad resources or name recognition of the upper echelons yet, but frequently distinguish themselves with inventive product lines, direct-to-consumer models or sustainable practices.

Their agility lets them pivot quickly to niche trends, such as grain-free or insect-protein-based palatants, and grab a toehold with premium and specialty pet food makers.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 4.3% |

| Germany | 4.9% |

| China | 5.5% |

| Japan | 5.0% |

| India | 6.2% |

Driven by pet humanization trends, the USA pet food palatants market is poised for steady growth as American pet owners are opting for high-quality food products, which deliver enhanced flavor and functional benefits. The growth of clean-label pet food has stimulated the demand for palatants, which are derived from natural ingredients such as liver, poultry fat, yeast extracts, and hydrolyzed proteins.

Players like Kemin Industries, AFB International and ADM are professionalizing species-specific palatants for performance, palatability and health. The rising expenditure on premium pet food and therapeutic diets has led to an increase in the incorporation of targeted palatants aiding digestive health and higher adherence to prescription meals.

This is a growing sector from the rise of e-commerce platforms and DTC brands, creating the demand for palatants that retain aroma and flavor fidelity during the shelf life of dry and wet packaged foods.

Germany continues to be an important European market that is attracting consumers who are focused on sustainable, transparent ingredients, as well as functional nutrition. (For eco-sensitive consumers, demand for sustainable palatants insect protein-based, yeast-derived, and fermentation-origin flavor enhancers has soared.

In Germany, pet parents are jumping on the grain-free and vet-recommended dog food bandwagon, too, often needing better palatability from their limited-ingredient lists. These companies are exploiting new frontier in flavor science, developing palatants that enhance flavor and authenticity, while remaining compatibly with hypoallergenic and functional products.

Similarly, the robustness of EU regulations regarding feed and food safety has driven pet food manufacturers in Germany to work with trusted palatant suppliers who provide and test for traceability and regulatory compliance.

The premium pet food boom is sweeping across China, stimulated by accelerated urbanization, a rising middle class, and the humanization of pets. Chinese companies have invested in these palatants, since consumers are willing to pay for quality and manufacturers have no choice but to add high-end palatants that mirror the aroma and taste of freshly prepared meat.

As pet food allows for functional, therapeutic, and life-stage-specific diversification, palatants are key to assure acceptability.” Urban pet parents favoring palatants in their snacks and treats are also expanding among Chinese manufacturers. Moreover, the country's large consumer feed industry has also introduced palatants to address feed waste and help with nutrient absorption, supporting the demand across pet and animal nutrition sectors. Local R&D is also on the rise, with partnerships with international brands to co-develop palatants for Asian palates.

Among the key territories, India is the fastest-growing pet food palatants market. As pet ownership continues to grow in urban and tier-2 cities, Indian consumers are on the lookout for tasty, protein-rich food for their pets. At the same time, affordability is still a priority which is fueling demand for effective but palatable formulations.

Domestically manufacturers such as Susheela Group and Profypet are launching poultry-based and organ-meat palatants customized for local palates and price points. Moreover, international players are foraying into the Indian market via partnerships to provide customized palatants as per FSSAI and export norms.

Similar trends are also emerging in India with growing consumption of pets' treat opening fresh growth opportunities for palatants used in the preparation of baked and dehydrated goods. The increase of online pet retail platforms went further increase way to worldwide brands, which led a positive pressure toward the quality and sensorial facet of daily pet meals.

The pet food palatants market is moderately consolidated, with key players including Kemin Industries, Inc., AFB International, Ohly, Lyka, BRF Ingredients, Symrise, DSM, ADM, Profypet, Trilogy Flavors, Susheela Group, Kerry Group plc., and Pet Flavors. These companies lead the market by providing innovative and high-quality palatant solutions that enhance the taste and aroma of pet food, catering to the growing demand for premium pet nutrition worldwide.

For example, Kemin Industries focuses on science-based, natural palatants that improve pet food palatability while supporting health. Symrise is notable for its global production capabilities and advanced flavor technologies, exemplified by their recent facility opening in Brazil. DSM and ADM contribute through their extensive ingredient portfolios and sustainability initiatives, aiming to meet diverse pet food formulation needs. Other players like AFB International and Kerry Group plc. specialize in tailored flavor systems designed for various pet types, reinforcing their positions in the competitive pet food palatants market.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.4 billion |

| Projected Market Size (2035) | USD 4 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Form Analyzed (Segment 1) | Dry, Wet |

| Nature Analyzed (Segment 2) | Animal Based, Plant Based |

| Pet Type Analyzed (Segment 3) | Cats (Kitten, Senior), Dogs (Puppy, Adult, Senior), Birds, Others |

| Application Analyzed (Segment 4) | Daily Based Food, Treats, Chews, Supplements |

| Claims Analyzed (Segment 5) | Grain-Free, Low-Fat, Non-GMO, Low in Calories |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, GCC Countries, South Africa |

| Key Players influencing the Pet Food Palatants Market | Kemin Industries, Inc., AFB International, Ohly, Lyka, BRF Ingredients, Symrise, DSM, ADM, Profypet, Trilogy Flavor, Other Prominent Market Player |

| Additional Attributes | Dollar sales by pet type (cats vs. dogs), Adoption trends in grain-free & low-fat palatants, Regional demand drivers for wet vs. dry forms, Influence of natural & organic claims, Demand patterns in Asia & North America |

In this segment, the industry has been categorized into dry and wet.

The nature segment has been categorized into Animal Based and Plant Based.

Pets such as Cats (Kitten, Senior), Dogs (Puppy, Adult, and Senior), Birds, and Others are included in the report.

In this segment, the industry has been categorized into Daily Based Food, Treats, Chews, Supplements.

Various claim types such as grain-free, low-fat, non-GMO, and low in calories are included in the report.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global industry is estimated at a value of USD 2.4 billion in 2025.

Sales increased at 3.5% CAGR between 2020 and 2024.

Some of the leaders in this industry include Kemin Industries, Inc., AFB International, Ohly, Lyka, BRF Ingredients, Symrise, DSM, ADM.

The North America is projected to hold a revenue share of 65% over the forecast period.

The industry is projected to grow at a forecast CAGR of 5.2% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The Pet Food market is segmented by Nature (Conventional, Organic, Monoprotein), Source (Animal-derived, Plant-derived, Insect-derived), Sales Channel (Store-based Retailing, Online Retailers), Product Type (Kibble/Dry, Wet Food, Frozen, Treats and Chews, Others), Animal Type (Dogs, Cats, Birds, Others), and Region. Forecast for 2026 to 2036.

The Pet Food Preservative Market is segmented by Product Type (Nisin, Natamycin, Benzyl Alcohol, Salicylic Acid, Sorbic Acid, Natural Acids, Botanical Extracts, Others), End-Use Application (Dog Food, Cat Food), and Region. Forecast for 2026 to 2036.

Pet Food Ingredients Market Size and Share Forecast Outlook 2026 to 2036

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.