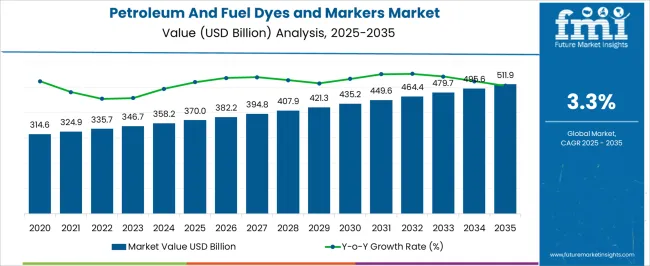

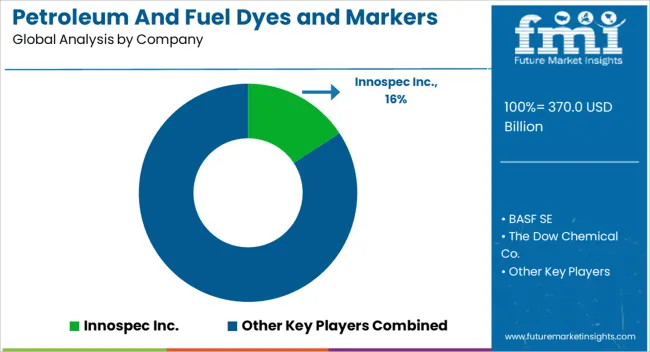

The Petroleum And Fuel Dyes and Markers Market is estimated to be valued at USD 370.0 billion in 2025 and is projected to reach USD 511.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Petroleum And Fuel Dyes and Markers Market Estimated Value in (2025 E) | USD 370.0 billion |

| Petroleum And Fuel Dyes and Markers Market Forecast Value in (2035 F) | USD 511.9 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The Petroleum and Fuel Dyes and Markers market is witnessing steady growth, driven by the increasing need for fuel authentication, regulatory compliance, and traceability in the oil and gas industry. Governments and regulatory bodies worldwide are implementing stringent mandates to prevent fuel adulteration, tax evasion, and illegal fuel trading, which is accelerating the adoption of dye and marker technologies. Advanced fluorescent and chemical marker solutions enable accurate identification, quantification, and monitoring of fuels across the supply chain, ensuring transparency and adherence to compliance standards.

Growing emphasis on environmental protection and the reduction of illegal fuel usage is further supporting market expansion. Technological advancements, including high-performance dyes with enhanced stability and detection capabilities, are improving operational efficiency and reliability.

Additionally, increasing awareness among distributors, refiners, and end users regarding quality assurance and regulatory obligations is driving market penetration With global demand for petroleum products continuing to rise, particularly in developing economies, the market is positioned for sustained growth, benefiting from innovations in traceability solutions, regulatory enforcement, and process standardization.

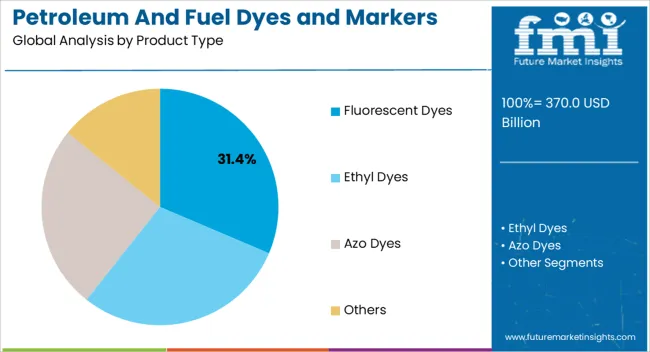

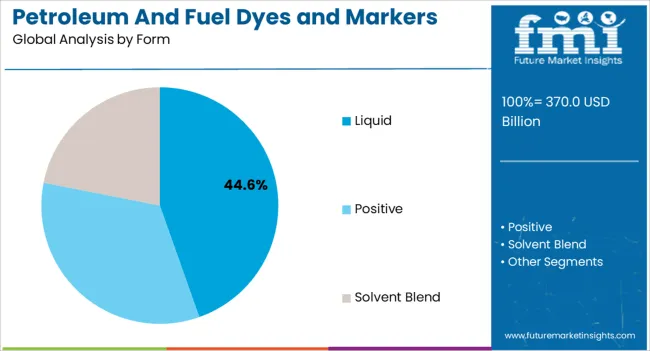

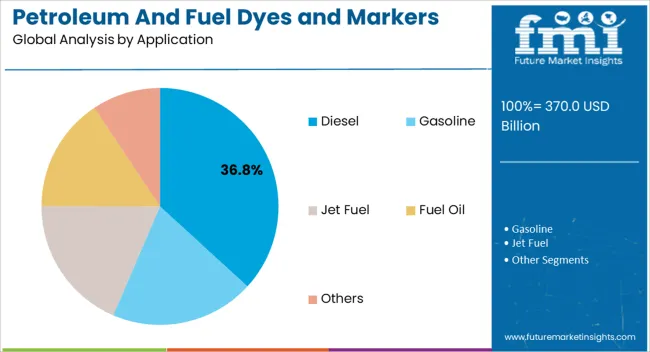

The petroleum and fuel dyes and markers market is segmented by product type, form, application, and geographic regions. By product type, petroleum and fuel dyes and markers market is divided into Fluorescent Dyes, Ethyl Dyes, Azo Dyes, and Others. In terms of form, petroleum and fuel dyes and markers market is classified into Liquid, Positive, and Solvent Blend. Based on application, petroleum and fuel dyes and markers market is segmented into Diesel, Gasoline, Jet Fuel, Fuel Oil, and Others. Regionally, the petroleum and fuel dyes and markers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fluorescent dyes product type segment is projected to hold 31.4% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is driven by the high sensitivity, stability, and visibility of fluorescent dyes, which allow for precise identification of petroleum products even at low concentrations. These dyes enable efficient monitoring and control of fuel supply chains, helping prevent illegal mixing, adulteration, and tax evasion.

The ability to detect and quantify dyes quickly using advanced detection systems enhances operational reliability and compliance adherence. Compatibility with various fuel types, including gasoline, diesel, and biofuels, further strengthens market adoption.

Additionally, regulatory mandates requiring traceable marking of fuels have increased the demand for fluorescent dyes in both domestic and industrial applications As traceability and authentication requirements continue to rise, fluorescent dyes are expected to maintain market leadership, driven by their performance, accuracy, and regulatory compliance capabilities, making them a preferred choice among refiners, distributors, and enforcement agencies.

The liquid form segment is expected to account for 44.6% of the market revenue in 2025, making it the leading form factor. Its growth is being supported by the ease of application, uniform dispersion, and compatibility with various fuel types, which ensures consistent marking across the supply chain. Liquid dyes and markers can be seamlessly integrated into fuels during refining or distribution processes without affecting combustion performance, making them highly suitable for large-scale adoption.

The precision offered by liquid formulations facilitates accurate detection and quantification, which is critical for regulatory compliance and fraud prevention. Increasing awareness among fuel producers and distributors regarding traceability and quality assurance has further strengthened adoption.

Additionally, liquid dyes provide advantages in terms of storage, handling, and rapid deployment, supporting operational efficiency With ongoing efforts to monitor fuel authenticity and prevent tax evasion, the liquid form segment is expected to retain its leading position, driven by its practicality, performance, and ability to meet stringent compliance requirements across global markets.

The diesel application segment is projected to hold 36.8% of the market revenue in 2025, establishing it as the leading application area. Growth in this segment is primarily driven by the widespread use of diesel in commercial transportation, industrial operations, and power generation, which makes it a high-risk target for adulteration and illegal trading. Dyes and markers are increasingly applied to diesel to ensure regulatory compliance, monitor usage, and prevent tax evasion.

The capability of fluorescent and chemical markers to provide reliable detection even at low concentrations enhances operational efficiency and reduces monitoring costs. Diesel-specific marking solutions also support audit readiness and enforcement of governmental mandates, which are becoming more stringent globally.

Technological advancements in marker stability and detection systems have further reinforced adoption in diesel applications As governments and industries continue to emphasize fuel traceability, environmental protection, and revenue protection, the diesel segment is expected to maintain its dominant position, supported by consistent demand, regulatory enforcement, and technological innovation.

Petroleum and fuel dyes is general name for a family of aromatic substance, either organic or synthetic, which are used to add colour characteristics to gasoline and other petroleum products. These complex unsaturated substances have inherent characteristics like solubility and intense colour, and exhibits good affinity towards substrate on which it is being applied.

Petroleum and Fuel Markers, on the other hand, are colourless substances, which when added to fuel, are detected by adding a specific reagent to produce a characteristic colour, and can also be detected by placing the sample in a spectrophotometer to produce an equivalent result.

These petroleum and fuel dyes and markers are used in applications where different grades of fuels need to be distinguished, to prevent fuel adulteration and theft, and to add aesthetic appeal to fuels. Unique characteristic features of petroleum dyes and markers, and rising applications of imparting colours to fuels and petroleum products is letting the market for petroleum fuel dyes and markers to grow steadily over the forecast period.

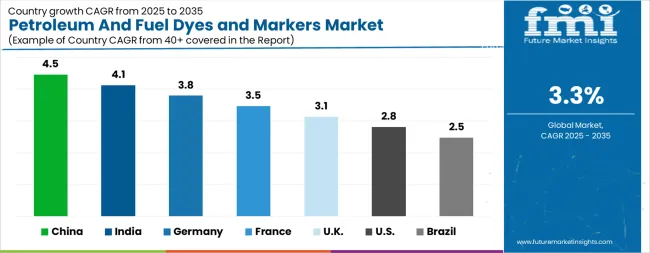

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

The Petroleum And Fuel Dyes and Markers Market is expected to register a CAGR of 3.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.5%, followed by India at 4.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.5%, yet still underscores a broadly positive trajectory for the global Petroleum And Fuel Dyes and Markers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 3.8%. The USA Petroleum And Fuel Dyes and Markers Market is estimated to be valued at USD 131.0 billion in 2025 and is anticipated to reach a valuation of USD 172.8 billion by 2035. Sales are projected to rise at a CAGR of 2.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 19.9 billion and USD 9.6 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 370.0 Billion |

| Product Type | Fluorescent Dyes, Ethyl Dyes, Azo Dyes, and Others |

| Form | Liquid, Positive, and Solvent Blend |

| Application | Diesel, Gasoline, Jet Fuel, Fuel Oil, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Innospec Inc., BASF SE, The Dow Chemical Co., John Hogg & Co Ltd., Authentix, Inc., Sunbelt Corporation, United Colour Manufacturing Co., Improchem. Pty Ltd., A.S. Harrison & Co Pty Ltd., and Fuel Theft Solutions Ltd |

The global petroleum and fuel dyes and markers market is estimated to be valued at USD 370.0 billion in 2025.

The market size for the petroleum and fuel dyes and markers market is projected to reach USD 511.9 billion by 2035.

The petroleum and fuel dyes and markers market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in petroleum and fuel dyes and markers market are fluorescent dyes, ethyl dyes, azo dyes and others.

In terms of form, liquid segment to command 44.6% share in the petroleum and fuel dyes and markers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Petroleum Fuel Dyes and Markers Market 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Jelly Market Growth - Trends & Forecast 2025 to 2035

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Petroleum Gas Storage Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA