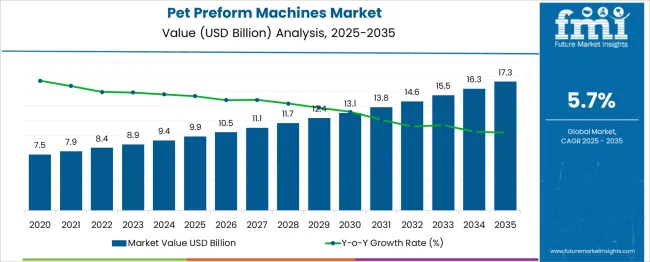

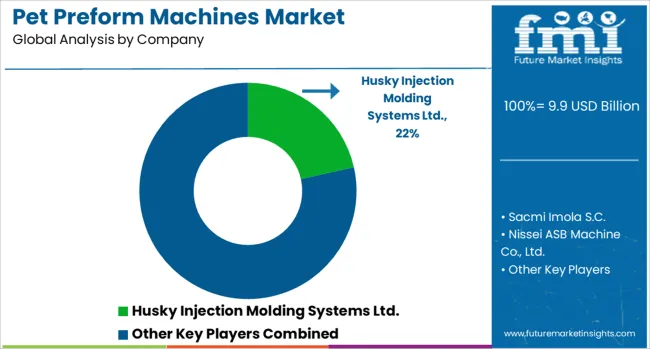

The PET Preform Machines Market is estimated to be valued at USD 9.9 billion in 2025 and is projected to reach USD 17.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| PET Preform Machines Market Estimated Value in (2025 E) | USD 9.9 billion |

| PET Preform Machines Market Forecast Value in (2035 F) | USD 17.3 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The PET preform machines market is expanding steadily, propelled by the rising demand for PET bottles across industries such as beverages, personal care, pharmaceuticals, and household products. Growth is largely attributed to increasing consumption of packaged water, carbonated drinks, and ready-to-drink beverages, where PET containers remain the preferred packaging medium due to their light weight, recyclability, and barrier properties.

Manufacturers are investing in technologically advanced machinery to enhance productivity, reduce cycle time, and improve energy efficiency. The market outlook is optimistic as automation, precision molding, and integration of Industry 4.0 capabilities become standard across production facilities.

Demand for cost-effective and high-output solutions is driving machine upgrades and replacement trends, particularly in developing economies. With growing emphasis on sustainable packaging and circular economy practices, PET preform machine suppliers are also focusing on enabling recyclability and minimizing material waste, contributing further to the long-term viability of the market.

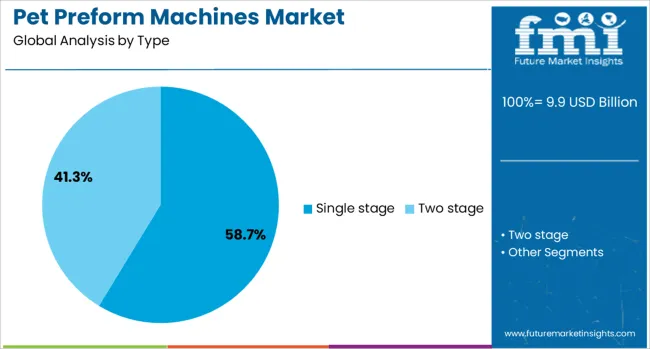

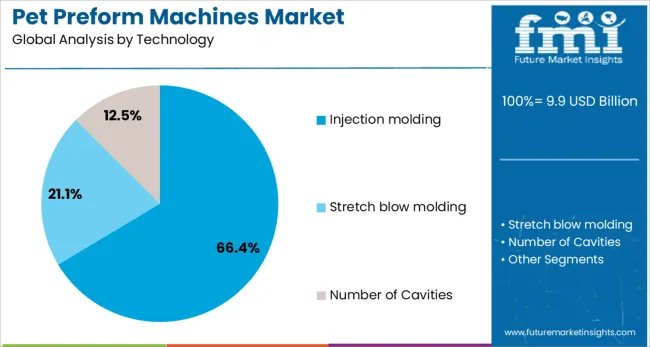

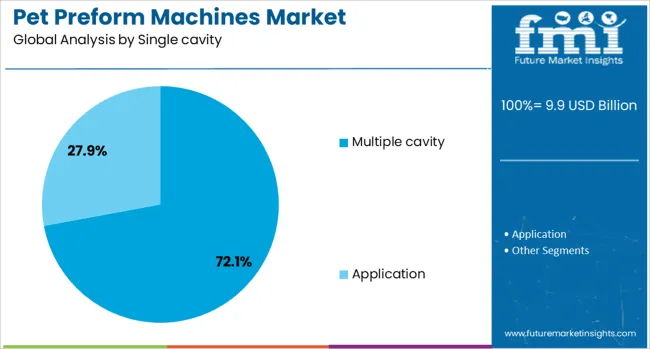

The PET preform machines market is segmented by type, technology, single cavity, carbonated beverages, and end-use and geographic regions. Based on the type of pet preform machines, the market is divided into single-stage and two-stage. The pet preform machines market is classified into Injection molding, Stretch blow molding, and the number of Cavities. Based on the single cavity of the pet preform machines, the market is segmented into Multiple cavities and applications. The carbonated beverages of the pet preform machines market is segmented into Bottled Water, Edible Oil, Non-Carbonated Beverages, Alcoholic Beverages, and Others. By end-use of the pet preform machines market is segmented into Beverages, Food, Personal Care & Cosmetics, Pharmaceuticals, Chemicals & Petrochemicals, and Others. Regionally, the pet preform machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single stage segment leads the market by type with a 58.7% share, reflecting its growing adoption in applications where operational integration and space efficiency are critical. This type of machine combines injection molding and blow molding processes within a single unit, eliminating the need for intermediate handling and storage of preforms.

The segment benefits from reduced labor requirements, minimized contamination risk, and streamlined production, which are particularly advantageous in pharmaceutical and cosmetic packaging applications. Smaller production runs and specialty bottle manufacturing further boost preference for single stage systems, offering better precision and customization capabilities.

Continuous improvements in energy consumption and faster cycle times are reinforcing this segment’s attractiveness. The single stage segment is expected to witness sustained adoption as manufacturers increasingly prioritize compact, all-in-one solutions to meet evolving product demands and regulatory compliance standards.

With a commanding 66.4% share in the technology category, injection molding remains the cornerstone of PET preform production, driven by its superior accuracy, repeatability, and ability to support high-volume output. The technology is widely favored for its compatibility with a broad range of preform designs and its capacity to produce lightweight yet structurally robust products.

Advancements in mold designs, hot runner systems, and cooling technologies have enhanced productivity and material utilization, making injection molding highly cost-effective over long production runs. Moreover, integration with robotic systems and digital monitoring tools has increased its efficiency and reduced operational downtimes.

The segment's dominance is further reinforced by the beverage industry’s continuous demand for standardized, high-speed preform manufacturing solutions. As manufacturers seek to increase throughput while maintaining consistent quality, the injection molding segment is set to retain its leadership position in the PET preform machines market.

The multiple cavity segment holds the largest share of 72.1% within the cavity configuration category, underscoring its pivotal role in enabling mass production and meeting the high-volume demands of packaging industries. These systems allow simultaneous production of multiple preforms in a single cycle, significantly increasing output while optimizing mold utilization and energy efficiency.

Adoption of multiple cavity machines is particularly strong among beverage bottlers and FMCG companies seeking to maintain fast turnaround times and reduce unit costs. The trend toward larger cavitation levels—enabled by robust mold designs and enhanced injection systems—has further solidified the segment’s dominance.

Manufacturers are also leveraging smart controls and predictive maintenance technologies to ensure consistent quality across all cavities, minimizing defect rates. With rising global demand for PET containers and a strong focus on productivity, the multiple cavity segment is expected to maintain its leadership in driving machine utilization and return on investment.

PET preform machines are being utilized in the beverage, personal care, and packaging industries to convert polymer resins into precise preform shapes for blow molding. Equipment featuring multi-cavity injection, rapid cycle control, and energy-saving designs is being selected to support large-volume production runs. Integration with automation systems for part unloading, quality inspection, and resin drying has been observed in turnkey packaging lines. Machine builders have introduced modular platforms that accommodate changes in neck size and cavity count without requiring full press replacement.

PET preform machines are being specified for their ability to deliver high production throughput using multi‑cavity injection modules and fast cycle technology. Hydraulic or electric drives with precision screw control have allowed consistent melt delivery and shot weight accuracy across repeated cycles. Modular machine bases have enabled cavity expansion or neck style conversion without machine swap‑out, reducing CAPEX for line retooling. Energy consumption has been reduced through optimized barrel insulation and variable pump drives. As brand owners and packagers have demanded cost‑efficient and consistent preform production, these machines have been integrated into automated feeding, inspection, and finishing systems to streamline factory operations.

PET preform machine deployment has been challenged by the need to retrofit or replace machines to adapt to changing bottle formats, cavity counts, and polymer blends. Reconfiguration of cavity tooling and injection parameters frequently requires technical support, extended downtime, and operator retraining. Maintenance complexity has been encountered due to high-pressure barrel wear, valve gate servicing, and hydraulic component upkeep. Integration of vision systems and part ejection robotics has required calibration expertise and alignment checks to ensure defect-free production. Parts procurement for specialized screws, barrels, and cavity plates has sometimes experienced lead‑time delays, affecting plant throughput and inventory planning. As packaging SKU variants increase, flexibility demands have raised equipment lifecycle management costs and scheduling pressures.

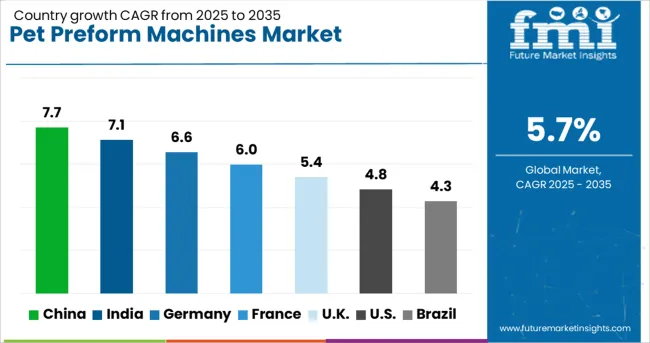

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The global PET Preform Machines market is expanding at a CAGR of 5.7%, driven by increasing demand for packaged beverages, improved automation, and sustainability in packaging production. In BRICS economies, China leads with a robust 7.7% growth rate, owing to strong domestic consumption and aggressive manufacturing expansion. India follows at 7.1%, fueled by rising demand for bottled water and growing investments in FMCG packaging. In the OECD region, Germany stands at 6.6%, leveraging engineering excellence and export-oriented production. France sees a 6.0% growth rate due to strong EU regulations supporting recyclable packaging. The United Kingdom registers a 5.4% rise, backed by rising demand in customized and eco-friendly PET packaging solutions. Growth across these regions reflects broader industrial development and demand for high-speed, energy-efficient PET preform manufacturing. This report includes insights on 40+ countries. The top five markets are shown here for reference.

India is growing at a CAGR of 7.1%, driven by surging demand in packaged drinking water and FMCG packaging sectors. Small- to mid-scale manufacturers are upgrading to semi-automatic and fully automatic machines to meet regional demand variations. There is significant interest in compact machines suitable for 250ml to 1-liter bottle formats, particularly in rural and semi-urban areas. Investment in PET processing technology is rising due to bottlers aiming to localize production and reduce transport overheads. Trade policies promoting local equipment sourcing are encouraging domestic OEMs to improve build quality and technical support offerings.

India is forecast to grow at a 7.1% CAGR, supported by strong demand from bottled water and FMCG sectors. Tier II and Tier III cities drive consumption, boosting investments in mid-capacity preform molding units. Domestic machine builders emphasize affordable, energy-efficient systems to serve SMEs, while premium players invest in fast-cycle, fully electric machines for large-scale manufacturers. Adoption of integrated preform and stretch blow-molding lines is increasing, reducing production downtime. The focus on PET recycling and lightweight preforms is reshaping machine specifications for cost efficiency and sustainability.

Germany is expected to grow at a 6.6% CAGR, driven by automation and precision requirements in high-speed PET packaging. Beverage and personal care sectors adopt multi-layer preform technologies to enhance barrier properties for premium applications. Leading machine suppliers focus on Industry 4.0 features, including predictive maintenance and remote monitoring. Demand for hybrid and all-electric PET preform machines grows as manufacturers prioritize energy efficiency. Innovations in servo-driven injection systems deliver reduced cycle times and precise wall-thickness control for lightweight packaging. German firms also export advanced systems to emerging European markets, strengthening their leadership in high-end solutions.

France is projected to grow at a 6.0% CAGR, supported by strong demand from mineral water bottling and premium beverage industries. Packaging companies are upgrading production lines with all-electric injection molding machines to reduce operational costs and energy consumption. Machine manufacturers integrate IoT-based performance monitoring and real-time quality control systems to optimize output. Adoption of multi-cavity molds is increasing for high-volume production in domestic and export markets. Additionally, the growing trend of on-the-go beverage packaging is accelerating machine modernization initiatives across regional hubs.

The United Kingdom is expected to grow at a 5.4% CAGR, driven by rising demand for lightweight PET bottles in carbonated drinks and functional beverages. Packaging firms prioritize flexible injection molding systems capable of handling different preform designs. OEMs introduce compact machine footprints and energy-saving features to cater to space-constrained facilities. Integration of quick-change mold systems is gaining traction to improve operational efficiency and minimize downtime. Partnerships between machine builders and beverage brands support co-development of advanced preform molding technologies tailored for new product launches.

The PET preform machine market is driven by global and regional suppliers delivering high-efficiency injection molding systems. Husky Injection Molding Systems leads with advanced multi-layer and rPET-capable platforms known for energy efficiency and communication integration. KraussMaffei, Sidel, and Milacron offer high-speed machines optimized for large-scale beverage production. Sumitomo (SHI) Demag and Nissei ASB focus on zero-defect technologies and precise mold control. SIPA and Sacmi emphasize flexible rotary systems for specialty packaging formats. Powerjet, Preform Technologies, and PET All Manufacturing deliver value-focused machines for emerging markets. Domestic suppliers such as Urola, Ferromatik Milacron India, H‑PET, and SANTSAI localize support, warranties, and cost-effective automation. Competition revolves around cycle time reduction, energy savings, integrated digital systems, multi-layer and rPET capability, custom mold solutions, and on-site service availability to meet diverse bottling and packaging client needs.

On May 7, 2024, Husky Technologies announced the launch of its HyPET 6e platform at NPE 2024. This next-generation PET preform injection molding system is engineered for processing up to 100% rPET, delivering faster cycle times of 4.5 seconds, achieving 35% energy savings, and featuring integrated communication across machine, mold, and auxiliary components for enhanced operational efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.9 Billion |

| Type | Single stage and Two stage |

| Technology | Injection molding, Stretch blow molding, and Number of Cavities |

| Single cavity | Multiple cavity and Application |

| Carbonated Beverages | Bottled Water, Edible Oil, Non-Carbonated Beverages, Alcoholic Beverages, and Others |

| End-use | Beverages, Food, Personal Care & Cosmetics, Pharmaceuticals, Chemicals & Petrochemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Husky Injection Molding Systems Ltd., Sacmi Imola S.C., Nissei ASB Machine Co., Ltd., SIPA S.p.A., Sidel Group, KraussMaffei Group GmbH, Urola S.Coop., Powerjet Plastic Machinery Co., Ltd., Sumitomo (SHI) Demag Plastics Machinery GmbH, Preform Technologies Inc., Milacron LLC, Ferromatik Milacron India Pvt. Ltd., H-PET Personalengesellschaft mbH, PET All Manufacturing Inc., and SANTSAI MACHINERY |

| Additional Attributes | Dollar sales by machine type (injection molding, stretch blow molding), regional adoption patterns, competitive landscape, buyer priorities for speed versus energy savings, integration with digital monitoring systems, innovations in multi-layer barrier technology, rPET processing capabilities, and hybrid automation solutions for enhanced production efficiency. |

The global pet preform machines market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the pet preform machines market is projected to reach USD 17.3 billion by 2035.

The pet preform machines market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in pet preform machines market are single stage and two stage.

In terms of technology, injection molding segment to command 66.4% share in the pet preform machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA