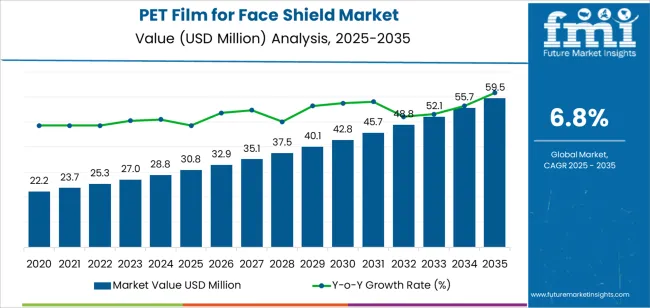

The global PET film for face shield market is forecasted to grow from USD 30.8 million in 2025 to approximately USD 59.5 million by 2035, recording an absolute increase of USD 28.7 million over the forecast period. This translates into a total growth of 93.2%, with the market forecast to expand at a CAGR of 6.8% between 2025 and 2035. The market size is expected to grow by nearly 1.9 times during the same period, supported by steady focus on personal protective equipment standards across healthcare and industrial sectors, growing workplace safety regulations requiring facial protection solutions, and increasing adoption of transparent barrier technologies in diverse occupational environments requiring visibility and protection integration.

The market expansion reflects fundamental shifts in occupational safety protocols focusing comprehensive facial protection beyond respiratory coverage alone. Organizations are investing in personal protective equipment systems that support splash protection, impact resistance, and optical clarity requirements across extended wear periods. PET films for face shields represent specialized polymer substrates requiring precise thickness control, surface treatment optimization, and mechanical property validation that directly impact user safety and comfort. Manufacturing standards are evolving to address diverse application environments ranging from surgical theaters to manufacturing facilities, driving demand for films that combine optical transparency, chemical resistance, and anti-fog performance across varied operational conditions.

Technological advancement in film processing is enabling enhanced surface coatings and multi-layer structures while maintaining clarity specifications and forming characteristics requirements. The integration of anti-scratch treatments and anti-static properties addresses durability concerns and contamination control objectives. Regional variations in workplace safety enforcement and healthcare infrastructure create differentiated growth trajectories, with developed markets focusing on premium performance features and disposal protocols while emerging markets emphasize cost-effective protection solutions and regulatory compliance establishment.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 30.8 million |

| Market Forecast Value (2035) | USD 59.5 million |

| Forecast CAGR (2025-2035) | 6.8% |

| SAFETY INFRASTRUCTURE ADVANCEMENT | PROTECTION STANDARD REQUIREMENTS | MATERIAL & REGULATORY STANDARDS |

|---|---|---|

| Global Workplace Safety Growth Continuing expansion of occupational health protocols across established and emerging industrial markets driving demand for reliable facial protection substrate solutions. | Comprehensive Protection Protocols Modern safety standards requiring transparent barrier systems offering splash protection, impact resistance, and unobstructed visibility across diverse work environments. | PPE Compliance Standards Regulatory requirements establishing performance benchmarks favoring certified optically clear protective films. |

| Healthcare Infection Control Focus Growing recognition of barrier protection importance in preventing pathogen transmission and maintaining sterile field integrity creating steady demand for medical-grade shield materials. | Extended Wear Demands Healthcare and industrial applications requiring comfortable, fog-resistant films supporting extended use periods without vision impairment or user fatigue. | Optical Quality Requirements Quality standards requiring distortion-free transparency and validated light transmission characteristics supporting visual task performance. |

| Industrial Safety Modernization Expansion of manufacturing and processing facility safety programs requiring facial protection beyond eyewear alone for comprehensive worker protection. | Chemical Resistance Standards Industrial applications demanding substrate materials resistant to cleaning agents, disinfectants, and workplace chemical exposure while maintaining clarity. | Material Safety Certification Manufacturing standards requiring validated biocompatibility for skin contact applications and confirmed absence of harmful extractables. |

| Category | Segments Covered |

|---|---|

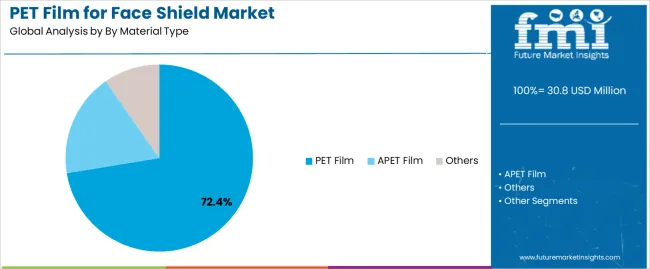

| By Material Type | PET Film, APET Film, Others |

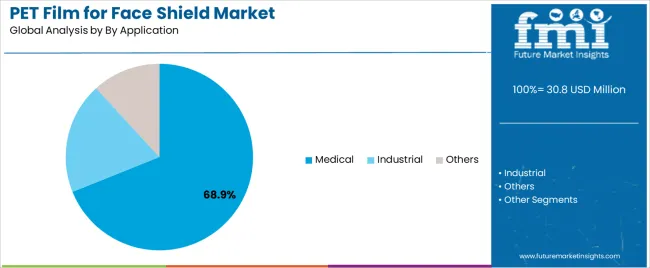

| By Application | Medical, Industrial, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| PET Film |

|

| APET Film |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Medical |

|

| Industrial |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Occupational Safety Regulation Growth Continuing expansion of workplace protection mandates across established and emerging industrial markets driving demand for compliant facial barrier materials. | Environmental Sustainability Pressures Growing concerns regarding single-use plastic waste and limited recycling infrastructure affecting disposable face shield acceptance and procurement decisions. | Anti-Fog Coating Innovation Integration of advanced surface treatment technologies enabling constant clarity during extended wear periods and high-humidity environments compared to untreated films. |

| Healthcare Infection Prevention Focus Increasing recognition of comprehensive barrier protection importance in preventing healthcare-associated infections and maintaining sterile procedural environments. | Cost Optimization Pressures Industrial and healthcare budget constraints affecting premium film adoption and encouraging reusable shield systems reducing film replacement frequency. | Multi-Layer Film Development Enhanced composite structures combining scratch resistance, anti-static properties, and chemical compatibility while maintaining optical clarity and formability characteristics. |

| Pandemic Preparedness Focus Growing institutional focus on maintaining PPE stockpiles and ensuring supply chain resilience for emergency response capacity supporting steady baseline demand. | Alternative Technology Competition Development of reusable rigid shields and alternative face protection systems potentially reducing disposable film consumption in certain applications. | Ecofriendly Material Research Development of bio-based PET alternatives and enhanced recyclability features addressing environmental concerns while maintaining performance specifications and regulatory compliance. |

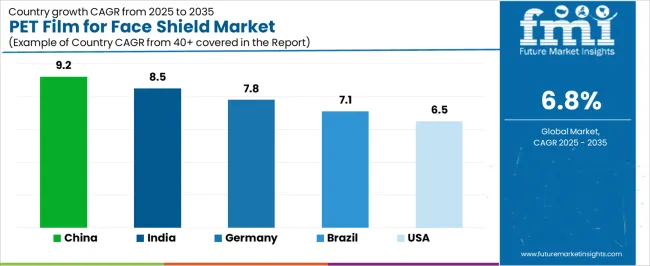

| Country | CAGR (2025-2035) |

|---|---|

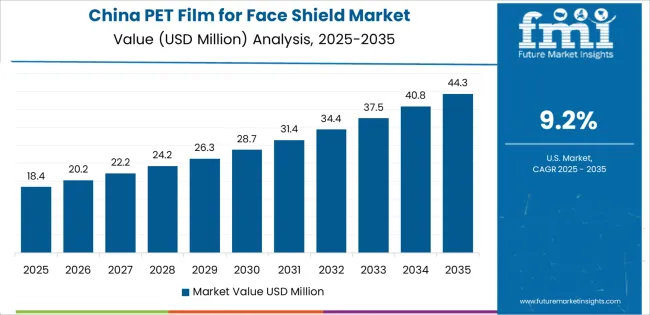

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| USA | 6.5% |

Revenue from PET film for face shields in China is projected to exhibit strong growth with substantial market value by 2035, driven by expanding industrial safety infrastructure and comprehensive workplace protection program implementation creating opportunities for protective film suppliers across manufacturing facilities, healthcare institutions, and processing industries. The country's extensive manufacturing base and growing occupational safety enforcement are creating significant demand for both standard and premium protective film solutions. Major polymer film manufacturers and PPE production networks are establishing comprehensive local supply capabilities to support large-scale shield manufacturing operations and meet growing demand for cost-effective protection materials.

India is expanding substantially by 2035, supported by extensive industrial development and comprehensive workplace safety regulation implementation creating steady demand for affordable protective film solutions across diverse manufacturing sectors and regional healthcare facilities. The country's growing industrial workforce and increasing safety awareness are driving demand for film solutions that provide reliable protection while supporting cost-effective procurement requirements. Polymer film manufacturers and PPE producers are investing in local production capabilities to support growing market demand and product availability enhancement.

Demand for PET film for face shields in Germany is projected to reach substantial value by 2035, supported by the country's leadership in occupational safety standards and advanced protective equipment technologies requiring premium film substrates for specialized applications and stringent performance requirements. German industrial facilities and healthcare institutions are implementing high-quality protective films that support optimal optical clarity, chemical resistance, and comprehensive safety compliance protocols. The market is characterized by focus on performance validation, material innovation, and compliance with stringent PPE and workplace safety standards.

Revenue from PET film for face shields in United States is growing to reach substantial value by 2035, driven by comprehensive healthcare infection prevention programs and constant PPE preparedness focus creating opportunities for film suppliers serving both medical facilities and industrial safety equipment manufacturers. The country's extensive healthcare infrastructure and established workplace safety frameworks are creating demand for film solutions that support diverse protection requirements while meeting regulatory compliance standards. Polymer film manufacturers and PPE producers are developing specialized product grades to support application-specific requirements and quality assurance expectations.

Demand for PET film for face shields in Brazil is projected to reach meaningful value by 2035, driven by industrial sector expansion and workplace safety regulation modernization supporting protective equipment adoption and compliance program development. The country's growing manufacturing base and increasing safety awareness are creating demand for cost-effective film solutions that support protection standards and accessibility requirements. Polymer film suppliers and PPE manufacturers are maintaining supply capabilities to support diverse industrial and healthcare protection requirements.

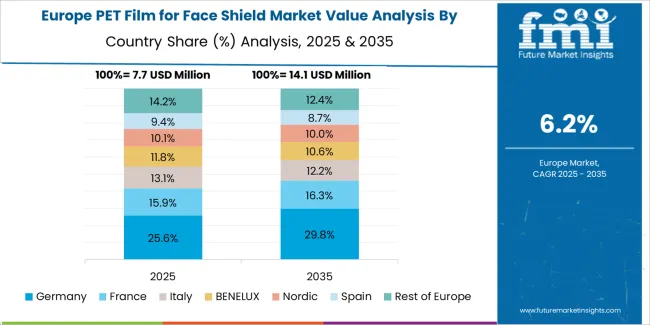

The PET film for face shield market in Europe is projected to grow from USD 10.6 million in 2025 to USD 18.9 million by 2035, registering a CAGR of 5.9% over the forecast period. Germany is expected to maintain its leadership position with a 32.6% market share in 2025, declining slightly to 31.8% by 2035, supported by its advanced industrial safety infrastructure and stringent workplace protection regulations.

France follows with a 22.4% share in 2025, projected to reach 23.1% by 2035, driven by comprehensive healthcare safety protocols and industrial facility modernization programs. The United Kingdom holds a 17.9% share in 2025, expected to decrease to 17.2% by 2035 due to post-Brexit supply chain adjustments affecting PPE procurement patterns. Italy commands a 13.8% share, while Spain accounts for 8.7% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 4.6% to 6.4% by 2035, attributed to increasing workplace safety standard adoption in Nordic manufacturing sectors and emerging Eastern European industrial facilities implementing comprehensive worker protection programs.

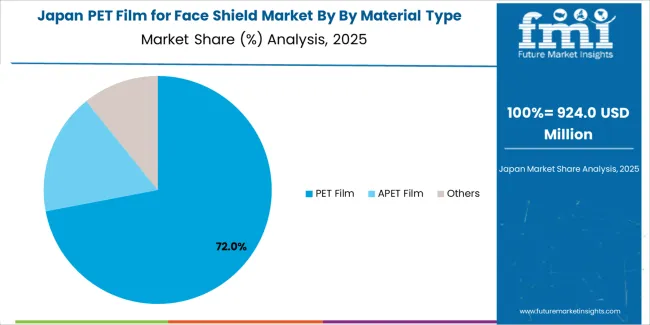

Japanese PET film for face shield operations reflect the country's meticulous approach to workplace safety and comprehensive quality control requirements. Major polymer film manufacturers including specialized protective material producers and established chemical companies maintain rigorous product validation processes focusing optical clarity consistency, dimensional stability, and surface quality standards that often exceed international PPE material specifications. This creates substantial barriers for foreign suppliers but ensures exceptional quality supporting optimal user safety and comfort.

The Japanese market demonstrates unique specification preferences, with particular focus on anti-fog performance reliability and constant clarity throughout extended wear periods. Industrial facilities and healthcare institutions require specific film thickness tolerances and surface treatment uniformity supporting demanding quality expectations and procedural protocol requirements.

Regulatory oversight through the Ministry of Health, Labour and Welfare emphasizes comprehensive safety validation for personal protective equipment materials, with particular attention to optical distortion limits and material biocompatibility characteristics. The classification system requires extensive technical documentation and performance testing validation, creating advantages for suppliers with established PPE material expertise and comprehensive quality management capabilities.

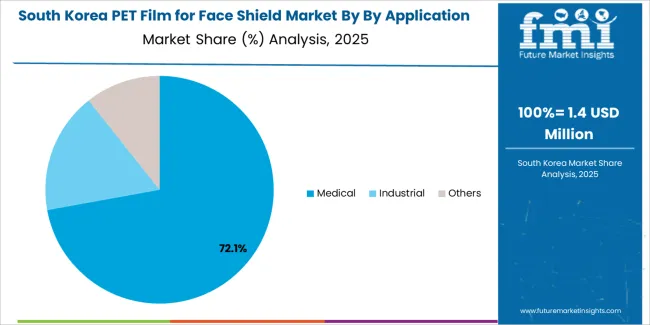

South Korean PET film for face shield operations reflect the country's advanced manufacturing capabilities and strong focus on workplace safety technology. Major industrial conglomerates including chemical divisions of Samsung, LG, and specialized film manufacturers drive sophisticated material specifications that influence regional quality standards and performance expectations.

The Korean market demonstrates particular strength in adopting advanced film processing technologies and multi-functional coating systems. Industrial facilities and healthcare institutions emphasize performance consistency and reliable supply chain relationships, creating demand for film materials that support standardized protection protocols while accommodating specific operational requirements.

Regulatory frameworks through the Ministry of Employment and Labor incorporate specific PPE material requirements addressing safety performance, optical quality standards, and manufacturing consistency. These standards align with international protective equipment regulations while incorporating Korean-specific testing protocols that support market quality expectations and worker protection reliability.

Profit pools are consolidating around specialized coating technologies and high-volume manufacturing capabilities, with value migrating from commodity film production to engineered solutions offering enhanced anti-fog performance, superior optical clarity, and validated safety compliance. Several competitive archetypes dominate market positioning: established polymer film manufacturers leveraging production scale and material science expertise; specialized protective equipment material suppliers focusing on application-specific formulations and technical support; regional converters providing customized solutions and rapid response capabilities; and emerging suppliers targeting cost-sensitive segments through efficient processing approaches.

Switching costs remain moderate due to equipment compatibility considerations and quality validation requirements, though established supplier relationships and consistent performance create procurement stability for major PPE manufacturers. Technology transitions toward green materials and enhanced surface treatments create periodic windows for competitive repositioning, particularly among suppliers offering comprehensive performance validation and regulatory compliance documentation. Quality consistency and supply reliability differentiate premium suppliers, especially during high-volume procurement periods and emergency response scenarios.

Market consolidation continues as larger chemical companies and film manufacturers acquire specialized protective material producers to expand application portfolios and capture growing PPE segments. Strategic partnerships between film suppliers and face shield manufacturers strengthen market positions through co-development relationships and long-term supply agreements. Strategic priorities center on establishing relationships with major PPE manufacturers and healthcare group purchasing organizations through validated material performance and comprehensive quality assurance capabilities. Product portfolio diversification across film grades, surface treatments, and thickness specifications addresses varying application requirements and performance expectations. Future positioning requires balancing manufacturing efficiency with innovation capabilities and maintaining regulatory compliance across multiple jurisdictions while adapting to ecofriendly pressures and circular economy initiatives.

| Items | Values |

|---|---|

| Quantitative Units | USD 30.8 million |

| Product | PET Film, APET Film, Others |

| Application | Medical, Industrial, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, Japan, United Kingdom, and other 40+ countries |

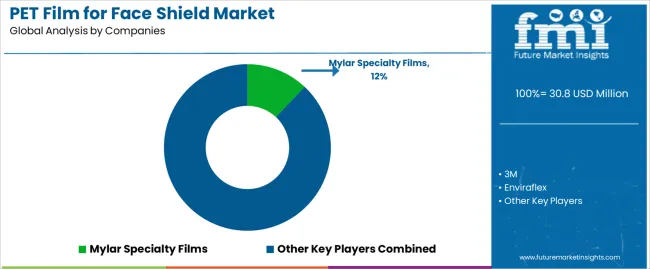

| Key Companies Profiled | Mylar Specialty Films, 3M, Enviraflex, Dexerials Corporation, Klöckner Pentaplast, WeeTect, Ergis, China Lucky Film |

| Additional Attributes | Dollar sales by material type/application, regional demand (NA, EU, APAC), competitive landscape, single-use vs. reusable considerations, anti-fog coating innovations, and surface treatment advancements driving optical clarity, extended wear comfort, and comprehensive facial protection effectiveness |

The global pet film for face shield market is estimated to be valued at USD 30.8 million in 2025.

The market size for the pet film for face shield market is projected to reach USD 59.5 million by 2035.

The pet film for face shield market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in pet film for face shield market are pet film, apet film and others.

In terms of by application, medical segment to command 68.9% share in the pet film for face shield market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA